A Franklin Ohio Convertible Secured Promissory Note is a legally binding financial agreement that outlines the terms and conditions of a loan between a lender and a borrower in Franklin, Ohio. This type of promissory note is unique because it provides flexibility for both parties involved. A convertible secured promissory note is named as such because it offers the borrower the option to convert the outstanding loan balance into shares of stock or equity in the company, typically at a predetermined conversion ratio and price. This feature makes it an attractive option for startups and small businesses that may not have sufficient collateral to secure traditional loans. The main purpose of a Franklin Ohio Convertible Secured Promissory Note is to protect the lender's interests by securing the loan with specific assets or collateral provided by the borrower. The collateral can be in the form of real estate, vehicles, inventory, or any other valuable assets. This security reduces the lender's risk and provides a way to recover their investment in case the borrower defaults on the loan. There are different types of Franklin Ohio Convertible Secured Promissory Notes available, each with its own specific features and variations. These include: 1) Traditional Convertible Secured Promissory Note: This type of promissory note includes a provision allowing the borrower to convert the loan into equity, which can be beneficial in case the borrower's business experiences significant growth and success. 2) Participating Convertible Secured Promissory Note: Unlike the traditional note, this type allows the lender to participate in the borrower's future profits or success. In addition to the option to convert the loan into equity, the lender receives a share of the borrower's profits based on a predetermined percentage. 3) Non-Participating Convertible Secured Promissory Note: This variation does not give the lender the right to participate in the borrower's future profits or success. The lender can only convert the loan into equity, without any additional entitlements. 4) Senior Convertible Secured Promissory Note: This note has priority over other outstanding debts or loans in case of borrower default or bankruptcy. This seniority increases the lender's chances of recovering their investment. 5) Subordinated Convertible Secured Promissory Note: This note is subordinate to other debts or loans in terms of repayment priority. The lender of this note will be repaid only after all other senior obligations have been fulfilled. Whether you are a lender or a borrower in Franklin, Ohio, understanding the various types of Franklin Ohio Convertible Secured Promissory Notes can help you make informed financial decisions. It is always recommended seeking legal advice or consult with professionals to ensure compliance with local laws and regulations when entering into such agreements.

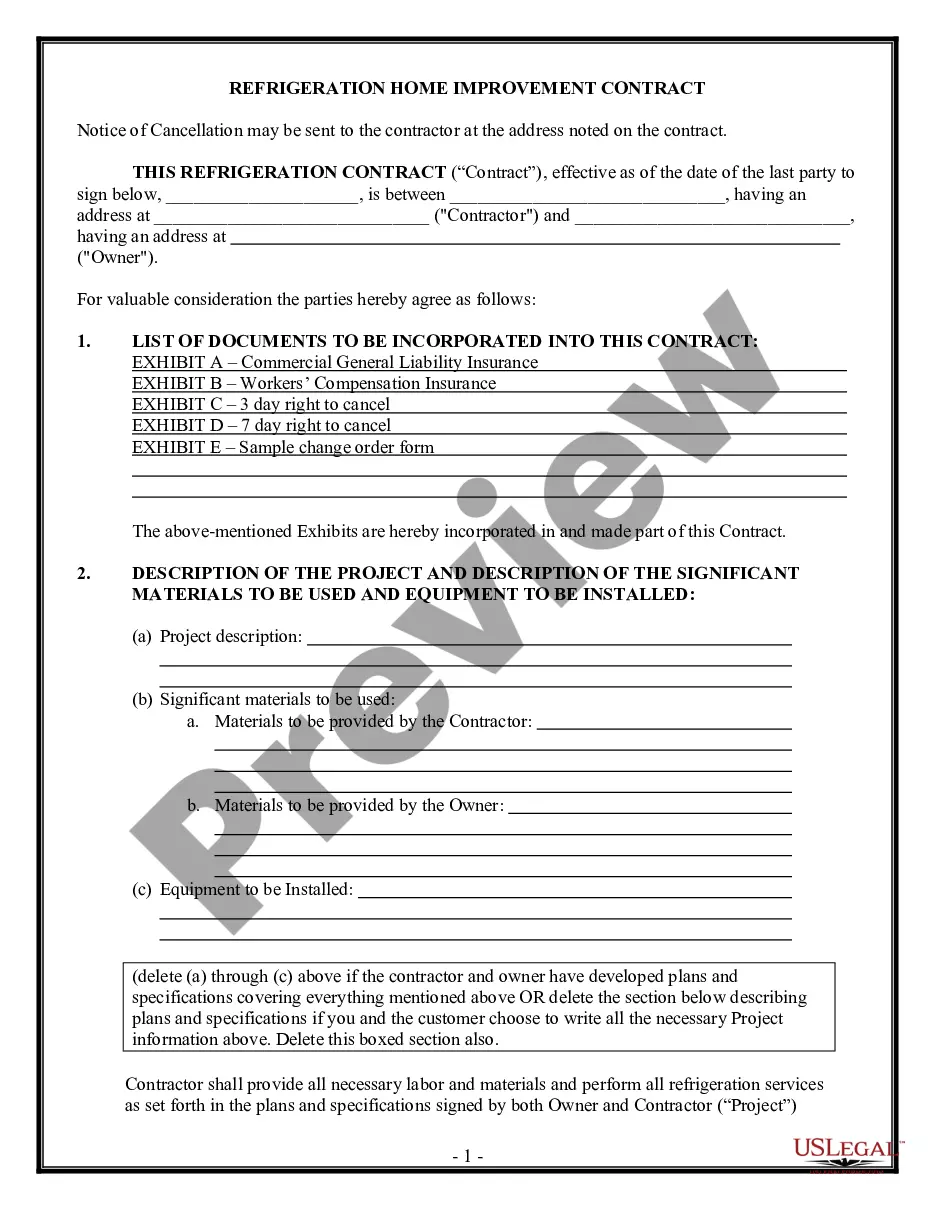

Franklin Ohio Convertible Secured Promissory Note

Description

How to fill out Franklin Ohio Convertible Secured Promissory Note?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Franklin Convertible Secured Promissory Note, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any activities related to paperwork completion simple.

Here's how to purchase and download Franklin Convertible Secured Promissory Note.

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the template of your choice is specific to your state/county/area since state laws can impact the legality of some documents.

- Examine the similar document templates or start the search over to locate the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Franklin Convertible Secured Promissory Note.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Franklin Convertible Secured Promissory Note, log in to your account, and download it. Of course, our platform can’t take the place of an attorney entirely. If you have to deal with an extremely complicated case, we recommend using the services of a lawyer to check your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and get your state-compliant documents with ease!