A Tarrant Texas Convertible Secured Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Tarrant County, Texas. The note serves as evidence of the debt and specifies the repayment terms, interest rate, and any collateral provided by the borrower to secure the loan. The convertible feature of the note allows the lender to convert the outstanding loan amount into equity or stock in the borrower's company, typically upon the occurrence of a predetermined event or at the lender's discretion. This feature provides the lender with potential upside if the borrower's business succeeds or undergoes a significant financial event, such as an IPO or acquisition. There are various types of Tarrant Texas Convertible Secured Promissory Notes, designed to cater to specific borrowing needs and circumstances. Some common types include: 1. Traditional Convertible Secured Promissory Note: This type of note provides the borrower with funds in exchange for a promise to repay the loan, along with an option for the lender to convert the outstanding debt into equity if certain conditions are met. 2. Secured Convertible Promissory Note: Similar to the traditional version, this note requires the borrower to provide collateral (such as real estate, inventory, or intellectual property) to secure the loan. If the borrower defaults, the lender can exercise their right to seize and sell the collateral to recover the outstanding debt. 3. Balloon Convertible Secured Promissory Note: With this note, the borrower makes smaller periodic payments of principal and interest throughout the loan term. However, a significant balance, typically called the balloon payment, is due at the end of the term. The lender has the right to convert the remaining balance into equity or demand full payment. 4. Convertible Bridge Loan Note: This note is often used in early-stage financing or temporary funding situations. It provides short-term financing to bridge the gap until a more substantial funding round or event occurs. The lender has the option to convert the loan into equity or demand repayment at maturity. Tarrant Texas Convertible Secured Promissory Notes are legal agreements that help protect both the lender and borrower's interests by clearly defining the loan terms and providing security with collateral. It is essential for all parties involved to carefully review and understand the terms before signing the note to ensure compliance and avoid any potential legal disputes in the future.

Tarrant Texas Convertible Secured Promissory Note

Description

How to fill out Tarrant Texas Convertible Secured Promissory Note?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from scratch, including Tarrant Convertible Secured Promissory Note, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different types varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any tasks associated with document execution straightforward.

Here's how to locate and download Tarrant Convertible Secured Promissory Note.

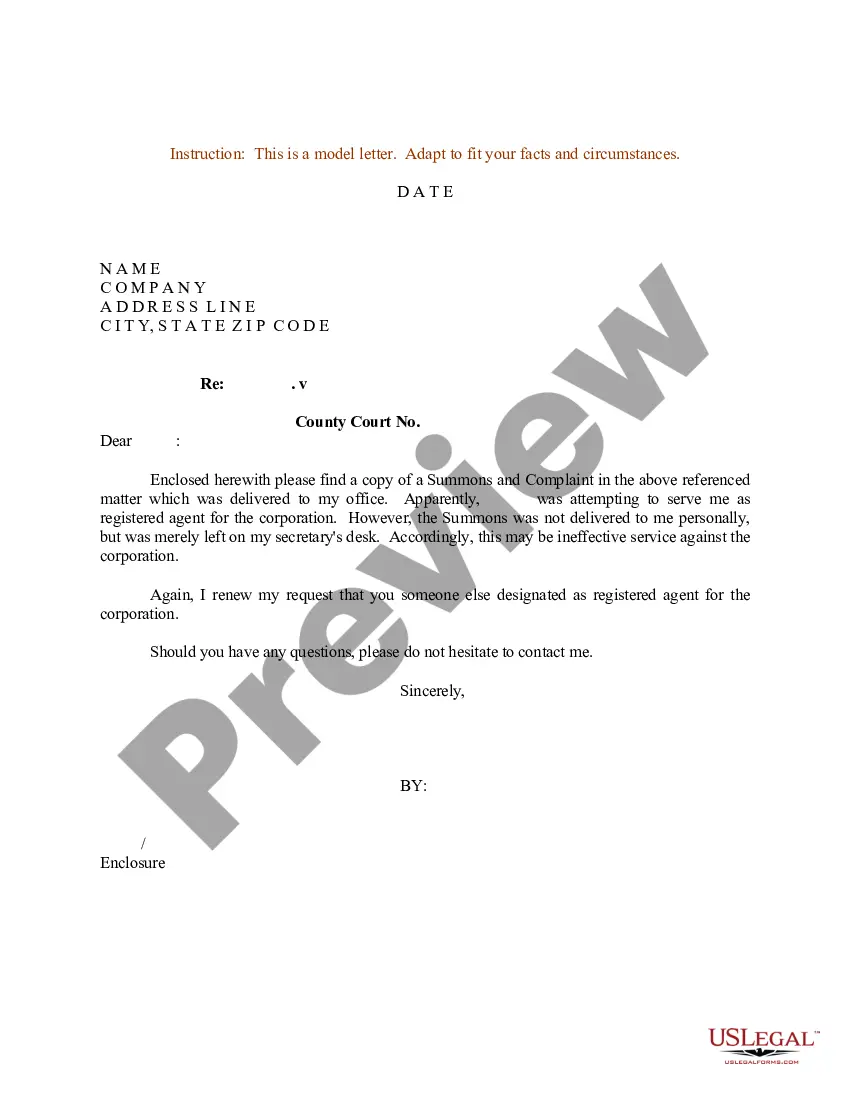

- Take a look at the document's preview and outline (if provided) to get a general idea of what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the validity of some records.

- Check the similar forms or start the search over to find the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Tarrant Convertible Secured Promissory Note.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Tarrant Convertible Secured Promissory Note, log in to your account, and download it. Of course, our website can’t take the place of an attorney completely. If you have to deal with an exceptionally difficult situation, we advise getting a lawyer to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork effortlessly!