A Bronx New York Grant Agreement is a legal document that outlines the terms and conditions for transferring funds or resources from a 501(c)(3) organization to a 501(c)(4) organization in the Bronx, New York. This agreement is commonly used when a nonprofit organization that qualifies under section 501(c)(3) of the Internal Revenue Code wishes to provide financial support or assistance to another nonprofit organization that falls under section 501(c)(4) of the Code. The Grant Agreement serves as a written contract between the two organizations, ensuring transparency, accountability, and adherence to applicable laws and regulations. It typically includes essential information such as the names and addresses of both the granter and the grantee, the purpose of the grant, the specific activities or programs to be funded, the amount of funding, and the period of the agreement. Both parties must carefully review and negotiate the terms before signing the agreement to ensure mutual understanding and compliance. Within Bronx, New York, there may be different types of Grant Agreements from 501(c)(3) to 501(c)(4), depending on the nature of the collaboration or the objectives of the granting organization. Examples of these agreements could include: 1. Project-Based Grant Agreement: This type of agreement focuses on funding a specific project or program initiated by the 501(c)(4) organization. It outlines the goals, milestones, and budget required for the project, and specifies how the funds will be allocated. 2. Capacity-Building Grant Agreement: In this case, the purpose of the grant is to strengthen the operational capabilities or expand the reach of the 501(c)(4) organization. The agreement may include provisions for training, administrative support, technology upgrades, or other resources to enhance their effectiveness. 3. General Operating Support Grant Agreement: This agreement aims to provide flexible funding for the overall operations of the 501(c)(4) organization. It enables the organization to cover its day-to-day expenses, pay salaries, maintain facilities, and sustain its core activities. 4. Emergency Relief Grant Agreement: In times of crises, such as natural disasters or public health emergencies, a Grant Agreement may be established to swiftly allocate funds from a 501(c)(3) organization to a 501(c)(4) organization. This agreement would outline the specific emergency response plan, funding amount, and requirements for reporting and accountability. 5. Multi-year Grant Agreement: If the 501(c)(3) organization intends to support the long-term goals or sustainability of the 501(c)(4) organization, a multi-year grant agreement may be formed. This agreement covers funding over an extended period, typically outlining annual disbursement amounts and reporting requirements. It is important to consult legal and tax professionals familiar with nonprofit grant agreements and compliance regulations when creating or modifying a Bronx New York Grant Agreement from 501(c)(3) to 501(c)(4). The specific terms and conditions of each agreement may vary depending on the unique needs and goals of the organizations involved.

Bronx New York Grant Agreement from 501(c)(3) to 501(c)(4)

Description

How to fill out Bronx New York Grant Agreement From 501(c)(3) To 501(c)(4)?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Bronx Grant Agreement from 501(c)(3) to 501(c)(4), you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you pick a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Bronx Grant Agreement from 501(c)(3) to 501(c)(4) from the My Forms tab.

For new users, it's necessary to make several more steps to get the Bronx Grant Agreement from 501(c)(3) to 501(c)(4):

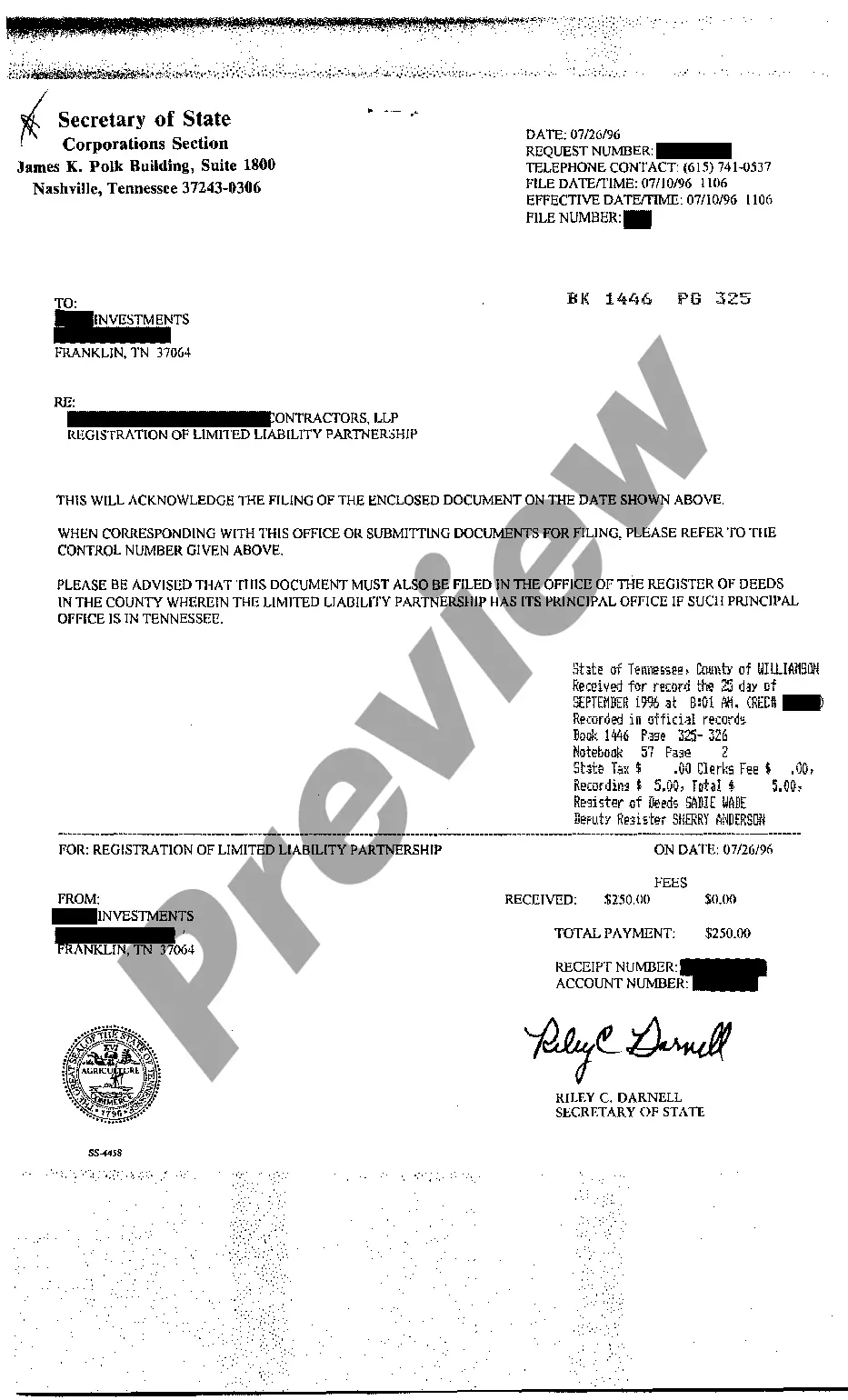

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!