Dallas Texas Grant Agreement from 501(c)(3) to 501(c)(4)

Description

How to fill out Dallas Texas Grant Agreement From 501(c)(3) To 501(c)(4)?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Dallas Grant Agreement from 501(c)(3) to 501(c)(4), you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Dallas Grant Agreement from 501(c)(3) to 501(c)(4) from the My Forms tab.

For new users, it's necessary to make some more steps to get the Dallas Grant Agreement from 501(c)(3) to 501(c)(4):

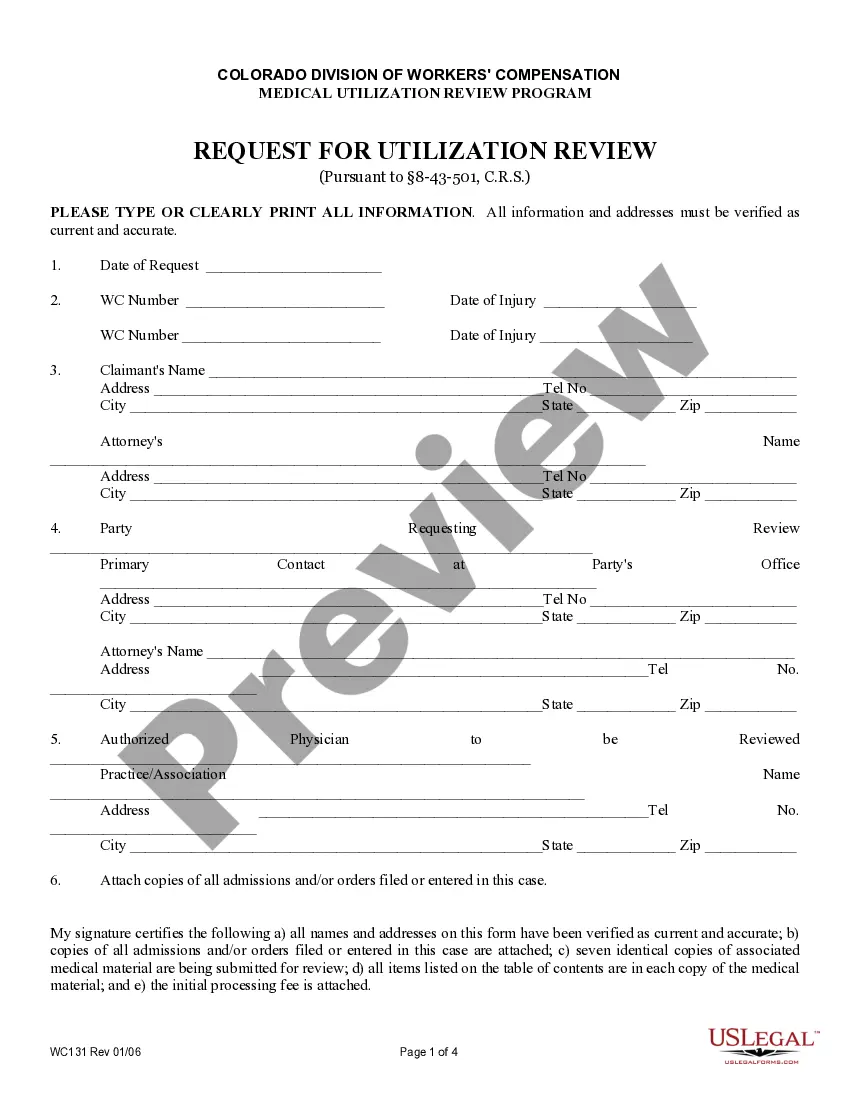

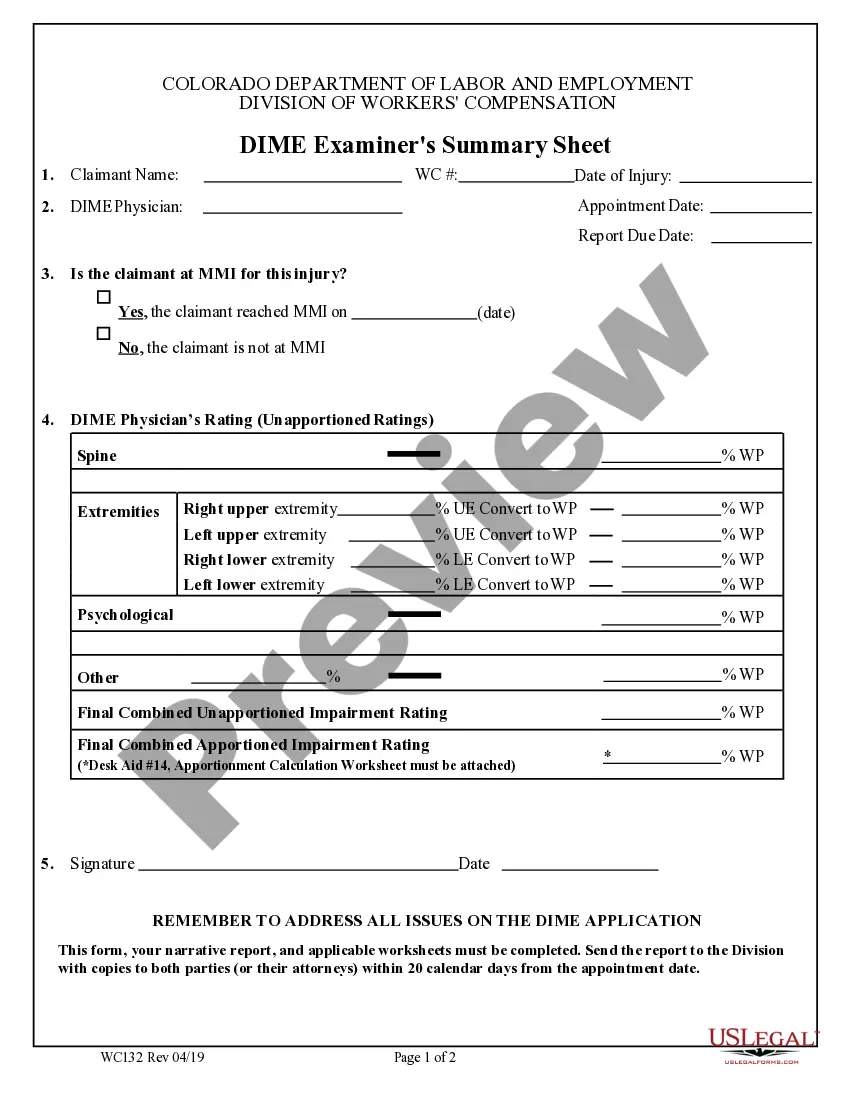

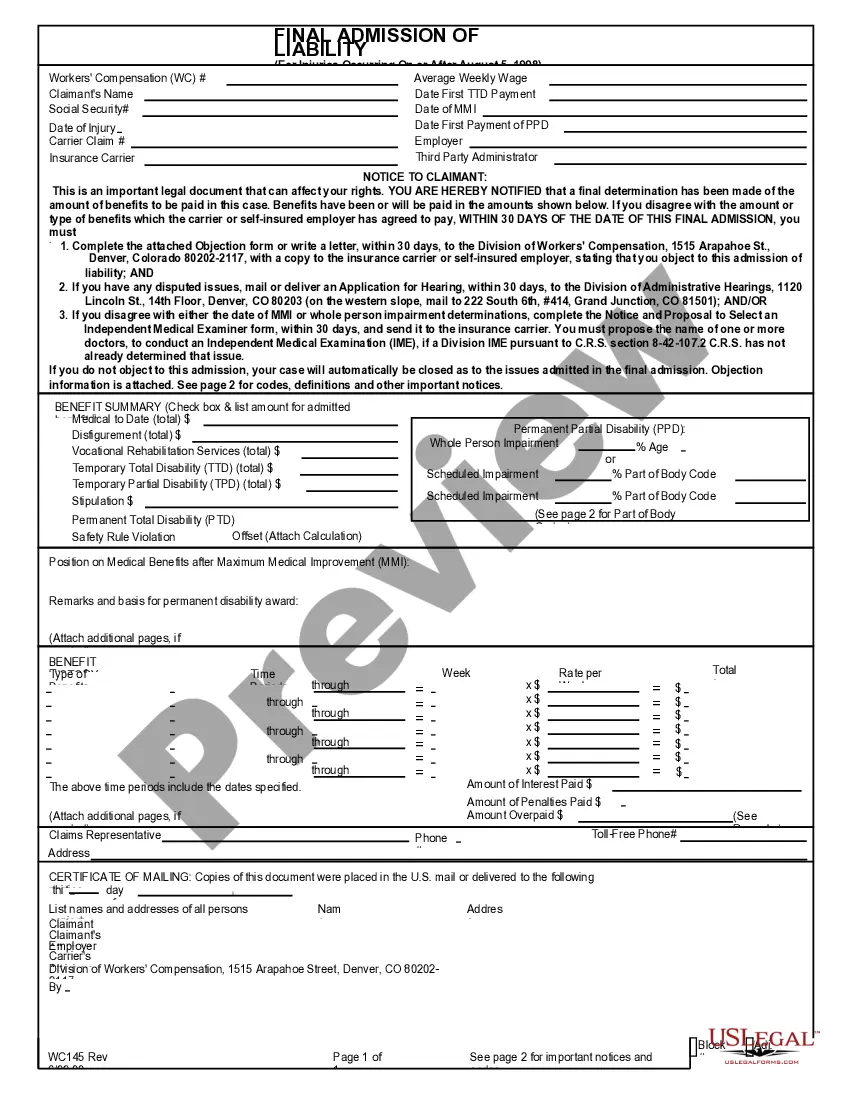

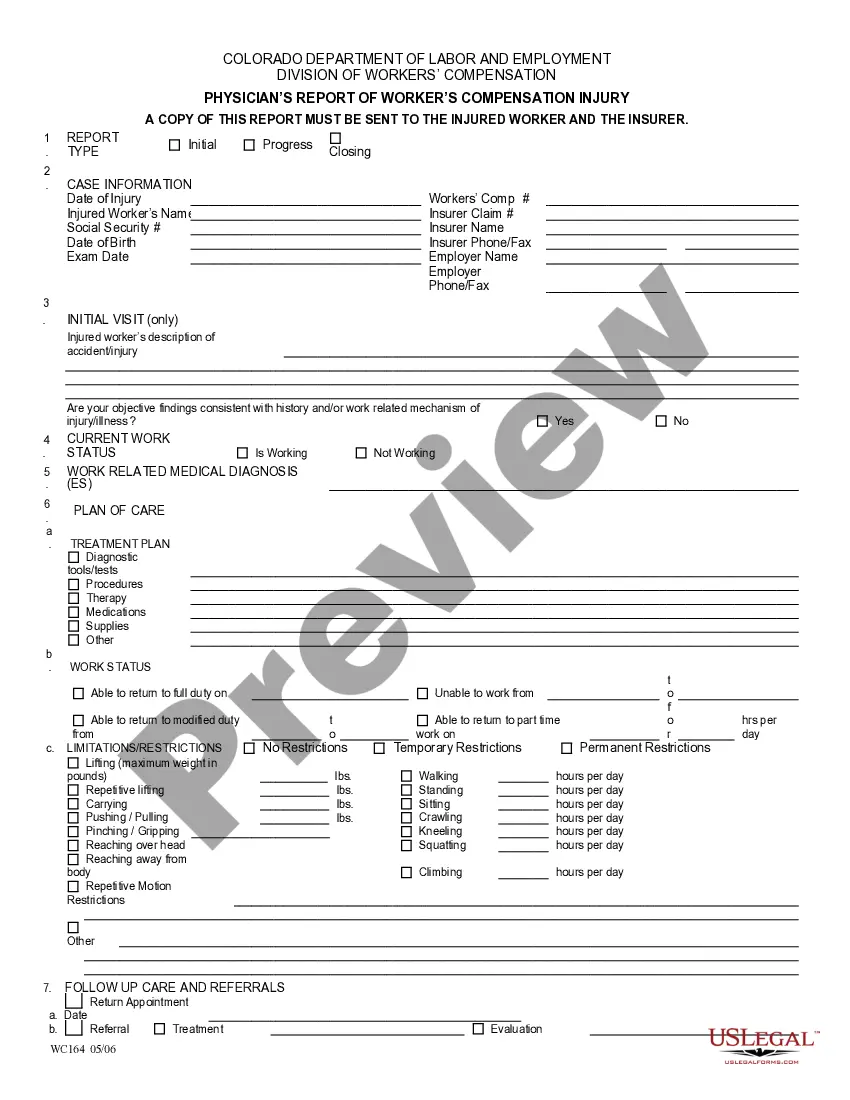

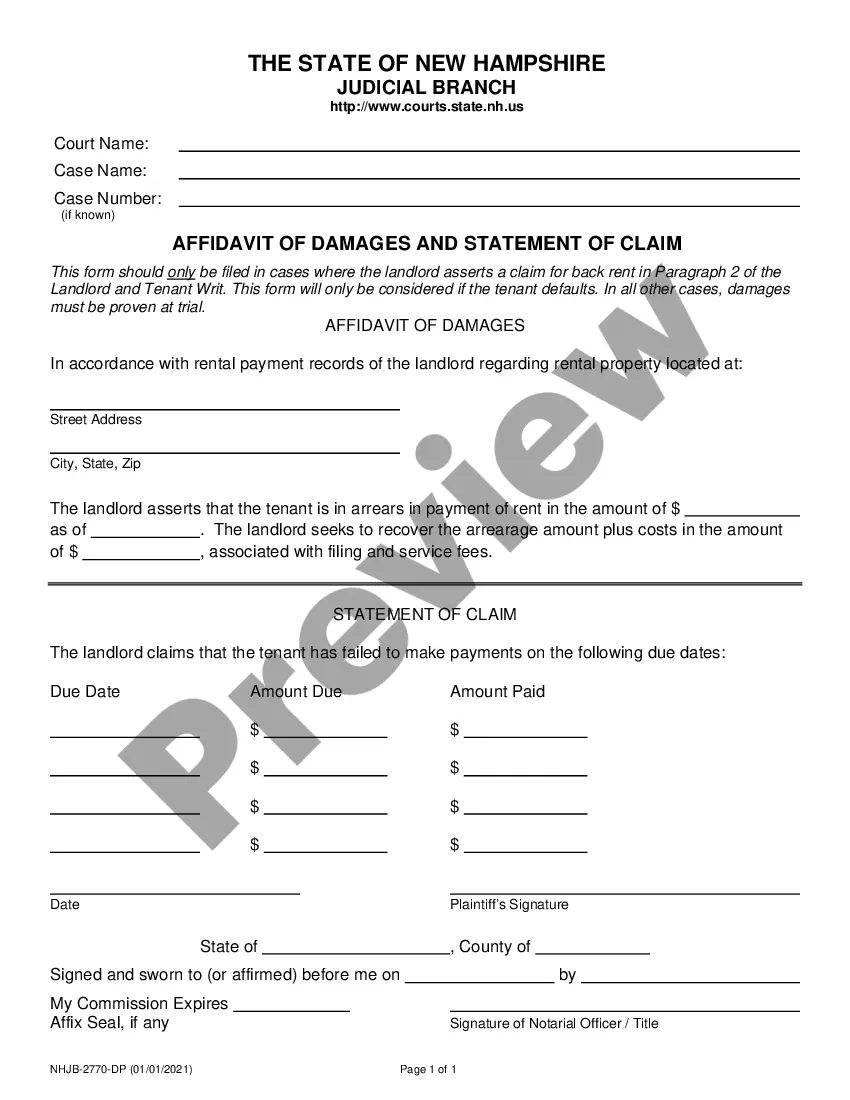

- Take a look at the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Essentially, a contract is a legally binding document in which the parties make promises to deliver a product or service in exchange for consideration (usually money.) A grant on the other hand is when one party grants funds to another party to do something, in reasonable hopes that the task can be accomplished.

501(c)(3) charities are the most popular type of nonprofit. There are more than 1.5 million registered charitable organizations in the United States. 501(c)(3) organizations are funded primarily through charitable donations and government grants.

A 501(c)(3) can donate to a 501(c)(4), as long as the donation is restricted to a charitable purpose that aligns with the organization's mission and does not violate the 501(c)(3) nonprofit's eligibility.

Grant agreement means a legal instrument of financial assistance between a Federal awarding agency or pass-through entity and a non-Federal entity that, consistent with 31 U.S.C.

Grant agreement means a legal instrument of financial assistance between a Federal awarding agency or pass-through entity and a non-Federal entity that, consistent with 31 U.S.C.

The corporation is the most common, and usually best, form for a nonprofit organization. Some of the benefits follow. There is a small price to pay for these benefits: the organization must register with a state and must make periodic filings and disclosures. There are also filing fees, but these are usually small.

There Are Three Main Types of Charitable Organizations Most organizations are eligible to become one of the three main categories, including public charities, private foundations and private operating foundations.

Creating an Effective Grant Agreement Amount and purpose of the grant. Grant agreements note specifically how much the fund is committing to what purpose, such as general operating support or a specific program.Grant period and payment schedule.Confirmation of charity's tax-exempt status.Notification of changes.

The purposes of these organizations may include but are not limited to the following: Religious. Scientific. Public safety-oriented. Charitable. Literary. Sports. Cruelty prevention.

Grant Agreement Number means the Grant Number assigned to Grantee.