Houston Texas Grant Agreement from 501(c)(3) to 501(c)(4): In Houston, Texas, a Grant Agreement from 501(c)(3) to 501(c)(4) refers to a legal document that outlines the transfer of funding or resources from a tax-exempt organization classified as a 501(c)(3) nonprofit to another organization seeking a 501(c)(4) status. This agreement is crucial for philanthropic organizations, public charities, or foundations looking to support advocacy groups or social welfare organizations that operate under a different tax-exempt status. A 501(c)(3) organization is typically characterized by its charitable purpose, such as providing relief to the poor, advancing education, or promoting science. These organizations rely on public donations and are tax-exempt, enabling donors to claim deductions on their contributions. However, they are subject to specific limitations on lobbying and political activities. On the other hand, a 501(c)(4) organization, also known as a social welfare organization, focuses primarily on promoting the common good and general welfare of the community. Unlike 501(c)(3) organizations, 501(c)(4) organizations have the ability to engage in a limited amount of lobbying and political advocacy activities. Contributions made to 501(c)(4) organizations are not tax-deductible, and they are not subject to the same restrictions on political campaign involvement as 501(c)(3) organizations. When a 501(c)(3) organization wishes to support a 501(c)(4) organization with a grant, a Grant Agreement is formulated to specify the terms and conditions of the transfer. This agreement not only outlines the financial aspects but also ensures that both parties are aware of their respective responsibilities and obligations. Some different types or variations of the Houston Texas Grant Agreement from 501(c)(3) to 501(c)(4) may include: 1. General Grant Agreement: This is the standard agreement form where a 501(c)(3) organization provides financial support to a 501(c)(4) organization, usually for a specific project or a broader social welfare cause. 2. Capacity Building Grant Agreement: This type of agreement focuses on enhancing the capabilities and effectiveness of the 501(c)(4) organization. It may include provisions for training, skill development, technical assistance, or infrastructure support, aimed at strengthening the recipient's ability to accomplish its mission. 3. Collaborative Grant Agreement: This agreement is suitable when multiple 501(c)(3) organizations come together to support a 501(c)(4) organization or a collaborative initiative. It outlines the roles, responsibilities, and funding commitments of each participating organization, ensuring transparency and clarity. 4. Advocacy Grant Agreement: Specifically tailored for supporting advocacy organizations, this type of Grant Agreement provides funding to advance a specific policy or legislative agenda. It may include clear guidelines on the permitted lobbying activities and reporting requirements to comply with IRS regulations. In summary, the Houston Texas Grant Agreement from 501(c)(3) to 501(c)(4) facilitates the transfer of resources or funding from a tax-exempt charitable organization to a social welfare organization. While there might be different types of Grant Agreements based on the purpose and scope of support, these agreements ensure that both parties understand their roles, and the funds are directed towards the intended social welfare or advocacy initiatives.

Houston Texas Grant Agreement from 501(c)(3) to 501(c)(4)

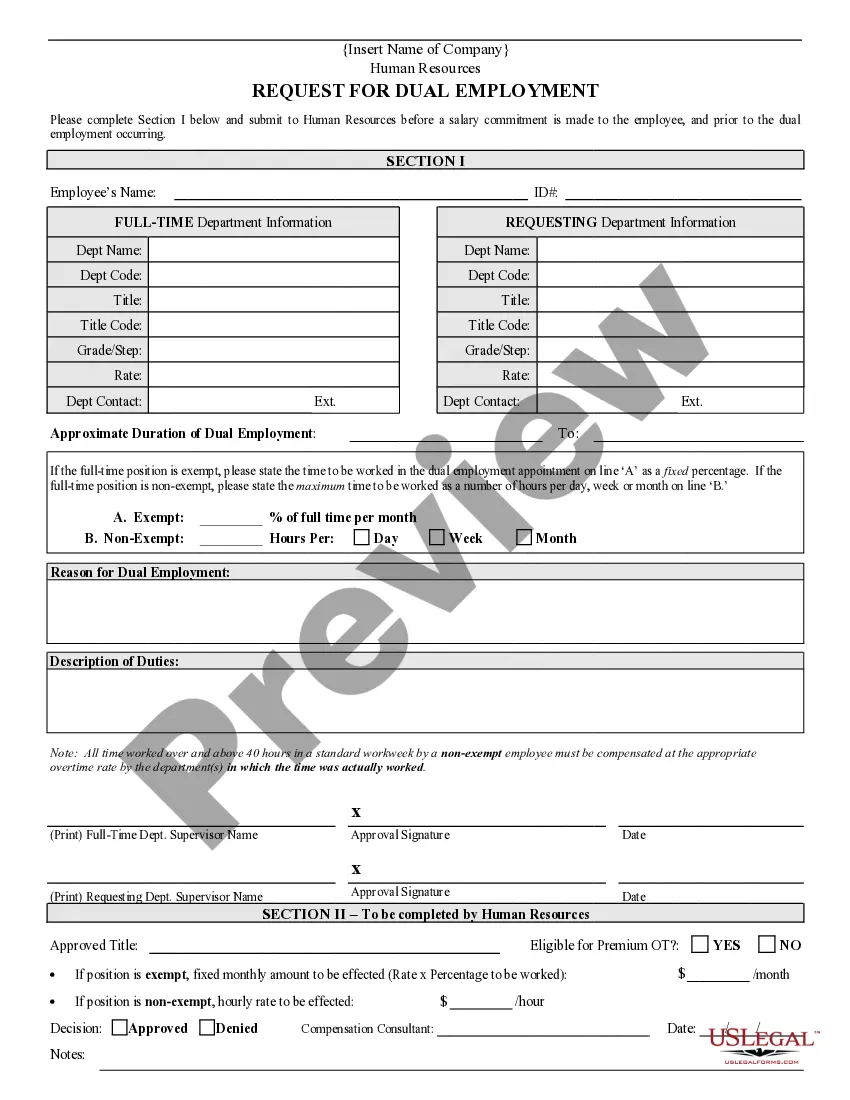

Description

How to fill out Houston Texas Grant Agreement From 501(c)(3) To 501(c)(4)?

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, finding a Houston Grant Agreement from 501(c)(3) to 501(c)(4) meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Apart from the Houston Grant Agreement from 501(c)(3) to 501(c)(4), here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Houston Grant Agreement from 501(c)(3) to 501(c)(4):

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Houston Grant Agreement from 501(c)(3) to 501(c)(4).

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!