San Diego, California Grant Agreement from 501(c)(3) to 501(c)(4) A San Diego, California Grant Agreement from 501(c)(3) to 501(c)(4) refers to a legally binding contract that governs the transfer of funds or resources from a nonprofit organization with a 501(c)(3) tax-exempt status to another organization seeking a 501(c)(4) tax-exempt status in the San Diego area of California. This agreement is significant as it involves a change in tax-exempt status for the receiving organization. Keywords: San Diego, California, Grant Agreement, 501(c)(3), 501(c)(4), nonprofit organization, tax-exempt status, resources, transfer of funds. Types of San Diego California Grant Agreements from 501(c)(3) to 501(c)(4): 1. Conversion Grant Agreement: This type of agreement outlines the process for a 501(c)(3) organization to transition or convert into a 501(c)(4) organization. It includes the terms and conditions for transferring funds, assets, programs, and personnel from the previous tax-exempt organization to the newly formed 501(c)(4) organization in San Diego, California. 2. Collaborative Grant Agreement: This grant agreement signifies a partnership between an existing 501(c)(3) organization based in San Diego, California, and a separate entity seeking a 501(c)(4) tax-exempt status. The agreement establishes the terms, responsibilities, and funding arrangements for their joint initiatives or projects while ensuring compliance with legal requirements for tax-exempt organizations. 3. Start-up Grant Agreement: This type of grant agreement involves providing financial support from a 501(c)(3) organization to a newly established 501(c)(4) organization in San Diego, California. It details the terms, funding amount, and conditions under which the funds will be utilized by the start-up organization for its specified programs or projects. 4. Revocation Grant Agreement: In some cases, a 501(c)(3) organization in San Diego, California might decide to relinquish its tax-exempt status and transfer its assets or resources to a 501(c)(4) organization. The revocation grant agreement outlines the terms of this transfer, including the allocation of funds, assets, and responsibilities during the transition. Each type of San Diego California Grant Agreement from 501(c)(3) to 501(c)(4) takes into account the specific needs and objectives of the organizations involved, ensuring compliance with tax regulations while facilitating the transfer of resources to support the charitable or social welfare goals of the receiving organization.

San Diego California Grant Agreement from 501(c)(3) to 501(c)(4)

Description

How to fill out San Diego California Grant Agreement From 501(c)(3) To 501(c)(4)?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including San Diego Grant Agreement from 501(c)(3) to 501(c)(4), with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different categories ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less challenging. You can also find information materials and guides on the website to make any activities associated with document completion simple.

Here's how you can find and download San Diego Grant Agreement from 501(c)(3) to 501(c)(4).

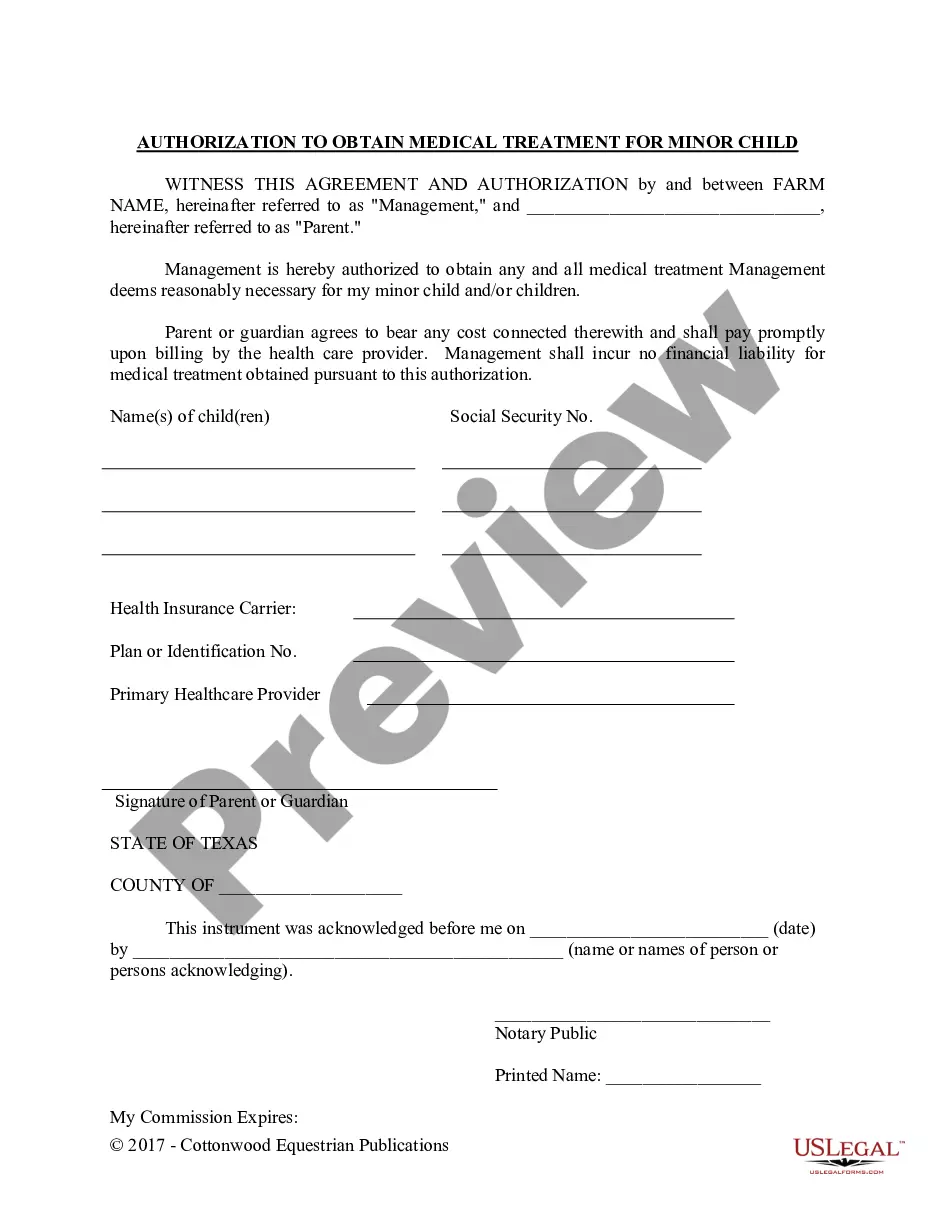

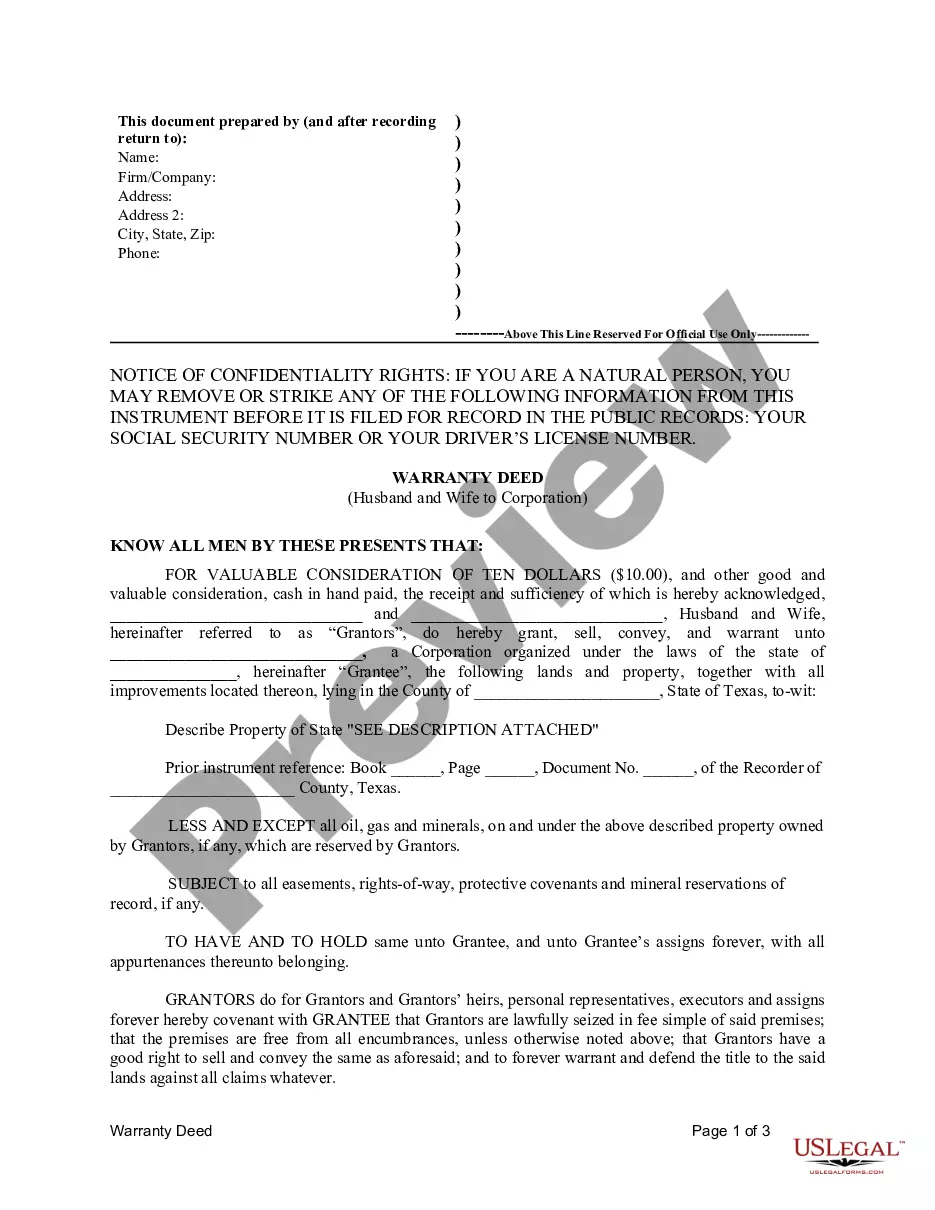

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the validity of some documents.

- Check the related document templates or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy San Diego Grant Agreement from 501(c)(3) to 501(c)(4).

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed San Diego Grant Agreement from 501(c)(3) to 501(c)(4), log in to your account, and download it. Of course, our platform can’t take the place of a lawyer entirely. If you have to deal with an extremely challenging situation, we recommend using the services of a lawyer to review your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Become one of them today and purchase your state-specific paperwork with ease!