The Dallas Texas Gust Series Seed Term Sheet is a crucial document outlining the terms and conditions associated with investing in early-stage startups in the Dallas area. It serves as a guideline for investors and entrepreneurs to facilitate funding discussions and negotiations. This comprehensive contract outlines the rights, obligations, and expectations of both parties involved in the investment process. To ensure clarity and transparency, the Gust Series Seed Term Sheet covers various essential elements: 1. Investment Structure: This section specifies the investment amount, valuation of the startup, and the percentage of ownership the investor will receive in return for their investment. 2. Dividend Preferences: The term sheet outlines the preferences and priorities regarding dividend payments, including any specific rights or preferences related to the distribution of profits. 3. Liquidation Preferences: Investors' entitlements in the event of a liquidation or acquisition of the startup are defined in this section. Different types of liquidation preferences may include participating and non-participating preferences, capped or uncapped preferences, or multiple liquidation preferences. 4. Anti-Dilution Protection: This clause safeguards investors against dilution of their ownership stake in case the company raises additional funds at a lower valuation. It details the mechanism for adjusting the investment price per share to maintain the investor's equity percentage. 5. Board of Directors: The term sheet may address the composition and representation on the company's board of directors, highlighting the investor's right to appoint a board member or an observer. 6. Protective Provisions: This section outlines specific protective rights of investors, such as veto rights on major company decisions, changes in capital structure, or the appointment of key executives. 7. Conversion Rights: If the startup seeks subsequent financing rounds, the term sheet defines whether the initial investment will convert into preferred shares or shares of the new funding round. Different types of Dallas Texas Gust Series Seed Term Sheets may vary in terms of their specifics or customizations. These variations can result from company-specific considerations, industry practices, or the preferences of investors. While the core elements remain consistent, certain term sheets may focus on specific provisions and customization to cater to the needs of different startups or investor groups. In summary, the Dallas Texas Gust Series Seed Term Sheet serves as a pivotal document in the early-stage startup investment process, providing a framework for negotiations and establishing the terms and expectations for both investors and entrepreneurs.

Dallas Texas Gust Series Seed Term Sheet

Description

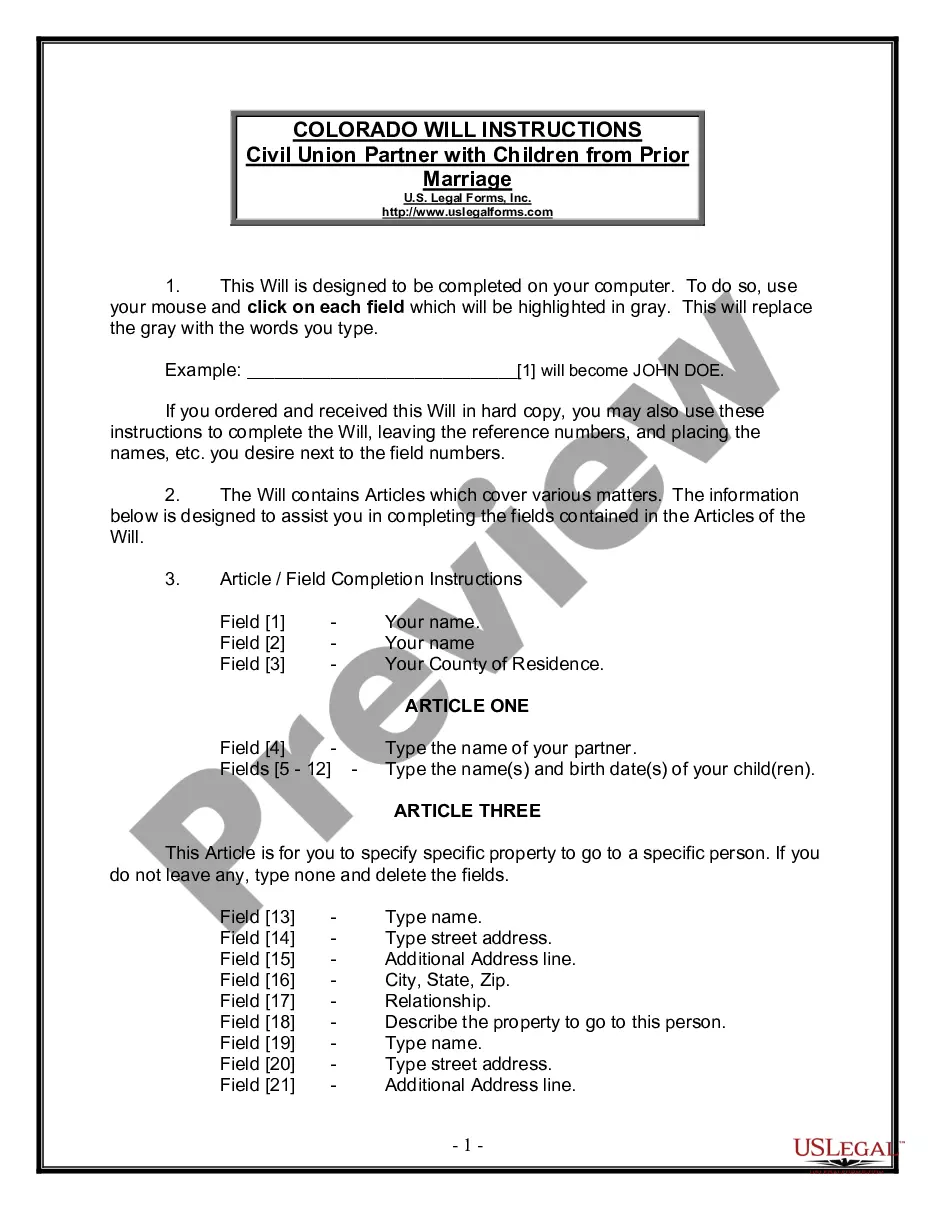

How to fill out Dallas Texas Gust Series Seed Term Sheet?

Draftwing forms, like Dallas Gust Series Seed Term Sheet, to manage your legal affairs is a tough and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents created for different cases and life circumstances. We ensure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Dallas Gust Series Seed Term Sheet template. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting Dallas Gust Series Seed Term Sheet:

- Ensure that your template is specific to your state/county since the rules for writing legal paperwork may vary from one state another.

- Learn more about the form by previewing it or going through a brief intro. If the Dallas Gust Series Seed Term Sheet isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin using our website and download the document.

- Everything looks good on your side? Click the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is all set. You can go ahead and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!