Maricopa, Arizona, Gust Series Seed Term Sheet is a comprehensive document outlining the terms and conditions related to the agreement between a startup company seeking funding and potential investors. This term sheet serves as a framework for negotiations and provides a detailed understanding of the terms under which the investors will provide seed funding to the startup. The Maricopa Arizona Gust Series Seed Term Sheet includes various key components that are crucial for investors and entrepreneurs alike. These components comprise the key financial arrangements, ownership rights, governance, and specific provisions related to the funding round. Here is an overview of some relevant keywords and concepts associated with the Maricopa Arizona Gust Series Seed Term Sheet: 1. Funding Round: This refers to the specific financing round for a startup seeking investment. Maricopa Arizona Gust Series Seed Term Sheet typically focuses on the initial investment round, often known as a seed or angel round. 2. Valuation: The valuation of the startup is an important aspect of the term sheet. It determines the worth of the company and helps establish the percentage ownership the investors will receive in exchange for their investment. 3. Investment Amount: The Maricopa Arizona Gust Series Seed Term Sheet specifies the total amount of funding the investors are willing to provide to the startup. This amount can vary depending on the startup's needs and growth plans. 4. pre-Roman and Post-Money Valuation: These terms refer to the valuation of the startup before and after the investment takes place, respectively. pre-Roman valuation is calculated by adding the investment amount to the startup's existing value, whereas post-money valuation considers the investment amount already infused. 5. Equity: Equity refers to the ownership stake in the startup that the investors will receive in exchange for their investment. The Maricopa Arizona Gust Series Seed Term Sheet outlines the percentage of equity the investors will obtain based on the valuation and investment amount. 6. Liquidation Preference: It represents the order in which investors receive their investment back if the startup is sold or goes bankrupt. The term sheet may outline specific preferences such as senior or participating preferred. 7. Investor Rights: The term sheet includes a section detailing the rights and privileges the investors possess, including information rights, board representation, anti-dilution provisions, and voting rights. 8. Vesting Schedule: This section outlines the terms and conditions related to the vesting of equity for founders and key team members. It ensures the alignment of the interests of both investors and the startup's team. While the Maricopa Arizona Gust Series Seed Term Sheet is not limited to specific types, it is important to note that there can be variations or modified versions tailored to specific startup contexts. These variations may incorporate additional elements based on the preferences and needs of investors and entrepreneurs. The key to a successful Maricopa Arizona Gust Series Seed Term Sheet is to ensure that it accurately represents the interests, rights, and obligations of both parties. Consulting legal and financial professionals experienced in startup investments is highly recommended drafting a robust and fair term sheet that aligns with the startup's vision and goals.

Maricopa Arizona Gust Series Seed Term Sheet

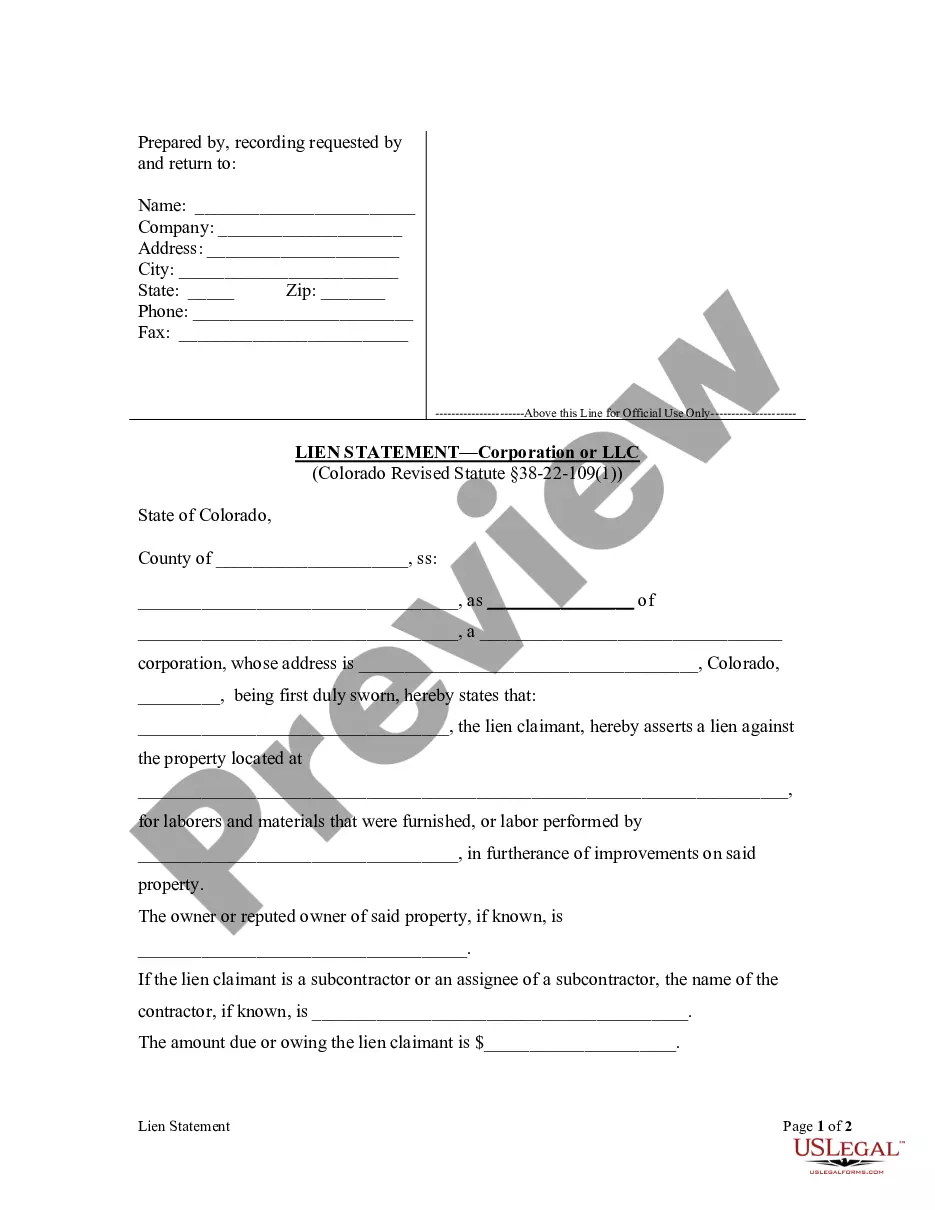

Description

How to fill out Maricopa Arizona Gust Series Seed Term Sheet?

Creating forms, like Maricopa Gust Series Seed Term Sheet, to manage your legal affairs is a difficult and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can acquire your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents created for a variety of cases and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Maricopa Gust Series Seed Term Sheet template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before getting Maricopa Gust Series Seed Term Sheet:

- Make sure that your template is specific to your state/county since the regulations for creating legal documents may differ from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Maricopa Gust Series Seed Term Sheet isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start utilizing our service and get the form.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment information.

- Your template is all set. You can try and download it.

It’s an easy task to find and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!