Dallas Texas is a prime location for entrepreneurs and investors seeking opportunities in the startup ecosystem. In this vibrant city, the Gust Series Seed Term Sheet plays a crucial role in facilitating funding for early-stage companies. The Gust Series Seed Term Sheet serves as a legally binding document that outlines the terms and conditions of investment between a startup and its investors. It serves as a foundation for discussions and negotiations, acting as a roadmap for the investment deal. Key terms commonly found in the Gust Series Seed Term Sheet include: 1. Valuation: This term determines the pre-money valuation of the startup, providing a basis for calculating the ownership percentage investors will receive in exchange for their investment. 2. Investment Amount: The term sheet specifies the amount of funding that the startup is seeking, allowing investors to assess the viability of the investment opportunity. 3. Use of Funds: It details how the investment will be utilized by the startup, providing transparency and accountability to the investors. 4. Liquidation Preference: This term determines how the proceeds from a liquidation event or sale of the company will be allocated. It is crucial for both investors and entrepreneurs to agree on the order in which they will receive their returns. 5. Board Composition: The term sheet often outlines the composition of the startup's board of directors. This includes specifying the number of seats allotted to investors, founders, and independent directors. 6. Anti-Dilution Protection: This clause aims to protect the investors from future dilution of their ownership stake in case the company raises funds at a lower valuation in subsequent funding rounds. 7. Milestones and Vesting: The term sheet may also include milestones or performance metrics that the startup needs to achieve to unlock additional funding or to trigger certain events. Furthermore, it may determine the vesting schedule of founders and key employees' equity. While there are no specific types of Gust Series Seed Term Sheets exclusive to Dallas Texas, variations can arise based on individual investor preferences, industry norms, and the unique characteristics of each startup. Nevertheless, the key terms mentioned above are typically found in most term sheets across different locations and industries. Overall, the Gust Series Seed Term Sheet is an essential document that establishes the foundation for investment in the Dallas Texas startup ecosystem. Entrepreneurs and investors alike rely on the clarity and fairness of its terms to forge prosperous partnerships and propel the growth of innovative companies.

Dallas Texas Gust Series Seed Term Sheet

Description

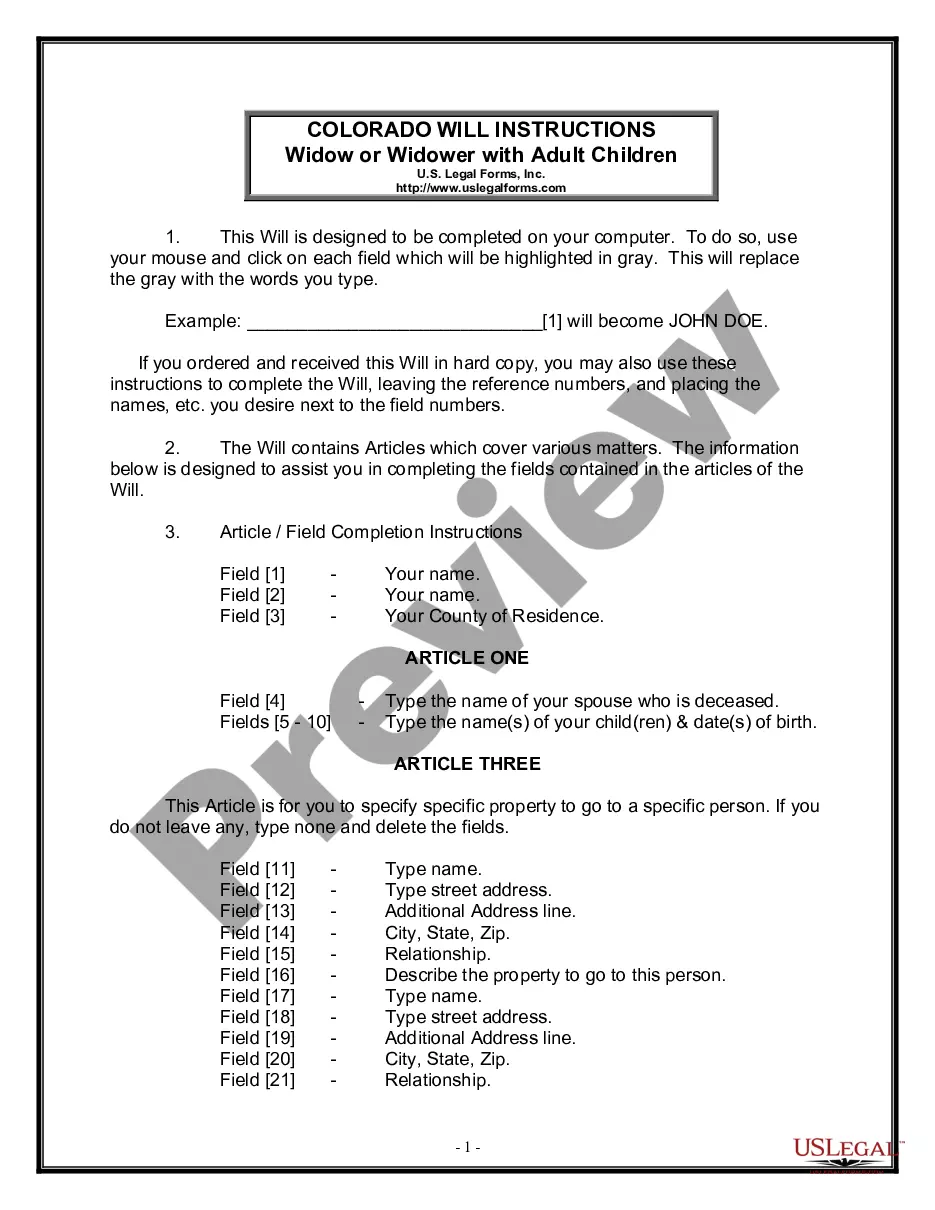

How to fill out Dallas Texas Gust Series Seed Term Sheet?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Dallas Gust Series Seed Term Sheet, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Dallas Gust Series Seed Term Sheet from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Dallas Gust Series Seed Term Sheet:

- Analyze the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!