Fairfax, Virginia is a vibrant city located in the northern part of the state. Known for its rich history, diverse community, and strong economy, Fairfax offers numerous opportunities for businesses and entrepreneurs. One popular aspect of the local business scene is the Fairfax Virginia Gust Series Seed Term Sheet, an important document used by startups and investors. The Fairfax Virginia Gust Series Seed Term Sheet acts as a framework for negotiations between founders and investors during the seed funding stage of a startup. It outlines the terms and conditions of the investment agreement, protecting the interests of both parties involved. This document plays a crucial role in attracting potential investors and fostering successful partnerships. The Gust Series Seed Term Sheet in Fairfax, Virginia encompasses several variations to cater to the diverse needs of startups and investors. Some common types include: 1. Standard Gust Series Seed Term Sheet: This version includes standard clauses and provisions commonly seen in seed funding agreements. It covers aspects such as valuation, funding amount, investor rights, anti-dilution protections, board representation, and more. 2. Customized Gust Series Seed Term Sheet: Startups and investors may opt for a customized term sheet tailored to their specific requirements. This allows parties to negotiate unique terms, allowing for flexibility and agreement on terms that may deviate from the standard template. 3. SAFE (Simple Agreement for Future Equity) Term Sheet: The SAFE term sheet is a popular alternative to traditional equity-based funding. It offers a simpler and more founder-friendly framework for seed-stage investments. The terms and conditions of SAFE term sheets can differ, and they are designed to provide startups with greater flexibility in raising capital. 4. Convertible Note Term Sheet: Another variant is the Convertible Note term sheet, which outlines the terms of a convertible debt financing arrangement. In this scenario, the investment is structured as a loan that can be converted into equity at a later stage, usually during a subsequent funding round. It is crucial for founders and investors in Fairfax, Virginia, to carefully review and negotiate the terms outlined in the Gust Series Seed Term Sheet. Seeking legal counsel specializing in startup funding and venture capital can ensure a fair and mutually beneficial agreement for both parties. In conclusion, the Fairfax Virginia Gust Series Seed Term Sheet is a vital tool for startups and investors in the region, enabling them to navigate the seed funding stage successfully. With various types available, founders and investors can select the term sheet that aligns with their requirements and negotiate terms that drive growth and success for their ventures.

Fairfax Virginia Gust Series Seed Term Sheet

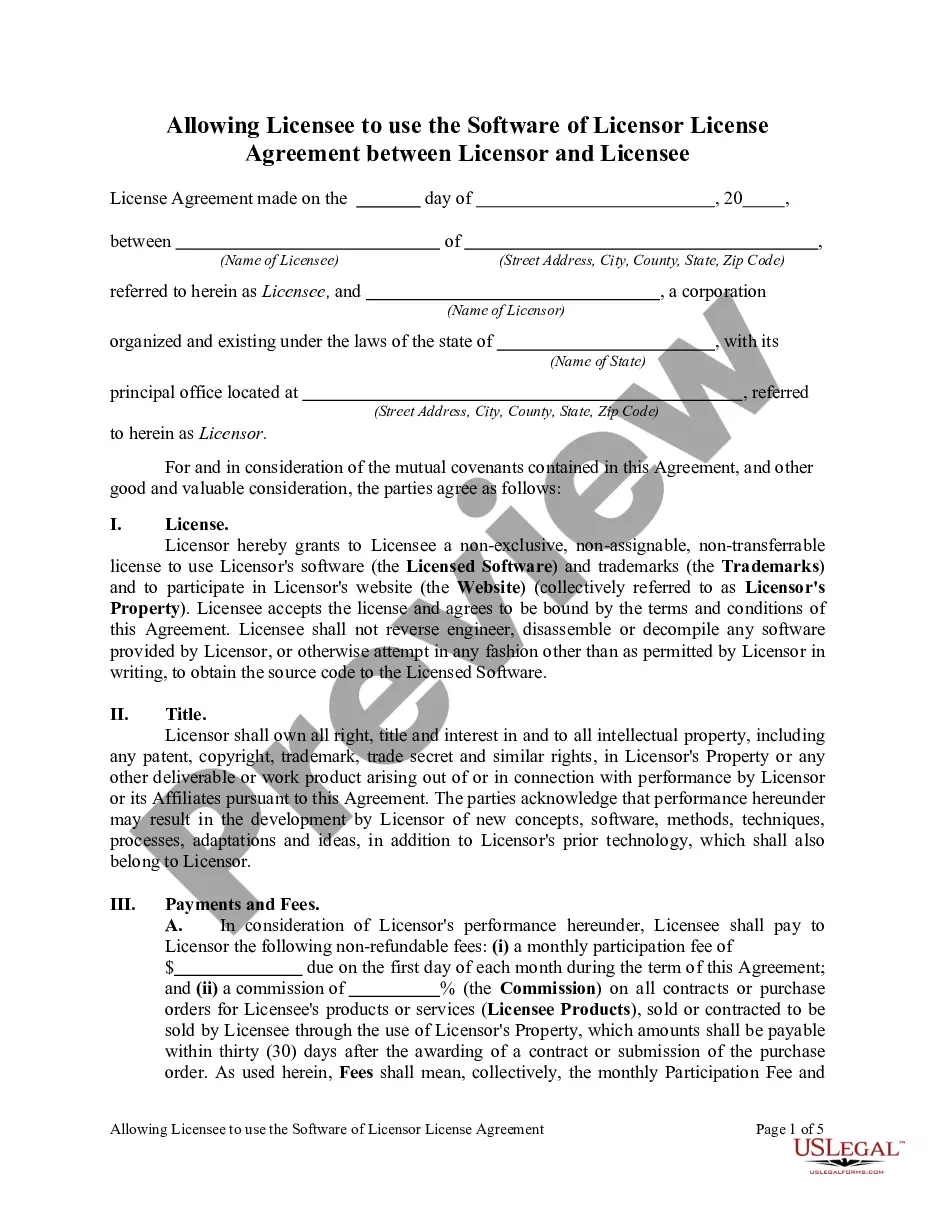

Description

How to fill out Fairfax Virginia Gust Series Seed Term Sheet?

How much time does it typically take you to draft a legal document? Because every state has its laws and regulations for every life situation, finding a Fairfax Gust Series Seed Term Sheet meeting all regional requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. In addition to the Fairfax Gust Series Seed Term Sheet, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Professionals verify all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Fairfax Gust Series Seed Term Sheet:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Fairfax Gust Series Seed Term Sheet.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!