The King's New York Gust Series Seed Term Sheet is a comprehensive legal document that outlines the terms and conditions associated with investment in early-stage startups. This term sheet serves as a tool for negotiation between investors and entrepreneurs, ensuring both parties are aligned on key aspects of the investment agreement. The King's New York Gust Series Seed Term Sheet covers various important areas such as funding details, ownership structure, investor rights, and key obligations. It provides a framework for determining the valuation of the startup, the amount of funding to be provided, and how the investment will be structured. Different types of Kings New York Gust Series Seed Term Sheets may include: 1. Equity Investment Term Sheet: This type of term sheet outlines the terms and conditions for equity investment in a startup. It specifies the percentage of ownership that the investor will receive in exchange for their funding. 2. Convertible Note Term Sheet: In cases where the startup is not yet ready for a full equity investment, a convertible note term sheet may be used. This type of term sheet establishes the terms under which a loan will be converted into equity at a later date, typically upon reaching specific milestones or a subsequent funding round. 3. Preferred Stock Term Sheet: Preferred stock term sheets are used when investors are seeking specific rights and privileges in exchange for their investment. It outlines the preferences, such as liquidation preference or anti-dilution provisions, that the investor will receive. 4. SAFE Term Sheet: A Simple Agreement for Future Equity (SAFE) is an increasingly popular investment tool. The SAFE term sheet outlines the terms and conditions under which the investor will receive equity in the startup at a later funding round or event, without setting a specific valuation at the time of investment. Overall, the King's New York Gust Series Seed Term Sheet provides a comprehensive and standardized framework for investors and entrepreneurs to negotiate and agree upon the terms of their investment in a startup. It ensures transparency and clarity in the investment process, fostering a fair and mutually beneficial agreement.

Kings New York Gust Series Seed Term Sheet

Description

How to fill out Kings New York Gust Series Seed Term Sheet?

Whether you plan to start your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Kings Gust Series Seed Term Sheet is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to get the Kings Gust Series Seed Term Sheet. Adhere to the guide below:

- Make certain the sample meets your individual needs and state law regulations.

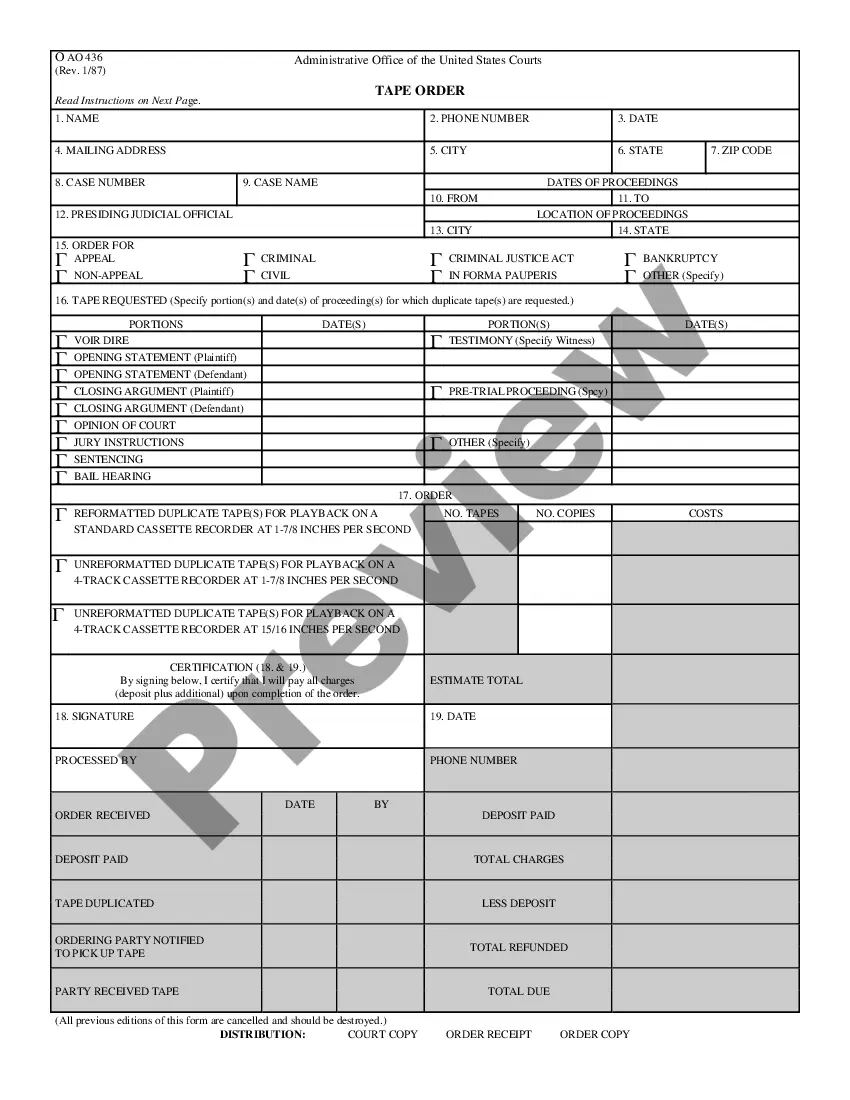

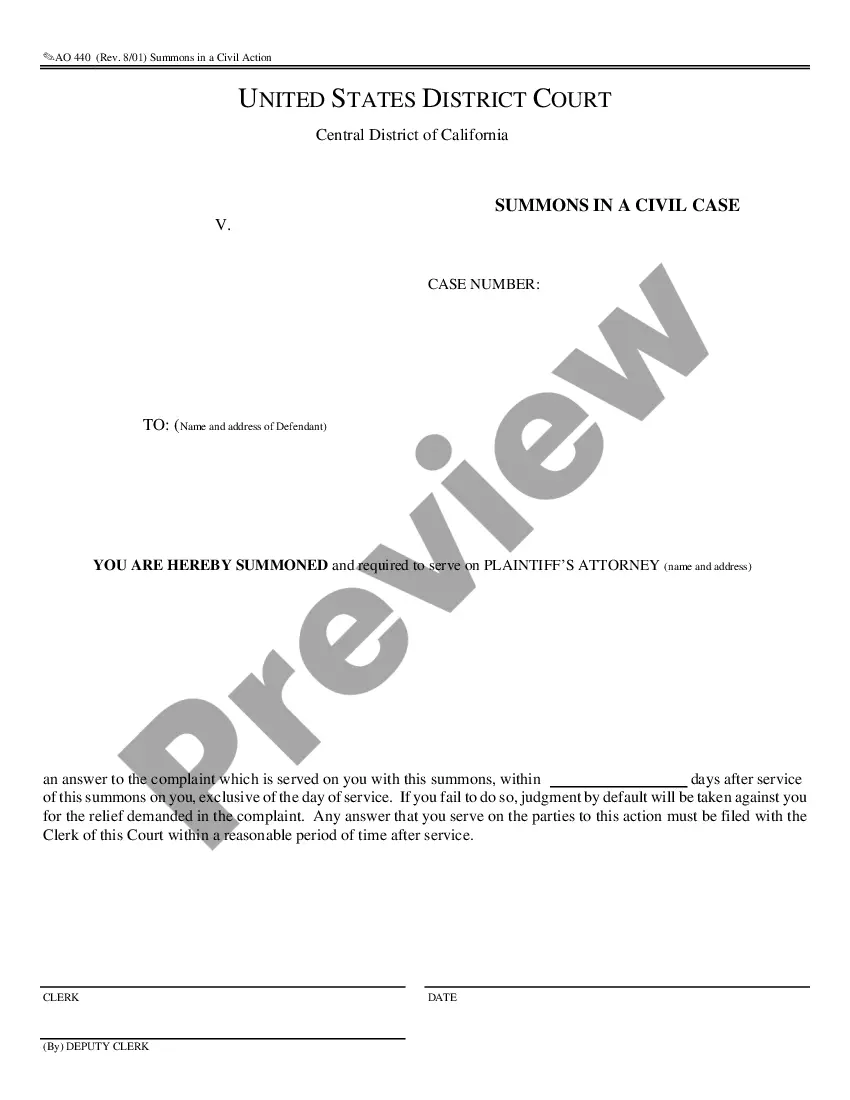

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Kings Gust Series Seed Term Sheet in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!