Orange, California, is a vibrant city located in Orange County, encompassing a diverse range of attractions, businesses, and residential areas. Known for its rich history and thriving community, Orange offers a unique blend of small-town charm and modern amenities. One notable term sheet that emerges within the realm of startup funding and investment agreements is the Orange California Gust Series Seed Term Sheet. This particular term sheet pertains to the series seed funding round, a crucial stage of financing for early-stage startups seeking to scale their operations and attract additional capital. The Gust Series Seed Term Sheet is an essential tool utilized by investors and founders when negotiating the terms of a potential investment deal. It serves as a preliminary agreement, outlining the principal stipulations and conditions that will govern the investment process. Highlighting the key aspects of the term sheet, it typically includes details related to the funding amount, valuation of the company, ownership dilution, liquidation preferences, anti-dilution provisions, investor rights, board composition, vesting schedules for founders and key employees, and other essential terms. While the Orange California Gust Series Seed Term Sheet encompasses various facets of an investment agreement, it is crucial to note that there can be slight variations or specific addendums tailored to each unique investment opportunity. Some key types or variations of the Gust Series Seed Term Sheet may include: 1. Standard Gust Series Seed Term Sheet: This is the most common version, representing a comprehensive framework for negotiating series seed investments with standard terms and conditions. 2. Founder-Friendly Gust Series Seed Term Sheet: This variation tends to favor the startup founders, offering more favorable terms regarding liquidation preferences, founder vesting, and other protective provisions. 3. Investor-Friendly Gust Series Seed Term Sheet: Conversely, this type of term sheet prioritizes investor interests, often including stricter provisions related to liquidation preferences, protective provisions, and investor rights. 4. Modified Gust Series Seed Term Sheet: This version involves amendments and adjusted terms from the standard template, reflecting specific requirements or preferences of either the founders or investors involved in the negotiation. In conclusion, the Orange California Gust Series Seed Term Sheet is an instrumental document used within the startup ecosystem, facilitating the financing process and articulating the essential terms of a funding round. It outlines key provisions, ensuring both parties have a solid foundation for further negotiations and finalization of a robust investment agreement that aligns with their objectives and expectations.

Orange California Gust Series Seed Term Sheet

Description

How to fill out Orange California Gust Series Seed Term Sheet?

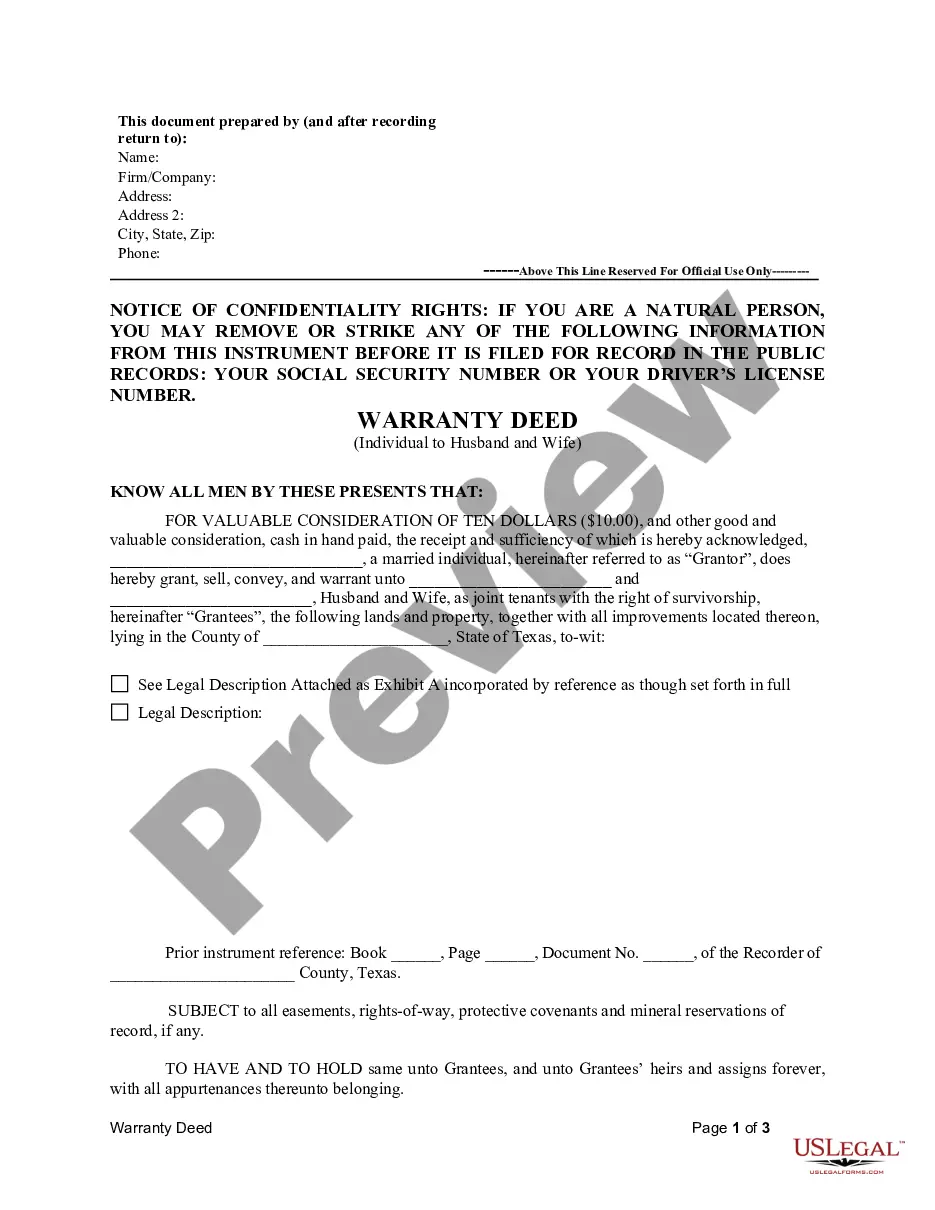

How much time does it typically take you to create a legal document? Because every state has its laws and regulations for every life situation, locating a Orange Gust Series Seed Term Sheet suiting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. In addition to the Orange Gust Series Seed Term Sheet, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Orange Gust Series Seed Term Sheet:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Orange Gust Series Seed Term Sheet.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!