Phoenix, Arizona Gust Series Seed Term Sheet: A Comprehensive Overview The Phoenix, Arizona Gust Series Seed Term Sheet is a crucial document utilized in the startup ecosystem to outline key terms and conditions for the initial seed funding round of a company. This term sheet serves as the foundation for negotiations between entrepreneurs and potential investors, ensuring alignment and establishing a solid framework for investment. Key Relevant Keywords: 1. Phoenix, Arizona 2. Gust Series Seed Term Sheet 3. Startup ecosystem 4. Seed funding 5. Investment 6. Negotiations 7. Entrepreneurs 8. Investors 9. Terms and conditions Different Types of Phoenix, Arizona Gust Series Seed Term Sheets: 1. Standard Gust Series Seed Term Sheet: — This format outlines the standard terms and conditions associated with seed investments in Phoenix, Arizona. It typically covers crucial aspects like valuation, investment amount, conversion mechanics, and investor preferences. 2. Phoenix Accelerator Gust Series Seed Term Sheet: — This term sheet variant is specifically designed for startups participating in accelerator programs in Phoenix, Arizona. It may include additional provisions, such as mentorship requirements, milestone expectations, and potential follow-on investment opportunities. 3. Gust Series Convertible Note Term Sheet: — Though not exclusively labeled as "Seed Term Sheet," this variant is commonly used in early-stage funding rounds as an alternative to equity financing. It establishes terms for convertible notes, creating a debt instrument that can be converted into equity at a later date, aligning with the seed investment structure. 4. Customized Phoenix Gust Series Seed Term Sheet: — This type of term sheet is flexible and tailored to meet specific startup and investor requirements. It allows for negotiation of unique terms and can cover aspects such as liquidation preferences, board composition, anti-dilution rights, and more. In conclusion, the Phoenix, Arizona Gust Series Seed Term Sheet is a significant document that plays a pivotal role in shaping early-stage investments for startups. It ensures transparency, aligns investor and entrepreneur expectations, and provides a strong foundation for negotiating investment deals. Understanding the various types of Phoenix Gust Series Seed Term Sheets can be valuable for both startups and investors seeking to navigate the local startup ecosystem and make informed investment decisions.

Phoenix Arizona Gust Series Seed Term Sheet

Description

How to fill out Phoenix Arizona Gust Series Seed Term Sheet?

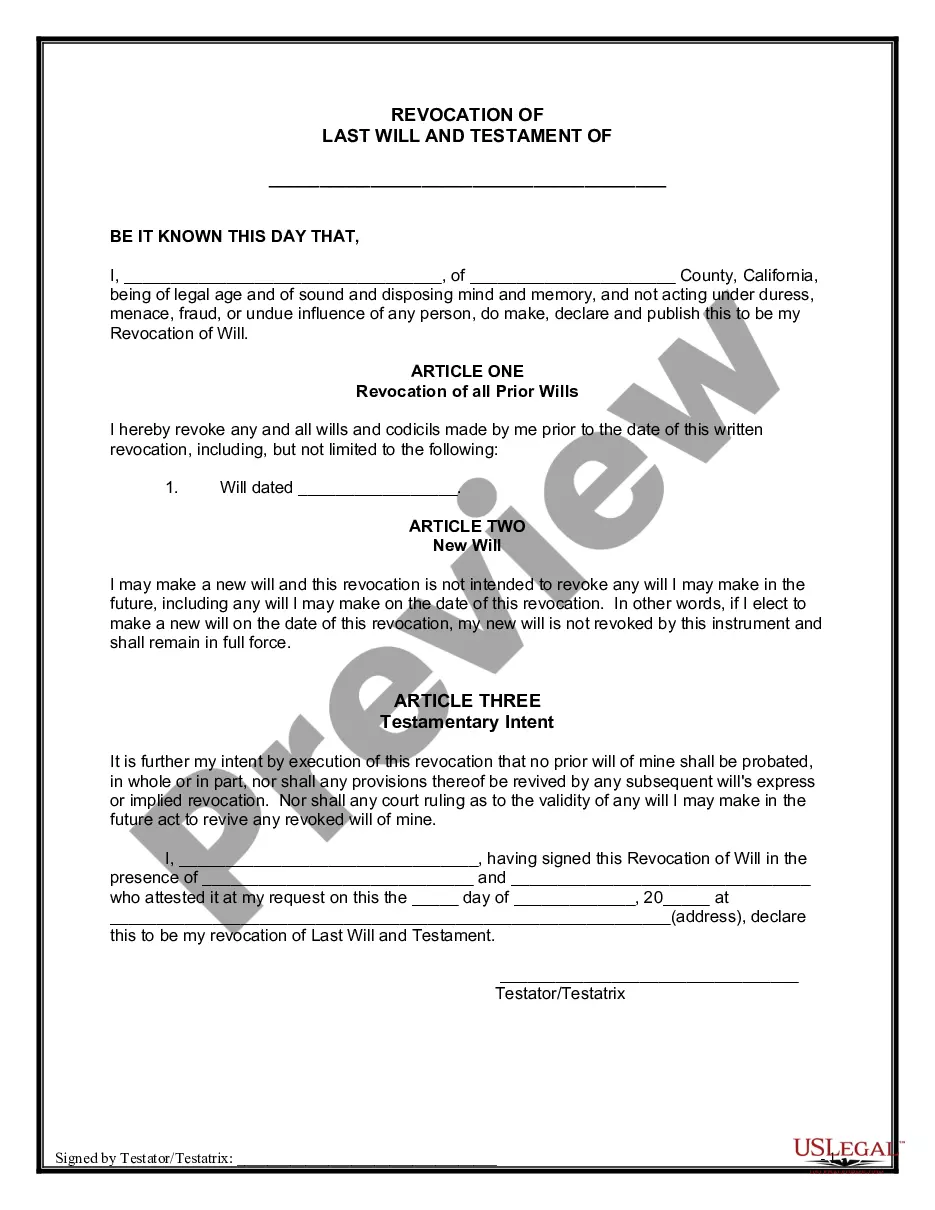

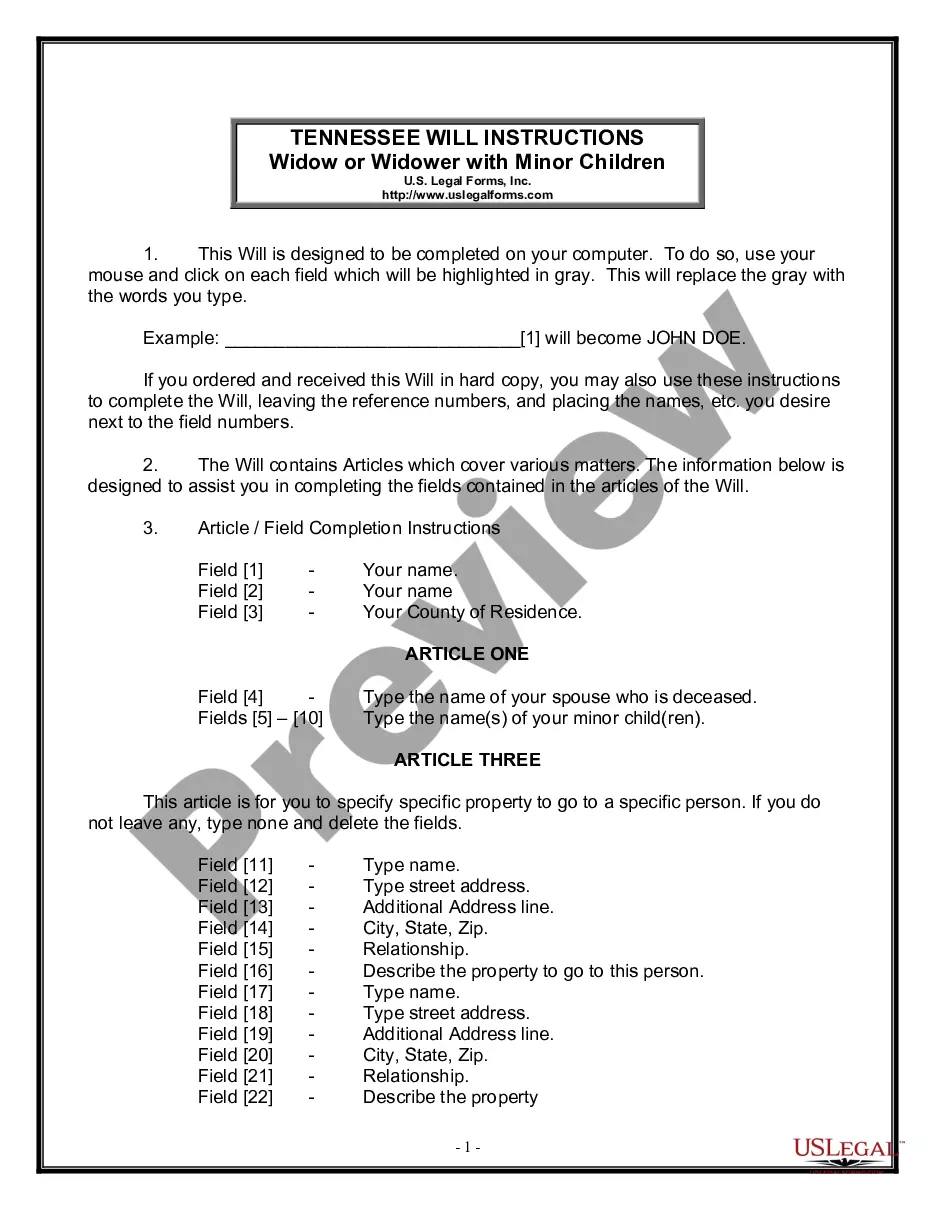

If you need to find a trustworthy legal form provider to obtain the Phoenix Gust Series Seed Term Sheet, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can browse from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning materials, and dedicated support team make it simple to find and execute different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to search or browse Phoenix Gust Series Seed Term Sheet, either by a keyword or by the state/county the form is intended for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Phoenix Gust Series Seed Term Sheet template and check the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be instantly available for download once the payment is processed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less expensive and more affordable. Create your first company, organize your advance care planning, draft a real estate contract, or execute the Phoenix Gust Series Seed Term Sheet - all from the comfort of your sofa.

Join US Legal Forms now!