Travis Texas Gust Series Seed Term Sheet is a comprehensive legal document that outlines the terms and conditions for investing in early-stage startups within Travis County, Texas. This term sheet is specific to the Gust Series Seed funding round, which is typically the first institutional financing a startup raises. The Travis Texas Gust Series Seed Term Sheet covers various crucial aspects of the investment agreement. It includes details about the amount of funding sought by the startup, the valuation of the company, and the percentage of equity the investor will receive in return for their investment. Additionally, it outlines the rights and obligations of both the investor and the startup founders. The key provisions in this term sheet encompass: 1. Investment Amount: The term sheet specifies the amount of funding the startup is seeking to raise in the Gust Series Seed round. This can range from a few thousand dollars to millions, depending on the startup's requirements. 2. Valuation: The term sheet determines the pre-money valuation of the startup, which is critical for calculating the investor's ownership stake post-investment. The valuation is typically based on the startup's market potential, intellectual property, and performance. 3. Equity Percentage: The term sheet stipulates the percentage of the company's equity the investor will receive in exchange for their investment. This is usually determined by dividing the investment amount by the post-money valuation. 4. Voting Rights: The term sheet outlines the investor's voting rights, which might include board seat allocation and certain veto powers over significant company decisions. 5. Liquidation Preference: This provision defines the order in which financial proceeds on exit or liquidation are distributed, favoring investors over common shareholders. 6. Anti-dilution Protection: The term sheet may incorporate clauses to protect the investor from future dilution of their ownership stake in case of subsequent financing rounds at a lower valuation. 7. Conversion Rights: If the startup undergoes a subsequent financing round, the term sheet may outline the investor's right to convert their preferred stock into common stock. 8. Information Rights: The investor is typically granted access to the startup's financials, progress reports, and may have the right to attend board meetings as an observer. 9. Governing Law: The term sheet specifies the jurisdiction and governing law under which any disputes between the parties will be resolved. It's worth noting that while the above provisions are common in Travis Texas Gust Series Seed Term Sheets, there might be slight variations based on the specific terms negotiated between the startup and the investor.

Travis Texas Gust Series Seed Term Sheet

Description

How to fill out Travis Texas Gust Series Seed Term Sheet?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official documentation that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your region, including the Travis Gust Series Seed Term Sheet.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Travis Gust Series Seed Term Sheet will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to obtain the Travis Gust Series Seed Term Sheet:

- Make sure you have opened the proper page with your local form.

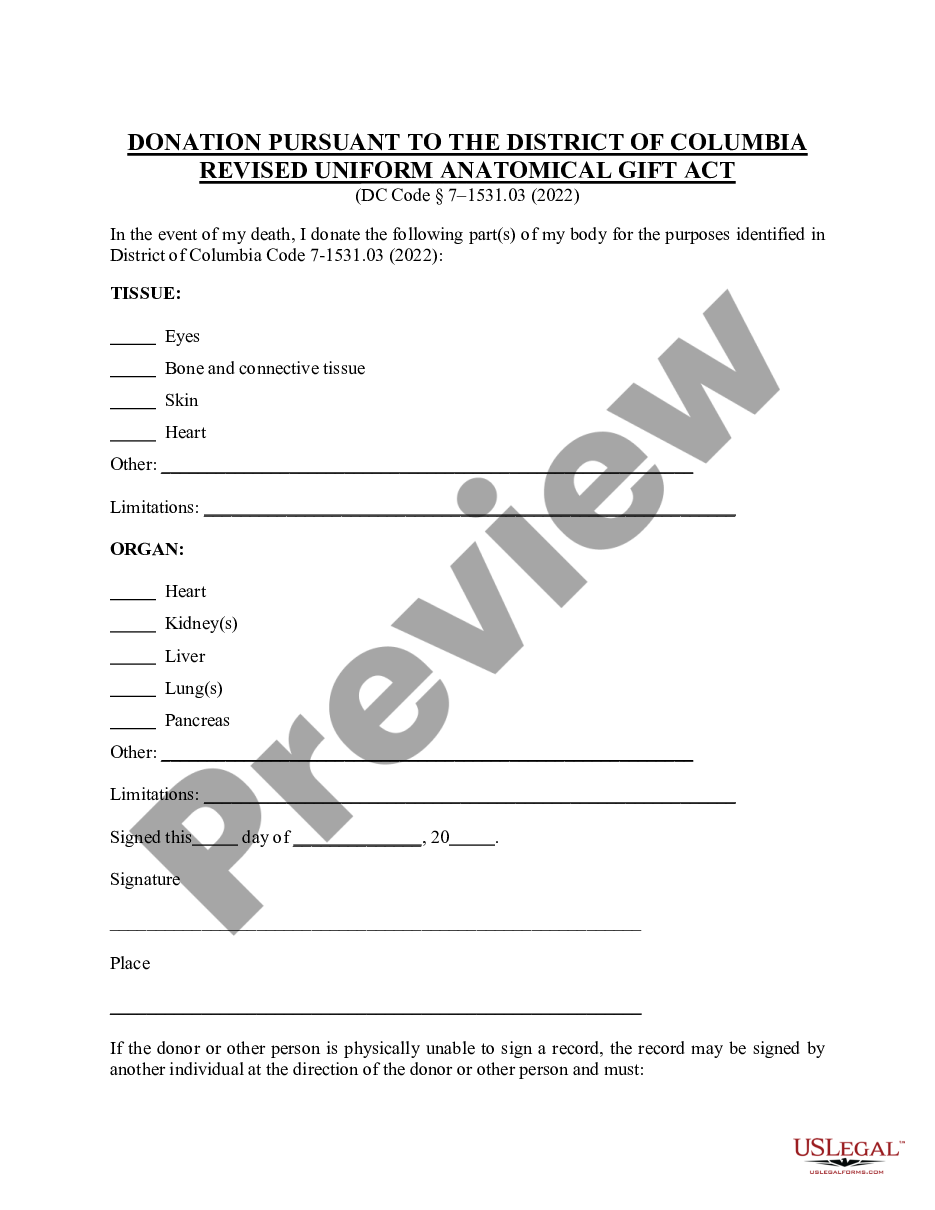

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Travis Gust Series Seed Term Sheet on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!