The Kings New York Investors Rights Agreement is a legal document that outlines the rights and protections granted to investors who have invested in a company based in New York. It is a crucial agreement that ensures the interests of the investors are safeguarded and that they have a say in important decision-making processes within the company. This agreement is designed to provide investors with certain key rights to protect their investment. It typically covers various aspects, including information rights, registration rights, and voting rights. These rights are essential to empower investors and enable them to actively participate in the company's affairs. Information rights are one of the primary components of the Kings New York Investors Rights Agreement. They grant investors access to relevant information about the company's financials, operations, and any material events or changes that could affect their investment. This transparency allows investors to stay informed and make informed decisions. Registration rights, another crucial aspect, provide investors with the ability to register their shares for public sale. This means that, if the company goes public or decides to offer additional shares to the public, investors have the right to include their shares in the offering. Such rights are essential for investors who want the option to sell their shares in the future. Voting rights, on the other hand, ensure that investors have a say in significant company decisions. These decisions may include matters such as the election of directors, mergers and acquisitions, or amendments to the company's articles of incorporation. By having voting rights, investors can actively participate in shaping the company's future direction and protect their interests. It is important to note that there can be variations or different types of Kings New York Investors Rights Agreements, depending on the specific terms and conditions negotiated between the investors and the company. Some variations may include additional rights or provisions tailored to the specific needs and preferences of investors. For example, certain agreements may grant anti-dilution rights to protect against future share issuance that could devalue the investors' shares. In summary, the Kings New York Investors Rights Agreement is an essential legal document that outlines the rights and protections granted to investors in a New York-based company. Through this agreement, investors gain information rights, registration rights, and voting rights, allowing them to stay informed, participate in decision-making, and safeguard their investment. Different variations of the agreement may exist, with additional provisions to meet specific investor needs.

Kings New York Investors Rights Agreement

Description

How to fill out Kings New York Investors Rights Agreement?

Creating paperwork, like Kings Investors Rights Agreement, to manage your legal affairs is a tough and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms crafted for different cases and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Kings Investors Rights Agreement template. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before downloading Kings Investors Rights Agreement:

- Ensure that your form is specific to your state/county since the rules for creating legal documents may vary from one state another.

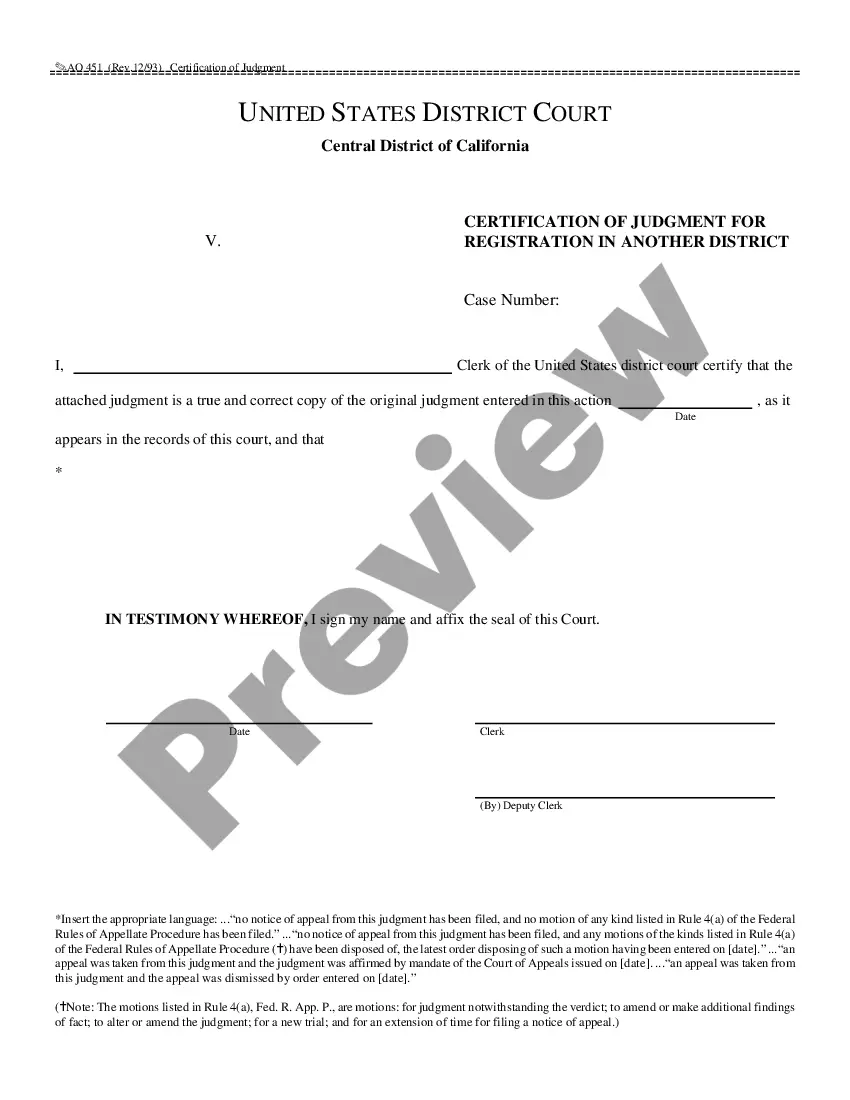

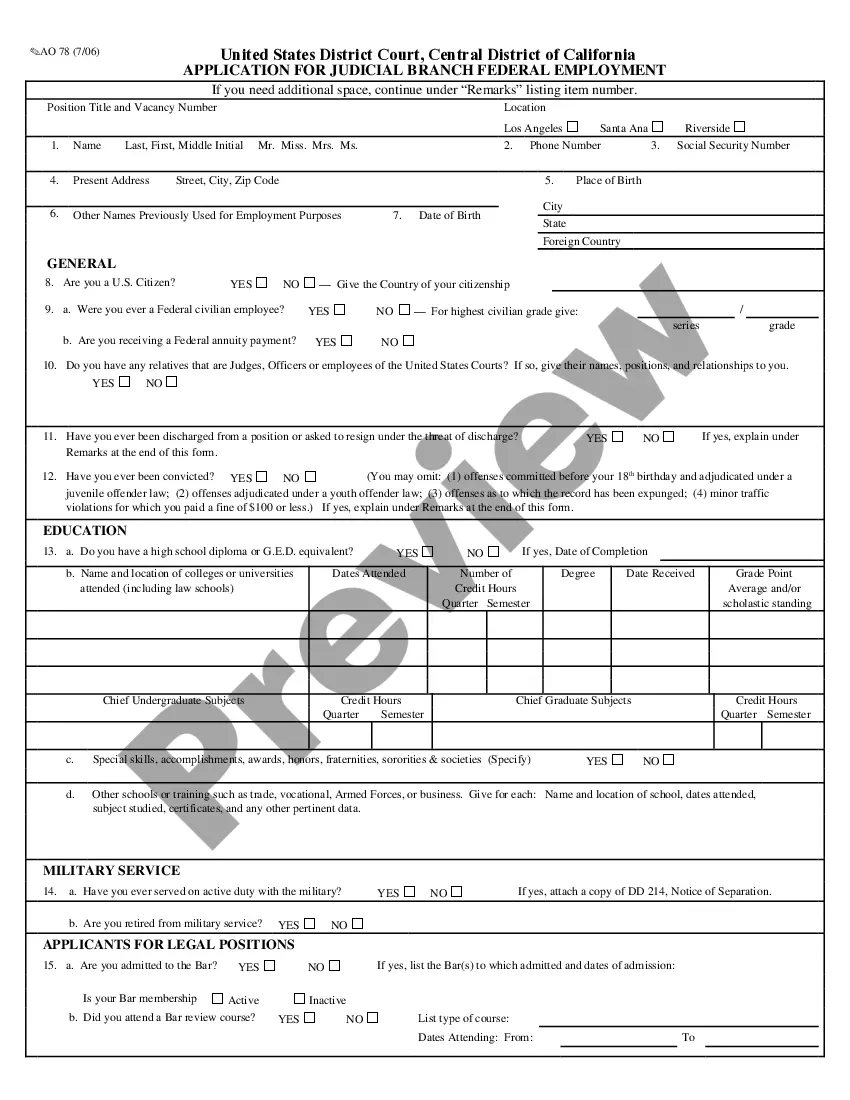

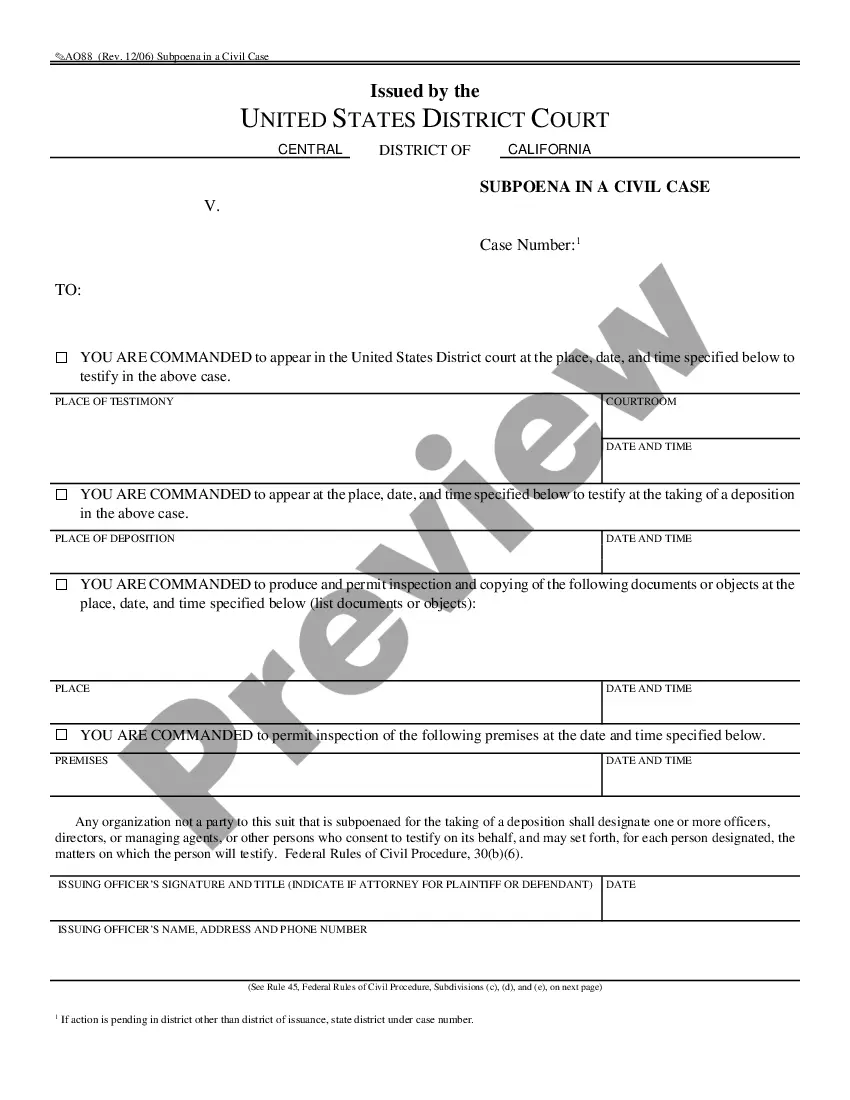

- Discover more information about the form by previewing it or reading a quick description. If the Kings Investors Rights Agreement isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start using our website and download the document.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!