The Fulton Georgia Series Seed Preferred Stock Purchase Agreement is a legal document that outlines the terms and conditions for the purchase and sale of seed preferred stock in Fulton, Georgia. This agreement commonly involves two parties, the issuer and the purchaser, who engage in a transaction pertaining to preferred stocks. The Series Seed Preferred Stock Purchase Agreement specifies the rights, obligations, and restrictions involved in the purchase and ownership of seed preferred stock. It typically covers key aspects such as the purchase price, number of shares, and the closing date of the transaction. This agreement also addresses the provisions related to dividends, liquidation preferences, anti-dilution measures, voting rights, and corporate governance matters. Fulton, Georgia, being a thriving business hub, may host various variations of the Series Seed Preferred Stock Purchase Agreement to suit different circumstances and preferences. Examples of these variations include: 1. Series A Seed Preferred Stock Purchase Agreement: This agreement pertains to the purchase of the first series of seed preferred stock issued by a company. It outlines the terms specific to this particular series and sets the foundation for subsequent series, if any. 2. Series B Seed Preferred Stock Purchase Agreement: In cases where a company decides to issue subsequent series of seed preferred stock, this agreement comes into play. It addresses the terms associated with the second series, including any modifications or improvements compared to the previous series. 3. Series C Seed Preferred Stock Purchase Agreement: Similar to the Series B agreement, this contract deals with the purchase of the third series of seed preferred stock. It accounts for any specific terms and conditions that differentiate it from prior series. 4. Series Seed Preferred Stock Purchase Agreement Addendum: This is not a distinct type, but rather an additional document that can modify or extend an existing Series Seed Preferred Stock Purchase Agreement. It may incorporate amendments, new clauses, or terms applicable to a particular situation. The Fulton Georgia Series Seed Preferred Stock Purchase Agreement, along with its variations, plays a crucial role in facilitating investment opportunities and promoting capital infusion in start-ups and growth-stage companies in Fulton, Georgia. It establishes a clear framework for investors and businesses to engage in mutually beneficial transactions, providing transparency and legal protection for all parties involved.

Fulton Georgia Series Seed Preferred Stock Purchase Agreement

Description

How to fill out Fulton Georgia Series Seed Preferred Stock Purchase Agreement?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Fulton Series Seed Preferred Stock Purchase Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the Fulton Series Seed Preferred Stock Purchase Agreement, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Fulton Series Seed Preferred Stock Purchase Agreement:

- Glance through the page and verify there is a sample for your area.

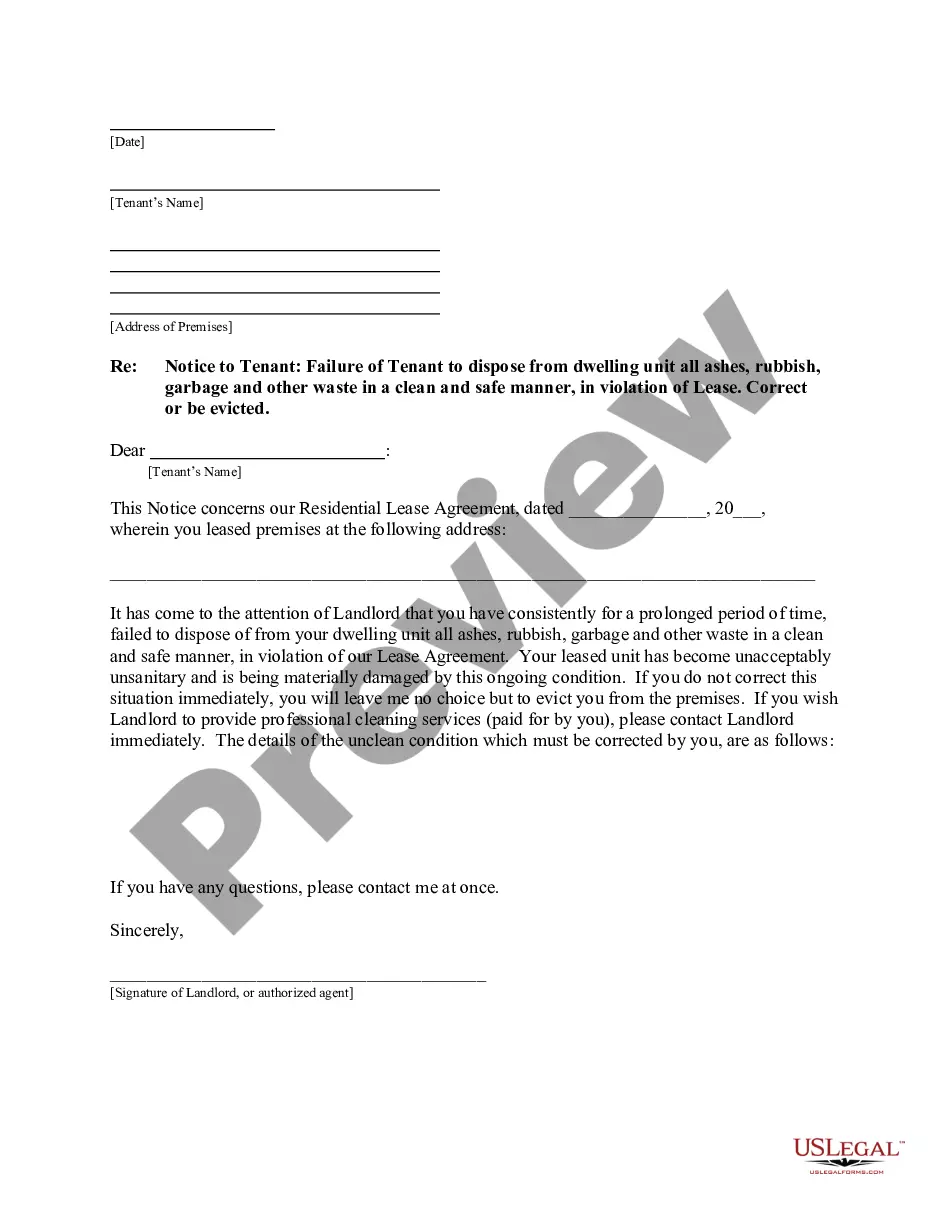

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Fulton Series Seed Preferred Stock Purchase Agreement and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!