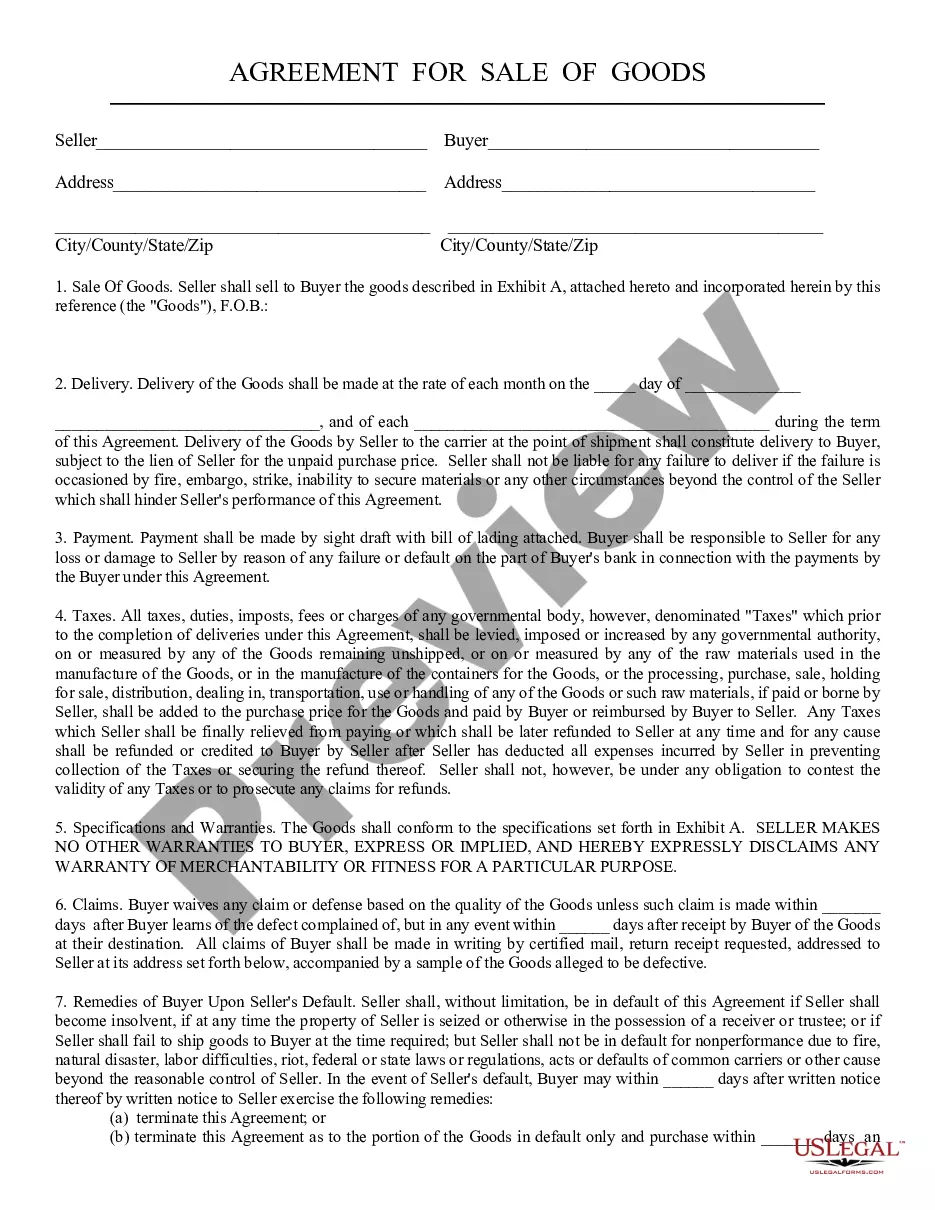

The Nassau New York Series Seed Preferred Stock Purchase Agreement is a legally binding document that governs the purchase and sale of preferred stock in a company based in Nassau, New York. This agreement is specifically designed for early-stage startups seeking financing from seed investors. The Series Seed Preferred Stock Purchase Agreement outlines the terms and conditions under which the preferred stock is sold, the rights and privileges granted to the investors, and the obligations and responsibilities of both parties involved. It serves as a crucial tool for ensuring clarity, certainty, and protection of interests in all parties. Some key provisions typically found in the Nassau New York Series Seed Preferred Stock Purchase Agreement include: 1. pre-Roman valuation: This clause determines the company's value before receiving the investment and is a pivotal factor in determining the number and price of preferred shares to be issued to the investor. 2. Purchase price and consideration: The agreement specifies the purchase price per share of preferred stock, the total consideration to be paid by the investor, and the payment terms agreed upon. 3. Dividend rights: It outlines the rights of the seed investors to receive dividends on their preferred stock investments and clarifies the frequency, calculation, and conditions for dividend payments. 4. Liquidation preference: This provision establishes the priority of payment to preferred stockholders in case of a liquidation event, ensuring they receive their investment amount before other shareholders. 5. Conversion rights: It details the circumstances in which the preferred shares can be converted into common stock and any applicable conversion ratio determined in the agreement. 6. Voting rights: The agreement specifies the extent of voting rights granted to the preferred stockholders, such as participating or non-participating rights, protective provisions, and board representation. 7. Anti-dilution protections: It outlines mechanisms to protect the investor's ownership percentage in case the company raises additional financing at a lower valuation, such as weighted average or full-ratchet anti-dilution adjustments. 8. Rights of first refusal and co-sale: The agreement may contain provisions giving the preferred stockholders the right to participate in future stock sales by the company or to offer their shares for sale alongside the founders or other investors. 9. Governing law and dispute resolution: This section identifies the jurisdiction and laws that govern the agreement and outlines the process for resolving any disputes that may arise. It's important to note that while the general structure and provisions of the Nassau New York Series Seed Preferred Stock Purchase Agreement remain relatively consistent, there could be variations or additional clauses included in individual agreements depending on the specific needs and negotiations between the parties involved.

Nassau New York Series Seed Preferred Stock Purchase Agreement

Description

How to fill out Nassau New York Series Seed Preferred Stock Purchase Agreement?

Are you looking to quickly create a legally-binding Nassau Series Seed Preferred Stock Purchase Agreement or maybe any other document to take control of your own or business matters? You can select one of the two options: contact a professional to write a legal document for you or draft it entirely on your own. The good news is, there's another option - US Legal Forms. It will help you get neatly written legal documents without having to pay sky-high prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-specific document templates, including Nassau Series Seed Preferred Stock Purchase Agreement and form packages. We offer templates for a myriad of use cases: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the needed template without extra troubles.

- First and foremost, carefully verify if the Nassau Series Seed Preferred Stock Purchase Agreement is tailored to your state's or county's regulations.

- If the form comes with a desciption, make sure to verify what it's intended for.

- Start the search again if the template isn’t what you were seeking by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Nassau Series Seed Preferred Stock Purchase Agreement template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Additionally, the templates we offer are updated by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!