Preferred stock pays fixed dividends and has also the potential to appreciate in price. That is to say, it combines features of debt and equity.

Preferred stock usually yields more than common stock, and it can be paid every month or every quarter. The dividends are fixed or set according to a benchmark interest rate. The dividend yield is influenced by adjustable-rate shares, and participating shares are able to pay more dividends that calculated by common stock dividends or business profits.

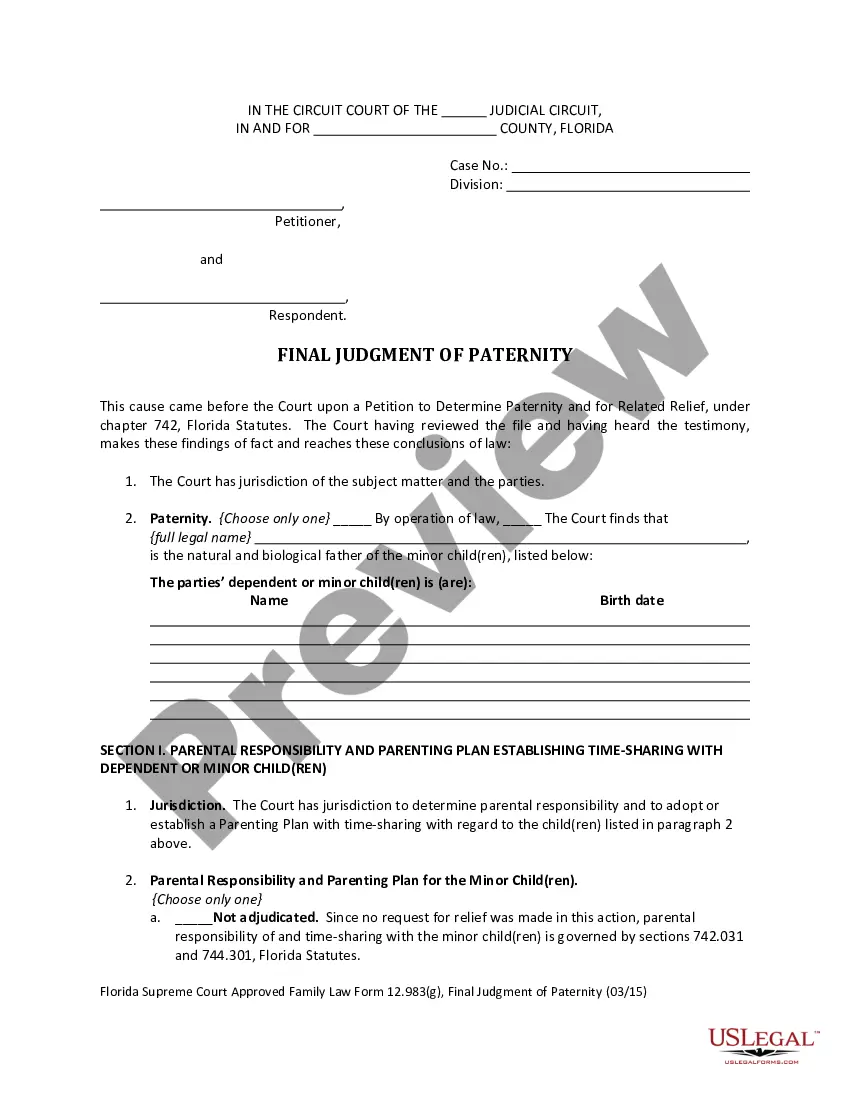

This is a template for agreeing on preferred stock purchases for your company to use when working with investors."

Philadelphia, Pennsylvania is a city renowned for its rich history, vibrant culture, and diverse population. Nestled in the northeastern United States, Philadelphia is the largest city in Pennsylvania and serves as a vital economic and cultural hub in the region. It is brimming with iconic landmarks, such as the Liberty Bell and Independence Hall, where the Declaration of Independence and the U.S. Constitution were formulated. Now, turning our attention to the legal and financial realm, we delve into the intricate details of the Philadelphia Pennsylvania Series Seed Preferred Stock Purchase Agreement. This agreement refers to a legally binding contract that governs the purchase of preferred stock in early-stage startup companies located in Philadelphia that have chosen to raise capital through a series seed funding round. The Series Seed Preferred Stock Purchase Agreement is designed to protect the interests of both the company issuing the stock (the issuer) and the investors (the purchasers). It outlines the terms and conditions of the investment, including the rights and preferences of the preferred stockholders, the purchase price, the vesting schedule (if applicable), and any potential conversion or redemption provisions. Within the realm of Philadelphia Pennsylvania Series Seed Preferred Stock Purchase Agreements, different variations may exist depending on the specific terms negotiated between the company and the investor. Some key types or variations of this agreement might include: 1. Standard Series Seed Preferred Stock Purchase Agreement: This is the generic form of the agreement, typically used as a starting point for negotiations between the parties involved. It outlines the foundational terms and conditions of the stock purchase arrangement. 2. Customized Series Seed Preferred Stock Purchase Agreement: This type of agreement deviates from the standard template and incorporates additional terms or modifications that cater to the specific needs and preferences of the company and the investors involved. These customizations can include specific protective provisions, anti-dilution adjustments, or unique investor rights. 3. Qualified Financing Series Seed Preferred Stock Purchase Agreement: In certain situations, a series seed funding round may be structured in anticipation of a future qualified financing round, such as a Series A funding round. In this case, the agreement may include provisions that align with the terms of the forthcoming financing round, providing clarity and consistency. 4. Conversion Series Seed Preferred Stock Purchase Agreement: This type of agreement addresses the potential conversion of the preferred stock into common stock at a later stage, based on predetermined conversion ratios. It establishes the terms and conditions under which preferred stockholders can convert their holdings into common equity. In conclusion, the Philadelphia Pennsylvania Series Seed Preferred Stock Purchase Agreement serves as a critical legal document in the early-stage funding ecosystem, providing a framework for investment and guiding the relationship between startups and their investors. With various types and customized variations, these agreements adapt to the unique circumstances and preferences of each transaction, ultimately fostering growth and innovation within the Philadelphia startup community.