Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made.

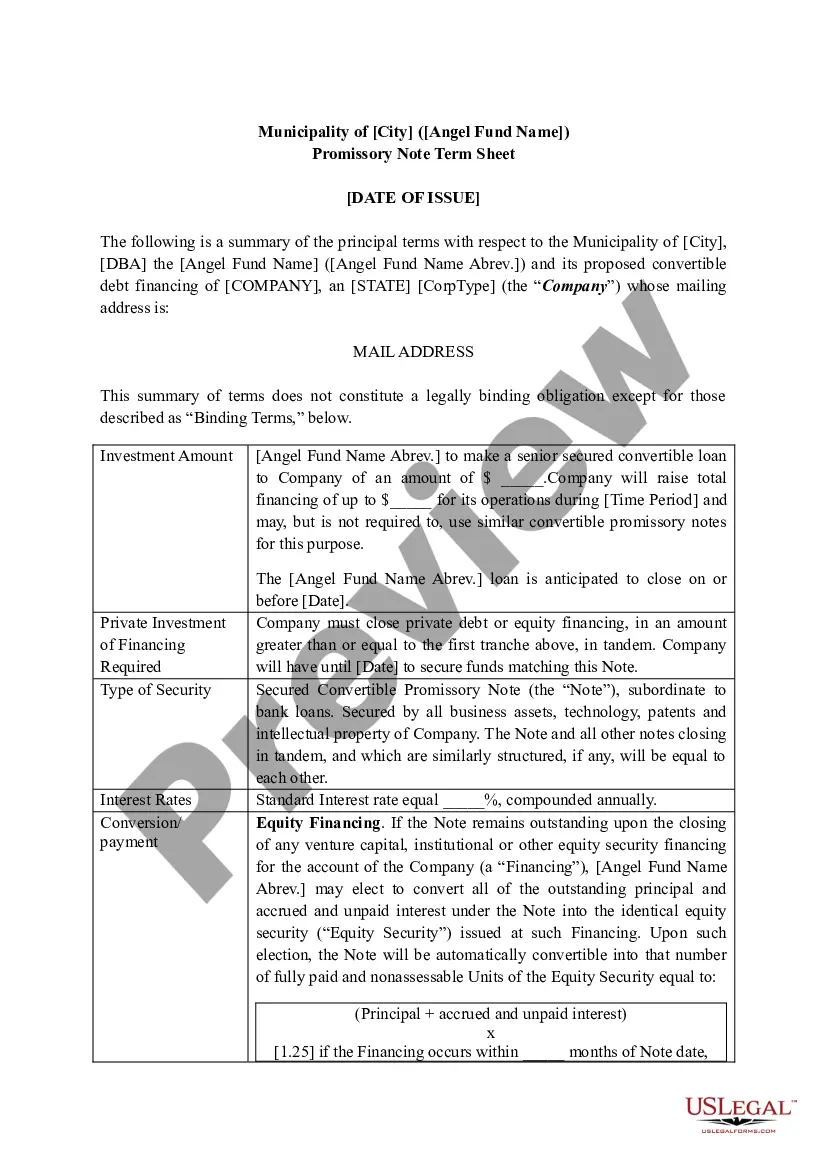

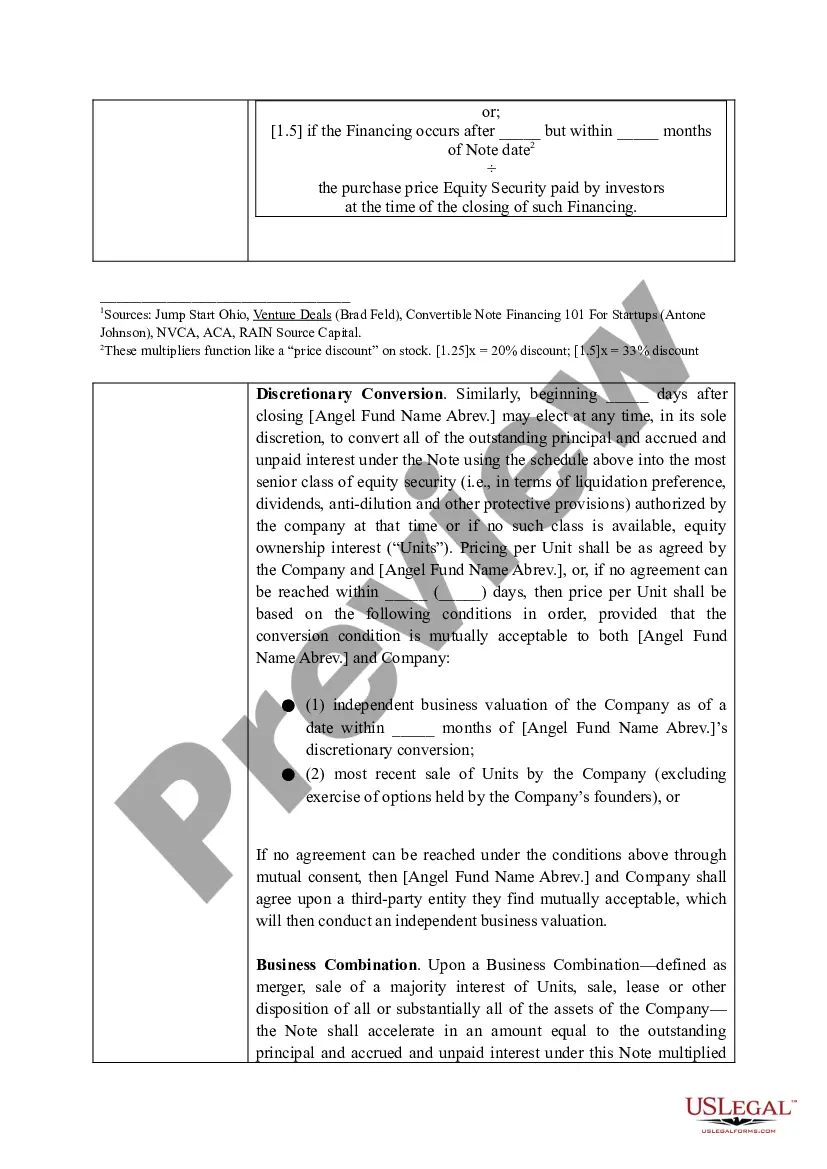

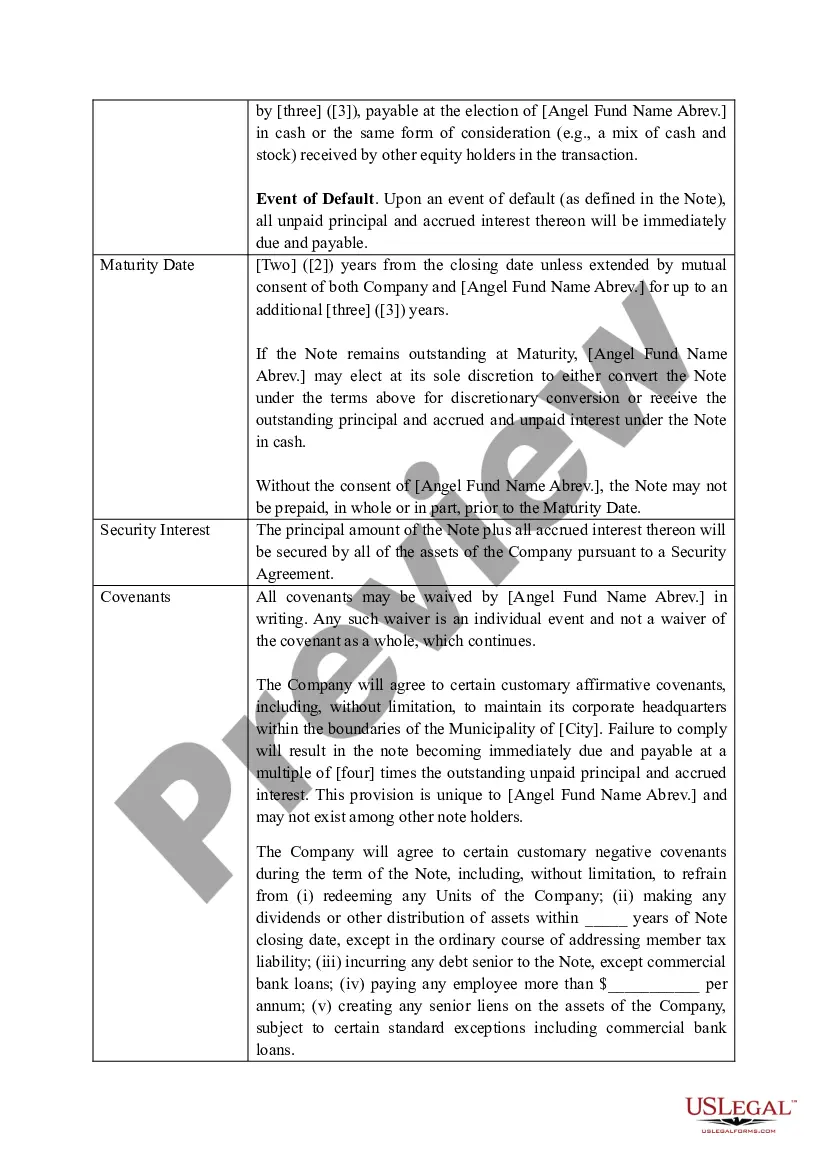

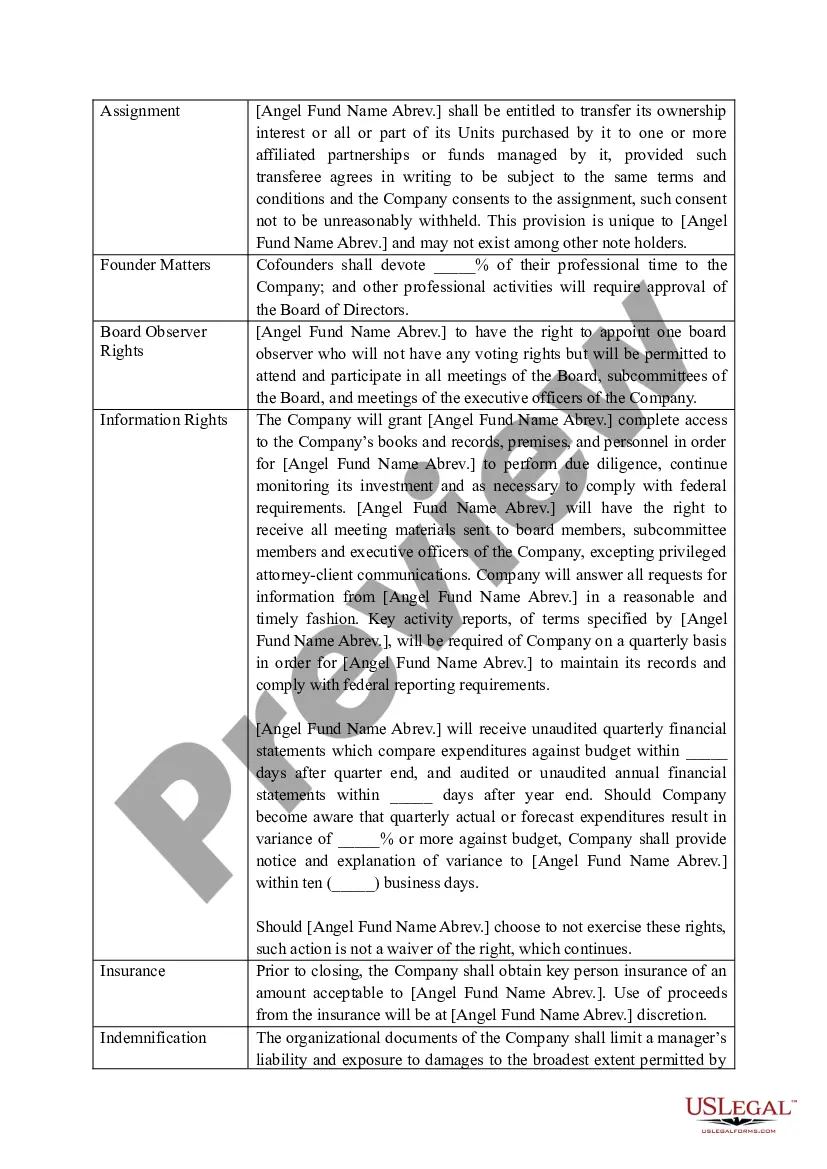

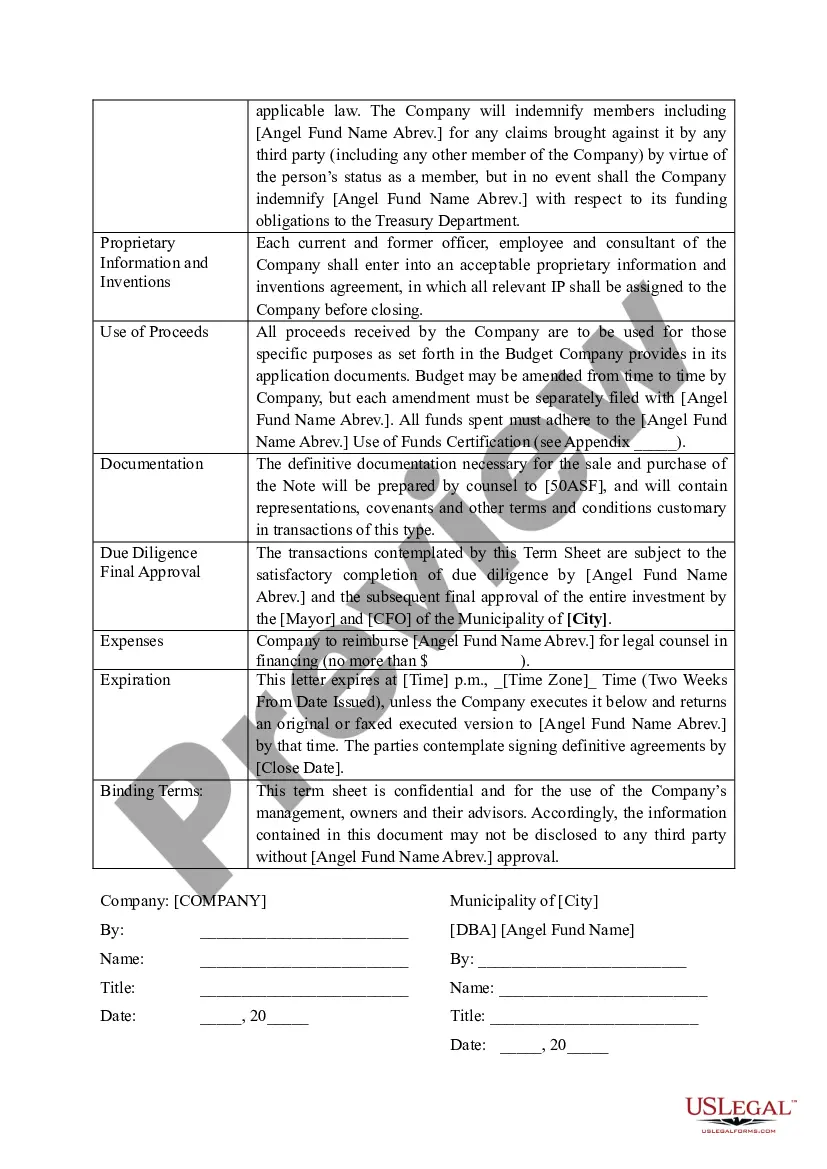

Harris Texas Angel Fund Promissory Note Term Sheet serves as a crucial document outlining the terms and conditions associated with a loan agreement between the Harris Texas Angel Fund and the borrower. This term sheet is a preliminary agreement that provides an overview of the financial arrangement before elaborating it in a formal agreement. The term sheet typically includes several key elements that both parties must agree upon. These elements and keywords often found in a Harris Texas Angel Fund Promissory Note Term Sheet are: 1. Loan Amount: The agreed-upon principal amount that the borrower will receive from the Harris Texas Angel Fund to support their business or personal financial needs. 2. Interest Rate: The stated rate at which the borrowed amount will accrue interest over the loan term. This rate is usually communicated as an annual percentage. 3. Maturity Date: The specified deadline by which the borrower must repay the loan in full, including both the principal and any accrued interest. 4. Repayment Terms: The method and schedule for repaying the loan, which may include periodic installments or a lump sum payment upon maturity. 5. Collateral: The assets or property pledged by the borrower to secure the loan, providing the Harris Texas Angel Fund with a form of security in case of default. 6. Default Terms: The consequences, penalties, or actions that may be undertaken by the Harris Texas Angel Fund if the borrower fails to repay the loan or breaches any terms specified in the agreement. 7. Governing Law: The legal jurisdiction and laws that will govern the interpretation and enforcement of the Harris Texas Angel Fund Promissory Note Term Sheet. Different variations of the Harris Texas Angel Fund Promissory Note Term Sheet may exist based on specific loan programs or requirements. Some variations can be: 1. Startup Business Loan Term Sheet: Geared towards entrepreneurs seeking financial assistance to kick-start their new business ventures. 2. Personal Loan Term Sheet: Designed for individuals seeking funds for personal reasons, such as debt consolidation, home improvements, or medical expenses. 3. Bridge Loan Term Sheet: Focused on short-term financing solutions to bridge the gap between immediate financial needs and expected future income or capital inflow. 4. Convertible Note Term Sheet: Pertains to a loan that can be converted to equity in the borrower's company at a later stage, often utilized in startup investments. It is essential for both parties to carefully review and negotiate the terms presented in the Harris Texas Angel Fund Promissory Note Term Sheet before finalizing the agreement. Once agreed upon, the term sheet will serve as the foundation for drafting a comprehensive loan agreement to ensure legal protection and clarity for both the Harris Texas Angel Fund and the borrower.