Maricopa Arizona Angel Fund is a venture capital investment fund specifically focused on providing financial support to startups and early-stage companies located in Maricopa, Arizona. As part of their investment process, Maricopa Arizona Angel Fund offers a Promissory Note Term Sheet, which outlines the essential terms and conditions of the investment agreement between the fund and the entrepreneur. The Maricopa Arizona Angel Fund Promissory Note Term Sheet serves as a preliminary agreement before finalizing the investment deal. It plays a crucial role in setting the groundwork for investment negotiations, as it outlines the principal terms that will govern the investment relationship. The term sheet acts as a blueprint for both parties, ensuring common understanding and alignment of expectations. The Maricopa Arizona Angel Fund Promissory Note Term Sheet typically includes various key elements. These may include: 1. Investment Amount: Specifies the amount of funding the Angel Fund is willing to invest in the startup or early-stage company. 2. Interest Rate: States the interest rate that will be charged on the loan amount provided by the Angel Fund. 3. Convertible or Non-Convertible: Defines whether the Promissory Note can be converted into equity or remains non-convertible throughout its term. 4. Maturity Date: Specifies the date by which the loan, along with any accrued interest, needs to be repaid by the borrower. 5. Default Provisions: Outlines the consequences, such as penalties or additional interest, in the event of default or late payment. 6. Repayment Terms: Describes the repayment structure, including periodic payments or a lump-sum repayment, depending on the agreed-upon terms. 7. Security or Collateral: Covers any security or collateral pledges provided by the borrower to secure the loan. 8. Governing Law and Jurisdiction: Determines the applicable laws and jurisdiction under which the agreement will be governed. While specific types of Maricopa Arizona Angel Fund Promissory Note Term Sheets may vary depending on individual circumstances, the main variations typically arise from factors such as the investment amount, interest rate, and conversion options. However, the general purpose of the Term Sheet remains the same — to lay out the foundation for a mutually beneficial investment agreement between the Maricopa Arizona Angel Fund and the entrepreneurial ventures they support.

Maricopa Arizona Angel Fund Promissory Note Term Sheet

Description

How to fill out Maricopa Arizona Angel Fund Promissory Note Term Sheet?

Draftwing paperwork, like Maricopa Angel Fund Promissory Note Term Sheet, to take care of your legal affairs is a challenging and time-consumming process. Many cases require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents intended for various cases and life situations. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Maricopa Angel Fund Promissory Note Term Sheet form. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before getting Maricopa Angel Fund Promissory Note Term Sheet:

- Make sure that your document is compliant with your state/county since the regulations for writing legal papers may differ from one state another.

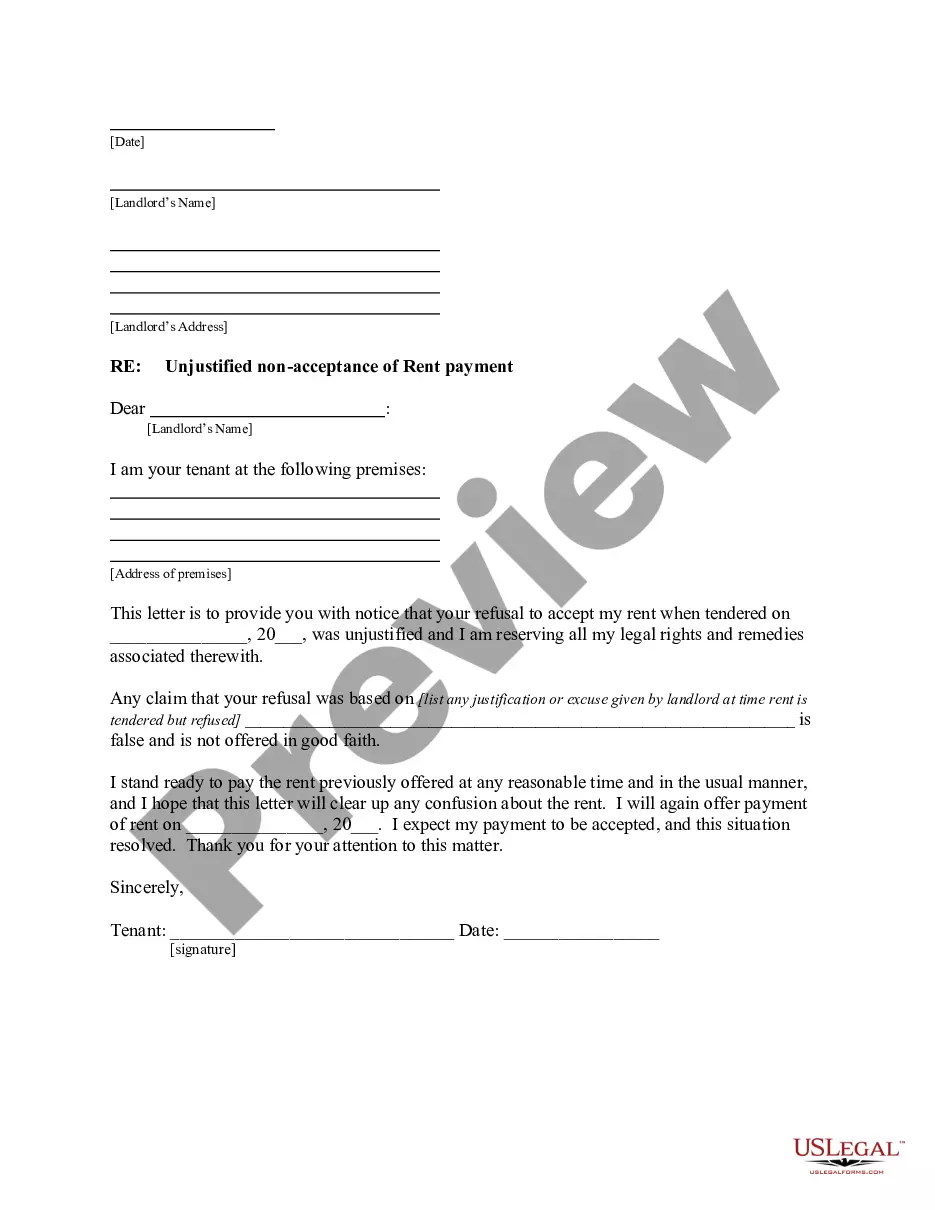

- Find out more about the form by previewing it or going through a brief description. If the Maricopa Angel Fund Promissory Note Term Sheet isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin utilizing our website and download the document.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment details.

- Your form is good to go. You can try and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!