Cook Illinois Angel Fund Promissory Note Term Sheet is a legal document that serves as an outline or agreement to establish the terms and conditions of a promissory note between the Cook Illinois Angel Fund and the borrower. This term sheet highlights the important details and provisions that both parties must comply with throughout the duration of the agreement. The Cook Illinois Angel Fund Promissory Note Term Sheet typically includes the following elements: 1. Loan Amount: This section specifies the principal amount of money that will be lent to the borrower by the Cook Illinois Angel Fund. 2. Interest Rate: The term sheet outlines the interest rate that will be charged on the loan. This rate is the percentage at which the borrower is obliged to repay the borrowed funds, typically calculated on an annual basis. 3. Repayment Terms: The term sheet outlines the repayment terms, including the installment schedule, frequency of payments, and the total number of payments required to fully repay the loan. 4. Maturity Date: This section specifies the maturity date, which is the due date by which the entire loan amount must be repaid to the Cook Illinois Angel Fund. 5. Collateral: If applicable, the term sheet may outline any collateral requirements, wherein the borrower pledges assets as security for the loan. This safeguards the lender's interests in case of default. 6. Prepayment: The term sheet may include provisions related to prepayment, allowing the borrower to repay the loan in part or in full before the maturity date, often with specified penalties or fees. 7. Events of Default: This section outlines the conditions that constitute a default under the promissory note, such as late payments, non-payment, or breach of the agreed-upon terms. It also specifies the remedies available to the Cook Illinois Angel Fund in the event of default. 8. Governing Law: The term sheet may identify the governing law under which the promissory note and the relationship between the parties will be regulated and interpreted. Different types of Cook Illinois Angel Fund Promissory Note Term Sheets may exist depending on the specific nature of the loan. Some examples include: 1. Convertible Promissory Note Term Sheet: This term sheet outlines the terms and conditions of a convertible loan, which allows the Cook Illinois Angel Fund to convert its debt into equity in the borrower's company under certain circumstances, typically during a future financing round. 2. Participating Promissory Note Term Sheet: This type of term sheet includes provisions that grant the Cook Illinois Angel Fund the right to participate in the borrower's future profits or equity appreciation in addition to receiving interest on the loan. 3. Subordinated Promissory Note Term Sheet: This term sheet establishes a subordinate position for the Cook Illinois Angel Fund's loan, meaning that its repayment priority is lower than other existing lenders, providing additional protection to the senior lenders. By utilizing a Cook Illinois Angel Fund Promissory Note Term Sheet, both the lenders and borrowers can ensure that their rights and obligations are clearly documented and agreed upon, fostering a transparent and mutually beneficial financial relationship.

Cook Illinois Angel Fund Promissory Note Term Sheet

Description

How to fill out Cook Illinois Angel Fund Promissory Note Term Sheet?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Cook Angel Fund Promissory Note Term Sheet, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching process less challenging. You can also find information materials and tutorials on the website to make any tasks associated with paperwork completion simple.

Here's how to find and download Cook Angel Fund Promissory Note Term Sheet.

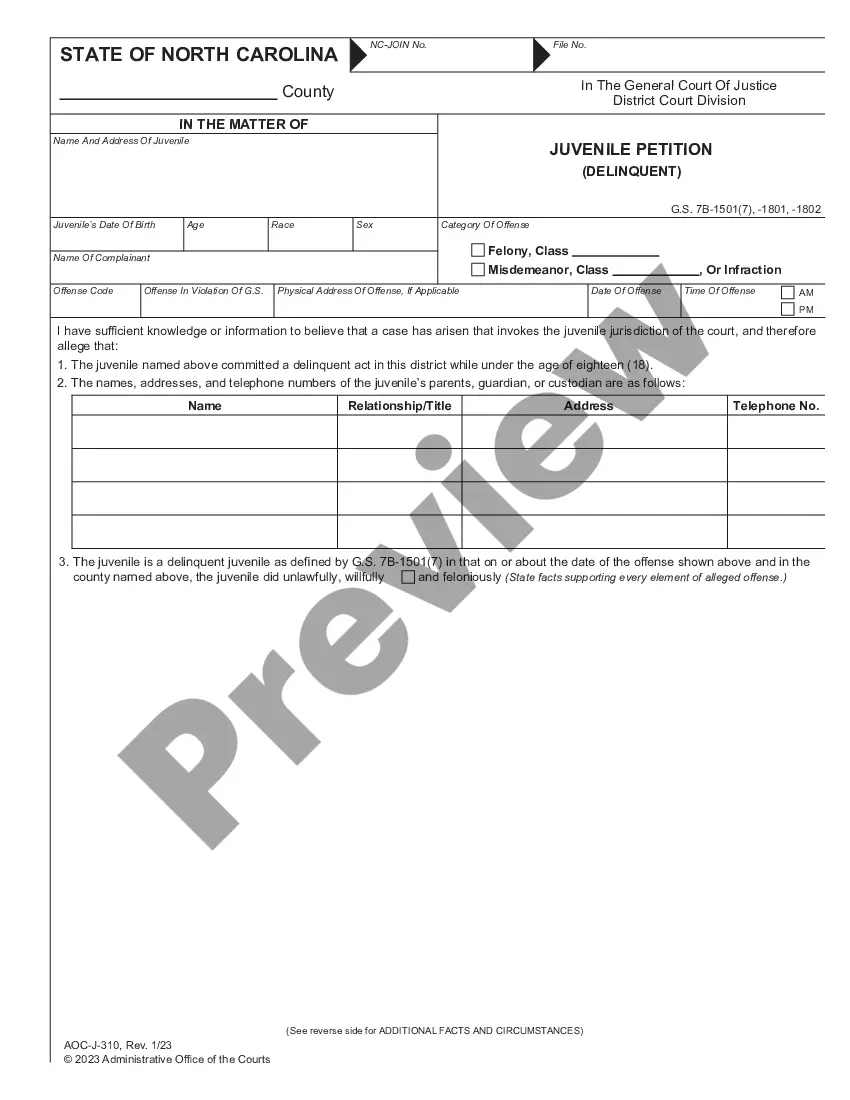

- Take a look at the document's preview and outline (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the validity of some documents.

- Check the related forms or start the search over to locate the correct document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase Cook Angel Fund Promissory Note Term Sheet.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Cook Angel Fund Promissory Note Term Sheet, log in to your account, and download it. Of course, our website can’t take the place of a legal professional completely. If you need to cope with an exceptionally difficult situation, we recommend using the services of a lawyer to check your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Become one of them today and purchase your state-specific paperwork effortlessly!