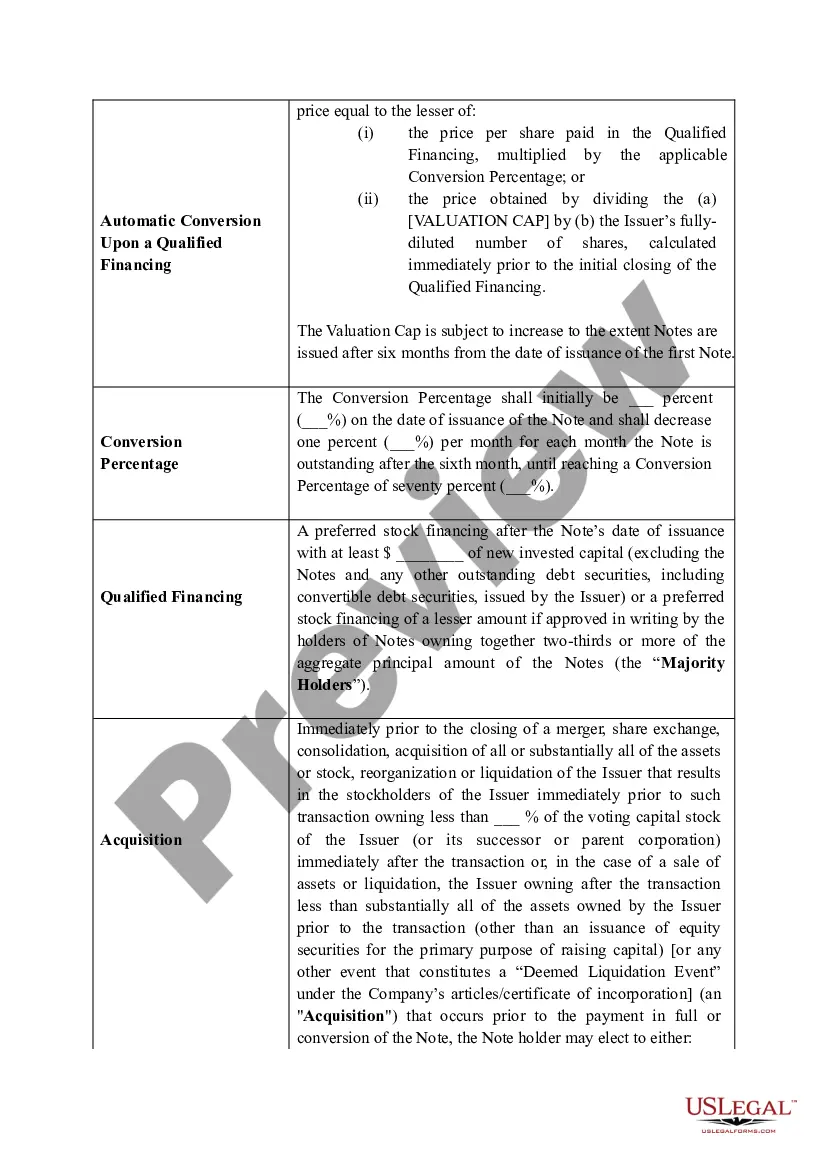

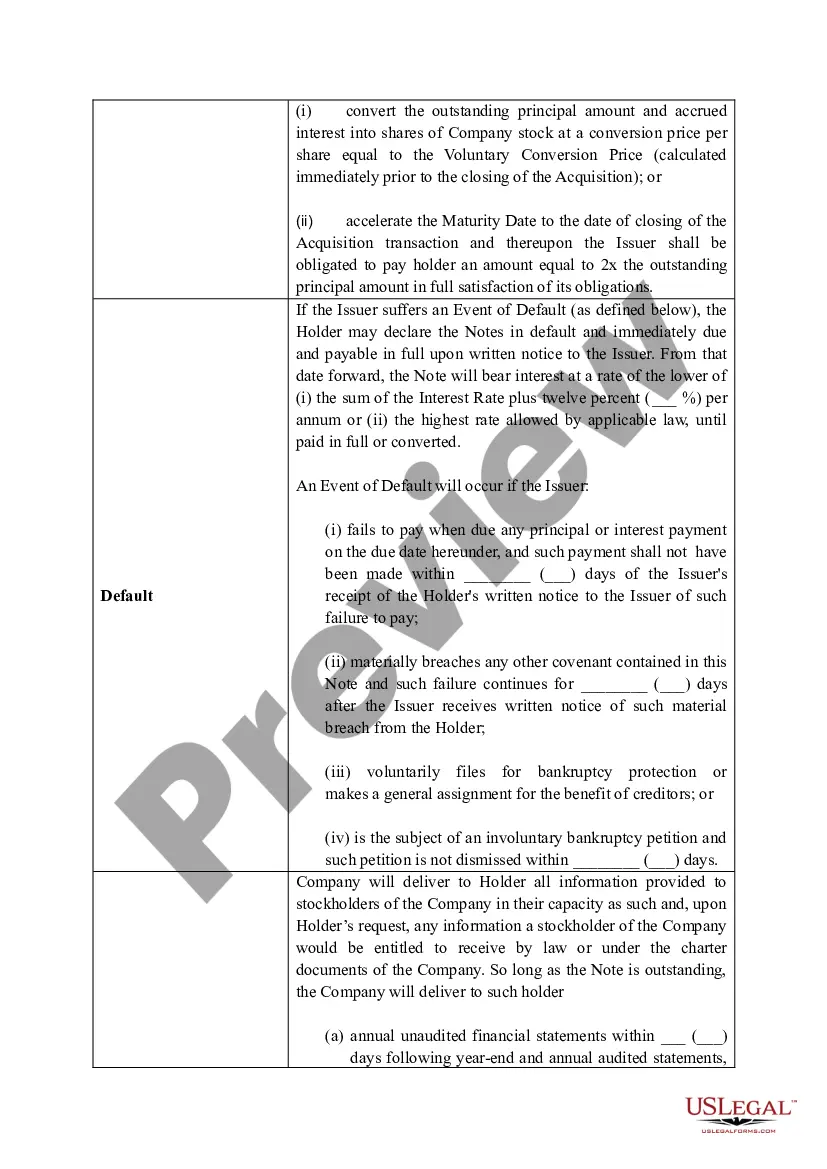

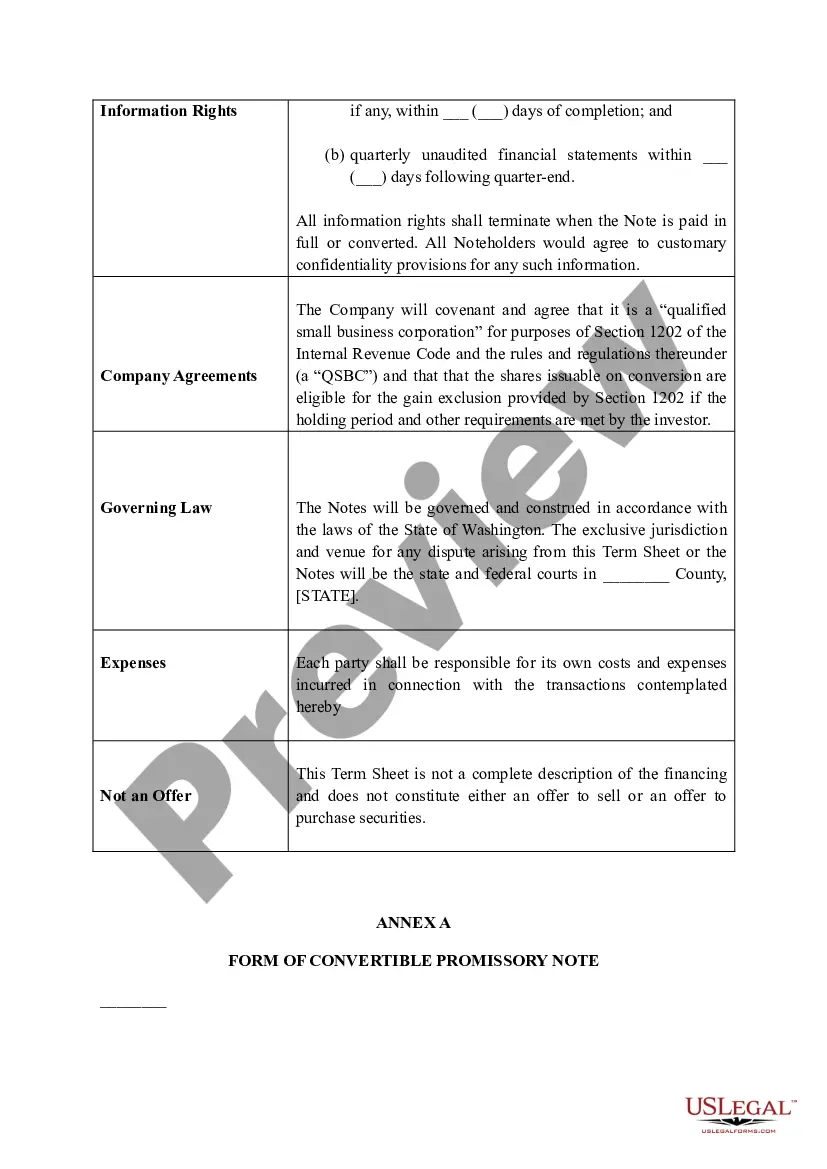

Hennepin Minnesota Angel Fund Promissory Note Term Sheet serves as a crucial document outlining the terms and conditions of a promissory note agreement entered into between the Hennepin Minnesota Angel Fund (IMAF) and the borrower. This term sheet provides a comprehensive overview of the key aspects of the agreement, ensuring clarity and transparency between the parties involved. The Hennepin Minnesota Angel Fund Promissory Note Term Sheet covers various important elements, including: 1. Borrower Details: This section includes information about the borrower, including their name, address, contact details, and legal representation, if applicable. 2. Lender Details: Here, the term sheet outlines the Hennepin Minnesota Angel Fund's information, such as the fund's name, address, contact details, and designated representatives responsible for any communication related to the promissory note. 3. Loan Amount and Purpose: The term sheet specifies the principal loan amount extended by the IMAF to the borrower. It also outlines the purpose for which the loan will be utilized, whether it is for business expansion, working capital, research, or any other justified need. 4. Interest Rate: This section determines the interest rate applicable to the loan, including any fixed or variable components, and states whether it is simple or compound interest. It may also include the details regarding any special interest rate provisions like grace periods or step-up rates. 5. Repayment Terms: The term sheet outlines the duration of the loan, specifying the repayment schedule and any milestones or deadlines for repayment installments. It may also include provisions for prepayment, late payment penalties, and default consequences. 6. Collateral or Security: If the loan requires collateral or security to safeguard the IMAF's investment, this section clearly defines the assets, property, or personal guarantees provided by the borrower. 7. Conversion or Equity Rights: In some cases, the IMAF may request conversion privileges, allowing them to convert the promissory note into equity or a stake in the borrower's business at a later stage. This section outlines the terms, conditions, and conversion ratio for such potential equity conversion. 8. Events of Default: The term sheet identifies the circumstances that qualify as a default on the promissory note, such as failure to make timely payments, breach of covenants, or violation of any terms outlined in the agreement. It may detail the consequences of default, including legal actions, penalties, or acceleration of the outstanding loan amount. Different types of Hennepin Minnesota Angel Fund Promissory Note Term Sheets may include variations in the aforementioned terms and may be customized depending on the specific requirements or preferences of the borrower and the IMAF. It is prudent for both parties to carefully review and negotiate the terms before signing the promissory note, ensuring mutual understanding and agreement on all terms and conditions outlined.

Hennepin Minnesota Angel Fund Promissory Note Term Sheet

Description

How to fill out Hennepin Minnesota Angel Fund Promissory Note Term Sheet?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Hennepin Angel Fund Promissory Note Term Sheet, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the latest version of the Hennepin Angel Fund Promissory Note Term Sheet, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Hennepin Angel Fund Promissory Note Term Sheet:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Hennepin Angel Fund Promissory Note Term Sheet and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!