Houston Texas Angel Fund Promissory Note Term Sheet

Description

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made."

How to fill out Angel Fund Promissory Note Term Sheet?

Do you require to swiftly create a legally-enforceable Houston Angel Fund Promissory Note Term Sheet or perhaps another document to manage your personal or business matters? You have two choices: reach out to a legal expert to draft a legal paper for you or compose it entirely on your own. The positive aspect is, there's an alternative option - US Legal Forms. It will assist you in acquiring professionally drafted legal documents without incurring exorbitant costs for legal services.

US Legal Forms offers an extensive inventory of over 85,000 state-specific form templates, including the Houston Angel Fund Promissory Note Term Sheet and form bundles. We provide templates for a wide range of applications: from divorce documents to real estate form templates. We've been operating for more than 25 years and earned an impeccable reputation among our clientele. Here's how you can become one of them and secure the requisite document without needless complications.

If you've already created an account, you can simply Log In to it, find the Houston Angel Fund Promissory Note Term Sheet template, and download it. To re-download the form, simply navigate to the My documents section.

It is straightforward to locate and download legal documents if you utilize our services. Furthermore, the forms we provide are revised by legal professionals, which gives you increased assurance when managing legal matters. Give US Legal Forms a try now and see for yourself!

- First and foremost, thoroughly confirm whether the Houston Angel Fund Promissory Note Term Sheet complies with your state's or county's regulations.

- If the document includes a description, ensure you check what it is appropriate for.

- Restart the search process if the template isn’t what you were expecting to find by utilizing the search box in the header.

- Choose the package that best fits your requirements and move forward to payment.

- Select the format you wish to receive your document in and download it.

- Print it, complete it, and sign on the designated line.

Form popularity

FAQ

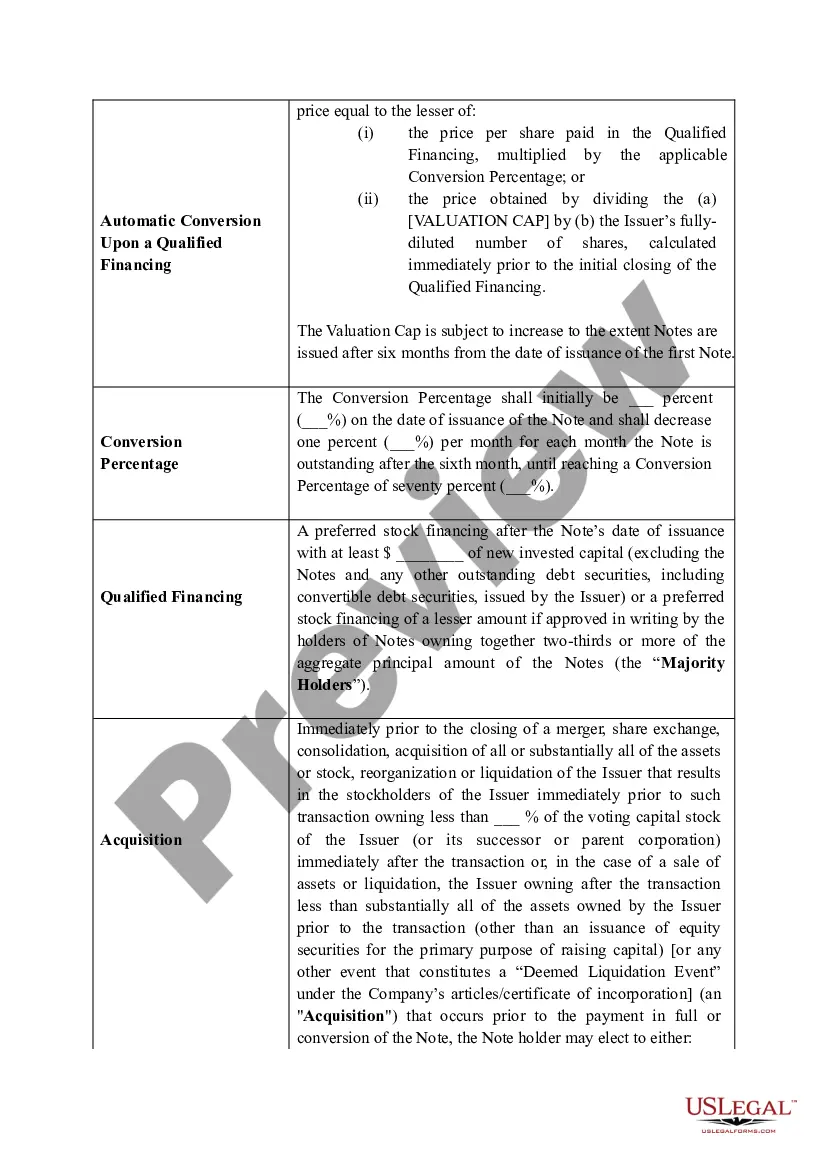

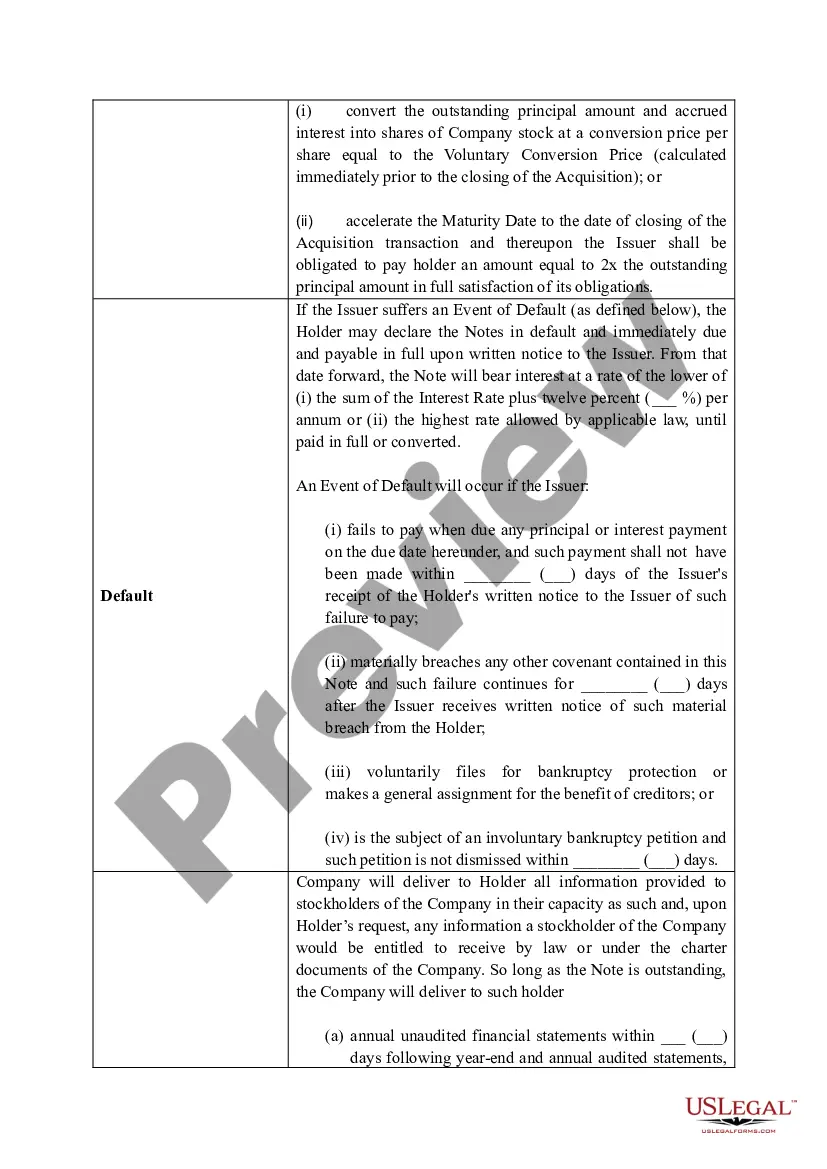

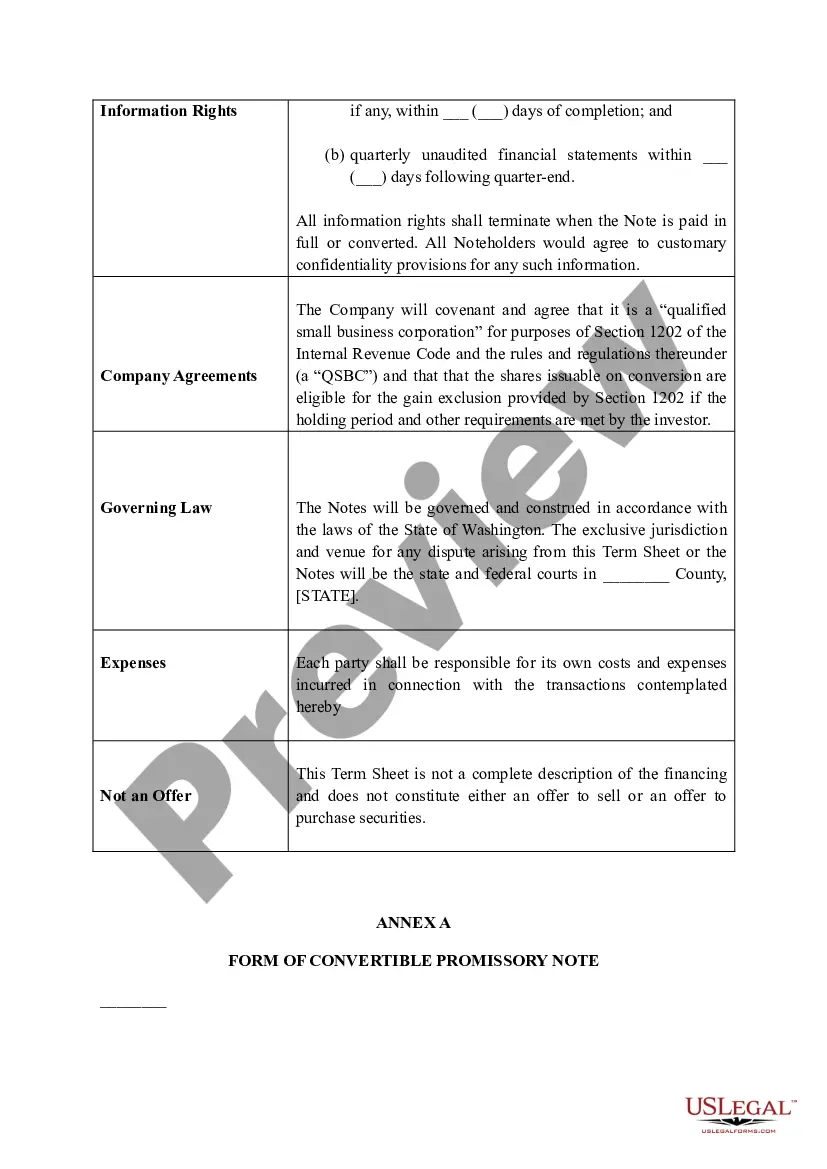

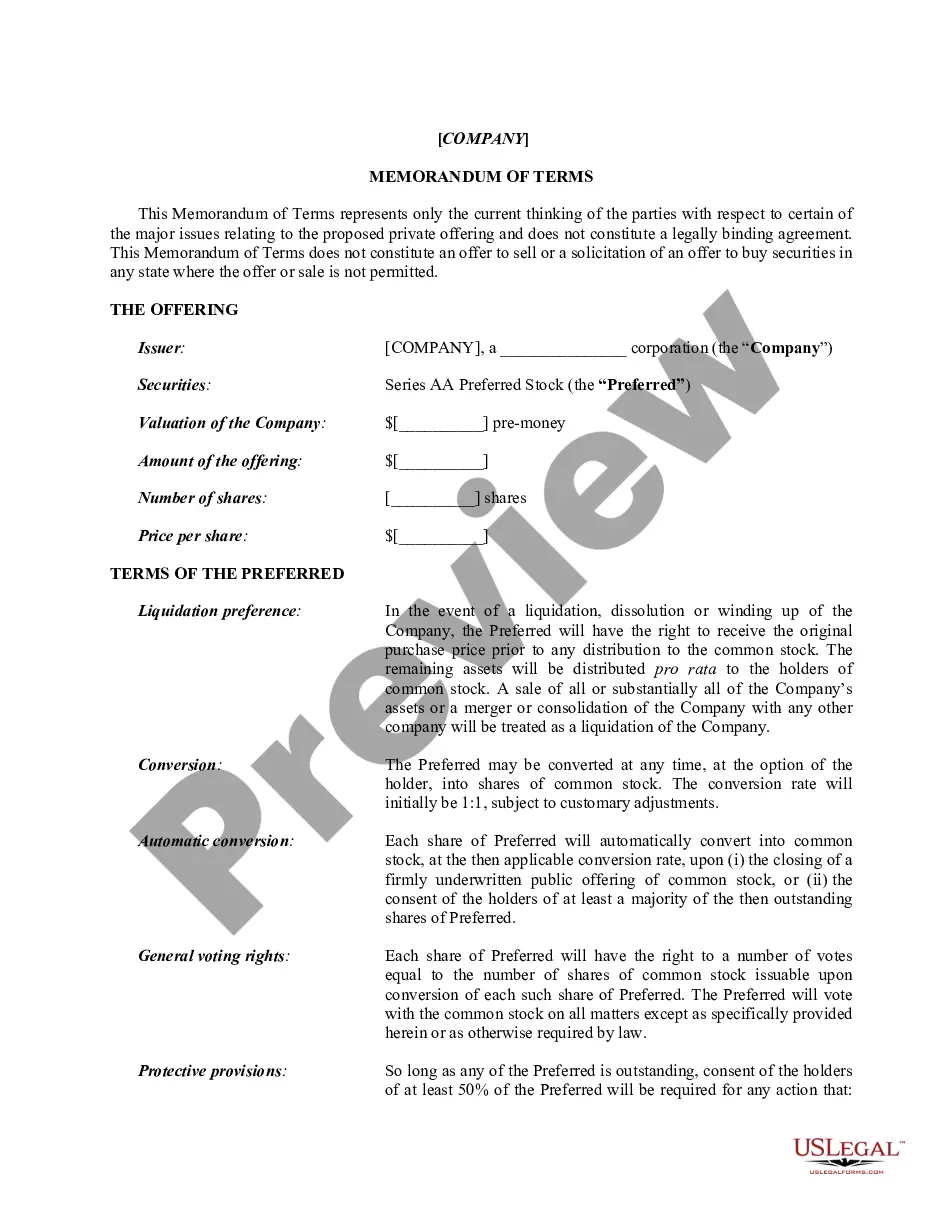

A typical VC term sheet outlines the investment structure from a venture capital firm to a startup. Key components usually include the amount invested, the company valuation, ownership information, and any protective provisions for investors. To gain insights into creating or interpreting such documents, consider exploring the Houston Texas Angel Fund Promissory Note Term Sheet, which summarizes these points for easy understanding and application.

The basic term sheet outlines the fundamental terms and conditions of a proposed investment. It typically includes details about the investment's size, the valuation of the company, and the rights of the investors. For those seeking to understand this process better, the Houston Texas Angel Fund Promissory Note Term Sheet from USLegalForms can help clarify these essential aspects, making it easier to navigate funding agreements.

Five key points of a term sheet include the investment amount, valuation of the company, percentage of equity being offered, any special rights or preferences for investors, and the timeline for the agreement. These elements provide clarity on both parties' expectations. A Houston Texas Angel Fund Promissory Note Term Sheet effectively summarizes these critical components, ensuring that all parties are aligned before formalizing any investments.

To write a term sheet effectively, start by outlining the essential elements such as investment amount, ownership percentage, and any special terms that apply. Next, be clear and concise in defining each section, as this document serves as a foundation for the future agreement. For those new to this process, consider using resources like the Houston Texas Angel Fund Promissory Note Term Sheet from USLegalForms to guide you in creating a comprehensive and effective term sheet.

A Letter of Intent (LOI) is a preliminary document outlining the intentions of the parties before finalizing a deal, while a term sheet provides specific terms of the agreement. The Houston Texas Angel Fund Promissory Note Term Sheet functions as a more detailed follow-up to an LOI, clarifying actual commitments and obligations. Understanding these differences helps you navigate the investment process more effectively. Both documents are important, but they serve different purposes in an investment journey.

The purpose of a term sheet is to provide a clear summary of the terms agreed upon by both investors and companies. It serves as a starting point for drafting legally binding contracts, such as the Houston Texas Angel Fund Promissory Note Term Sheet. This document helps all parties involved to align their expectations and makes it easier to move forward with negotiations. Essentially, it lays the groundwork for a successful investment relationship.

A term sheet should include essential elements such as the investment amount, valuation, and equity stake being offered. It should also specify any rights of the investors, including liquidation preferences and voting rights. When drafting a Houston Texas Angel Fund Promissory Note Term Sheet, including all necessary details ensures that both parties understand their commitments. This foundational document can significantly influence future negotiations.

Term sheets for investment serve as preliminary agreements outlining the terms and conditions between investors and startups. These documents are crucial for establishing expectations and can vary in complexity. In the context of the Houston Texas Angel Fund Promissory Note Term Sheet, a comprehensive term sheet can help ensure a smooth investment process. They help to prevent misunderstandings by clearly defining roles and responsibilities.

A fund term sheet is a document that outlines the key terms and conditions of an investment fund. It includes details about the investment strategies, fees, and distribution methods. When considering investments, such as those involving a Houston Texas Angel Fund Promissory Note Term Sheet, having a well-structured term sheet is essential. It provides clarity and transparency for both the fund managers and investors.

Angel investor terminology refers to specific language and terms used in the angel investment industry. Understanding these terms is crucial when dealing with documents like the Houston Texas Angel Fund Promissory Note Term Sheet. Clear comprehension helps entrepreneurs and investors communicate more effectively. Key terms include valuation, equity, and funding rounds.