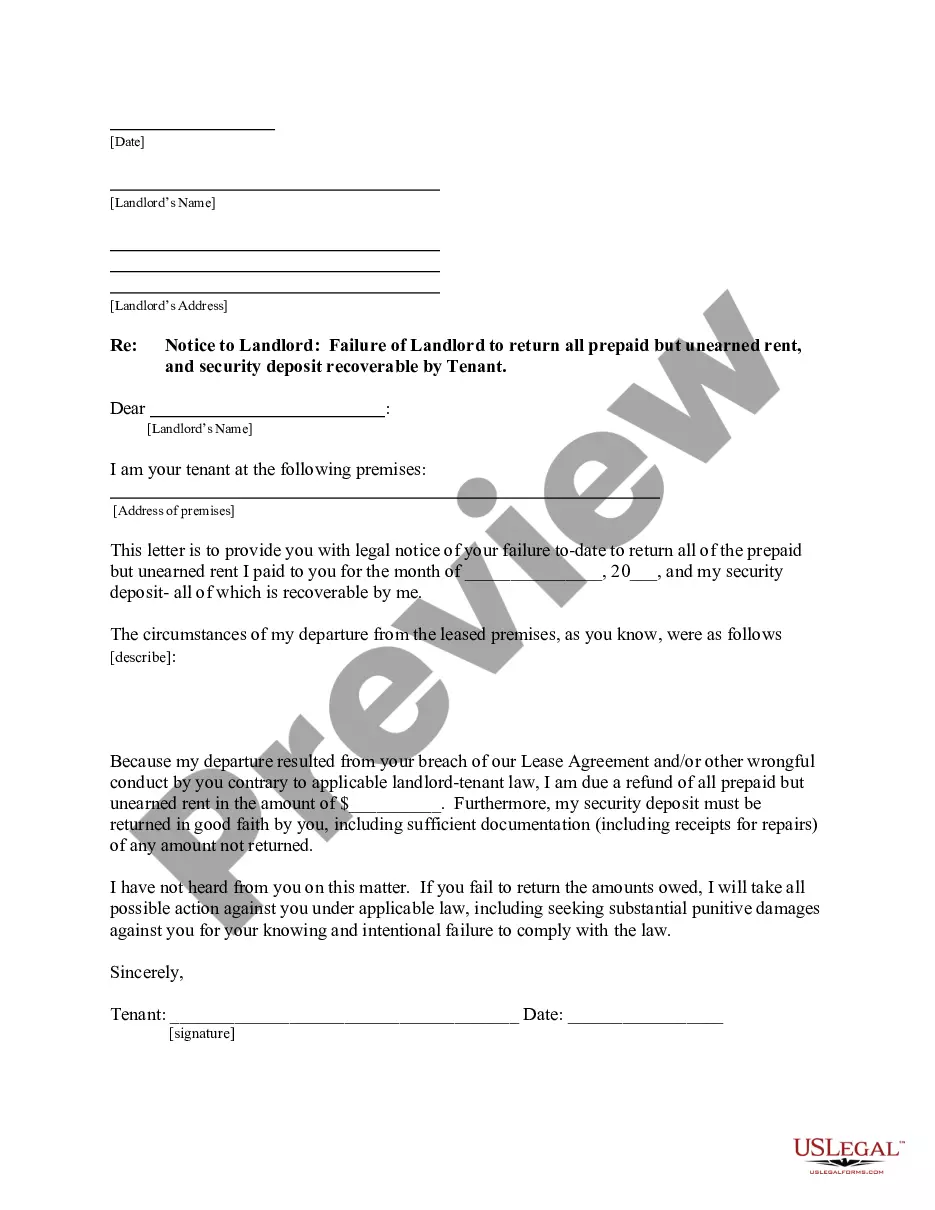

The Maricopa Arizona Angel Fund Promissory Note Term Sheet is a legal document that outlines the terms and conditions of a loan agreement between an angel investor and a startup company located in Maricopa, Arizona. This term sheet serves as a foundation for the final promissory note, governing the terms of the loan. The Maricopa Arizona Angel Fund Promissory Note Term Sheet is a crucial document for both parties involved, as it establishes the main points of the loan agreement that will need to be agreed upon before moving forward. It is an integral part of the due diligence process when an angel investor considers providing funding to a startup in Maricopa, Arizona. The term sheet typically contains several key elements and may vary depending on the specific requirements and preferences of the parties involved. These can include: 1. Loan Amount: The term sheet outlines the amount of money the angel investor is willing to provide to the startup company as a loan. This can range from a few thousand dollars to a substantial sum, depending on the needs of the startup. 2. Interest Rate: The term sheet specifies the interest rate at which the loan will accrue. This rate is usually influenced by factors such as market conditions, the risk associated with the startup, and the prevailing interest rates. 3. Repayment Terms: The term sheet details the repayment structure, including the timeline for repayment, frequency of installments, and any associated fees or penalties for late payments. 4. Convertibility: In some cases, the term sheet may include provisions for the loan to convert into equity at a later stage. This allows the angel investor to potentially become a shareholder in the startup. 5. Collateral: If required, the term sheet may outline the collateral that the startup company is willing to provide as security for the loan. This could be assets such as equipment, intellectual property, or other valuable holdings. It's essential to note that the Maricopa Arizona Angel Fund Promissory Note Term Sheet can vary depending on the specific needs and preferences of the angel investor and the startup company. The details of the term sheet are typically negotiated between the two parties, taking into account factors such as the size of the loan, the risk associated with the startup, and the expected return on investment. Overall, the Maricopa Arizona Angel Fund Promissory Note Term Sheet serves as a crucial document that facilitates the loan agreement between an angel investor and a startup company. It provides a clear outline of the terms and conditions, protecting the interests of both parties involved.

Maricopa Arizona Angel Fund Promissory Note Term Sheet

Description

How to fill out Maricopa Arizona Angel Fund Promissory Note Term Sheet?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your region, including the Maricopa Angel Fund Promissory Note Term Sheet.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Maricopa Angel Fund Promissory Note Term Sheet will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Maricopa Angel Fund Promissory Note Term Sheet:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Maricopa Angel Fund Promissory Note Term Sheet on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!