Tarrant Texas Angel Fund Promissory Note Term Sheet

Description

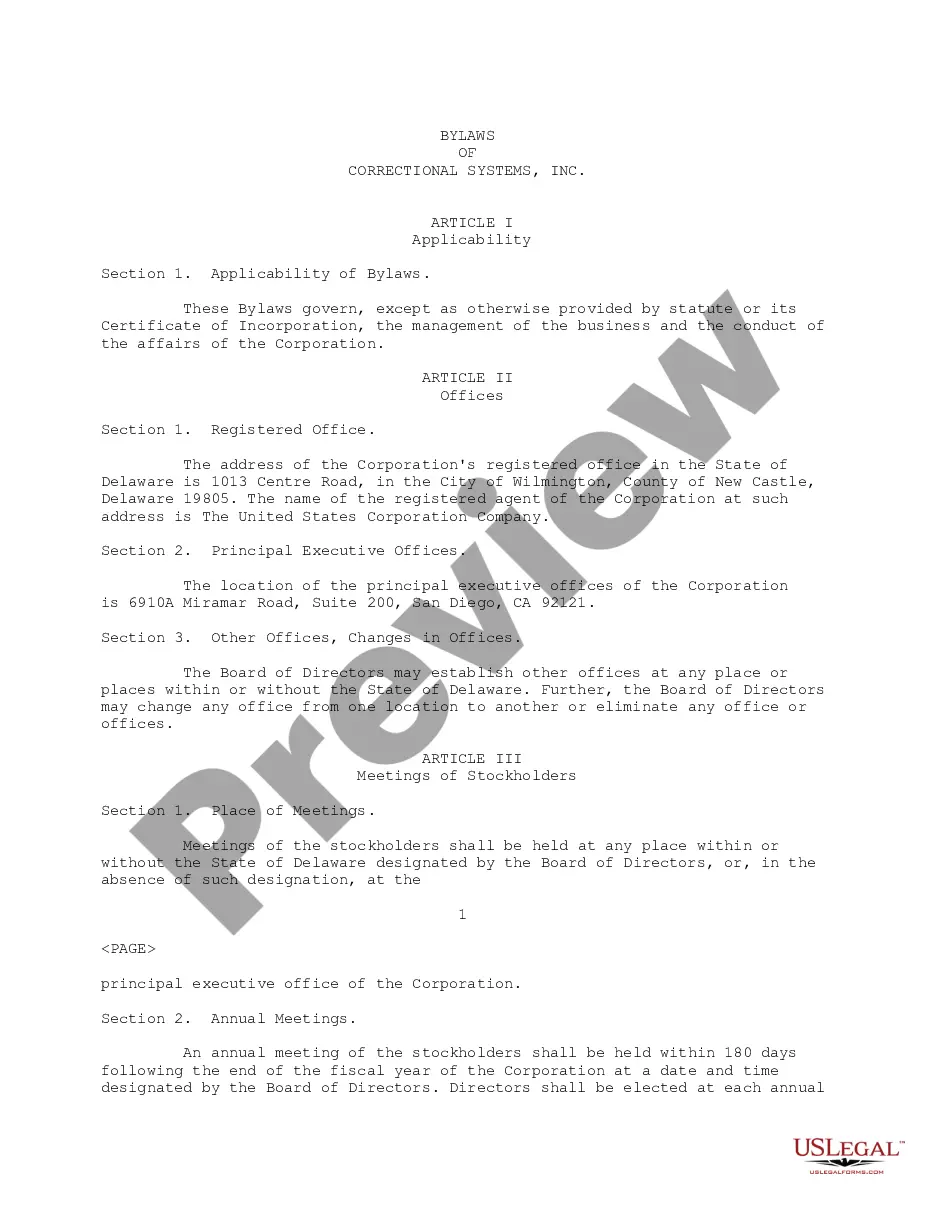

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made."

How to fill out Angel Fund Promissory Note Term Sheet?

Legislation and statutes across all domains vary across the nation.

If you're not an attorney, it's simple to become bewildered by the numerous rules regarding the creation of legal paperwork.

To prevent costly legal fees when drafting the Tarrant Angel Fund Promissory Note Term Sheet, you require an authenticated template applicable to your jurisdiction.

Fill out and sign the document on paper after printing it or complete everything electronically. This is the simplest and most cost-effective method to obtain current templates for any legal purposes. Access them all with just a few clicks and maintain your documentation organized with the US Legal Forms!

- Visit the webpage to confirm you've selected the correct document.

- Use the Preview feature or examine the form description if provided.

- Search for an alternative document if it doesn't match any of your requirements.

- Press the Buy Now button to acquire the template once the correct one is identified.

- Select one of the subscription plans and either Log In or set up a new account.

- Decide your payment method for the subscription (via credit card or PayPal).

- Choose the format in which you'd like to save the file and hit Download.

Form popularity

FAQ

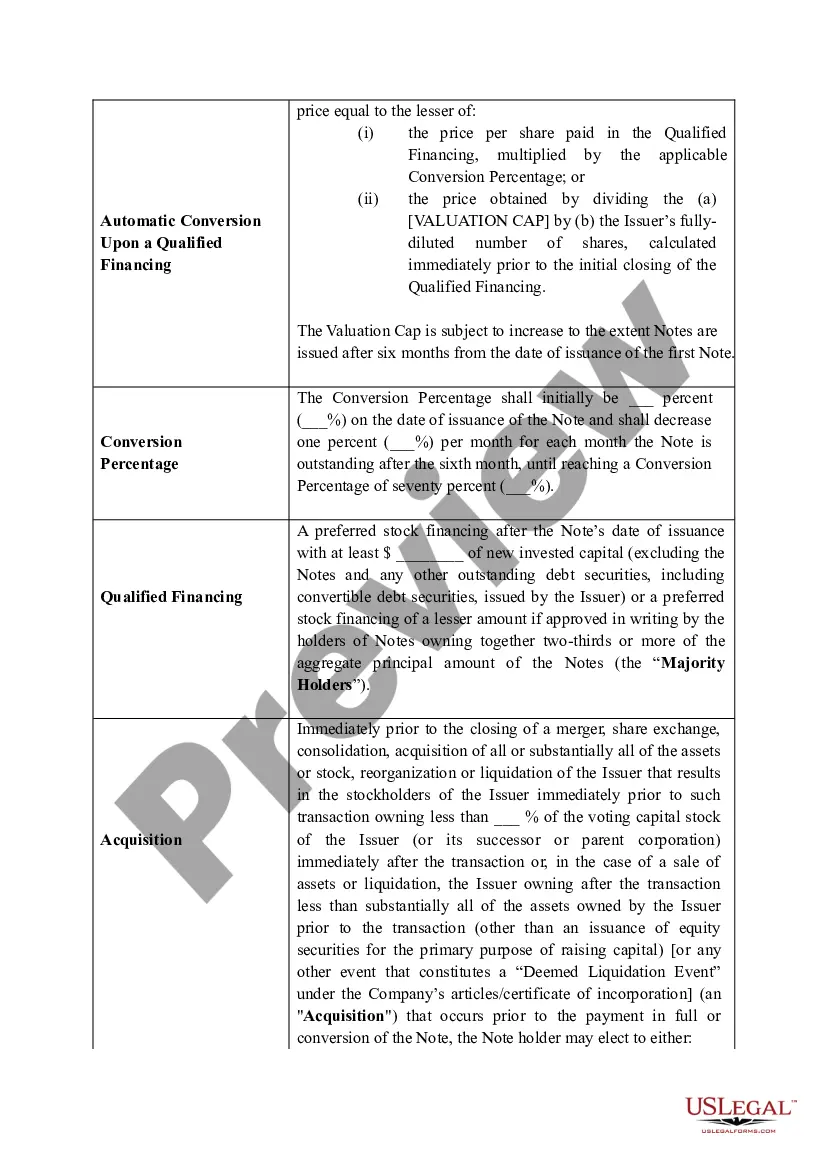

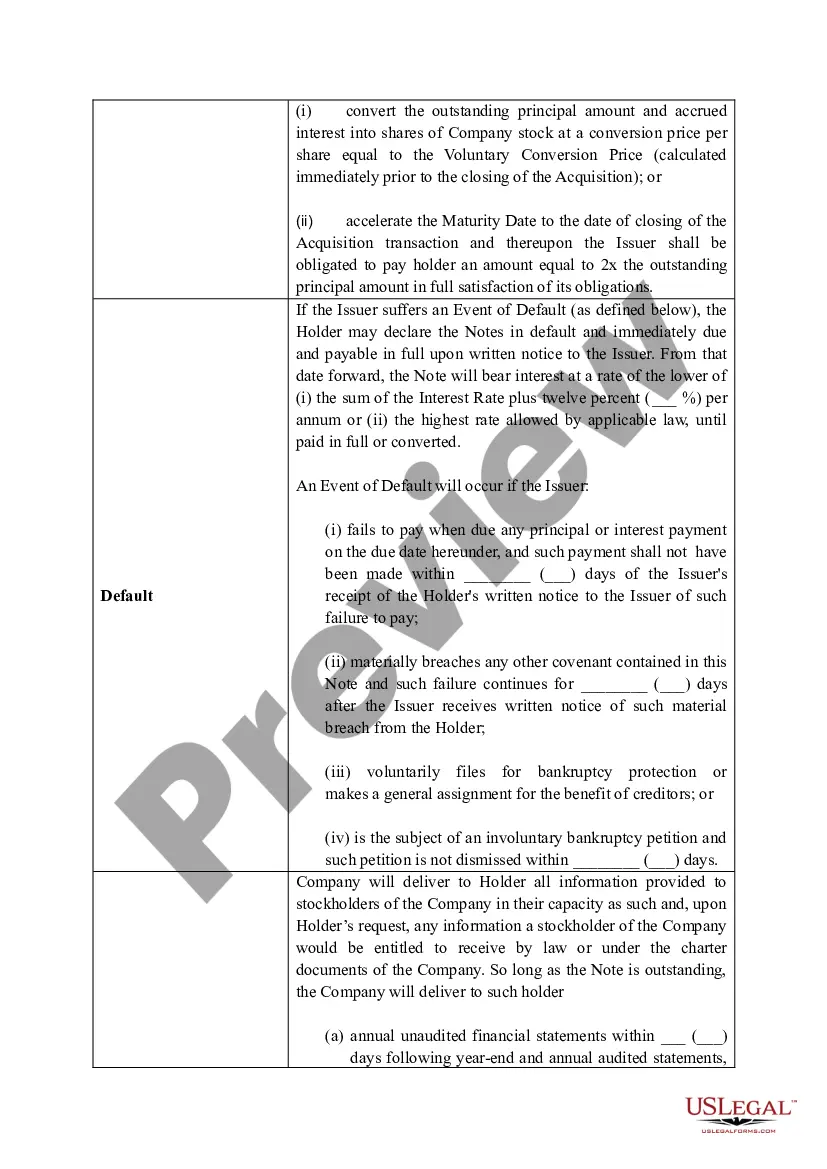

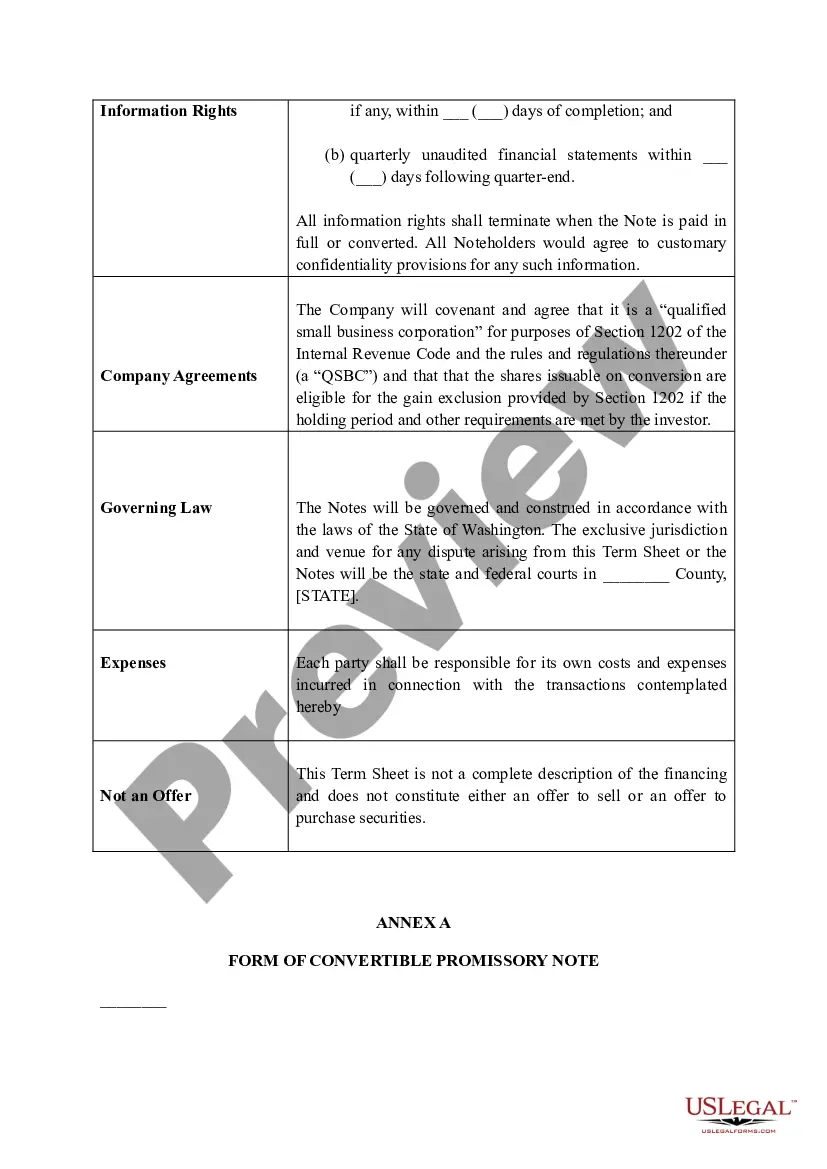

All term sheets contain information on the assets, initial purchase price including any contingencies that may affect the price, a timeframe for a response, and other salient information. Term sheets are most often associated with startups.

A venture capital (VC) term sheet is a statement of the proposed terms and conditions for a proposed investment. Most of the terms are non-binding, except for certain confidentiality and exclusivity rights. Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process.

A venture capitalist (VC) is a private equity investor that provides capital to companies with high growth potential in exchange for an equity stake.

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with start-ups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

A term sheet is a list of terms and conditions on which an investor is prepared to fund your business. At a basic level, term sheets describe the amount of the proposed investment and the share of your business the investor would like in return.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

A term sheet is a relatively short document that an investor prepares for presentation to the company in which the investor states the investment that he is willing to make in the company. This document is usually 5-8 pages in length.

Venture capital (VC) is money invested in startups or small businesses with high-growth potential. These investments often, but not always, come in a company's early days, before the business has a finished product or meaningful revenue.

Term Sheet Template A term sheet outlines the basic terms and conditions of an investment opportunity and is a non-binding agreement that serves as a starting point for more detailed agreements ? like a commitment letter, definitive agreement (share purchase agreement), or subscription agreement.