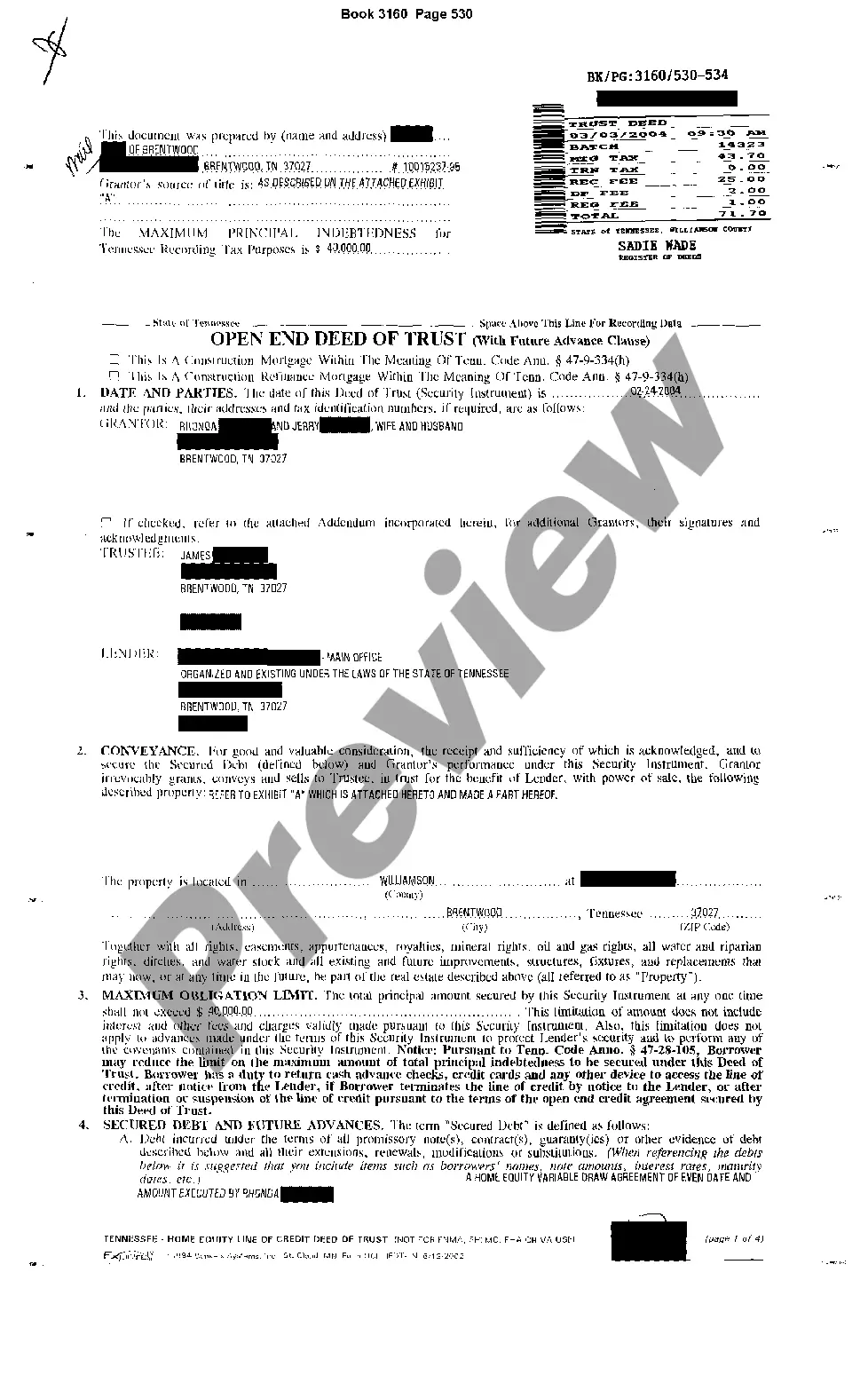

Allegheny Pennsylvania Construction Loan Financing Term Sheet is a document that outlines the terms and conditions of a construction loan provided by financial institutions to borrowers in Allegheny County, Pennsylvania. This term sheet acts as a preliminary agreement between the lender and the borrower, indicating the basic terms of the loan before the detailed loan agreement is finalized. Key Elements of Allegheny Pennsylvania Construction Loan Financing Term Sheet: 1. Loan Amount: This specifies the maximum loan amount that the borrower can obtain for their construction project. 2. Interest Rate: The interest rate determines the cost of borrowing and is expressed as a percentage. It is essential to understand whether the interest rate will be fixed or variable during the construction phase. 3. Loan Term: The loan term refers to the period within which the loan must be repaid in full. Construction loans often have shorter terms compared to other types of loans, typically ranging from 6 to 24 months. 4. Loan Disbursement: This section details how the loan funds will be disbursed during the construction process. Funds are typically released in installments or "draws" as the project progresses, based on a predetermined schedule. 5. Loan to Cost (LTC) Ratio: LTC ratio reflects the loan amount compared to the total cost of the project. A lower LTC ratio indicates a higher down payment requirement from the borrower. 6. Loan to Value (LTV) Ratio: LTV ratio represents the loan amount compared to the appraised value of the property. A lower LTV ratio implies a lower loan amount relative to the property value. 7. Appraisal Process: This outlines the process of property appraisal to determine its value. Lenders usually require an independent appraisal to ensure the property's value aligns with the loan amount. Different Types of Allegheny Pennsylvania Construction Loan Financing Term Sheets: 1. Single-Close Construction Loan Term Sheet: This term sheet covers both the construction phase and the permanent financing phase. It allows borrowers to save on closing costs and simplify the loan process. 2. Two-Time Close Construction Loan Term Sheet: In this case, the construction loan and the long-term financing are separate, requiring borrowers to secure a new loan for the permanent phase. This type of construction loan is more common in Allegheny, Pennsylvania. 3. Renovation Loan Term Sheet: This term sheet is specifically designed for borrowers seeking financing for property renovations or remodeling projects. Remember, specific financial institutions may have their own variations of the term sheets mentioned above, tailored to their lending criteria and borrower requirements. It is crucial to carefully review and understand the terms and conditions before entering into any construction loan agreement.

Allegheny Pennsylvania Construction Loan Financing Term Sheet

Description

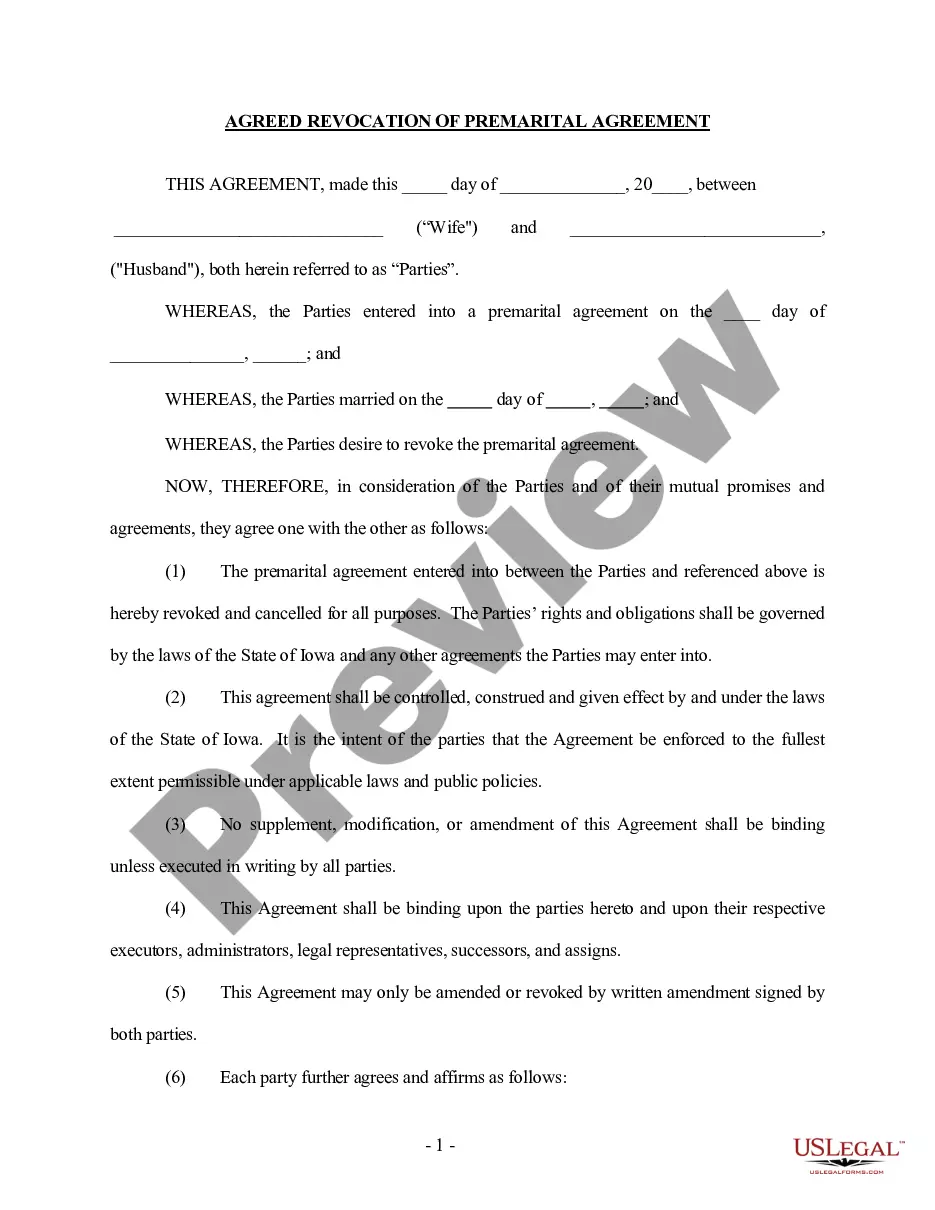

How to fill out Allegheny Pennsylvania Construction Loan Financing Term Sheet?

Whether you intend to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Allegheny Construction Loan Financing Term Sheet is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Allegheny Construction Loan Financing Term Sheet. Follow the guide below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Construction Loan Financing Term Sheet in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

A term sheet is a summary of the main business terms and possible options for a prospective financing. Term sheets are provided by lenders to prospective borrowers prior to a full underwriting of and credit approval by the lender.

A Term Sheet is a lender's formal expression of interest making a loan. However, it is not a legally binding contract. A Term Sheet includes a summary of key loan terms like amount, interest rate, payment, and covenants.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity.Securities being issued.Board rights.Investor protections.Dealing with shares.Miscellaneous provisions.

Recording Fees The fee to record a deed, mortgage or easement is $181.75. Or if there are over 30 parcels (only parcels that require deed certification, $10.00 per parcel). This does not apply to leases or mortgages. The Department of Real Estate will accept certified checks, business checks, or money orders.

A term sheet is a sign your loan request is moving forward. It's usually issued after the loan officer and credit officer have reached an accord on proposed terms, and before the full underwriting of the loan request. Commercial bankers use these non-binding documents to achieve a number of goals.

Loan terms refers to the terms and conditions involved when borrowing money. This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged, and any other special conditions that may apply.

Commonly, you'll make interest-only payments during the construction period while the loan is paying the contractors and subcontractors in regular installments based on how much work has been done. These installments are called draws because you're drawing on the loan to pay costs.

Compare The Best Construction Loan Lenders CompanyStarting Interest RateMinimum Credit ScoreNationwide Home Loans Group Best OverallVaries640FMC Lending Best for Bad Credit ScoreVariesNoneNationwide Home Loans, Inc. Best for First-Time BuyersVariesVariesNormandy Best Online Borrower ExperienceVaries6203 more rows

Construction loans provide short-term financing to build a new home. Borrowers usually only pay interest during the life of the loan. Once everything is finished and you obtain a certificate of occupancy, you can convert your construction loan into a conventional fixed or adjustable-rate mortgage.

The benefit of financing big renovations with a construction loan, rather than a personal loan or a home equity line of credit, is that you'll generally pay a lower interest rate and have a longer repayment period.