San Antonio Texas Construction Loan Financing Term Sheet serves as a comprehensive document that outlines the key terms and conditions for obtaining financing for construction projects in San Antonio, Texas. This term sheet plays a crucial role in facilitating the construction loan process and serves as the foundation for the construction loan agreement between borrowers and lenders. Keywords: San Antonio, Texas, construction loan, financing, term sheet. The San Antonio Texas Construction Loan Financing Term Sheet is specifically tailored to address the unique requirements and regulations of the construction industry in San Antonio. It provides a detailed overview of the financial aspects involved in constructing a project, helping borrowers and lenders establish a clear understanding of their responsibilities and obligations. Different types of San Antonio Texas Construction Loan Financing Term Sheets may vary based on project scope, loan amount, timeline, and risk assessment. Here are some types of term sheets commonly utilized: 1. Residential Construction Loan Term Sheet: This type of term sheet focuses on financing construction projects for residential properties in San Antonio. It outlines specific terms such as loan amount, interest rates, repayment schedules, and any additional requirements related to single-family homes, multi-unit dwellings, or townhouses. 2. Commercial Construction Loan Term Sheet: Specifically designed for commercial construction projects, this term sheet addresses the financing needs of businesses, developers, or investors involved in erecting commercial structures like office buildings, shopping centers, or industrial facilities. 3. Land Development and Infrastructure Loan Term Sheet: This type of term sheet caters to the financing requirements of land development projects in San Antonio. It includes provisions related to funding the development of basic infrastructure such as roads, sewage systems, utilities, and ensuring compliance with local zoning regulations for subdivisions or master-planned communities. 4. Construction-to-Permanent Loan Term Sheet: For projects that involve both construction and permanent financing, this term sheet outlines the transition from the construction phase to a long-term mortgage. It provides information about the construction loan terms and how it will convert into a permanent loan upon completion of the project. Each type of term sheet will generally cover key aspects such as loan terms, interest rates, maturity date, payment schedules, disbursement procedures, collateral requirements, and any specific conditions related to San Antonio's construction industry regulations. San Antonio Texas Construction Loan Financing Term Sheets play a crucial role in facilitating seamless communication and understanding between borrowers and lenders. It ensures transparency and clarity in financial agreements, allowing projects to proceed smoothly while mitigating risks for all parties involved.

San Antonio Texas Construction Loan Financing Term Sheet

Description

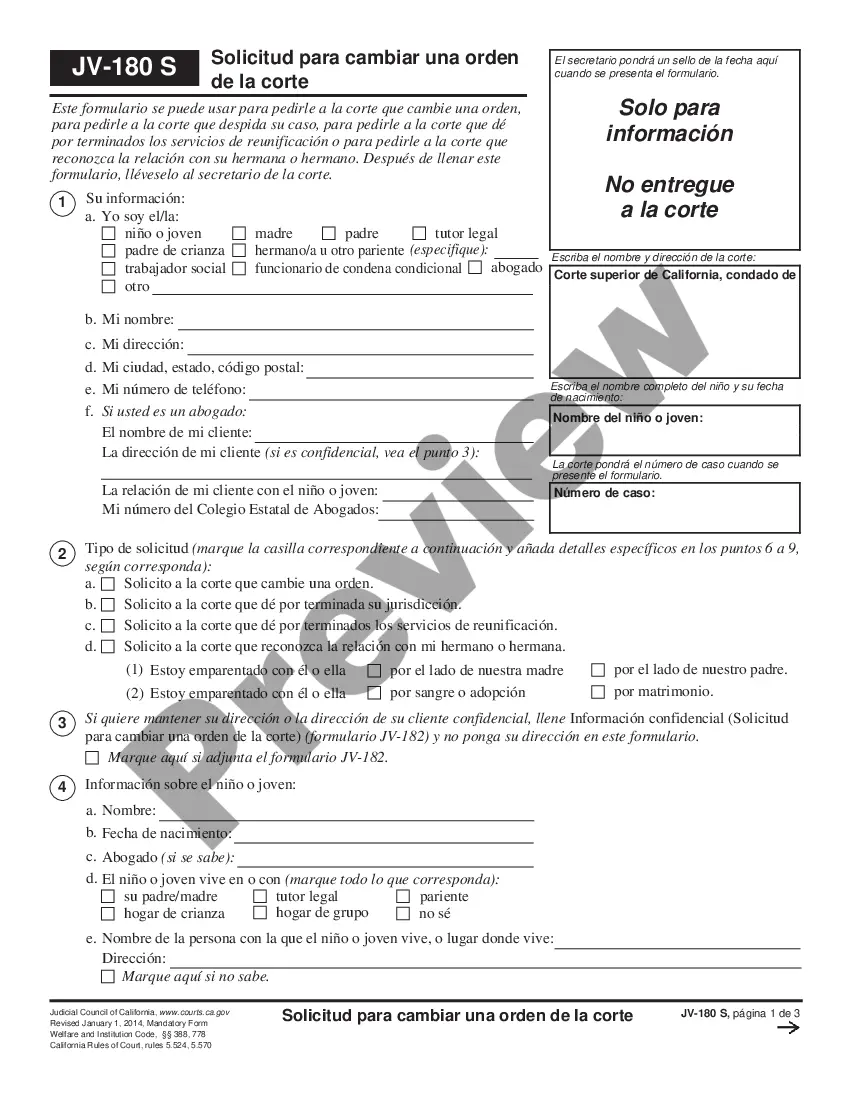

How to fill out San Antonio Texas Construction Loan Financing Term Sheet?

Whether you intend to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business case. All files are grouped by state and area of use, so opting for a copy like San Antonio Construction Loan Financing Term Sheet is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few additional steps to get the San Antonio Construction Loan Financing Term Sheet. Follow the guide below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Antonio Construction Loan Financing Term Sheet in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

What Are Loan Terms? Loan terms refers to the terms and conditions involved when borrowing money. This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged, and any other special conditions that may apply.

Project finance may come from a variety of sources. The main sources include equity, debt and government grants. Financing from these alternative sources have important implications on project's overall cost, cash flow, ultimate liability and claims to project incomes and assets.

Principal, interest, taxes, and insurance form the four (4) basic components of a mortgage that require payments on a monthly or yearly basis.

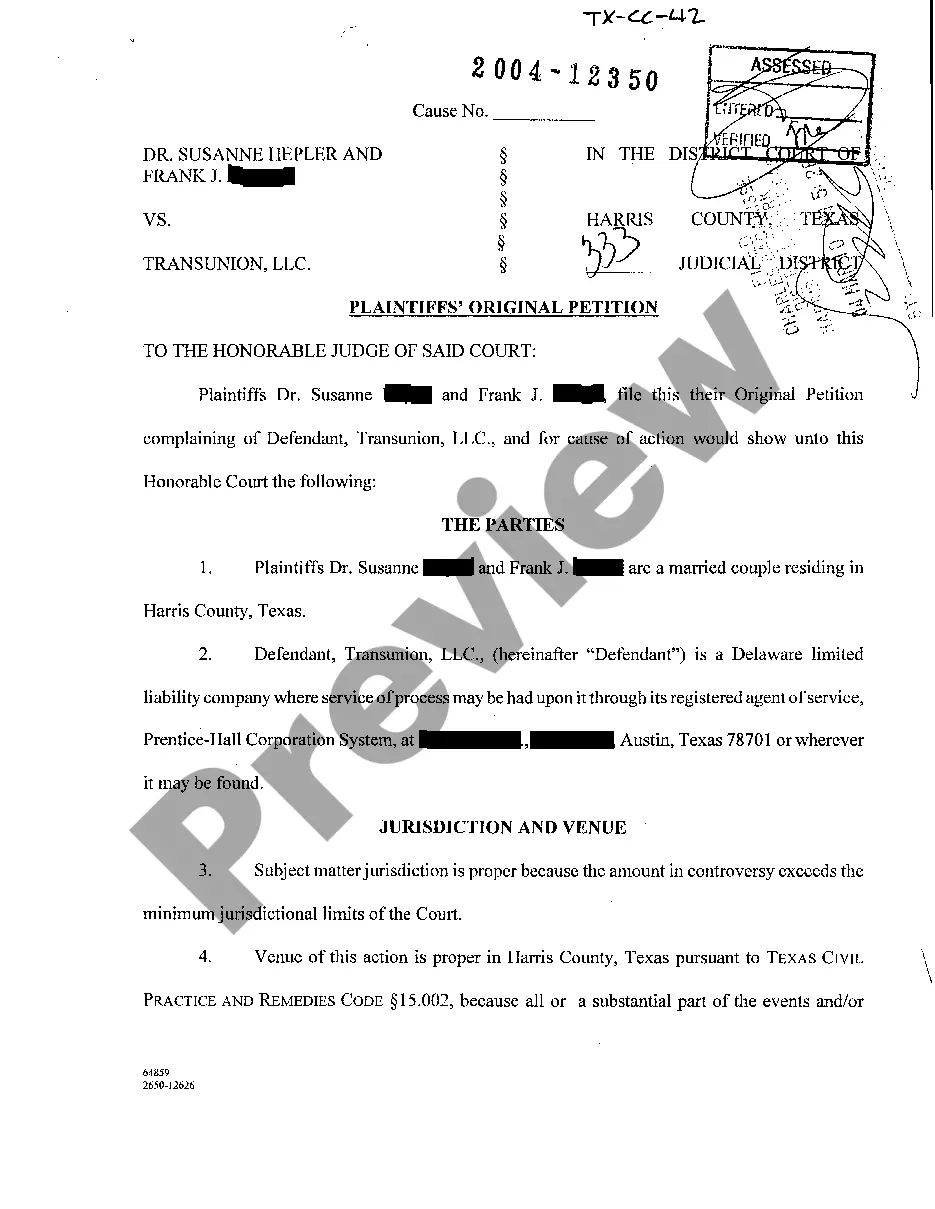

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

Some projects can be self-funding, which means that the earlier work stages generate enough revenue to fund the later work stages. External financing of projects can take the form of loans, funds from shareholders, venture capital, grants, donations, subsidies, 'crowdfunding', and so on.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

If you're a current or future college student, chances are good that you're considering a student loan. Before you make any decisions, it pays to understand the basic principles behind borrowing. All loans consist of three components: The interest rate, security component and term.

8 Common Sources of Construction Financing Commercial banks. Savings and loan associations. Mutual savings banks. Mortgage banking companies. Life insurance companies. Real estate investment trusts. Government agencies. Alternate sources.

Rather than receiving a lump sum check, construction loans pay out the loan amount over the course of the project. The installments are called draws, as the lender draws funds from the account. A draw request is necessary to ensure disbursement of the funds.