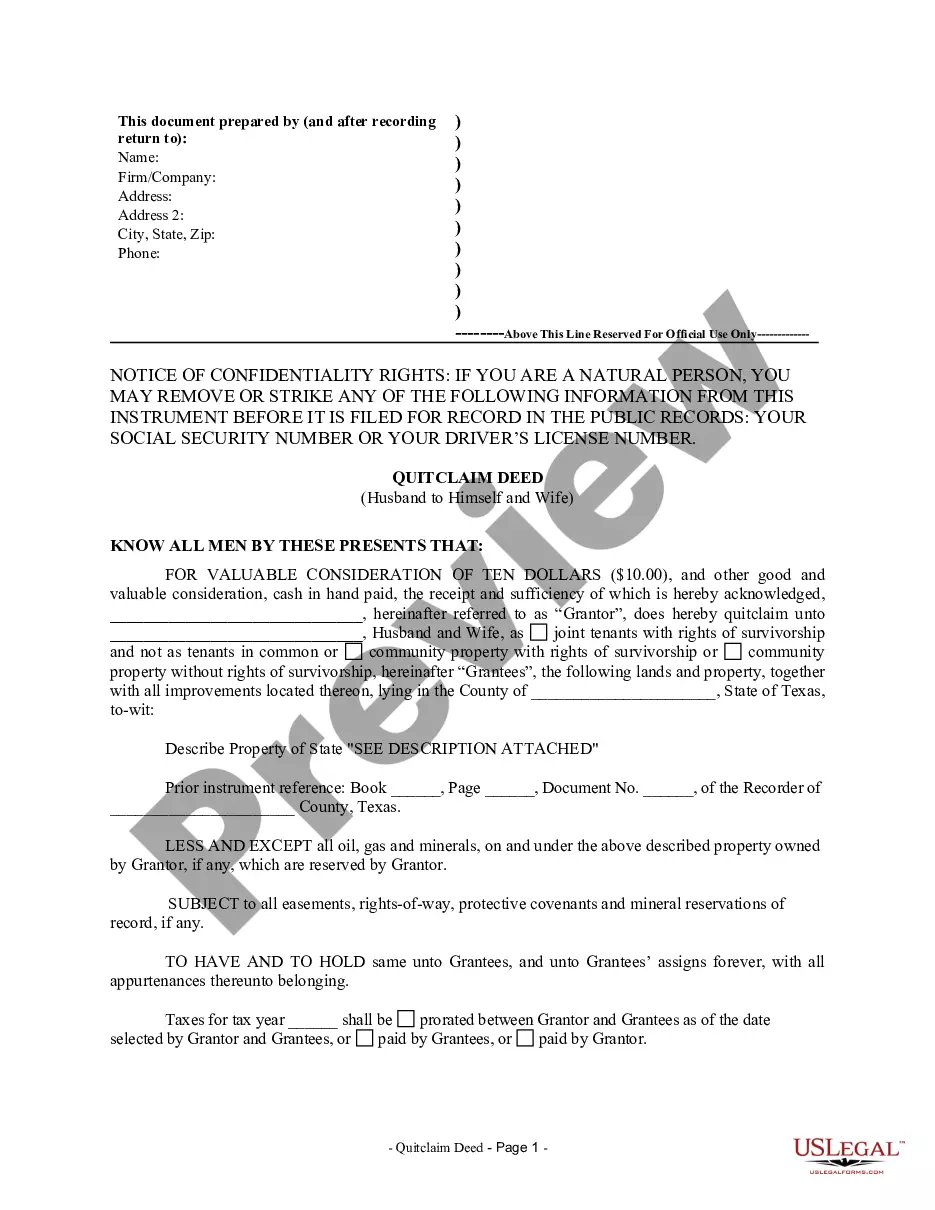

Orange California Investment Agreement refers to a legal contract entered into between an investor and a business entity based in Orange, California. This agreement outlines the terms and conditions under which the investor agrees to invest funds or resources into the business, typically in exchange for ownership shares or a return on investment. Keywords: Orange California, investment agreement, investor, business entity, terms and conditions, invest funds, resources, ownership shares, return on investment. There are several types of Orange California Investment Agreements that can be categorized based on their purpose and structure: 1. Equity Investment Agreement: This type of agreement is commonly used when an investor provides capital in exchange for ownership equity in the business. The agreement typically specifies the percentage of ownership, voting rights, and the investor's potential returns through dividends or capital gains. 2. Debt Investment Agreement: In this form of agreement, the investor lends funds to the business entity, usually with an agreed interest rate and repayment terms. This type of agreement often includes provisions to protect the investor's rights, such as collateral or guarantees. 3. Joint Venture Agreement: A joint venture agreement is used when two or more parties come together to pool resources and expertise to pursue a specific business opportunity or project. This agreement outlines each party's contribution, profit-sharing arrangement, decision-making process, and exit strategies. 4. Share Subscription Agreement: This type of agreement is commonly used when a new investor subscribes to newly issued shares of a business entity. The agreement specifies the number of shares, the subscription price, and any conditions or restrictions attached to the shares. 5. Convertible Note Agreement: This agreement is frequently used in startup financing, wherein the investor lends funds to the business with the option to convert the loan into equity at a later date or upon specific events, such as a subsequent funding round. In conclusion, an Orange California Investment Agreement is a legally binding contract that defines the terms and conditions of an investment made by an investor into a business entity based in Orange, California. The agreement can take various forms, including equity, debt, joint venture, share subscription, or convertible note agreements, depending on the nature of the investment and the intentions of the parties involved.

Orange California Investment Agreement

Description

How to fill out Orange California Investment Agreement?

Preparing legal documentation can be burdensome. Besides, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Orange Investment Agreement, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

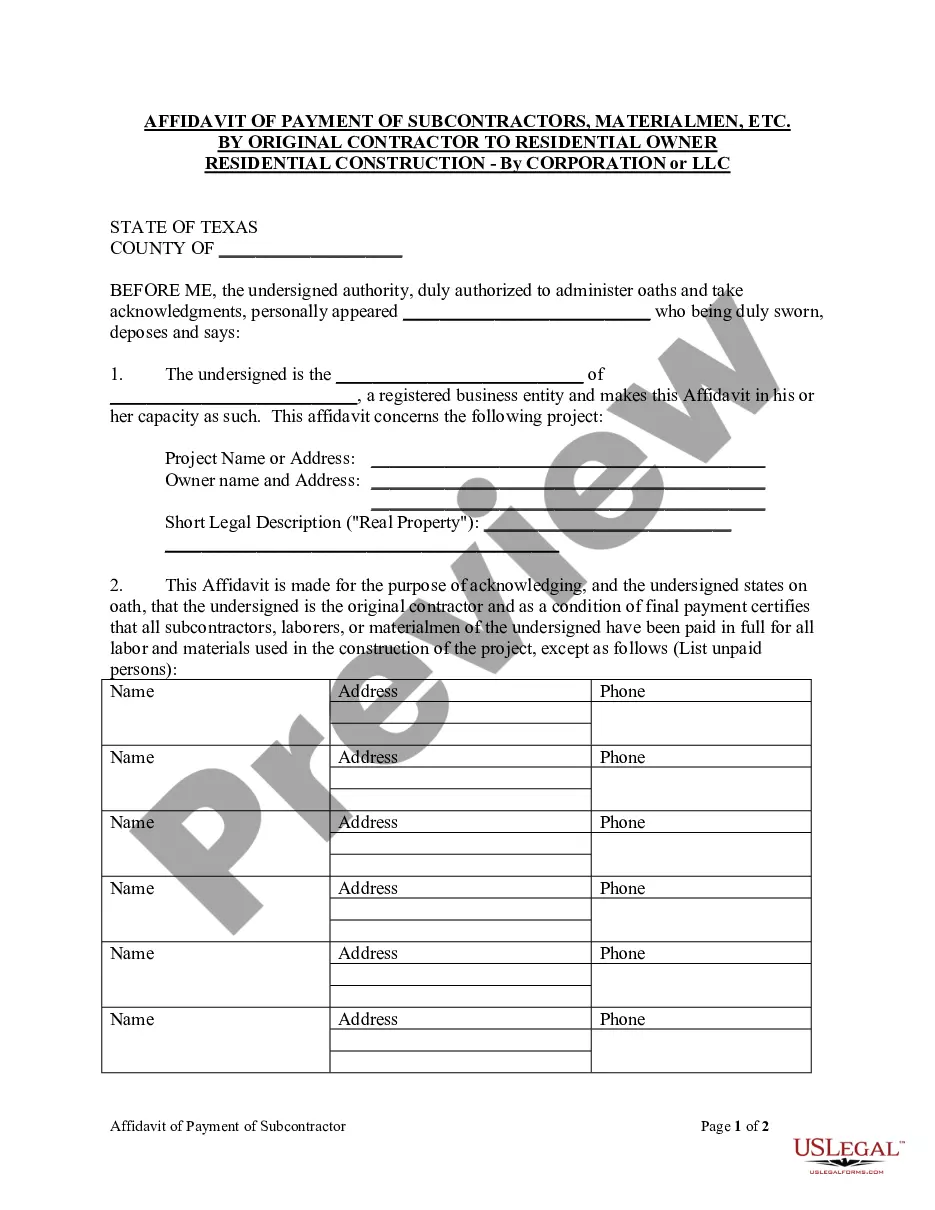

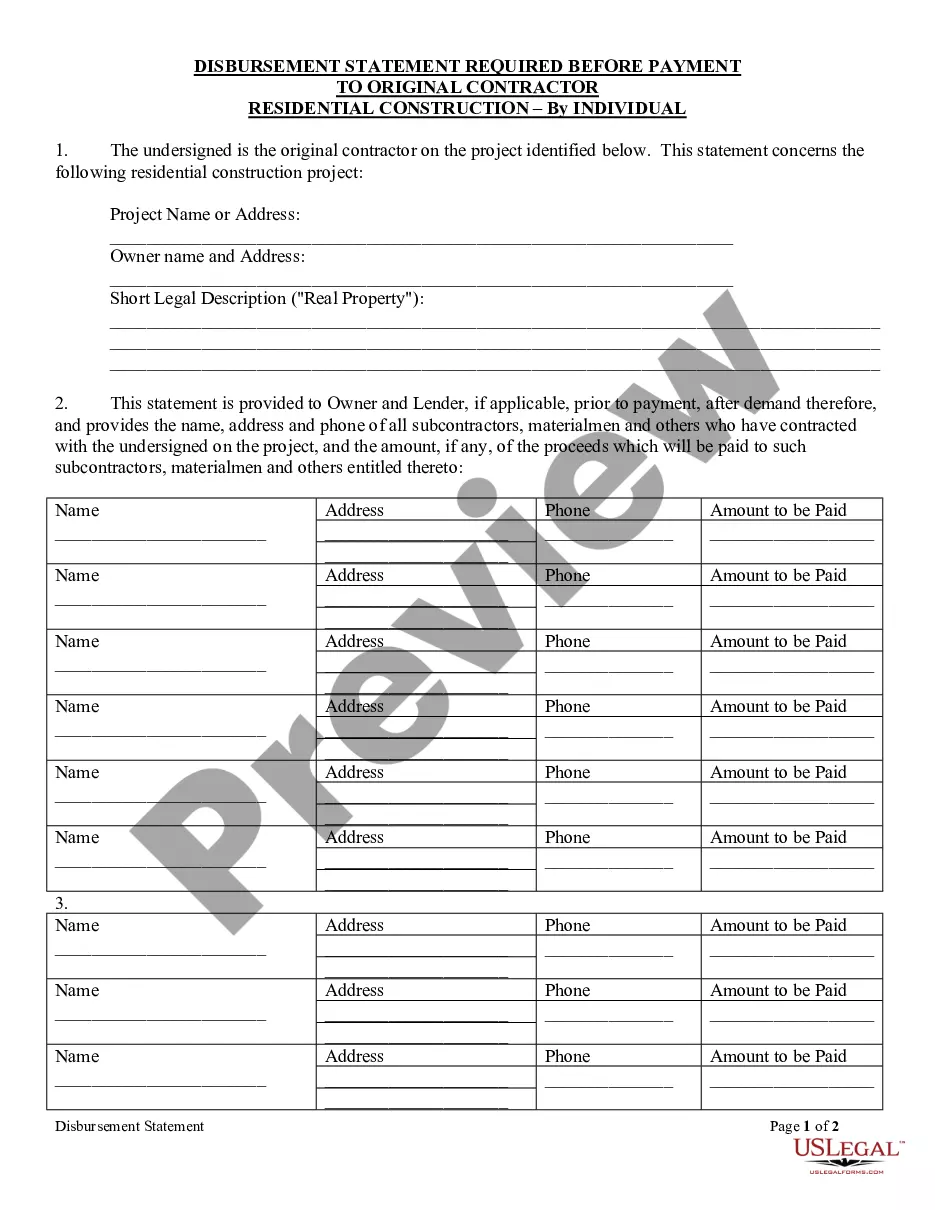

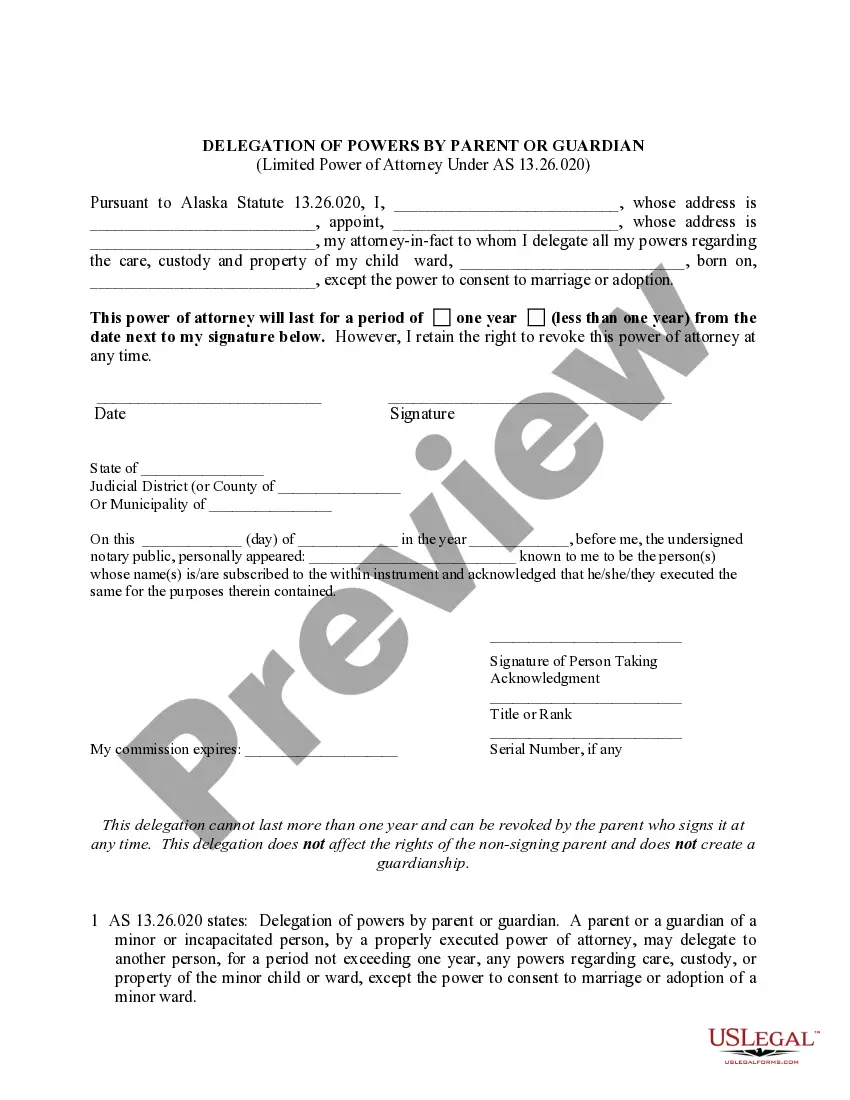

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Consequently, if you need the current version of the Orange Investment Agreement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Orange Investment Agreement:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Orange Investment Agreement and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!