Kings New York Convertible Note Financing

Description

Just like any other debt investment, senior convertible notes offer investors the ability to earn interest. Rather than cash payments, however, the interest payments typically will accrue and the amount the company owes the investor will increase over time.

Bothstartup companiesand well-established companies may opt to issue senior convertible notes to raise funds from investors. This type of company financing has the advantage of being fairly simple to execute. This means the process of issuing the notes is relatively inexpensive for companies and it allows them quicker access to investor funding."

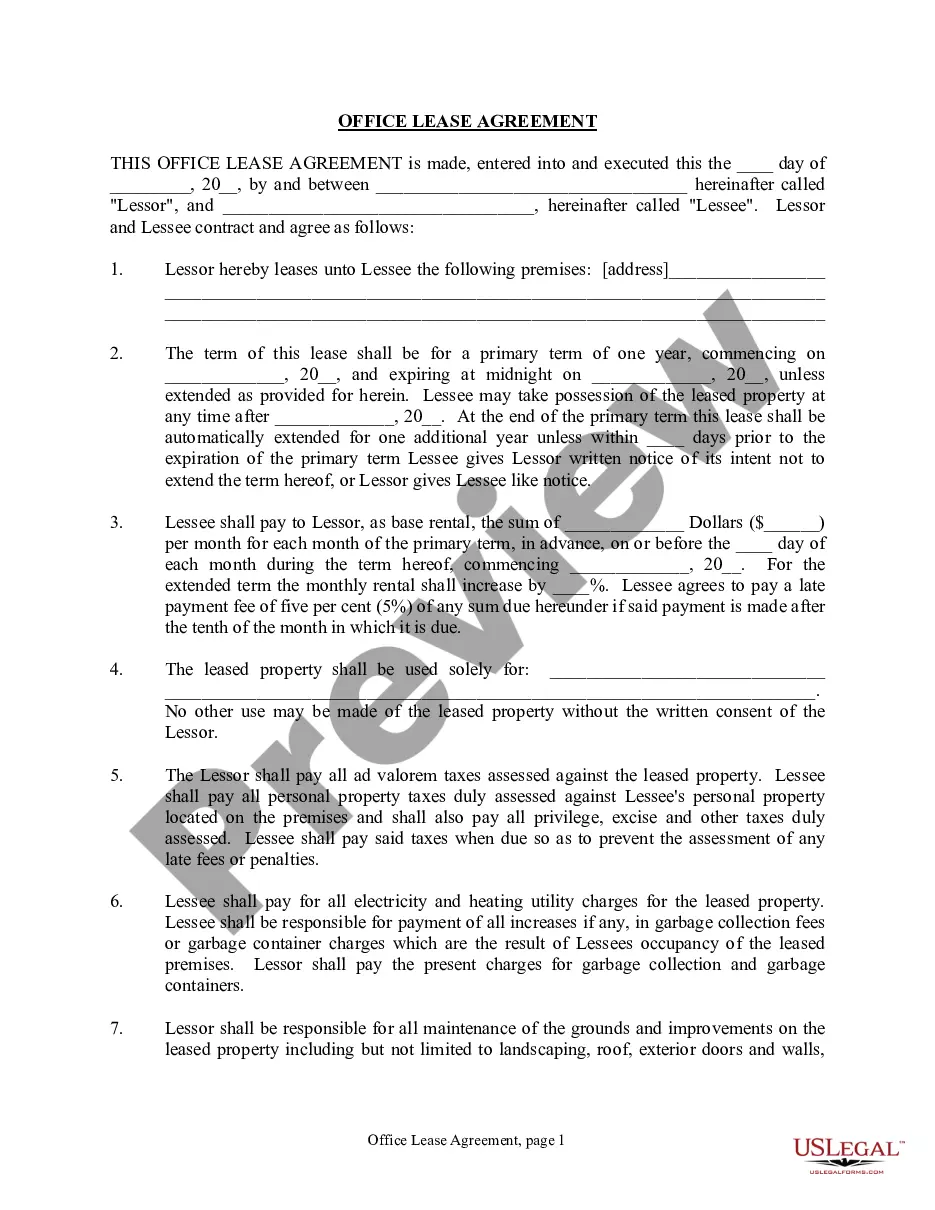

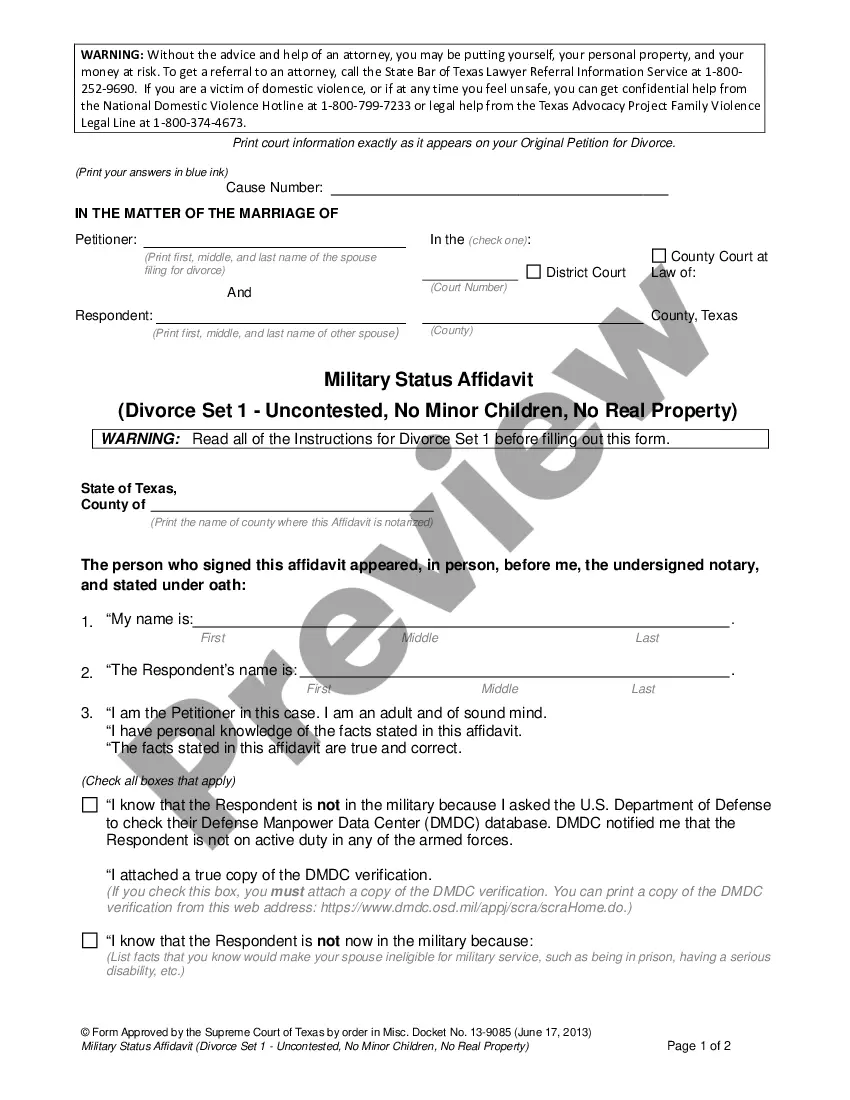

How to fill out Convertible Note Financing?

Organizing documents for business or personal necessities is consistently a significant obligation.

When formulating an agreement, a public service application, or a power of attorney, it is vital to consider all federal and state regulations of the designated area.

Nonetheless, small counties and even towns also possess legislative rules that you must factor in.

The remarkable aspect of the US Legal Forms library is that all the documents you have ever bought are never lost - you can retrieve them in your profile within the My documents section at any time. Join the platform and easily access validated legal forms for any purpose with just a few clicks!

- All these elements render the task of drafting Kings Convertible Note Financing laborious and time-consuming without expert assistance.

- It is feasible to avoid squandering money on attorneys preparing your documents and generate a legally valid Kings Convertible Note Financing independently, utilizing the US Legal Forms online repository.

- It is the largest online collection of state-specific legal documents that have been expertly validated, so you can trust their legitimacy when selecting a template for your county.

- Previously subscribed users just need to Log In to their accounts to access the necessary form.

- If you do not have a subscription yet, adhere to the step-by-step guide below to acquire the Kings Convertible Note Financing.

- Review the page you have accessed and confirm if it contains the document you need.

- To do this, utilize the form description and preview if these features are available.

Form popularity

FAQ

Most convertible notes, like other forms of debt, provide that they are due at the maturity date, usually 18 to 24 months. Occasionally, convertible notes will provide that at maturity they automatically convert to equity, or convert to equity at the option of the lender.

In other words, convertible notes are loans to early-stage startups from investors who are expecting to be paid back when their note comes due. But, instead of being paid back in principal with interestas would be the case with a typical loanthe investor can be repaid in equity in your company.

Convertible notes can be an excellent option for the right company and the right investor. The high-risk, high-reward model can offer a way for startups to obtain seed funding before they have the resources to get to Series A funding.

Convertible notes are good for quickly closing a Seed round. They're great for getting buy in from your first investors, especially when you have a tough time pricing your company.

Since convertible loans are part debt and part equity, investors earn interest on the total loan amount over the term of the loan. In most cases, the interest is added to the principal each month, and not paid each month.

A convertible loan note (also known as a convertible note, or CLN) is a type of short-term debt that is converted into equity shares at a later date. Making an investment into a startup via a convertible loan note typically allows the investor to receive a discounted share price based on the company's future valuation.

Most convertible notes have meager interest rates, with many notes issued at the lowest legal interest rates for debt financing. The reason behind this is that investors value the growth potential of future equity more than any short-term guarantees of cash through a true bond-like interest rate.

The maturity date is usually set at 1824 months after the date of the convertible note investment. The Interest rate is most often between 28%.

When a startup fails, the company typically has run out of money. The owner of a convertible note may get nothing, or at best may only receive pennies on the dollar. You also may be able to write off your loss. There are a number of factors that go into determining what happens with a convertible note.

The convertible note interest rate can range from 2 to 8 percent. However, it stays most often in the 5 to 6 percent range. There are instances when the interest rate can range from 2 to 4 percent annually.