Travis Texas Convertible Note Financing is a type of investment vehicle that combines debt and equity components. It is commonly utilized by startups and early-stage companies as a means to raise capital for their growth and expansion plans. This financing option offers flexibility to both investors and the issuing company, providing an attractive alternative to traditional debt or equity financing. The key feature of a Travis Texas Convertible Note Financing is its convertibility. It starts as a debt instrument, similar to a loan, where the company borrows money from investors in exchange for issuing convertible notes. These notes have an agreed-upon interest rate, maturity date, and a conversion feature, which allows them to be converted into equity shares of the company under certain predefined conditions. One significant advantage of Travis Texas Convertible Note Financing is the ability to delay the valuation of the company until a later financing round or significant event, such as a merger or acquisition. This feature provides flexibility in determining the conversion price and protects both the company and investors from potentially undervaluing the business in its early stages. It also allows the company to attract early investors without the immediate need to establish a fixed valuation. In addition, Travis Texas Convertible Note Financing often includes certain protective provisions for investors. These provisions might include features like a discount rate or a valuation cap, which provide investors with additional perks when they convert their notes into equity. The discount rate typically allows investors to convert their notes at a lower price compared to the future round's valuation. The valuation cap sets an upper limit on the conversion price, ensuring that investors do not miss out on significant upside potential. Different types of Travis Texas Convertible Note Financing include: 1. Simple Convertible Notes: These are the most basic form of convertible notes that do not incorporate complex provisions, such as cap or discount rate. The conversion occurs at a predetermined price based on the next financing round's valuation. 2. Convertible Notes with Discount Rate: This type of financing includes a discount rate, typically ranging from 10% to 30%, which grants investors the advantage of converting their notes at a discounted price compared to the future round's valuation. 3. Convertible Notes with Valuation Cap: In this type, the conversion price is capped at a maximum limit, protecting investors from any excessive increase in the company's value before the next financing round. 4. Convertible Notes with Both Discount Rate and Valuation Cap: This type offers a combination of discount rate and valuation cap, providing investors with multiple perks when converting their notes into equity. Overall, Travis Texas Convertible Note Financing is an attractive option for both early-stage companies looking for capital and investors seeking potential high-growth opportunities. Its flexibility, delay in valuation, and protective provisions make it a versatile choice that suits the dynamic needs of startups in their early growth phases.

Travis Texas Convertible Note Financing

Description

How to fill out Travis Texas Convertible Note Financing?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Travis Convertible Note Financing, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Travis Convertible Note Financing from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Travis Convertible Note Financing:

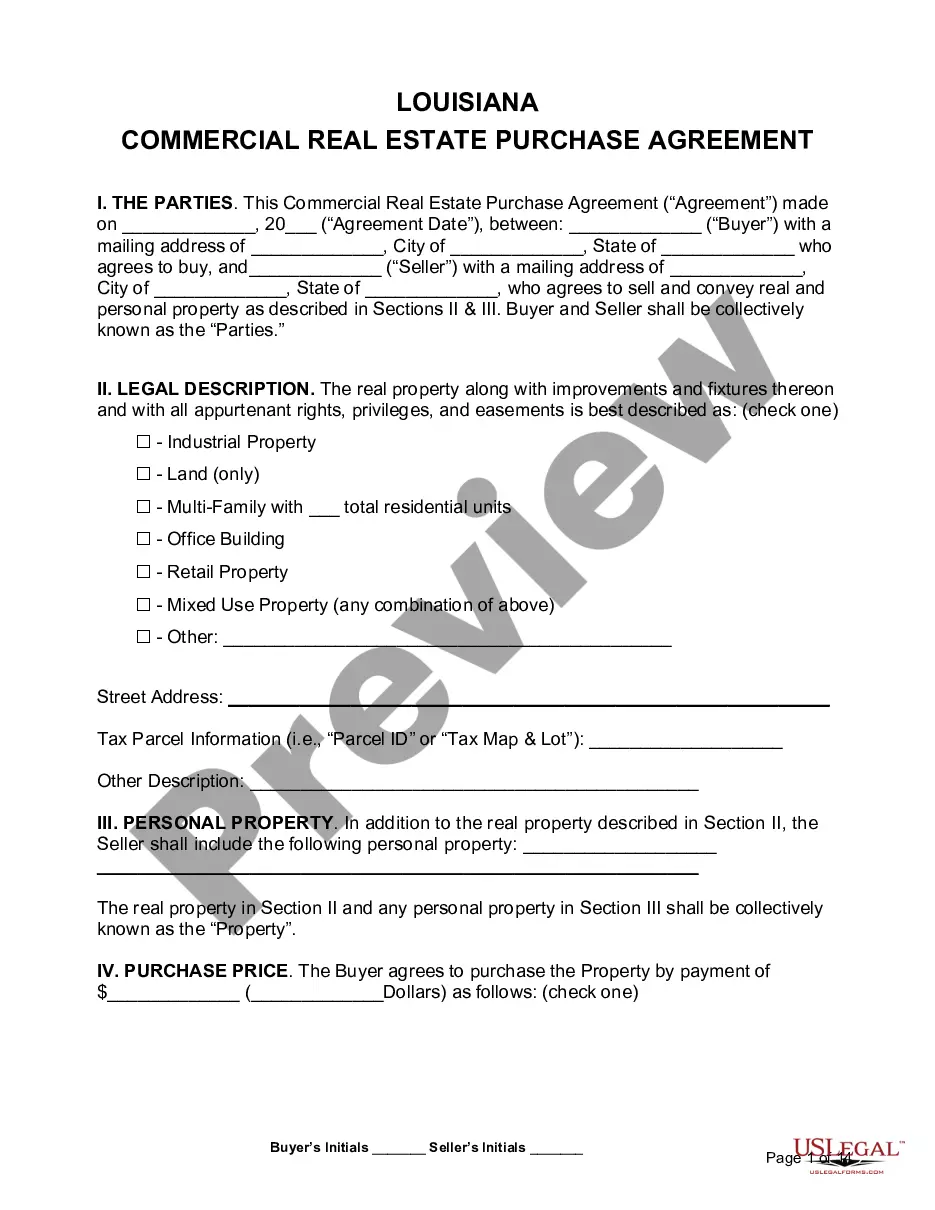

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!