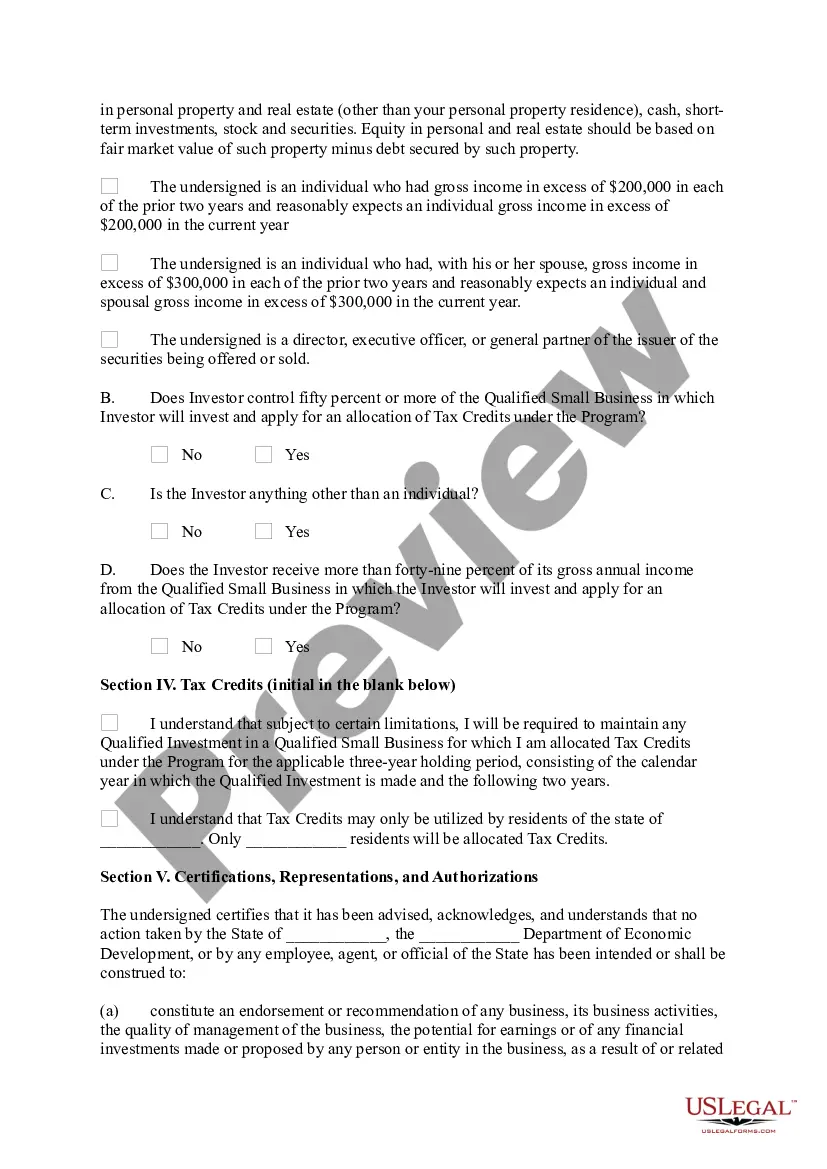

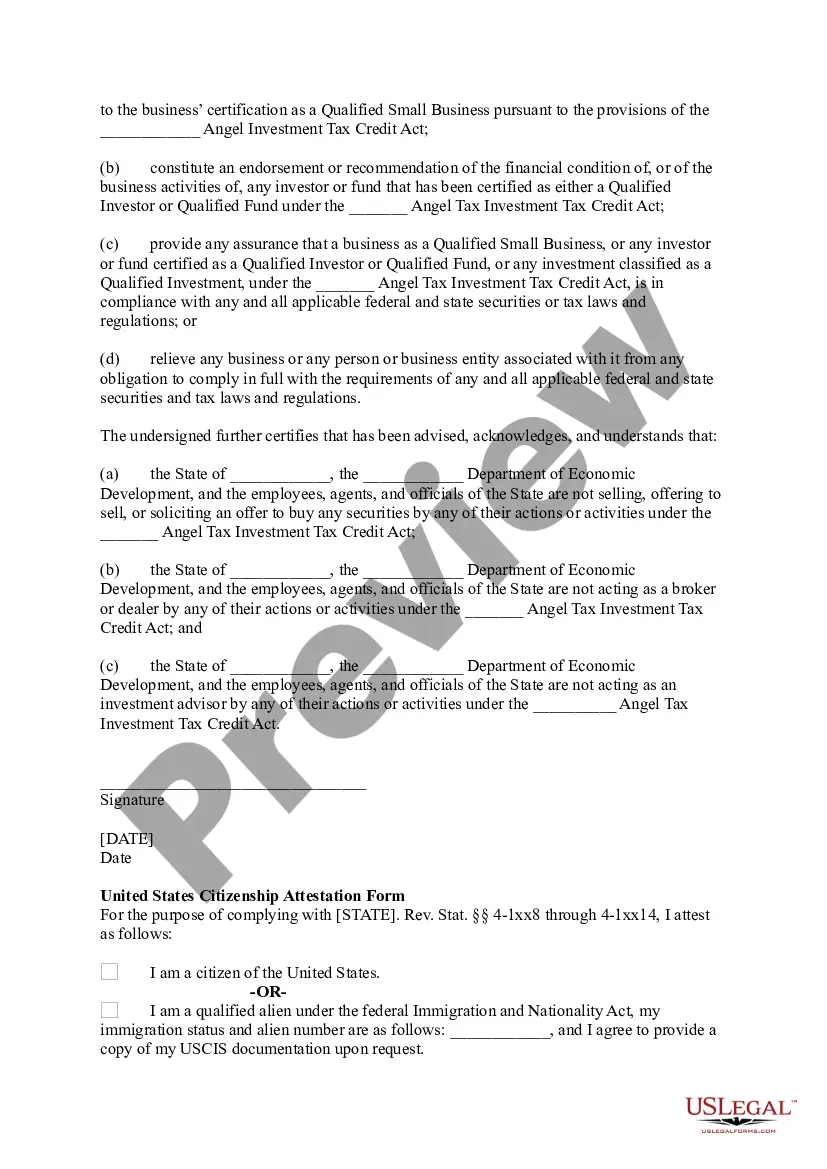

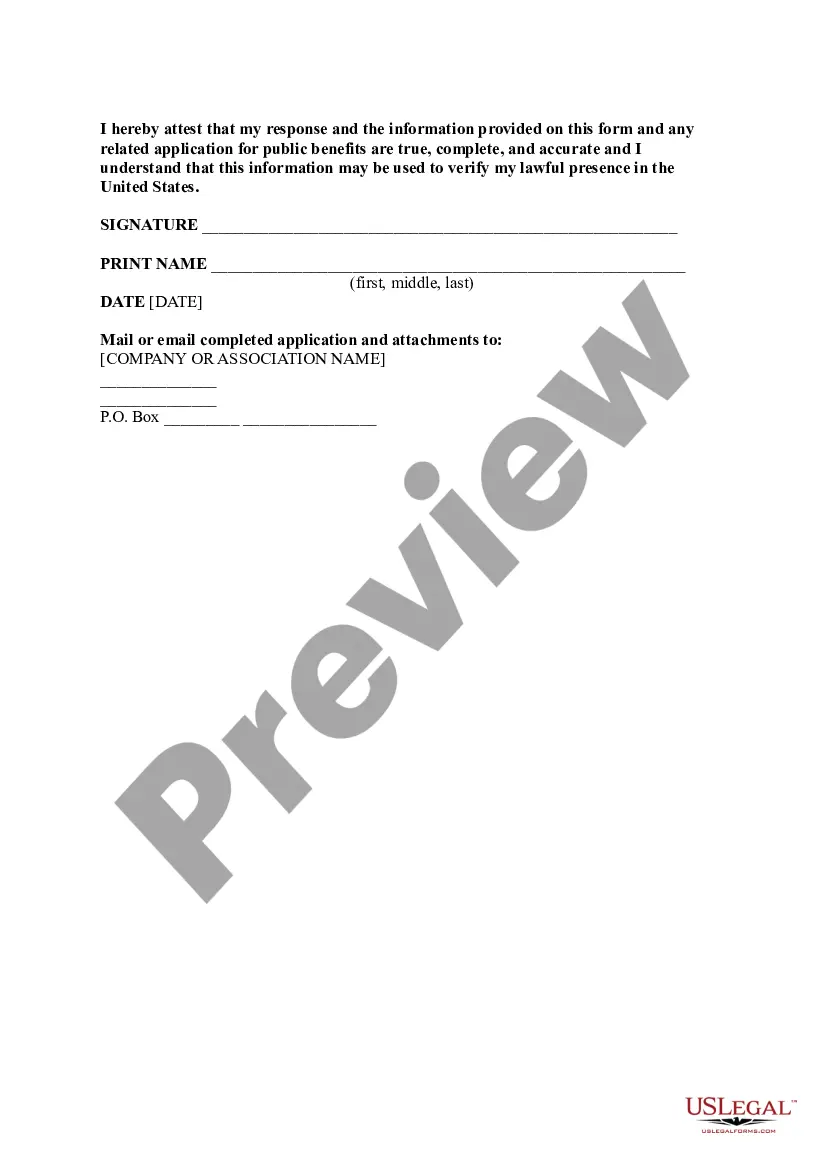

The Chicago Illinois Qualified Investor Certification Application is a comprehensive document required for individuals seeking qualification as a qualified investor in the city of Chicago, Illinois. This certification is essential for individuals who wish to participate in certain investment opportunities that are exclusively available to qualified investors. To initiate the process, interested individuals must complete the Chicago Illinois Qualified Investor Certification Application accurately and thoroughly. This application serves as a tool to assess an individual's financial competency and understanding of the risks associated with investment activities. All sections of the application must be diligently filled out, providing complete and accurate information to ensure a fair evaluation according to the criteria set forth by the Chicago authorities. The Chicago Illinois Qualified Investor Certification Application encompasses various crucial aspects related to an individual's financial status, investment experience, and understanding of relevant investment concepts. Key areas covered in the application include: 1. Personal Information: This section requires applicants to provide their full legal name, contact information, and residency status to establish identity and eligibility for the certification. 2. Net Worth Calculation: Applicants must thoroughly disclose their financial assets and liabilities, including properties, investments, cash, debts, and other relevant financial information. This information is essential to assess an individual's net worth and determine their suitability as a qualified investor. 3. Investment Experience: This part of the application aims to gauge an individual's experience in various investment activities, such as stock market investments, real estate ventures, private equity investments, and any other relevant investments. Providing a detailed overview of past investment experience and successful transactions helps authorities evaluate an applicant's expertise in the field. 4. Risk Assessment: Applicants are required to demonstrate their understanding of investment risks and acknowledge the potential financial losses that could occur while engaging in investment activities. This section ensures that individuals comprehend the uncertainties associated with investments and are well-informed before participating as a qualified investor in Chicago. 5. Professional Accreditation: The application also allows applicants to disclose any relevant professional accreditations, licenses, or certifications they hold in the fields of finance, investment, or related areas. These credentials can further enhance an applicant's suitability as a qualified investor. It is essential to note that there are currently no specific types of Chicago Illinois Qualified Investor Certification Applications; however, the application may undergo periodic revisions or updates to align with changing regulations or industry best practices. As such, it is advisable for applicants to consult the official Chicago authorities or legal advisors to ensure they are using the most up-to-date version of the application form. In conclusion, the Chicago Illinois Qualified Investor Certification Application is a comprehensive document that serves as a gateway for individuals to participate in exclusive investment opportunities in the city. By meticulously completing this application, applicants can demonstrate their financial competency, investment experience, and understanding of the associated risks, ultimately positioning themselves as qualified investors in Chicago, Illinois.

Chicago Illinois Qualified Investor Certification Application

Description

How to fill out Chicago Illinois Qualified Investor Certification Application?

Preparing legal documentation can be difficult. In addition, if you decide to ask a legal professional to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Chicago Qualified Investor Certification Application, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the Chicago Qualified Investor Certification Application, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Chicago Qualified Investor Certification Application:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Chicago Qualified Investor Certification Application and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!