Title: Dallas Texas Qualified Investor Certification Application: Detailed Description and Types Introduction: The Dallas Texas Qualified Investor Certification Application is a comprehensive and legally recognized process that enables individuals or entities to qualify as accredited investors in the state of Texas. This certification demonstrates an individual's expertise, financial stability, and understanding of investment risks, allowing them to participate in certain investment opportunities not available to non-accredited investors. Keywords: Dallas Texas, Qualified Investor Certification Application, accredited investors, investment opportunities, financial stability, investment risks. Description: The Dallas Texas Qualified Investor Certification Application serves as a means to assess and verify an investor's eligibility for investment opportunities that fall under the United States Securities and Exchange Commission (SEC) regulations. These applications are reviewed by regulatory bodies to ensure compliance with state and federal laws. The purpose of the Dallas Texas Qualified Investor Certification Application is to protect investors and ensure they possess the financial capacity and knowledge required for engaging in higher-risk investment strategies. Types of Dallas Texas Qualified Investor Certification Applications: 1. Individual Accredited Investor Certification: This type of application is designed for individual investors who meet specific income or net worth requirements. The individual's income, net worth, or joint income with a spouse are evaluated in conjunction with their investment experience, occupation, and understanding of the potential risks involved. 2. Entity Accredited Investor Certification: This application category targets legal entities such as corporations, partnerships, limited liability companies (LCS), and trusts. Eligibility for entity certification depends on meeting certain asset thresholds, having substantial business operations, or holding certain investments. 3. Government-defined Qualified Institutional Investor Certification: This category is specifically tailored for qualifying institutional investors, including banks, insurance companies, registered investment companies (mutual funds), employee benefit plans, and charitable organizations. The certification ensures these institutions meet stringent criteria related to their net worth, assets under management, or qualification standards specified by the government. Conclusion: The Dallas Texas Qualified Investor Certification Application offers prospective investors the opportunity to become accredited investors and access a wider range of investment opportunities. The application process comprises evaluating an individual's financial standing, investment experience, and comprehension of potential risks. By classifying into different types, such as individual, entity, or institutional certification, the application accommodates various investor profiles, supporting a robust financial ecosystem in Dallas Texas. Keywords: accredited investors, financial standing, investment experience, investment opportunities, investor profiles, Dallas Texas, Qualified Investor Certification Application.

Dallas Texas Qualified Investor Certification Application

Description

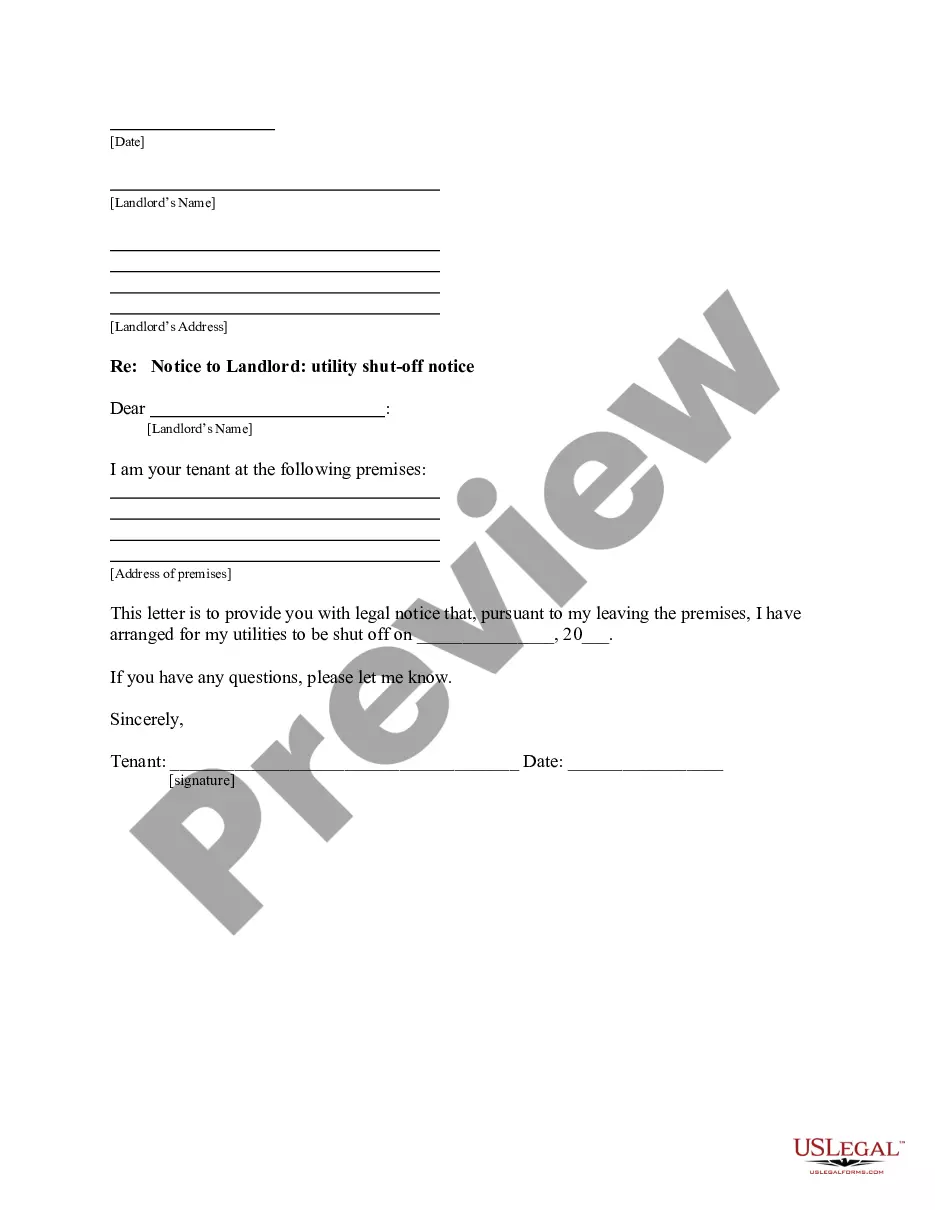

How to fill out Dallas Texas Qualified Investor Certification Application?

If you need to find a trustworthy legal paperwork supplier to get the Dallas Qualified Investor Certification Application, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning materials, and dedicated support make it simple to locate and complete various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply type to search or browse Dallas Qualified Investor Certification Application, either by a keyword or by the state/county the document is created for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Dallas Qualified Investor Certification Application template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less expensive and more reasonably priced. Create your first business, arrange your advance care planning, draft a real estate contract, or complete the Dallas Qualified Investor Certification Application - all from the comfort of your home.

Sign up for US Legal Forms now!