To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims."

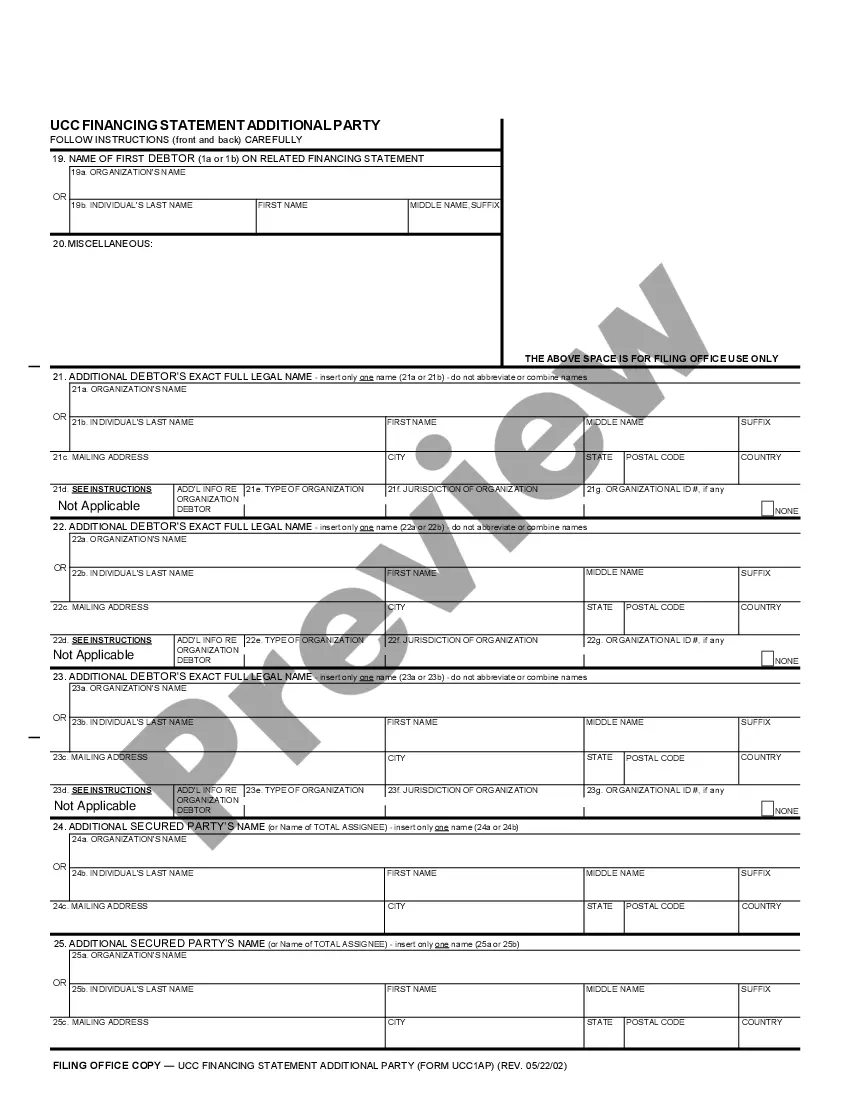

The Hillsborough Florida Qualified Investor Certification Application is a detailed application form specifically designed for individuals or entities seeking to obtain Qualified Investor Certification in the Hillsborough County of Florida, USA. The purpose of the certification is to verify an individual or entity's eligibility to engage in certain investment activities that may be restricted to qualified investors. The application process aims to ensure that those applying meet the necessary requirements to participate in investment opportunities that are typically offered exclusively to qualified investors. To complete the Hillsborough Florida Qualified Investor Certification Application, applicants are required to provide a comprehensive set of information and documentation. This includes personal details such as full name, contact information, and social security number (or taxpayer identification number for entities). Additionally, applicants must provide financial information like income, net worth, assets, and liabilities, as well as investment experience and knowledge. It is worth mentioning that there may be different types or variations of the Hillsborough Florida Qualified Investor Certification Application based on the specific investment opportunities available within the county. These variations may focus on particular types of investments or cater to different investor categories, such as individuals, corporations, limited liability companies (LCS), or partnership entities. For instance, there might be specific application forms for real estate investments, private equity investments, or venture capital investments. Keywords: Hillsborough Florida, Qualified Investor Certification, application form, eligibility, investment activities, restricted investments, investment opportunities, qualified investors, personal details, contact information, social security number, taxpayer identification number, financial information, income, net worth, assets, liabilities, investment experience, investment knowledge, investment opportunities, county-specific variations, investor categories, corporations, limited liability companies (LCS), partnership entities, real estate investments, private equity investments, venture capital investments.