Allegheny, Pennsylvania Term Sheet for Potential Investment in a Company: Allegheny, Pennsylvania, is a vibrant region known for its strong economic and industrial sectors. When considering potential investment opportunities in the area, it is important to understand the various types of term sheets available for potential investments in a company. 1. Series A Term Sheet: The Series A term sheet is one of the most common types used for early-stage investments. It outlines the key terms and conditions of the investment, including the investment amount, equity percentage, liquidation preference, board seats, and protective provisions. Additionally, it may specify any rights or preferences granted to the investor and highlight important financial metrics or milestones. 2. Growth Equity Term Sheet: Growth equity investments occur when a company has already reached its initial growth stage and requires further capital to expand operations or enter new markets. The growth equity term sheet typically includes provisions like investment amount, equity stake, preemptive rights, shareholder rights, and liquidation preference. It might also encompass details regarding management rights, reporting requirements, and exit strategies. 3. Acquisition Term Sheet: In the case of an acquisition, the term sheet plays a crucial role in outlining the terms and conditions of the investment or purchase. This type of term sheet typically reflects aspects like the purchase price, structure of the transaction (cash, stock, or both), allocation of liabilities, representations and warranties, indemnification terms, and applicable closing conditions. Moreover, an acquisition term sheet highlights key dates and milestones during the due diligence and negotiation process. 4. Convertible Debt Term Sheet: Convertible debt term sheets are often used in early-stage investments when the valuation of the company is uncertain or investors wish to defer deciding on valuation until later rounds. This type of term sheet specifies the loan amount, interest rate, maturity date, conversion terms, and other relevant terms. It might also outline any conversion discount or cap, investor rights, and the events that can trigger conversion. Investors seeking potential opportunities in Allegheny, Pennsylvania, should carefully review and understand the specific details outlined in the term sheets. Each term sheet serves as a roadmap for investment negotiations and provides a comprehensive overview of the intended investment structure, investor rights, and other crucial elements. By studying and evaluating the different Allegheny, Pennsylvania term sheets for potential investments in a company, investors can make informed decisions and strategically align their interests with the business's needs. It is advisable to consult legal and financial experts to ensure a thorough understanding of the implications and potential risks associated with each term sheet type before proceeding with any investment.

Allegheny Pennsylvania Term Sheet for Potential Investment in a Company

Description

How to fill out Allegheny Pennsylvania Term Sheet For Potential Investment In A Company?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Allegheny Term Sheet for Potential Investment in a Company, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Allegheny Term Sheet for Potential Investment in a Company from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Allegheny Term Sheet for Potential Investment in a Company:

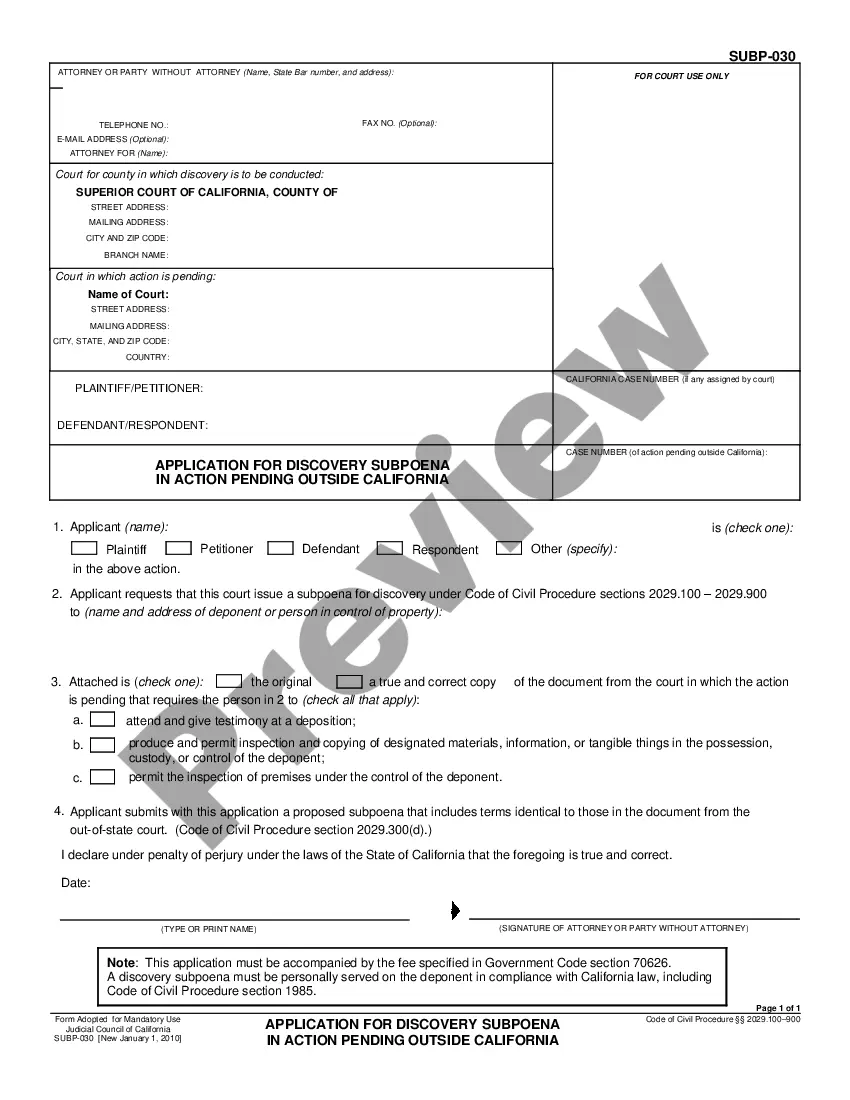

- Take a look at the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!