Title: Phoenix Arizona Term Sheet for Potential Investment in a Company: Overview, Types, and Key Considerations Introduction: Phoenix, Arizona, renowned for its vibrant business environment and robust economy, offers an array of term sheet options for potential investments in companies. An essential preliminary document in the investment landscape, a term sheet outlines the key terms and conditions of an investment deal. In this article, we will provide a detailed description of Phoenix Arizona term sheets for potential investments in companies, exploring different types and essential aspects to consider. 1. Early-Stage Investment Term Sheet: The early-stage investment term sheet caters to early-stage companies seeking funding to fuel their growth. This type of term sheet typically covers elements such as funding amount, shareholder rights, valuation, liquidation preferences, and employee stock options. It sets the foundation for negotiations and future investment rounds. 2. Venture Capital Term Sheet: Venture capital term sheets are commonly used in Phoenix, Arizona, where the thriving startup ecosystem attracts significant venture capital investments. These comprehensive documents detail investment terms, investor protection rights, preferred equity stakes, governance provisions, anti-dilution protection, and milestone-based financing. 3. Private Equity Term Sheet: For mature companies looking to scale or undergo a strategic transition, private equity term sheets emerge as a common investment instrument. These term sheets often emphasize operational control rights, management participation, performance milestones, exit strategies, and the potential for future add-on investments or roll ups. 4. Bridge Loan Term Sheet: Bridge loan term sheets serve as temporary financing solutions to bridge the gap between funding rounds. These short-term loans provide immediate capital while awaiting a more substantial funding event or exit. The key terms encompass interest rates, repayment terms, default provisions, conversion options, and potential equity kickers. Key considerations in Phoenix Arizona Term Sheets: a. Valuation: The term sheet should clarify the pre-money valuation or the agreed-upon valuation of the company before investment. This serves as a basis for determining investors' equity stakes and dilution. b. Investment Amount and Structure: The term sheet must define the investment amount, whether it is a lump sum upfront or a multi-tranche investment over time. It should also specify whether the investment is in the form of equity, debt, or a combination. c. Rights and Preferences: Investors' rights, such as board representation, blocking rights, information rights, and liquidation preferences, must be clearly outlined in the term sheet. d. Exit Strategy: The term sheet should address the anticipated exit strategy, whether through an initial public offering (IPO), merger and acquisition (M&A), or other means. It should also define whether there are any liquidation or preference rights for investors in the event of a sale or dissolution. e. Governing Law and Jurisdiction: The term sheet should establish an agreed governing law and jurisdiction to avoid potential jurisdictional disputes. Conclusion: Phoenix, Arizona offers a plethora of term sheet options for potential investments in companies, catering to early-stage startups, venture-backed firms, private equity targets, and companies seeking bridge financing. Understanding the specific type of term sheet and considering crucial details such as valuation, investment structure, rights, exit strategies, and jurisdiction safeguards investors and companies in their investment journey. So, whether you are an entrepreneur or an investor, carefully drafting and negotiating a well-defined term sheet can lay a solid foundation for a successful investment endeavor in Phoenix, Arizona.

Phoenix Arizona Term Sheet for Potential Investment in a Company

Description

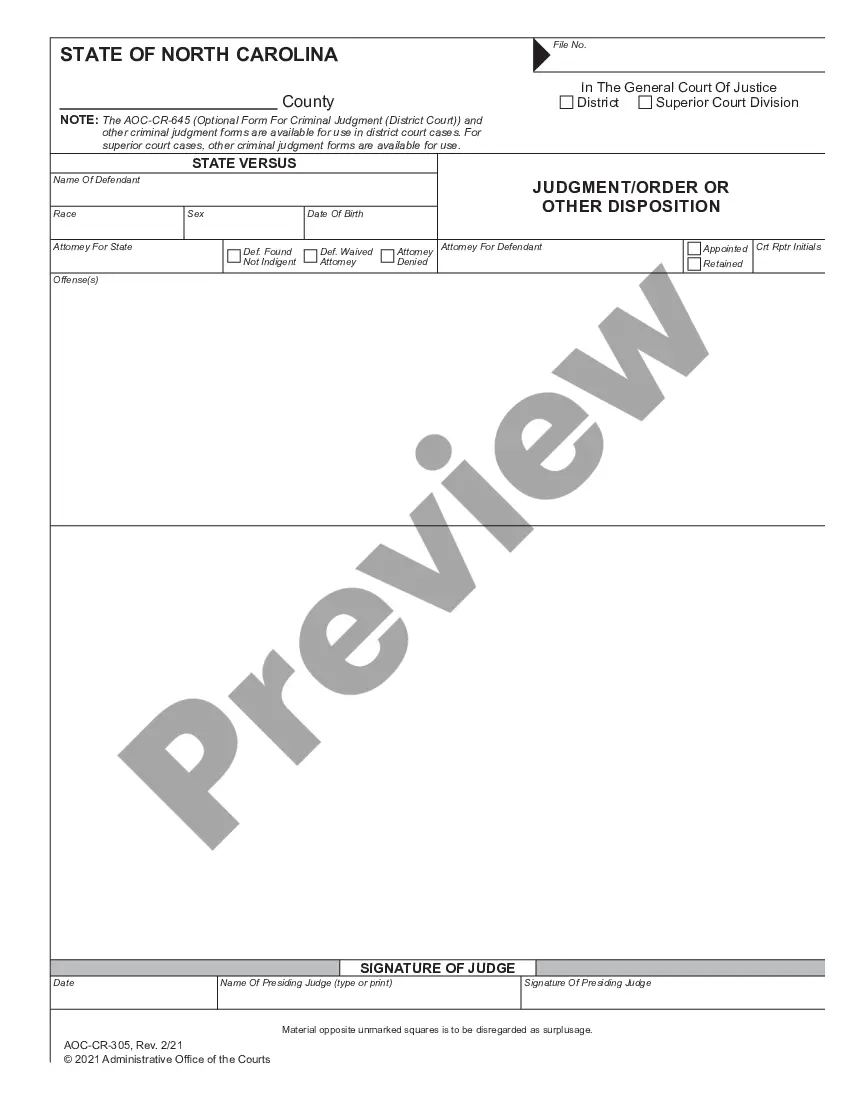

How to fill out Phoenix Arizona Term Sheet For Potential Investment In A Company?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life situation, locating a Phoenix Term Sheet for Potential Investment in a Company suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. In addition to the Phoenix Term Sheet for Potential Investment in a Company, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Phoenix Term Sheet for Potential Investment in a Company:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Phoenix Term Sheet for Potential Investment in a Company.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Term Sheet Template A term sheet outlines the basic terms and conditions of an investment opportunity and is a non-binding agreement that serves as a starting point for more detailed agreements ? like a commitment letter, definitive agreement (share purchase agreement), or subscription agreement.

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with start-ups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

The main difference between the two is that a term sheet is simply a document that lays out the terms that both parties wish to include, and usually neither party will sign the document. The letter of intent, on the other hand, includes those terms but is singed by both parties involved.

One of the first and most important items on the term sheet is the investment amount. Typically the term sheet specifies the amounts per investor (lead, non-lead).

The purpose of the term sheet The term sheet is the document that outlines the terms by which an investor (angel or venture capital investor) will make a financial investment in your company. Term sheets tend to consist of three sections: funding, corporate governance and liquidation.

A term sheet is a relatively short document that an investor prepares for presentation to the company in which the investor states the investment that he is willing to make in the company. This document is usually 5-8 pages in length.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity.Securities being issued.Board rights.Investor protections.Dealing with shares.Miscellaneous provisions.

A term sheet lays out the terms and conditions for investment. It's used to negotiate the final terms, which are then written up in a contract. A good term sheet aligns the interests of the investors and the founders, because that's better for everyone involved (and the company) in the long run.