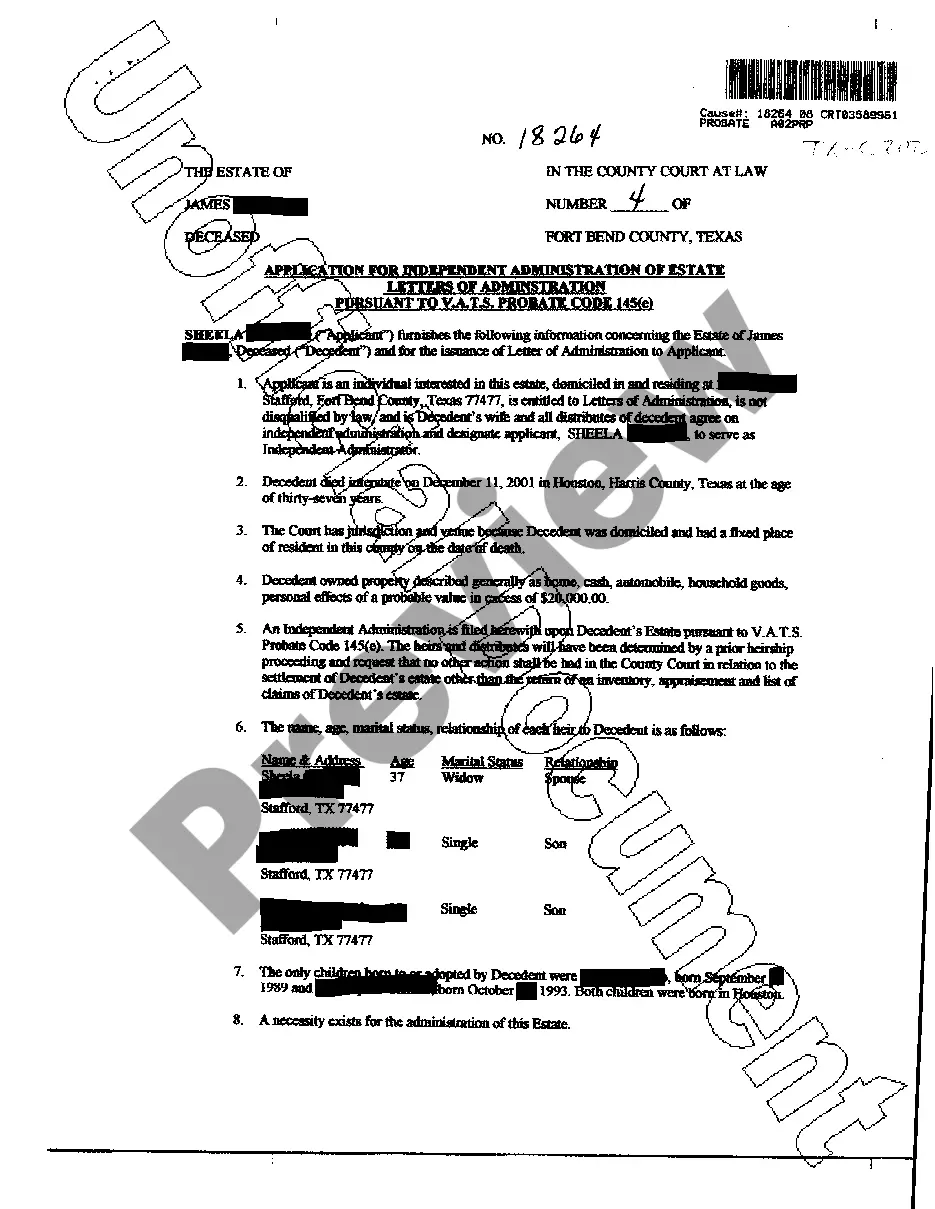

San Bernardino, California is a city located in the Inland Empire region of Southern California, known for its diverse population, proximity to natural attractions, and economic opportunities. When it comes to potential investment in a company, a San Bernardino California Term Sheet can be a valuable tool for establishing the terms and conditions of the investment. A San Bernardino California Term Sheet for Potential Investment in a Company generally outlines the basic details and provisions of the potential investment agreement. It serves as a preliminary agreement between the investors and the company, providing a framework for negotiating the final investment agreement. The term sheet incorporates key terms such as the investment amount, valuation of the company, ownership stake, rights and obligations of the parties involved, and potential exit strategies. There might be different types of San Bernardino California Term Sheets for Potential Investment in a Company, tailored to various investment scenarios and preferences. Some common types include: 1. Equity Term Sheet: This type of term sheet outlines the terms for an equity investment, where the investor acquires ownership shares in the company in exchange for their investment. It covers details like the percentage of ownership, voting rights, dividend preferences, vesting schedules, and any protective clauses. 2. Debt Term Sheet: In a debt investment scenario, the term sheet specifies the terms for a loan provided to the company, which must be repaid with interest. It includes details such as the loan amount, interest rate, repayment schedule, collateral requirements, and any covenants or conditions attached to the loan. 3. Convertible Note Term Sheet: If the investment is structured as a convertible note, the term sheet outlines the terms for a loan that can convert into equity at a later stage. It typically includes details such as the loan amount, interest rate, conversion terms, valuation cap, discount rate, and maturity date. 4. Mezzanine Term Sheet: In cases where an investment combines elements of both equity and debt financing, a mezzanine term sheet is utilized. It outlines the terms for a hybrid investment, often used for growth-stage companies, including features like equity warrants, subordinated debt, or revenue-based repayment options. When considering a San Bernardino California Term Sheet for Potential Investment in a Company, it is crucial to consult with legal and financial professionals who can ensure that the terms align with the specific needs and goals of both the investor and the company.

San Bernardino California Term Sheet for Potential Investment in a Company

Description

How to fill out San Bernardino California Term Sheet For Potential Investment In A Company?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the San Bernardino Term Sheet for Potential Investment in a Company, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the San Bernardino Term Sheet for Potential Investment in a Company from the My Forms tab.

For new users, it's necessary to make several more steps to get the San Bernardino Term Sheet for Potential Investment in a Company:

- Examine the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!