Contra Costa California Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings

Description

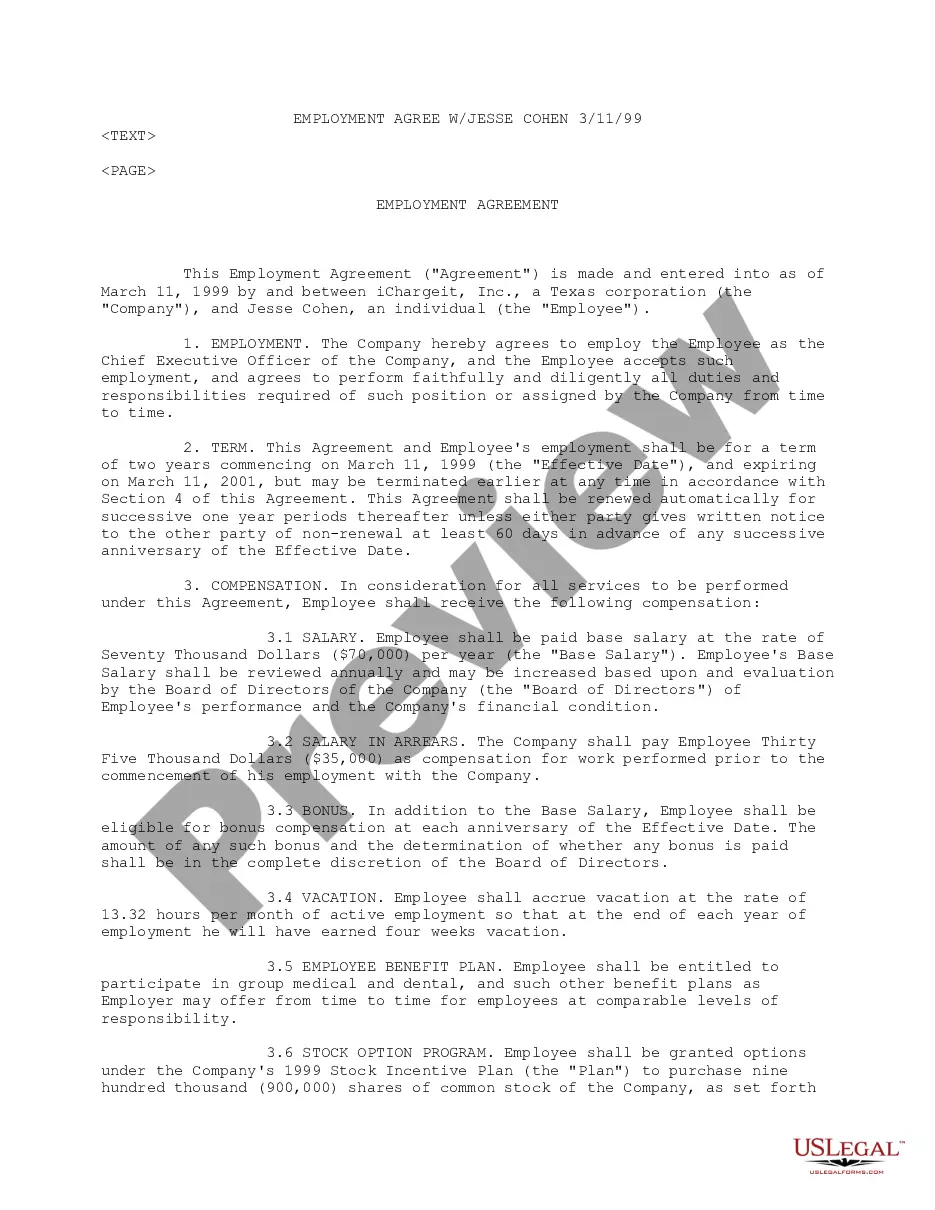

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

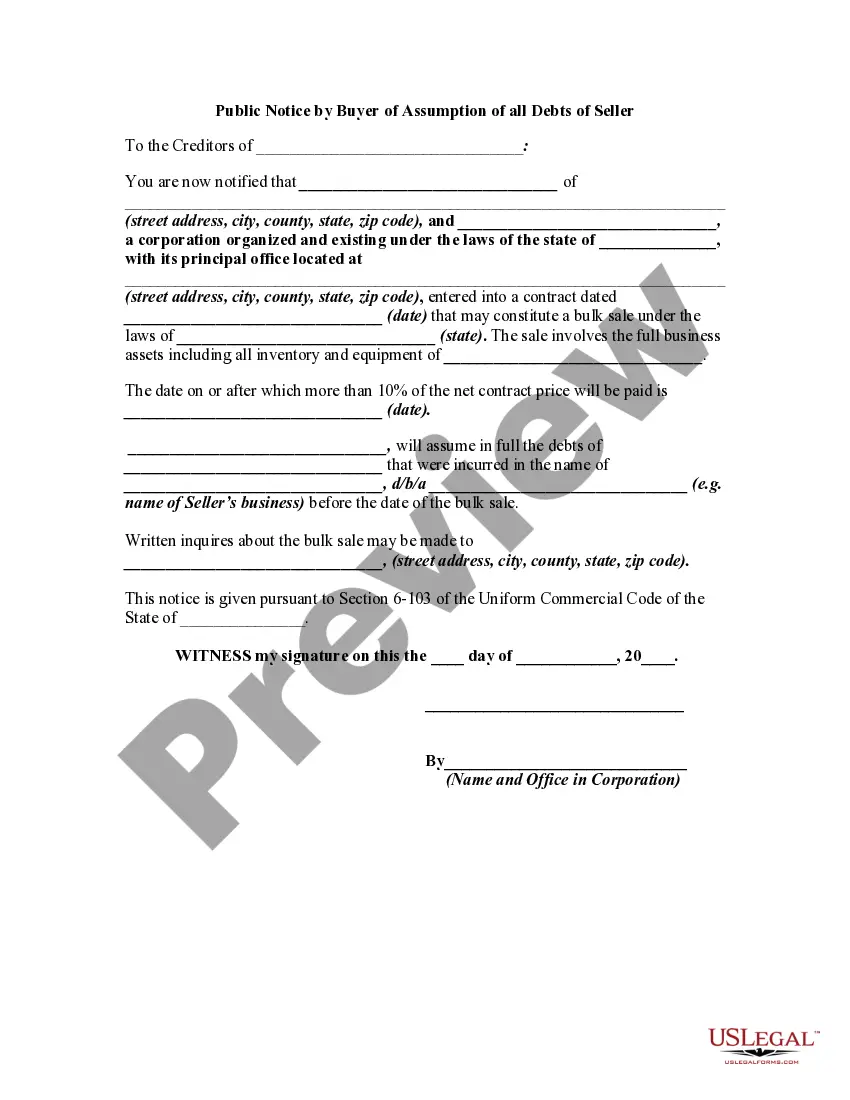

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims."

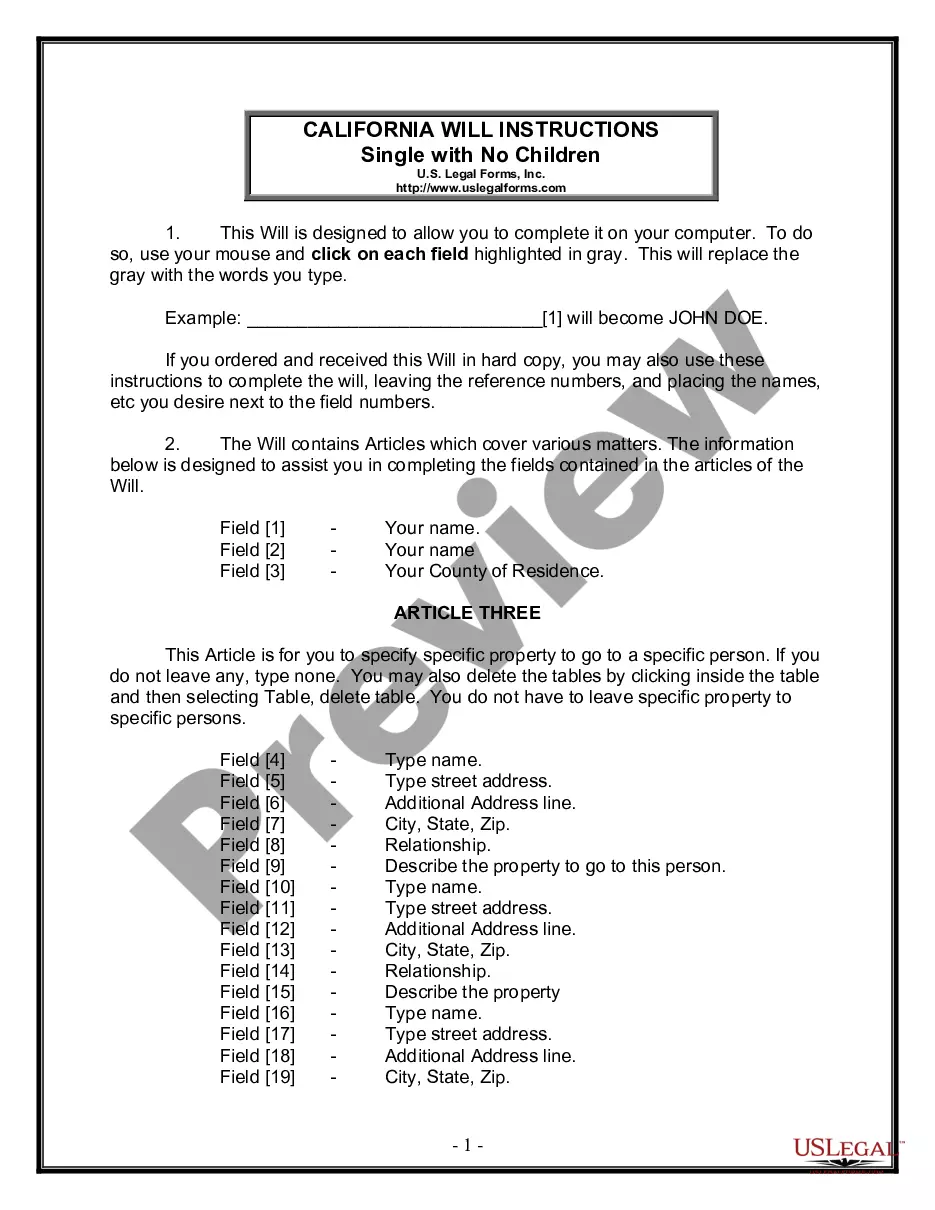

How to fill out Accredited Investor Qualification And Verification Requirements For Reg D, Rule 506(c) Offerings?

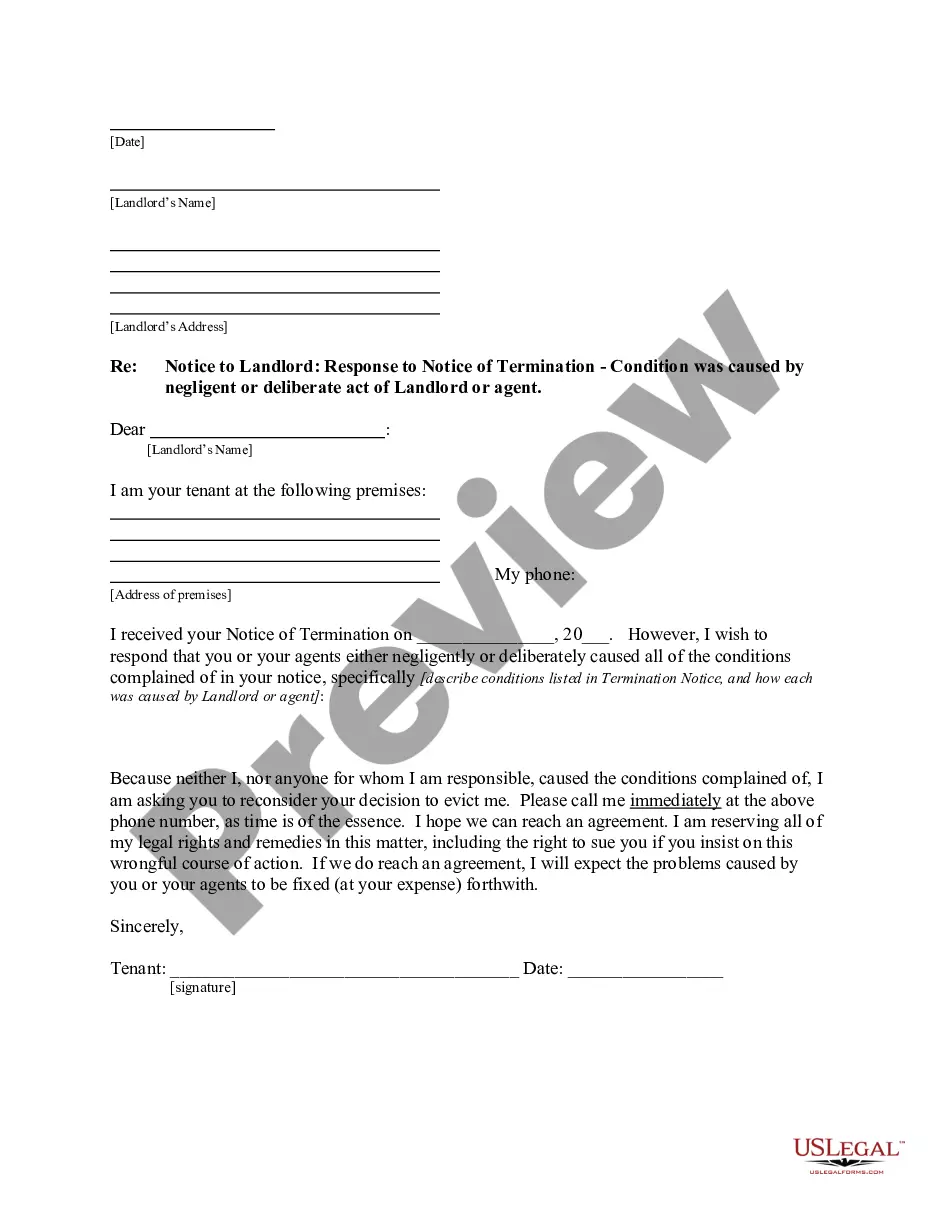

A document process always accompanies any legal activity you undertake.

Launching a business, applying for or accepting a job opportunity, transferring assets, and numerous other life situations require you to prepare official documentation that differs across the nation.

This is why gathering it all in one location is incredibly beneficial.

US Legal Forms is the largest online compilation of current federal and state-specific legal documents.

Employ it as required: print it or complete it electronically, sign it, and file it where needed. This represents the simplest and most dependable method to acquire legal documents. All templates available in our library are professionally prepared and verified for compliance with local laws and regulations. Organize your paperwork and manage your legal matters effectively with US Legal Forms!

- Here, you can effortlessly find and obtain a document for any personal or commercial purpose needed in your county, including the Contra Costa Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings.

- Finding templates on the platform is exceptionally easy.

- If you already possess a subscription to our service, Log In to your account, search for the template using the search field, and click Download to store it on your device.

- Subsequently, the Contra Costa Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings will be available for further usage in the My documents section of your profile.

- Should this be your first time using US Legal Forms, follow this quick guide to obtain the Contra Costa Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings.

- Ensure you've accessed the proper page with your localized form.

- Make use of the Preview mode (if available) and browse through the sample.

- Examine the description (if any) to confirm the template meets your requirements.

- If the sample does not suit your needs, look for another document using the search option.

- Once you find the required template, click Buy Now.

- Select the appropriate subscription plan, then Log In or create an account.

- Choose your preferred payment method (using a credit card or PayPal) to continue.

- Select file format and download the Contra Costa Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings to your device.

Form popularity

FAQ

Reg D 506 B and 506(c) both allow issuers to raise capital, but they differ in solicitation and investor verification. Reg D 506 B allows for general solicitation but requires investors to have a pre-existing relationship with the issuer, while 506(c) permits general advertising but requires all investors to be verified accredited investors. Understanding the Contra Costa California Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings is essential for making informed decisions, whether you choose option B or C.

Participation in a Reg D offering is restricted to accredited investors as defined by the SEC. This typically includes individuals with a net worth exceeding $1 million or annual income exceeding $200,000 in the past two years. Understanding the Contra Costa California Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings is vital for ensuring compliance and successful participation.

Do You Have to Prove You Are an Accredited Investor? The burden of proving that you are an accredited investor does not fall directly on you but rather the investment vehicle you would like to invest in. An investment vehicle, such as a fund, would have to determine that you qualify as an accredited investor.

Some documents that can prove an investor's accredited status include: Tax filings or pay stubs; A letter from an accountant or employer confirming their actual and expected annual income; or. IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

Regulation C offers an exemption from the registration requirement, hence allowing companies to sell up and offer up to $1.07M of their securities without having to register the offering with the SEC. Regulation Crowdfunding Collecting and Reporting. Regulation Crowdfunding or Reg C is relatively new.

There are essentially three approaches: (1) the issuer itself can verify each investor's status, (2) the investor's accountant, lawyer, or another professional can verify the investor's status, or (3) the issuer can hire a third-party verification service to verify each investor's status.

Reg D: Rule 504. A rule that allows a business to offer up to $5,000,000 in securities privately in a 12-month period without the need of registering the offering with the SEC (such registration is mandatory).

Rule 506(c) permits issuers to broadly solicit and generally advertise an offering, provided that: all purchasers in the offering are accredited investors. the issuer takes reasonable steps to verify purchasers' accredited investor status and. certain other conditions in Regulation D are satisfied.

Rule 506(c) permits issuers to broadly solicit and generally advertise an offering, provided that: all purchasers in the offering are accredited investors. the issuer takes reasonable steps to verify purchasers' accredited investor status and.

Simplified Income Verification for Rule 506(c) Investors Investors still will need to provide tax returns, brokerage, and financial statements, or an accountant, broker-dealer, or other professional must certify accredited status.