Cuyahoga Ohio Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506© Offerings In Cuyahoga County, Ohio, the accreditation status of investors plays a crucial role in determining their eligibility to participate in certain investment opportunities, especially those offered under Regulation D, Rule 506(c). These requirements aim to protect both investors and issuers by ensuring that only financially sophisticated individuals or entities with sufficient resources can engage in higher-risk investments. Meeting the accredited investor qualifications helps maintain the integrity of the financial markets. To qualify as an accredited investor in Cuyahoga County, Ohio, individuals must meet certain criteria determined by the U.S. Securities and Exchange Commission (SEC). The primary criterion is based on an individual's income or net worth. Individuals must have an annual income exceeding $200,000 (or $300,000 jointly with a spouse) for the two most recent years and have a reasonable expectation of reaching the same income level in the current year. Alternatively, individuals can qualify if they possess a net worth of over $1 million (individually or jointly with a spouse), excluding the value of their primary residence. Entities like corporations, partnerships, and certain trusts can also qualify as accredited investors under certain circumstances. These entities should have total assets exceeding $5 million and not be formed primarily to acquire the securities being offered. In some cases, certain directors, officers, or general partners of the issuer may also be considered accredited investors even if they do not meet the income or net worth thresholds. Once an investor meets the accredited investor qualifications, they can participate in Rule 506(c) offerings, which allow issuers to openly advertise and solicit investment opportunities to accredited investors. Unlike Rule 506(b) offerings, which permit a limited number of non-accredited investors, Rule 506(c) offerings solely cater to accredited individuals or entities. This exclusion of non-accredited investors signifies the higher-risk nature of these offerings and the importance of ensuring that participants have the necessary financial understanding and resources to engage in them. In terms of verification requirements, issuers conducting Rule 506(c) offerings in Cuyahoga County, Ohio, must take reasonable steps to verify the accredited investor status of each participating investor. While there is no specific method outlined by the SEC, various approaches can be used to ensure compliance. These may include reviewing recent tax forms, bank statements, credit reports, or obtaining written statements from a third party certifying the investor's accredited status. It is essential for issuers and investors in Cuyahoga County, Ohio, to understand and adhere to these accredited investor qualification and verification requirements for Reg D, Rule 506(c) offerings. Compliance with these rules promotes investor confidence and transparency in the financial markets while allowing qualified individuals and entities to access potential investment opportunities tailored for accredited investors only.

Cuyahoga Ohio Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings

Description

How to fill out Cuyahoga Ohio Accredited Investor Qualification And Verification Requirements For Reg D, Rule 506(c) Offerings?

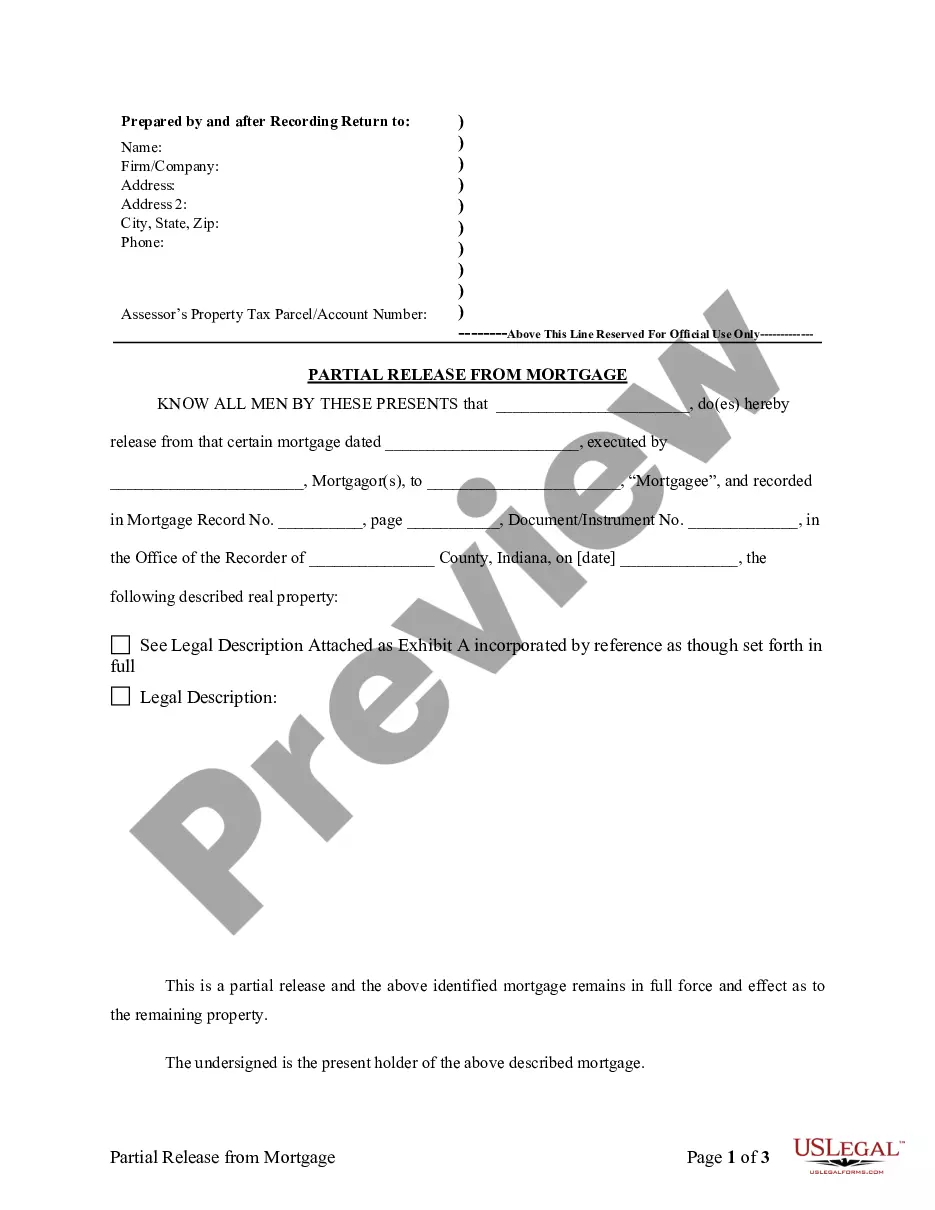

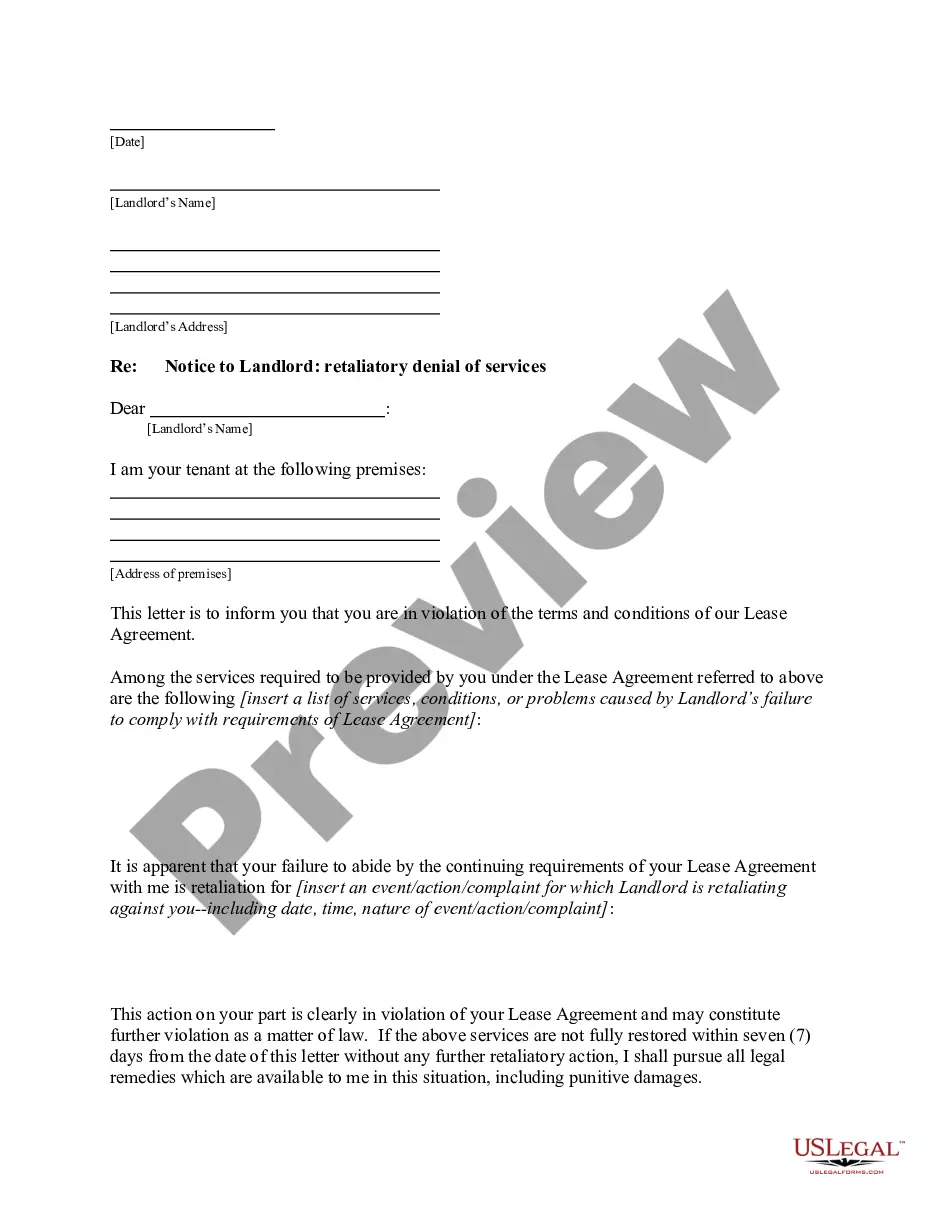

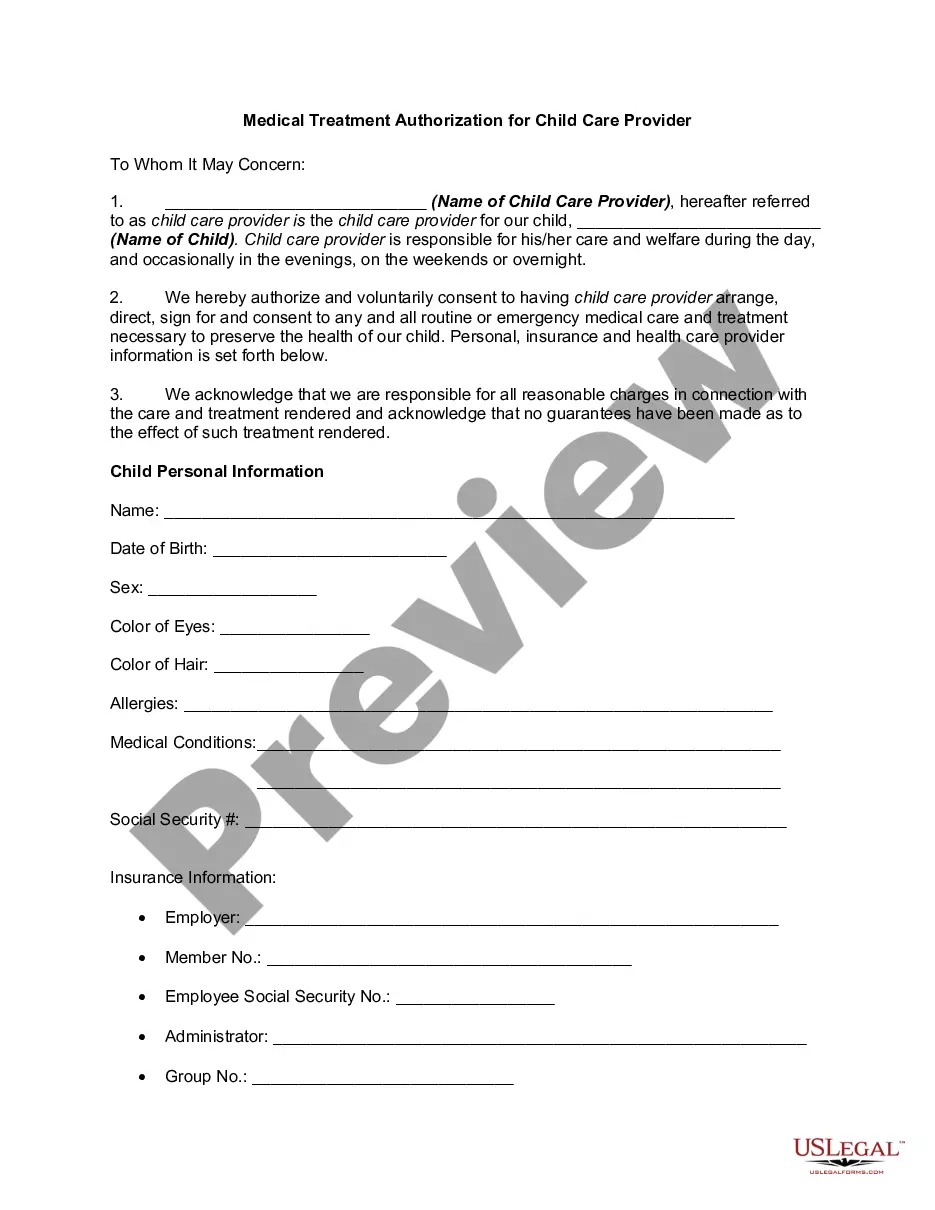

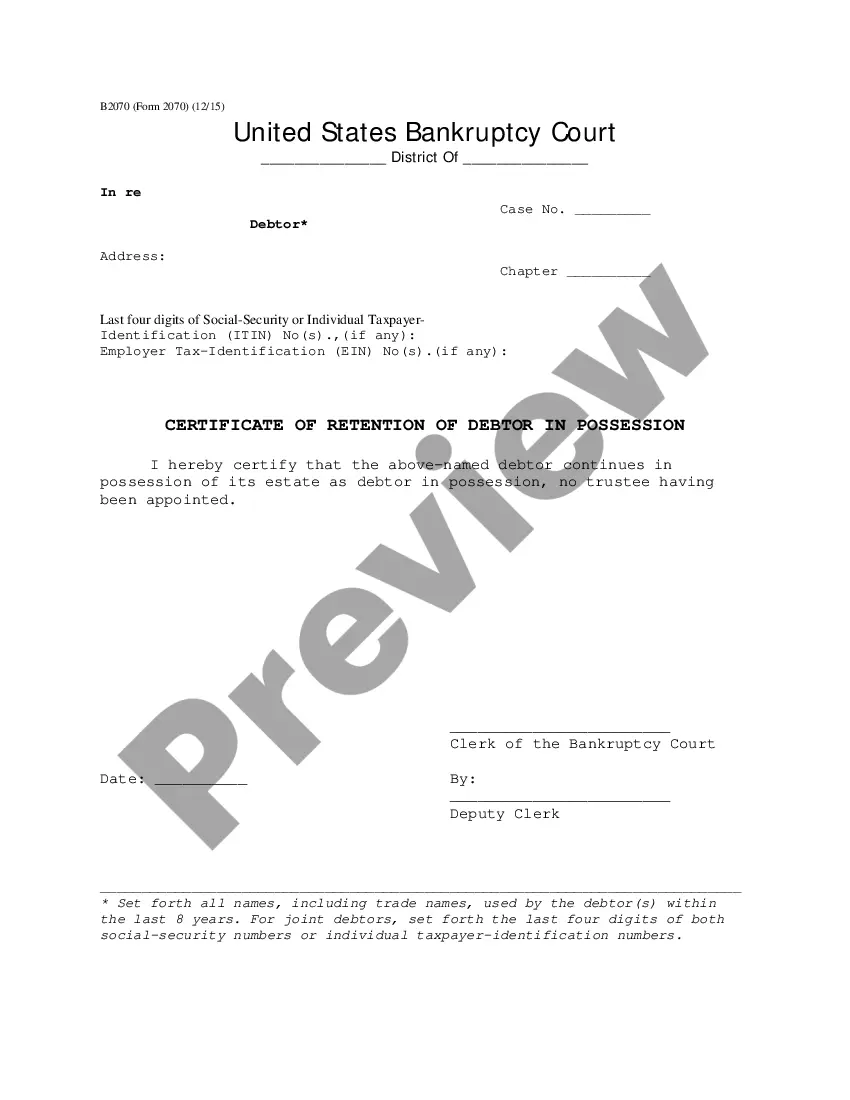

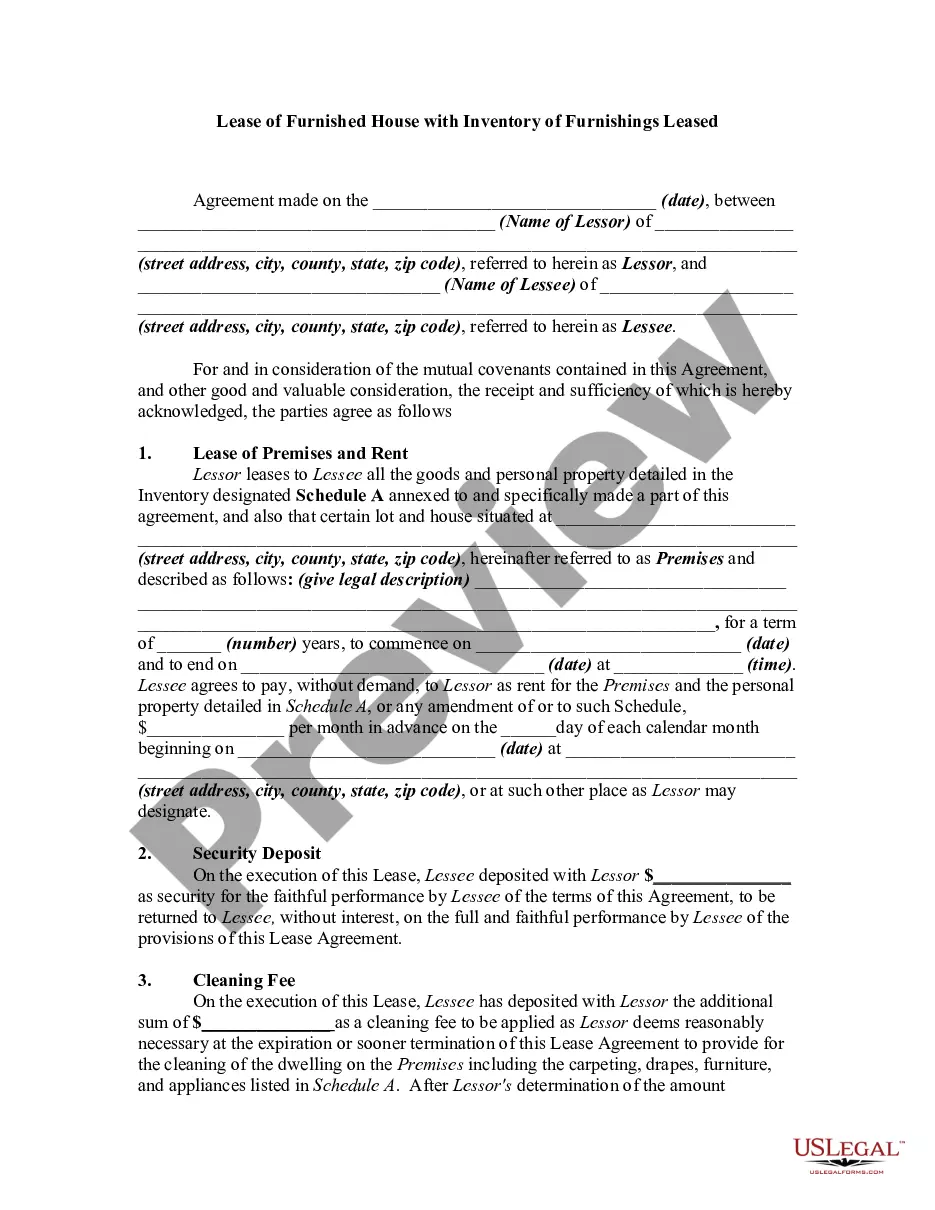

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Cuyahoga Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Cuyahoga Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings from the My Forms tab.

For new users, it's necessary to make some more steps to get the Cuyahoga Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings:

- Analyze the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!