Franklin Ohio Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506© Offerings: Accredited Investor Qualification Definition: Franklin Ohio follows the general definition of an accredited investor as outlined in Rule 501 of Regulation D. An accredited investor can be an individual or an entity that meets specific income or net worth criteria. Income-Based Accredited Investor Qualification Requirement: To qualify as an accredited investor based on income, an individual must have an annual income exceeding $200,000 individually or $300,000 jointly with a spouse for the past two years, with a reasonable expectation of maintaining the same level of income in the current year. Net Worth-Based Accredited Investor Qualification Requirement: Individuals can also qualify as an accredited investor in Franklin Ohio if their net worth exceeds $1 million, either individually or jointly with a spouse, excluding the value of their primary residence. Net worth criteria include assets held such as real estate, investments, cash, and other assets, minus any liabilities. Entity-Based Accredited Investor Qualification Requirement: Entities such as corporations, partnerships, limited liability companies (LCS), and trusts can also qualify as accredited investors. For entities, the net worth or income requirements do not apply. Instead, they must meet certain criteria, including being composed of equity owners that themselves are accredited investors. Verification Requirements for Reg D, Rule 506© Offerings: Franklin Ohio, like other jurisdictions, requires issuers to take reasonable steps to verify that investors are accredited. Rule 506(c) offerings allow for solicitation of funds from the public, but only accredited investors can participate. Below are some potential verification methods: 1. Income Verification: Obtain copies of W-2s, tax returns, or other documentation to verify income levels. 2. Net Worth Verification: Obtain documentation such as bank statements, brokerage statements, appraisals, or third-party valuations of assets and liabilities to establish net worth. 3. Written Representations: Investors can provide written statements confirming their accredited investor status, accompanied by relevant supporting documentation. 4. Third-Party Verification: Use third-party services, such as accredited investor verification platforms, to verify an investor's accredited status. 5. Prior Verification: If an investor has been previously verified as an accredited investor for a Rule 506(c) offering, a self-certification or representation of their accredited status may be acceptable. Remember, Franklin Ohio's specific requirements might vary, and it is crucial to consult legal professionals or securities regulators to ensure compliance with the applicable regulations. Different Types of Franklin Ohio Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506© Offerings: There aren't usually different types of qualification or verification requirements specifically tailored to Franklin Ohio. The requirements mentioned above generally apply to Reg D, Rule 506(c) offerings at the federal level. However, it is essential to understand that individual states may have additional regulations or interpretations governing the qualification and verification of accredited investors. Consulting legal professionals or regulatory authorities in Franklin Ohio is crucial to stay fully compliant with state-specific requirements.

Franklin Ohio Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings

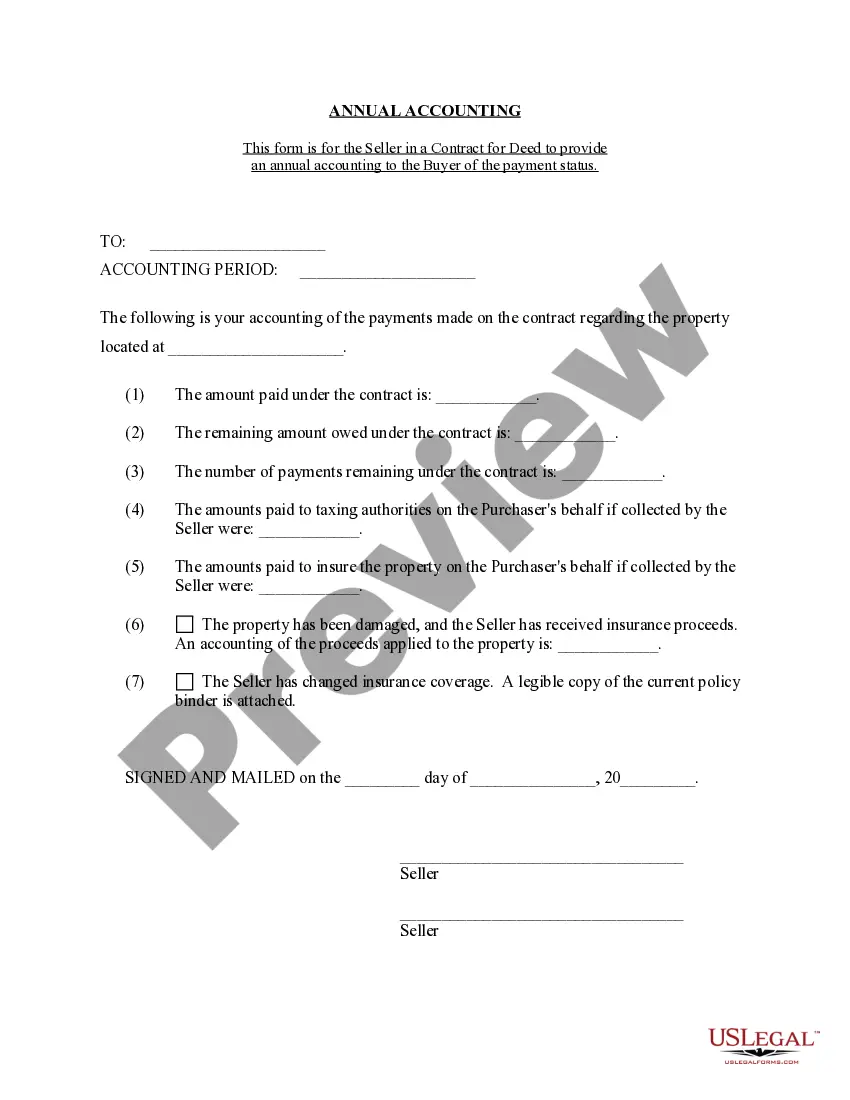

Description

How to fill out Franklin Ohio Accredited Investor Qualification And Verification Requirements For Reg D, Rule 506(c) Offerings?

Draftwing documents, like Franklin Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings, to take care of your legal matters is a tough and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents created for different cases and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Franklin Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before getting Franklin Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings:

- Ensure that your template is specific to your state/county since the regulations for creating legal documents may vary from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Franklin Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start utilizing our service and download the form.

- Everything looks great on your side? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!