An Alameda California Term Sheet — Royalty Payment Convertible Note is a legal document that outlines the terms and conditions of an investment agreement between a company and an investor. This type of term sheet is particularly relevant for startups and early-stage businesses located in Alameda, California. The Alameda California Term Sheet — Royalty Payment Convertible Note allows the investor to lend money to the company in exchange for a regular royalty payment or the option to convert the debt into equity in the future. This provides the company with crucial capital to support its growth and development. The key elements typically included in the Alameda California Term Sheet — Royalty Payment Convertible Note are the principal loan amount, interest rate, repayment terms, conversion terms, and the royalty payment percentage or rate. The principal loan amount refers to the initial investment sum provided by the investor to the company. The interest rate determines the cost of borrowing and is often fixed or varies based on specific conditions. Repayment terms may define how and when the investor will be paid back, including the repayment schedule, grace period, and any applicable penalties. Conversion terms ensure that the investor has the option to convert the debt into equity if certain predetermined conditions are met, such as a specific valuation milestone or a subsequent round of funding. Different types of Alameda California Term Sheet — Royalty Payment Convertible Notes may exist based on variations in terms and conditions. For instance, some term sheets may provide a higher royalty payment percentage, a longer conversion timeframe, or include additional clauses to safeguard the investor's interests. It is crucial for both companies and investors in Alameda, California to thoroughly review and negotiate the terms of a Term Sheet — Royalty Payment Convertible Note to ensure their respective rights and obligations are protected. Seeking legal counsel is highly recommended ensuring compliance with local laws and to address any potential risks or complexities associated with the specific investment arrangement. In conclusion, an Alameda California Term Sheet — Royalty Payment Convertible Note is a significant legal document that facilitates financing for startups or early-stage businesses. It outlines the terms and conditions of the investment agreement between the investor and the company, allowing for regular royalty payments or the option to convert the debt into equity. Companies and investors in Alameda, California should carefully consider the various terms and seek legal advice to navigate the intricacies of the agreement.

Alameda California Term Sheet - Royalty Payment Convertible Note

Description

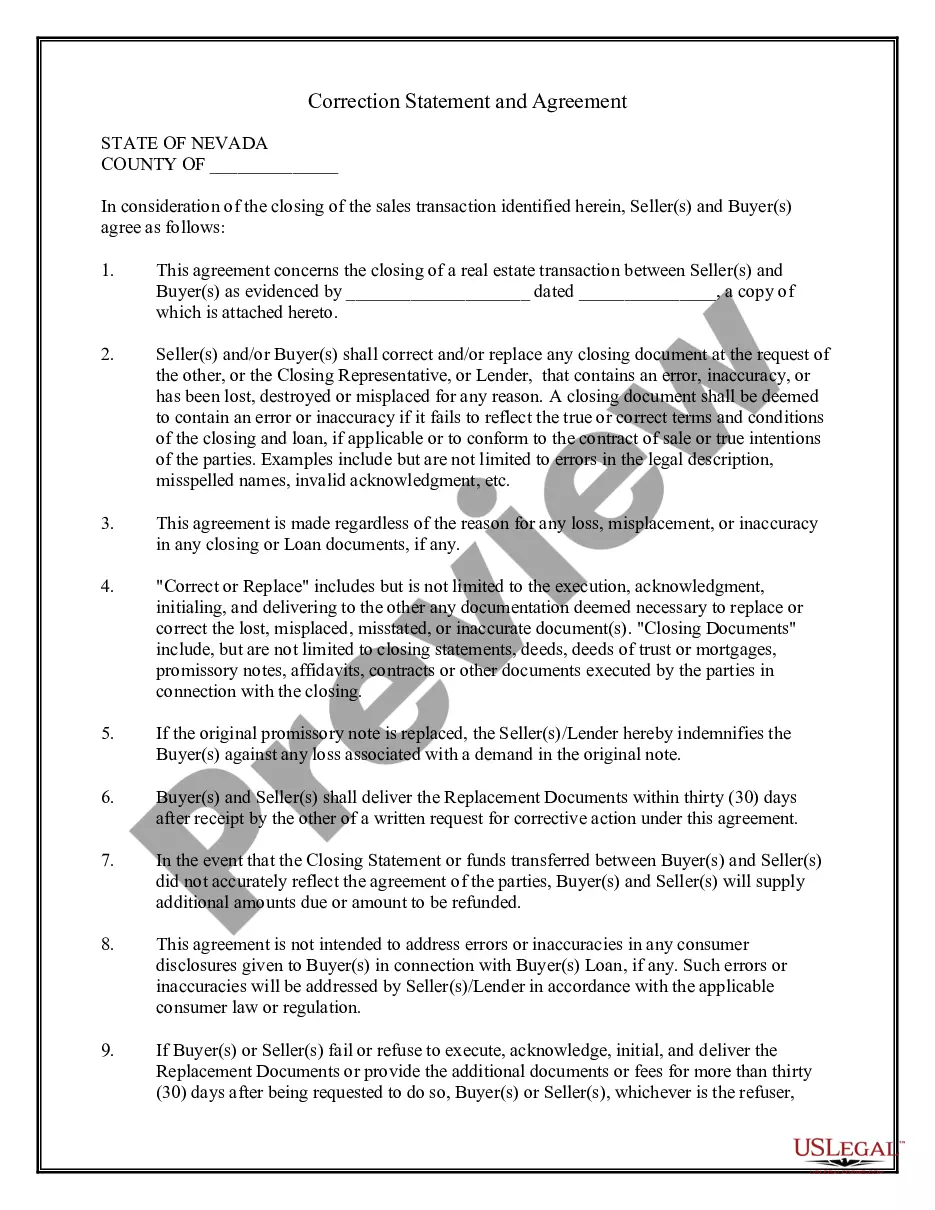

How to fill out Alameda California Term Sheet - Royalty Payment Convertible Note?

Draftwing forms, like Alameda Term Sheet - Royalty Payment Convertible Note, to take care of your legal matters is a difficult and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal matters into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents intended for a variety of cases and life circumstances. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Alameda Term Sheet - Royalty Payment Convertible Note form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before downloading Alameda Term Sheet - Royalty Payment Convertible Note:

- Ensure that your document is compliant with your state/county since the rules for creating legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Alameda Term Sheet - Royalty Payment Convertible Note isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to begin using our website and get the document.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!