Allegheny Pennsylvania Term Sheet — Royalty Payment Convertible Note is a legal document that outlines the terms and conditions of a financial agreement between two parties, where an investor lends funds to a business in exchange for a share of future revenues. This type of convertible note is commonly used in startup financing. In this term sheet, the terms and conditions regarding the investment amount, interest rate, maturity date, repayment terms, and royalty payment structure are outlined. The Allegheny Pennsylvania jurisdiction is specified to ensure legal compliance and consistency with local laws and regulations. There may be different types of Allegheny Pennsylvania Term Sheet — Royalty Payment Convertible Note, such as: 1. Standard Royalty Payment Convertible Note: This type of term sheet follows the traditional format and includes standard provisions related to investment amount, interest rate, maturity date, repayment terms, and royalty payment structure. 2. Customized Royalty Payment Convertible Note: In some cases, businesses and investors may require customized terms to better suit their specific needs. These customized term sheets may include additional clauses addressing unique requirements, such as milestone-based royalty payments or preferential conversion terms. 3. Prenegotiated Royalty Payment Convertible Note: Sometimes, businesses and investors negotiate the terms of the convertible note before drafting the term sheet. In such cases, the term sheet serves as a summary or documentation of the already agreed-upon terms. 4. Series Seed Royalty Payment Convertible Note: This type of term sheet is specifically designed for early-stage startups raising seed funding. It typically includes provisions that align with the industry-standard Series Seed documents, addressing the unique requirements of startup financing. Overall, the Allegheny Pennsylvania Term Sheet — Royalty Payment Convertible Note sets the foundation for a financial agreement between an investor and a business, providing clarity and protection for both parties involved. It is essential to consult legal professionals to ensure compliance with applicable laws and to draft a comprehensive and tailored term sheet that suits the specific needs of the business and investor.

Allegheny Pennsylvania Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Allegheny Pennsylvania Term Sheet - Royalty Payment Convertible Note?

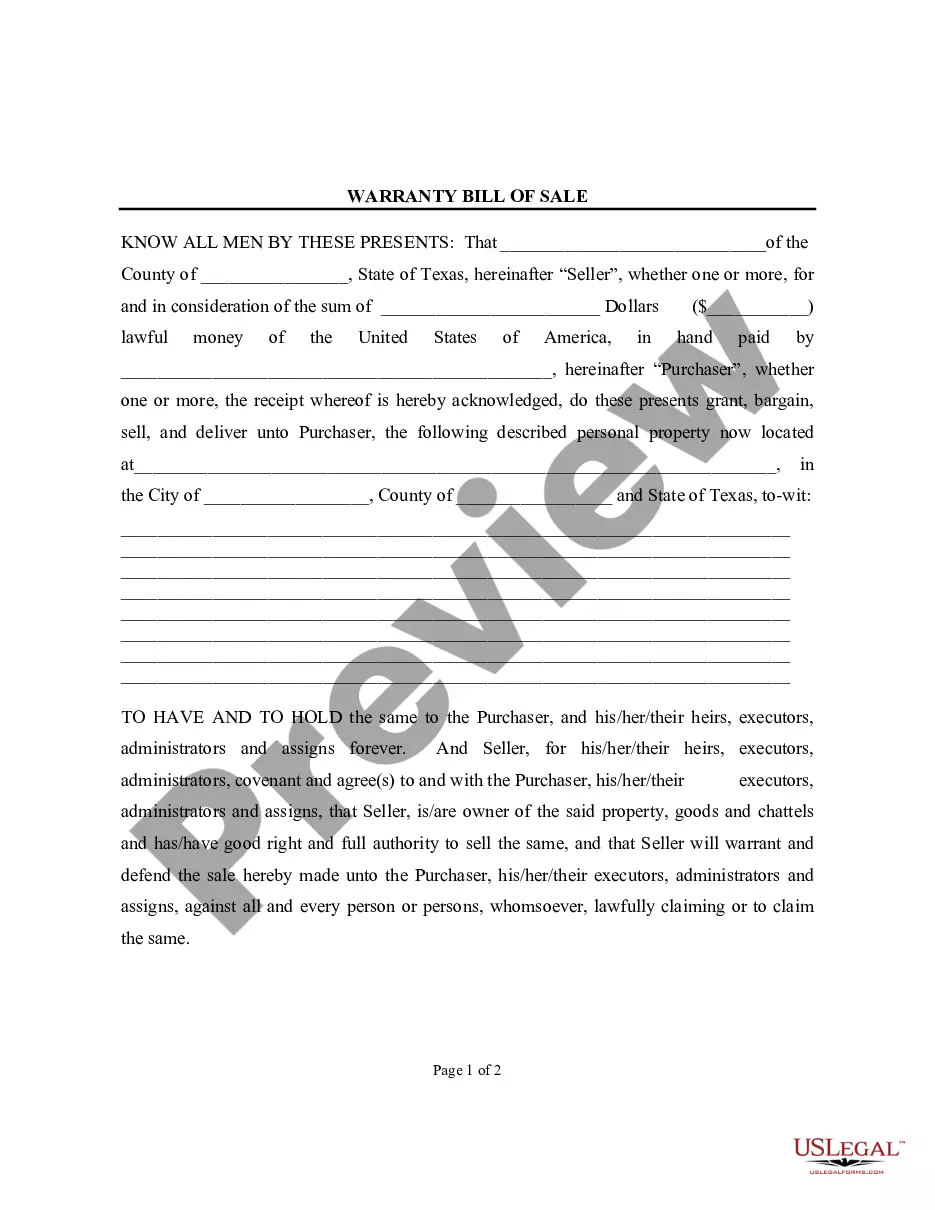

If you need to get a trustworthy legal document provider to find the Allegheny Term Sheet - Royalty Payment Convertible Note, consider US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of supporting resources, and dedicated support make it easy to find and complete various papers.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to search or browse Allegheny Term Sheet - Royalty Payment Convertible Note, either by a keyword or by the state/county the document is created for. After locating necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Allegheny Term Sheet - Royalty Payment Convertible Note template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less pricey and more affordable. Create your first company, organize your advance care planning, draft a real estate agreement, or execute the Allegheny Term Sheet - Royalty Payment Convertible Note - all from the convenience of your sofa.

Join US Legal Forms now!