A Fairfax Virginia Term Sheet — Royalty Payment Convertible Note is a legal document that outlines the terms and conditions of a financial agreement between a company and its investors. This type of term sheet specifically focuses on royalty payments and the ability to convert the investment into equity shares in the future. Fairfax, Virginia: Located in Northern Virginia, Fairfax is a thriving city that serves as the county seat of Fairfax County. Known for its historical significance, vibrant community, and proximity to Washington D.C., Fairfax offers a wide range of opportunities for businesses and investors. Term Sheet: A term sheet is a non-binding document that outlines the basic terms and conditions of a proposed investment or financing agreement. It serves as a starting point for negotiations between the parties involved. Royalty Payment: In the context of this term sheet, a royalty payment refers to a percentage of revenue or sales that the company has agreed to pay to the investor as a return on their investment. This payment is often based on a predetermined rate or formula. Convertible Note: A convertible note is a type of debt instrument that allows the investor to convert their investment into equity shares at a later date, typically during a future financing round or when certain milestones are reached. This provides the investor with the opportunity to participate in the company's growth and potentially earn higher returns. There may be different types of Fairfax Virginia Term Sheet — Royalty Payment Convertible Note, including: 1. Standard Term Sheet: This type of term sheet includes the essential terms and conditions of the agreement, such as the principal amount, interest rate, royalty rate, conversion terms, and key milestones. 2. Preferred Term Sheet: A preferred term sheet may include additional terms that provide certain privileges or preferences to the investor, such as a higher royalty rate, priority in repayment, or greater control over certain decision-making processes. 3. Customized Term Sheet: In some cases, companies and investors may negotiate and customize the term sheet according to their specific needs and requirements. This type of term sheet may include unique provisions or adjustments tailored to the investment agreement. In conclusion, a Fairfax Virginia Term Sheet — Royalty Payment Convertible Note is a crucial legal document that outlines the terms and conditions for an investment agreement, focusing on royalty payments and the option to convert the investment into equity shares. This type of term sheet plays a vital role in ensuring clarity and protection for both the company and investor involved in the agreement.

Fairfax Virginia Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Fairfax Virginia Term Sheet - Royalty Payment Convertible Note?

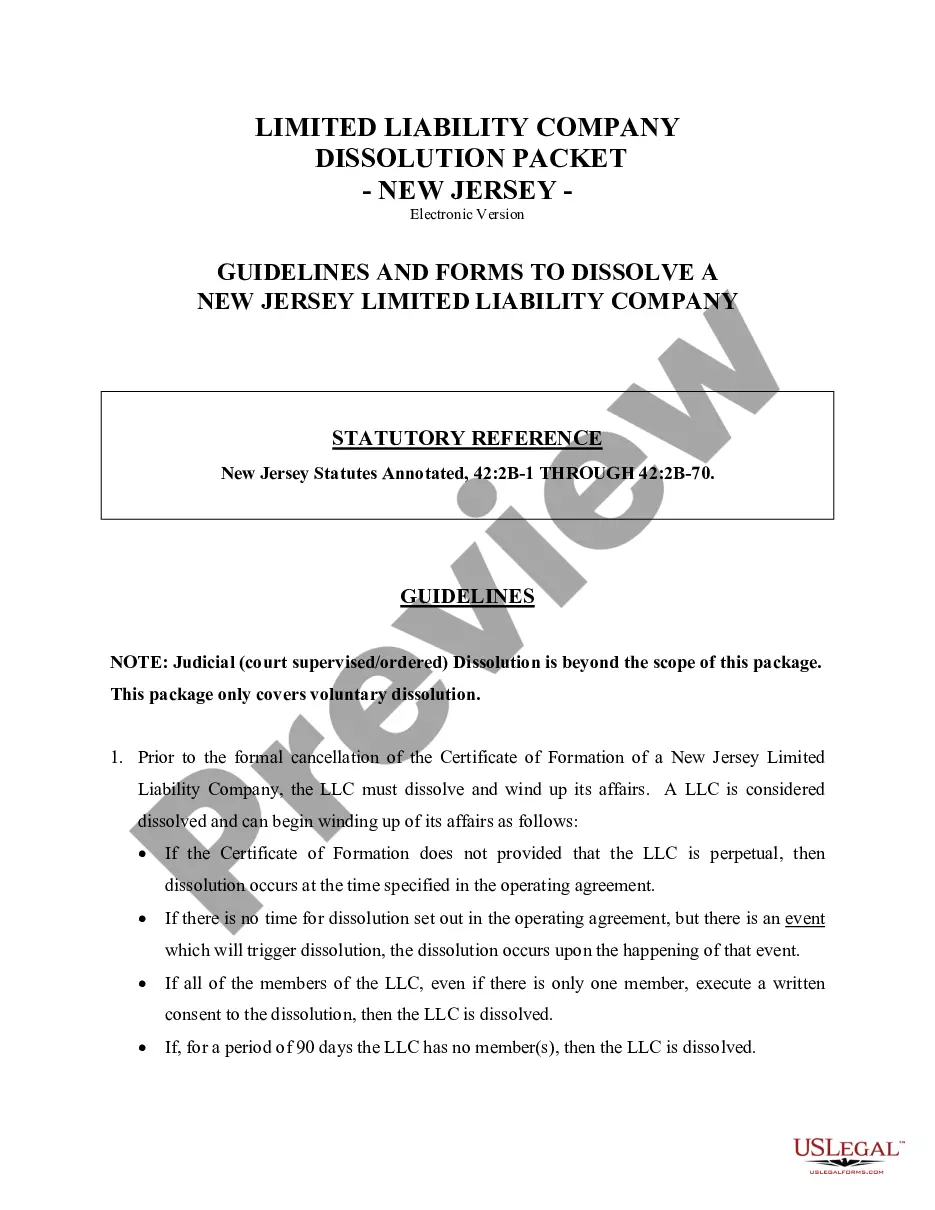

How much time does it typically take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Fairfax Term Sheet - Royalty Payment Convertible Note suiting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. Aside from the Fairfax Term Sheet - Royalty Payment Convertible Note, here you can get any specific document to run your business or individual affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Fairfax Term Sheet - Royalty Payment Convertible Note:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Fairfax Term Sheet - Royalty Payment Convertible Note.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

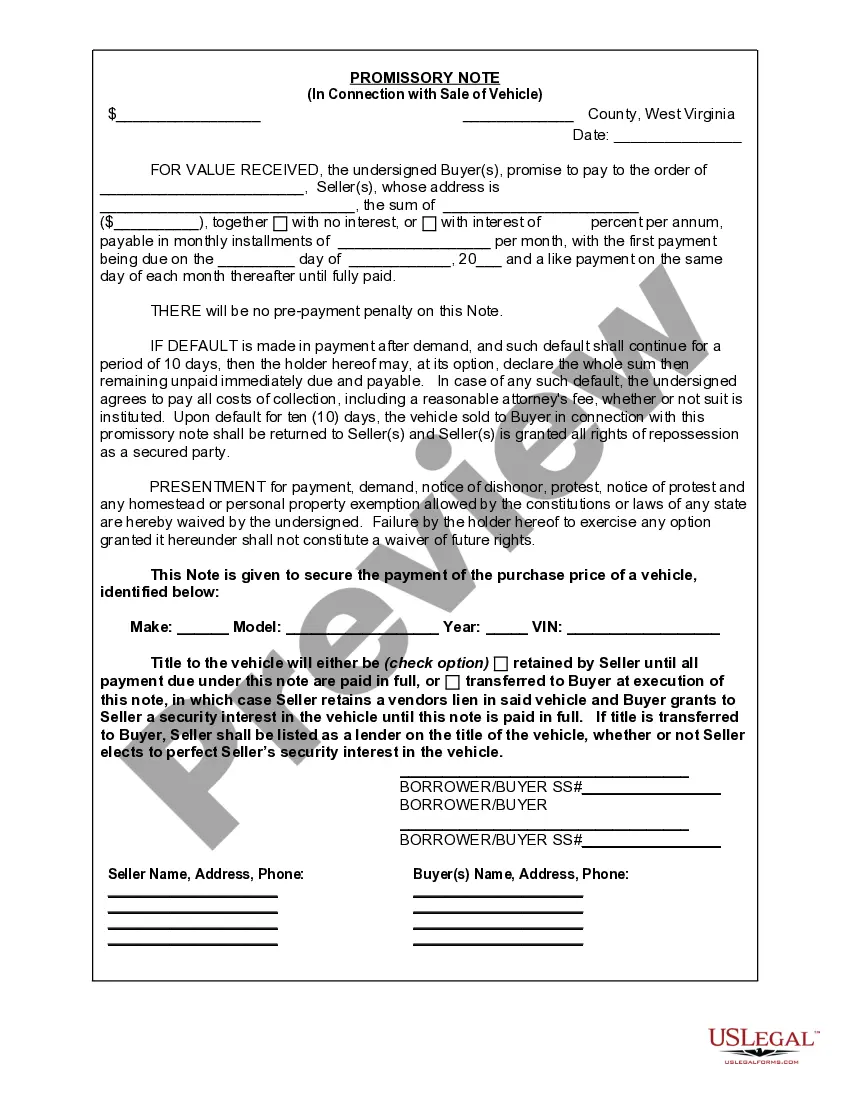

Convertible notes are debt instruments that include terms like a maturity date, an interest rate, etc., but that will convert into equity if a future equity round is raised. The conversion typically occurs at a discount to the price per share of the future round.

As the name implies, 'convertible notes' usually result in debt funding being converted into equity, providing the investor with upside returns.

Convertible notes are freely transferable and can be acquired/transferred by way of sale, provided the sale is in accordance with the pricing guidelines prescribed by the RBI.

Because convertible bonds have a maturity of greater than one year, they appear under the long-term liabilities section of the balance sheet.

It is a hybrid of all the instruments mentioned above as it is neither a debt nor an equity but it regulated by the Company Law as a CCPS, which makes it sound and secure. It is convertible on the occurrence of specified events and is both investor and founder friendly.

Accounting for Convertibles refers to the accounting of the debt instrument that entitles or provide rights to the holder to convert its holding into a specified number of issuing company's shares where the difference between the fair value of total securities along with other consideration that is transferred and the

A Convertible Note Term Sheet is the summary outline of the key terms for a convertible debt seed financing. As you approach potential investors, the term sheet will be a critical part of your seed financing toolkit, together with the executive summary and investor pitch deck.

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

Convertible notes may be converted only into equity shares, and not preference shares (such as CCPS).

Convertible notes are loans that (ideally) convert into the preferred stock that is sold in a subsequent equity round of investmet. The note might also cover contingencies, such as what happens if the company does not get to the investment by the maturity date of the loan, or if the company is sold prior to conversion.

More info

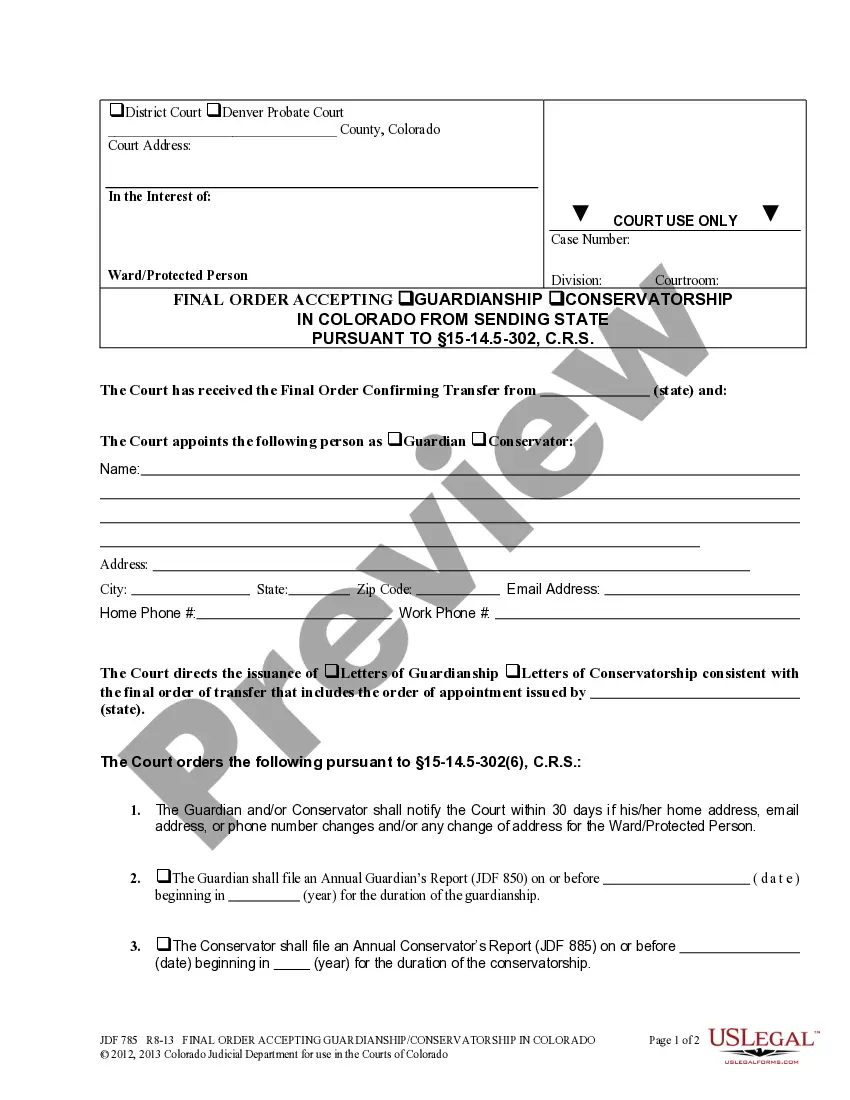

Au is a publically listed mining company which is currently engaged in the exploration and development of iron ore deposits at it's mine sites at Cara dona and Rose dale, New South Wales, and at a number of exploration sites in Western Australia. The Company is also conducting exploration and development activities to the north of the Australian Capital Territory with respect to copper, bauxite, molybdenum and gold in the Murray Basin, and to the east of the Australian Capital Territory in the Hope Creek formation. We are interested in purchasing a substantial portion of the underlying assets and, at our discretion, also the Notes and the Warrant. The Note is being made available for sale by us under our Securities Purchase Agreement with Au. We anticipate that our investment will comprise approximately 2.9% of our total assets. Our investment may be withdrawn or withdrawn more rapidly if required by a deterioration in the operating performance of Au.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.