Nassau New York Term Sheet — Royalty Payment Convertible Note is a legal document that outlines the specifics and terms of a financial agreement between parties in Nassau County, New York. It is commonly used in business transactions involving investment or funding. The terms and conditions mentioned in this term sheet are crucial for governing the payment of royalties and potential conversion of the note into equity. Keywords: Nassau New York, term sheet, Royalty Payment Convertible Note, financial agreement, investment, funding, terms and conditions, payment of royalties, conversion, equity. Different types of Nassau New York Term Sheet — Royalty Payment Convertible Notes may include: 1. Standard Royalty Payment Convertible Note: This type of term sheet defines the terms of the agreement where the investor provides funding in exchange for a fixed periodic royalty payment from the issuer. It also outlines the conditions under which the note can be converted into equity at a future date. 2. Participation Royalty Payment Convertible Note: In this variation, the investor receives a share in the issuer's revenue as a royalty payment instead of a fixed amount. The term sheet will specify the percentage of revenue to be paid, conversion terms, and other relevant details. 3. Performance-based Royalty Payment Convertible Note: This type of term sheet links the royalty payments to certain performance metrics or milestones achieved by the issuer. The investor's returns are based on the issuer's success, ensuring that both parties have a vested interest in achieving predefined goals. 4. Monthly/Quarterly Royalty Payment Convertible Note: This variant of the term sheet outlines the frequency of royalty payments. The investor may receive payments on a monthly or quarterly basis, depending on the terms agreed upon. 5. Fixed Rate Royalty Payment Convertible Note: In this type of term sheet, the royalty payment is fixed at a predetermined rate and does not fluctuate based on the issuer's financial performance. The document specifies the percentage or amount to be paid, ensuring stable returns for the investor. It is important to consult legal and financial professionals to customize and draft a Nassau New York Term Sheet — Royalty Payment Convertible Note that aligns with the specific needs and objectives of the parties involved.

Nassau New York Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Nassau New York Term Sheet - Royalty Payment Convertible Note?

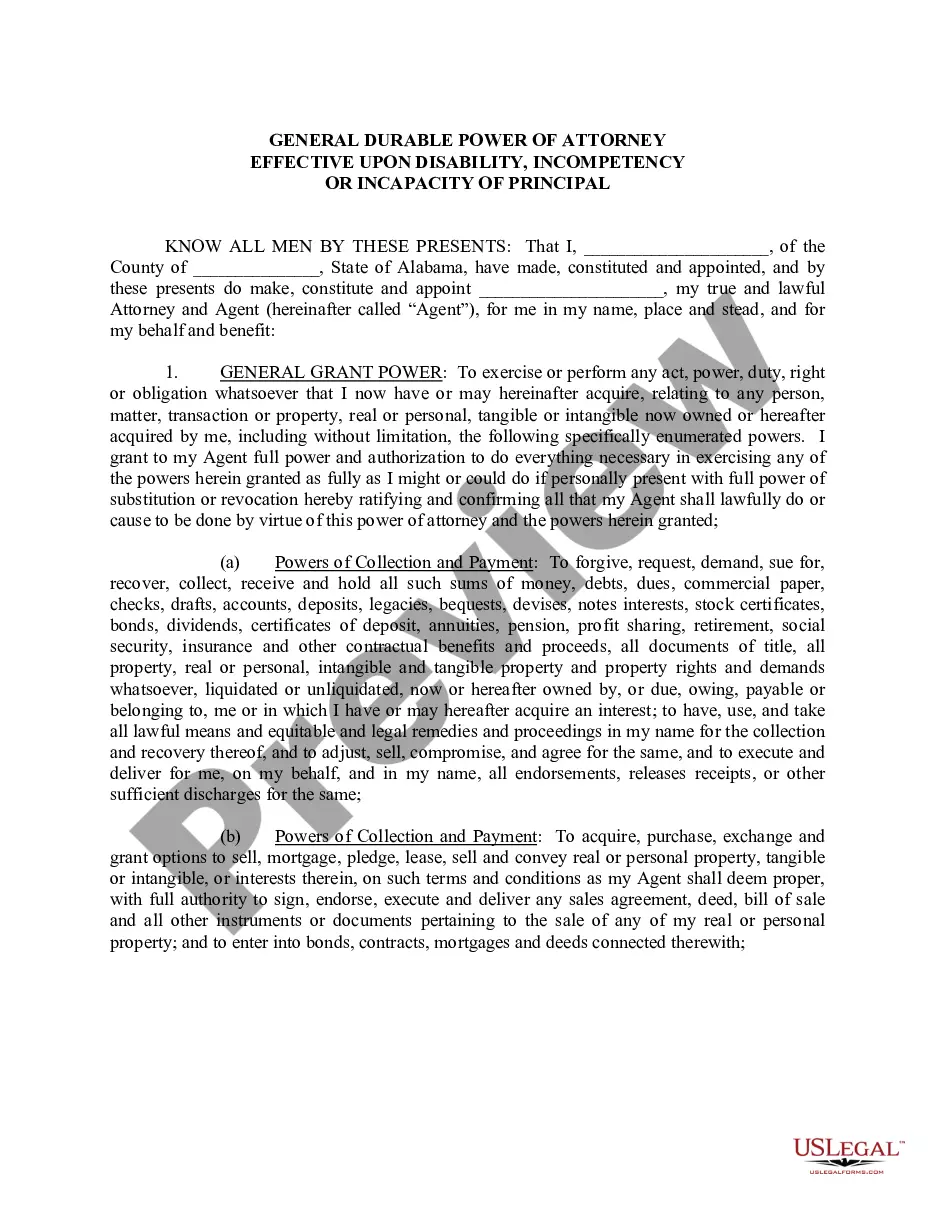

Are you looking to quickly create a legally-binding Nassau Term Sheet - Royalty Payment Convertible Note or probably any other document to take control of your personal or business affairs? You can select one of the two options: hire a professional to write a legal paper for you or draft it completely on your own. The good news is, there's a third option - US Legal Forms. It will help you get neatly written legal documents without paying unreasonable prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-compliant document templates, including Nassau Term Sheet - Royalty Payment Convertible Note and form packages. We offer documents for an array of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the needed template without extra hassles.

- To start with, carefully verify if the Nassau Term Sheet - Royalty Payment Convertible Note is tailored to your state's or county's regulations.

- In case the form has a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the document isn’t what you were looking for by utilizing the search box in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Nassau Term Sheet - Royalty Payment Convertible Note template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Moreover, the paperwork we offer are reviewed by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!