Orange California Term Sheet — Royalty Payment Convertible Note is a legal document that outlines the terms and conditions of an agreement between a company and an investor. This type of term sheet is designed to facilitate investment in a company by offering a royalty payment structure with the possibility of converting the investment into equity. The Orange California Term Sheet — Royalty Payment Convertible Note is a flexible financing option that allows companies in Orange, California to raise capital without immediately diluting their ownership. The term sheet includes important details such as the investment amount, interest rate, maturity date, conversion terms, and royalty payment structure. There are various types of Orange California Term Sheet — Royalty Payment Convertible Notes depending on specific agreement terms and conditions. These may include: 1. Simple Royalty Convertible Note: This type of note entitles the investor to receive royalty payments from the company's revenue until the investment amount is repaid. Additionally, the investor has the option to convert the outstanding amount into equity shares at a predetermined conversion ratio. 2. Preferred Royalty Convertible Note: In this case, the investor receives a higher priority in terms of royalty payments compared to other stakeholders. If there are excess royalty payments after meeting the preferred return, they are disbursed to other shareholders. The investor can also choose to convert the investment into shares as per the agreed conversion terms. 3. Elective Royalty Convertible Note: This structure offers the investor the choice between receiving royalty payments or converting their investment into equity. This flexibility allows investors to select the option that aligns with their investment goals and the company's performance. 4. Dividend Royalty Convertible Note: This type of note allows the investor to receive dividend-like payments based on the company's profits instead of revenue. These payments are made in addition to the principal amount and interest. The investor can convert the investment into equity based on the agreed conversion terms. The Orange California Term Sheet — Royalty Payment Convertible Note provides a win-win situation for both the company and the investor. It gives companies access to immediate capital while providing investors with potential returns through royalty payments and equity ownership. However, it is essential for both parties to carefully review and negotiate the terms to ensure a fair and mutually beneficial agreement.

Orange California Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Orange California Term Sheet - Royalty Payment Convertible Note?

Preparing legal paperwork can be difficult. In addition, if you decide to ask an attorney to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Orange Term Sheet - Royalty Payment Convertible Note, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Consequently, if you need the latest version of the Orange Term Sheet - Royalty Payment Convertible Note, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Orange Term Sheet - Royalty Payment Convertible Note:

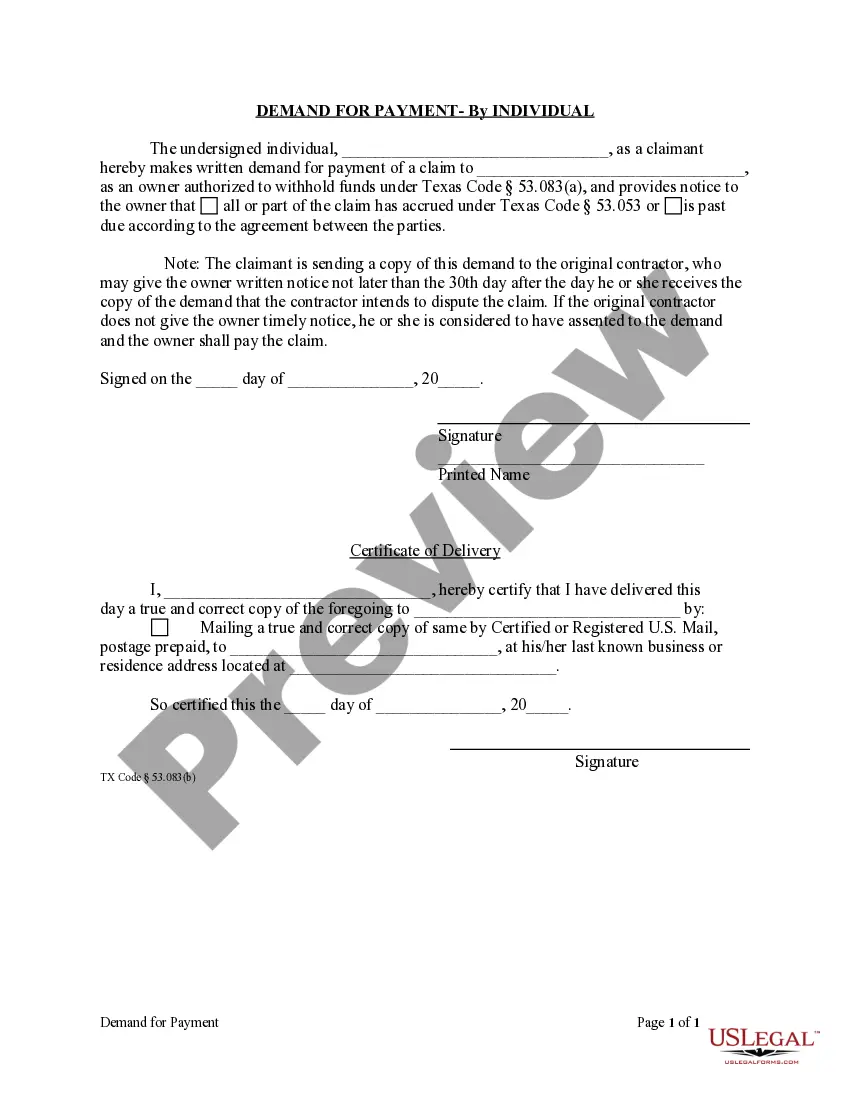

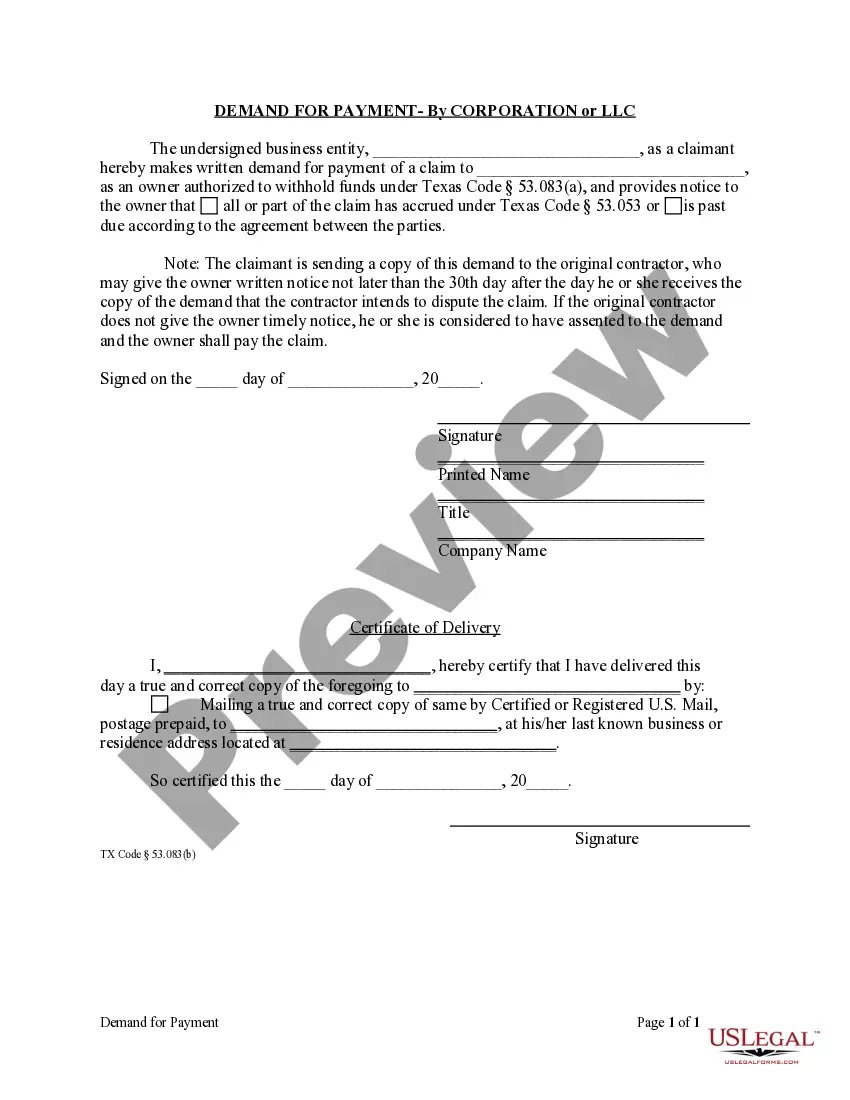

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Orange Term Sheet - Royalty Payment Convertible Note and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!