Palm Beach Florida Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Palm Beach Florida Term Sheet - Royalty Payment Convertible Note?

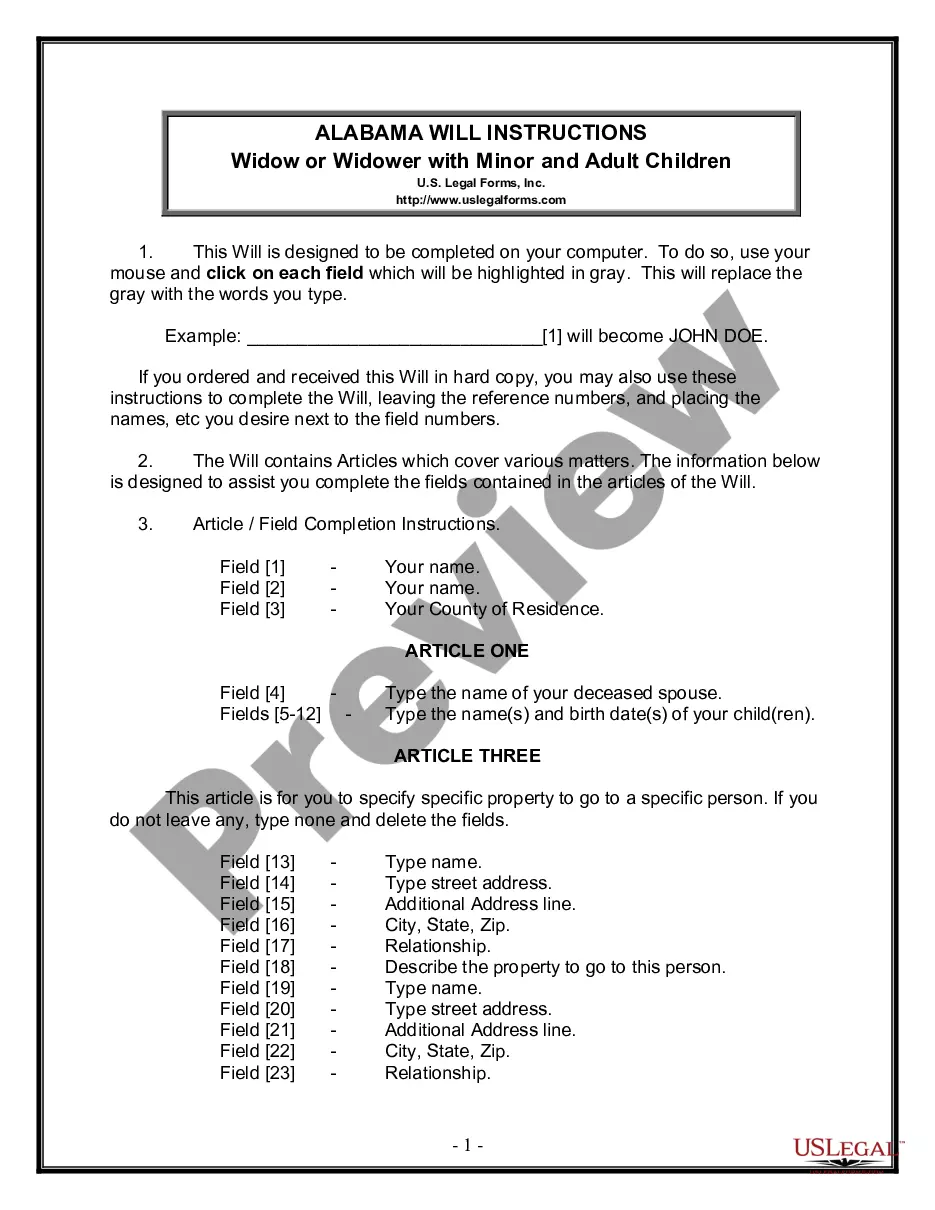

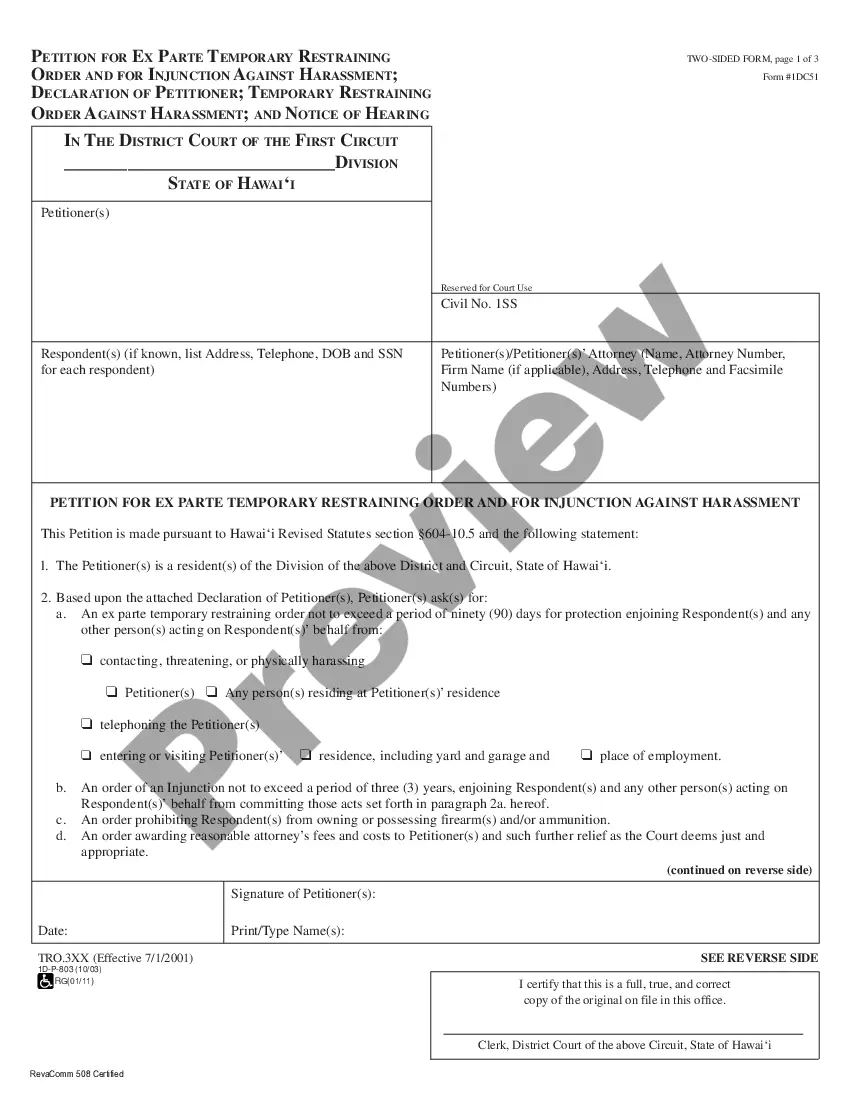

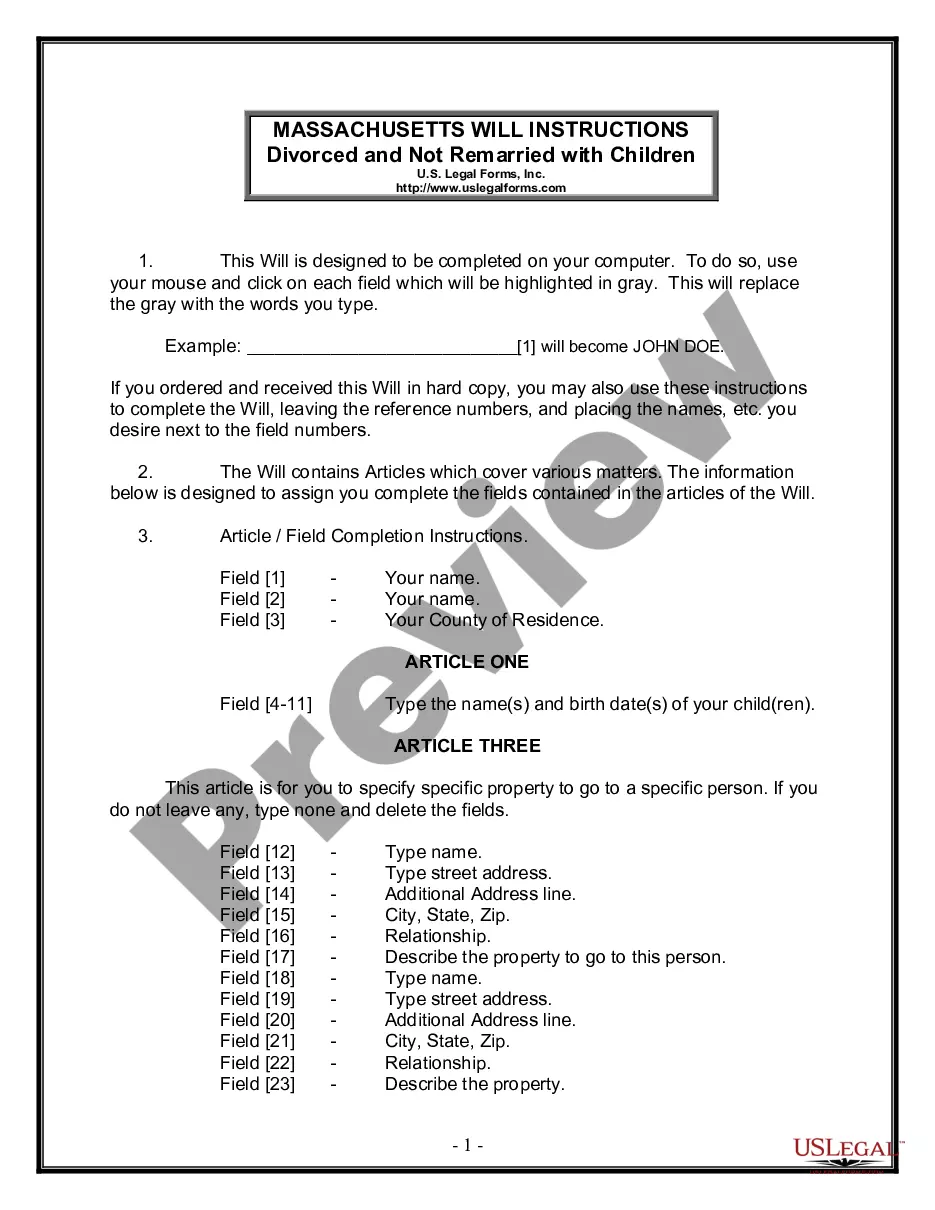

Whether you plan to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Palm Beach Term Sheet - Royalty Payment Convertible Note is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Palm Beach Term Sheet - Royalty Payment Convertible Note. Follow the guidelines below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Palm Beach Term Sheet - Royalty Payment Convertible Note in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

The convertible note interest rate can range from 2 to 8 percent. However, it stays most often in the 5 to 6 percent range. There are instances when the interest rate can range from 2 to 4 percent annually.

Convertible Notes are loans so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Since convertible loans are part debt and part equity, investors earn interest on the total loan amount over the term of the loan. In most cases, the interest is added to the principal each month, and not paid each month.

Convertible notes may be converted only into equity shares, and not preference shares (such as CCPS).

A convertible note is a form of short-term debt that converts into equity, typically in conjunction with a future financing round; in effect, the investor would be loaning money to a startup and instead of a return in the form of principal plus interest, the investor would receive equity in the company.

Standard convertible note terms are parameters for a specific form of short-term business debt. A convertible note will convert into equity at a future date, meaning that the investor loans money to an entrepreneur and receives equity in the company rather than payments on the principal plus interest.

A Convertible Note Term Sheet is the summary outline of the key terms for a convertible debt seed financing. As you approach potential investors, the term sheet will be a critical part of your seed financing toolkit, together with the executive summary and investor pitch deck.

Convertible notes are debt instruments that include terms like a maturity date, an interest rate, etc., but that will convert into equity if a future equity round is raised. The conversion typically occurs at a discount to the price per share of the future round.

A convertible note is a way for seed investors to invest in a startup that isn't ready for valuation. They start as short-term debt and are converted into equity in the issuing company.

The maturity date is usually set at 1824 months after the date of the convertible note investment. The Interest rate is most often between 28%.