A term sheet, particularly in the context of Chicago, Illinois, is a non-binding document outlining the key terms and conditions of an investment agreement for a Series Seed Preferred Share. This agreement is specifically designed for companies based in Chicago, Illinois, and serves as a framework that lays out the structure and guidelines for securing funding. In the Chicago Illinois Term Sheet — Series Seed Preferred Share for Company, there may be variations based on the specific requirements of the company and investor. Some potential types or variations of the term sheet include: 1. Equity Financing: This type of term sheet focuses on issuing preferred shares to investors in exchange for equity ownership in the company. 2. Valuation and Pricing: This section of the term sheet outlines the agreed-upon valuation and pricing mechanisms for the preferred shares, which determines the investment amount and the ownership stake acquired by the investor. 3. Liquidation Preferences: This clause specifies the preferred treatment that the shareholders, especially preferred shareholders, receive in the event of a sale, merger, or liquidation of the company. It defines the priority of payout and can include multiple tiers or waterfall structures. 4. Dividends and Distributions: This section details the dividend rights and preferences of the preferred shareholders, including whether cumulative or non-cumulative dividends are applicable. It also covers any distribution rights for excess profits or other distributions. 5. Participating Rights: This provision determines whether preferred shareholders are entitled to participate in the distribution of proceeds alongside common shareholders upon the sale or merger of the company. 6. Anti-Dilution Protection: This term protects the preferred shareholders from dilution caused by future equity issuance sat a lower price per share. It ensures that the investors' ownership percentage is preserved in subsequent funding rounds. 7. Voting Rights: The term sheet may outline the voting rights granted to the preferred shareholders, such as board representation or consent rights on specific matters. 8. Governing Law and Jurisdiction: This provision specifies that any disputes arising from the term sheet will be governed by the laws of the state of Illinois and resolved within the courts of Chicago, as agreed upon by both parties. 9. Convertible Debt Option: Although not preferred shares, some term sheets might include provisions regarding convertible debt, allowing investor loans to convert into equity under certain conditions. 10. Founder Vesting: Depending on the agreement between the company and the investors, the term sheet might include vesting provisions that outline the conditions under which the founders' equity stake fully vests over time or upon achieving specific milestones. By considering these keywords and variations, potential investors and companies seeking funding in Chicago, Illinois, can gain a deeper understanding of a Term Sheet — Series Seed Preferred Share and its various components, tailored specifically to their needs.

Chicago Illinois Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Chicago Illinois Term Sheet - Series Seed Preferred Share For Company?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your county, including the Chicago Term Sheet - Series Seed Preferred Share for Company.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Chicago Term Sheet - Series Seed Preferred Share for Company will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Chicago Term Sheet - Series Seed Preferred Share for Company:

- Make sure you have opened the correct page with your localised form.

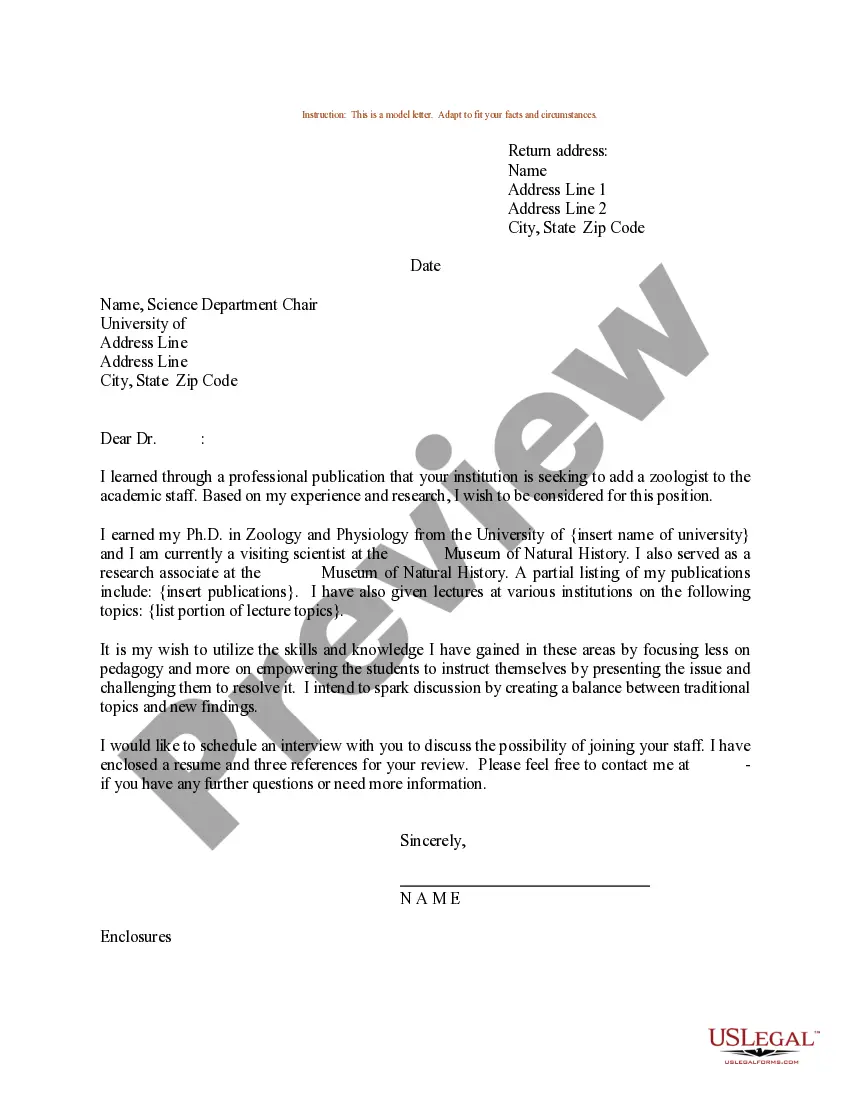

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Chicago Term Sheet - Series Seed Preferred Share for Company on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!