A Clark Nevada Term Sheet is a legal document outlining the terms and conditions of an investment agreement specific to Series Seed Preferred Shares for a company. This term sheet serves as a preliminary agreement between the investors and the company, highlighting the key provisions and terms that both parties agree upon during the funding process. The Clark Nevada Term Sheet is crucial in protecting the interests of investors while providing a framework for the company to obtain necessary funding. It typically includes various sections covering important aspects such as the investment amount, valuation, liquidation preferences, anti-dilution provisions, rights and restrictions, governance, and investor rights. The Series Seed Preferred Share is a specific type of equity instrument offered to early-stage companies seeking investment. These shares are often granted to investors who are willing to provide capital at an early stage of the company's growth, typically before Series A funding rounds. The Series Seed Preferred Shares generally come with certain privileges and preferential treatment compared to common shares, which enhances investor protection and potential returns. Different types of Clark Nevada Term Sheets may exist based on the specific needs and negotiation terms involved in each investment agreement. Some key variations of the Clark Nevada Term Sheet — Series Seed Preferred Share for a Company include: 1. Basic Clark Nevada Term Sheet — Series Seed Preferred Share: This outlines the essential terms, such as the investment amount, valuation, liquidation preferences, and basic investor rights. 2. Fully Featured Clark Nevada Term Sheet — Series Seed Preferred Share: This expands upon the basic term sheet to include more detailed provisions, such as anti-dilution protection, protective rights, participation rights, conversion rights, founder vesting, and drag-along rights. 3. Investor-Friendly Clark Nevada Term Sheet — Series Seed Preferred Share: This term sheet is designed to favor the investors by providing even stronger protective provisions and favorable terms, such as higher liquidation preferences, more extensive veto rights, and additional financial reporting requirements. 4. Founder-Friendly Clark Nevada Term Sheet — Series Seed Preferred Share: This term sheet prioritizes the interests of the company's founders by reducing investor privileges, providing lower liquidation preferences, limiting the influence of protective provisions, and allowing more flexibility in future financing rounds. It is important for both the investors and the company to thoroughly review and negotiate the terms included in the Clark Nevada Term Sheet — Series Seed Preferred Share. Seeking legal and financial advice is recommended to ensure that the agreement properly reflects the interests and objectives of both parties and to minimize potential disputes in the future.

Clark Nevada Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Clark Nevada Term Sheet - Series Seed Preferred Share For Company?

Draftwing documents, like Clark Term Sheet - Series Seed Preferred Share for Company, to take care of your legal affairs is a tough and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms crafted for different cases and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Clark Term Sheet - Series Seed Preferred Share for Company template. Simply log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before getting Clark Term Sheet - Series Seed Preferred Share for Company:

- Make sure that your form is specific to your state/county since the rules for creating legal documents may differ from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Clark Term Sheet - Series Seed Preferred Share for Company isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to begin utilizing our service and download the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your form is all set. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

Term sheets typically contain a great deal of important information, set out in three specific sections: Funding. Corporate Governance. Liquidation.

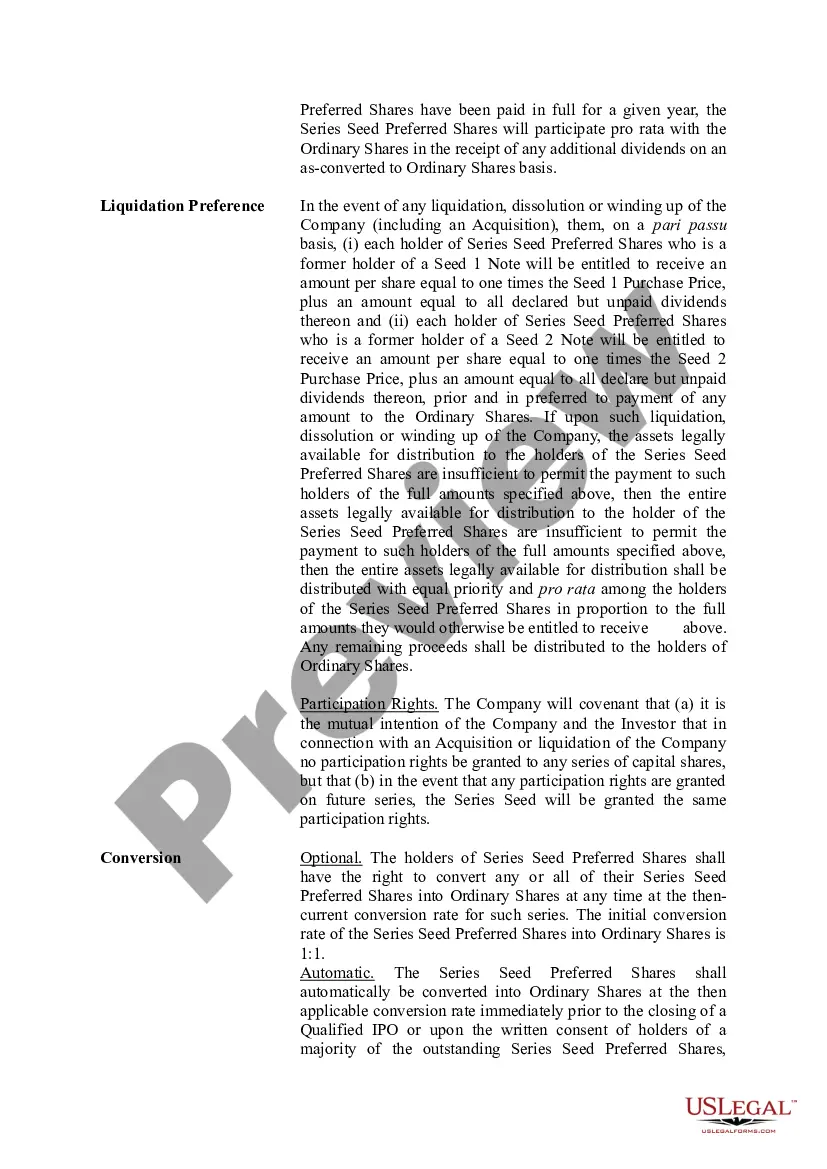

Common Series Seed terms include: Preferred Stock. Preferred stock is a class of stock with certain preferences and rights that are superior to the rights of the common stock that is issued to the founders. Series Seed will generally be issued as preferred stock.

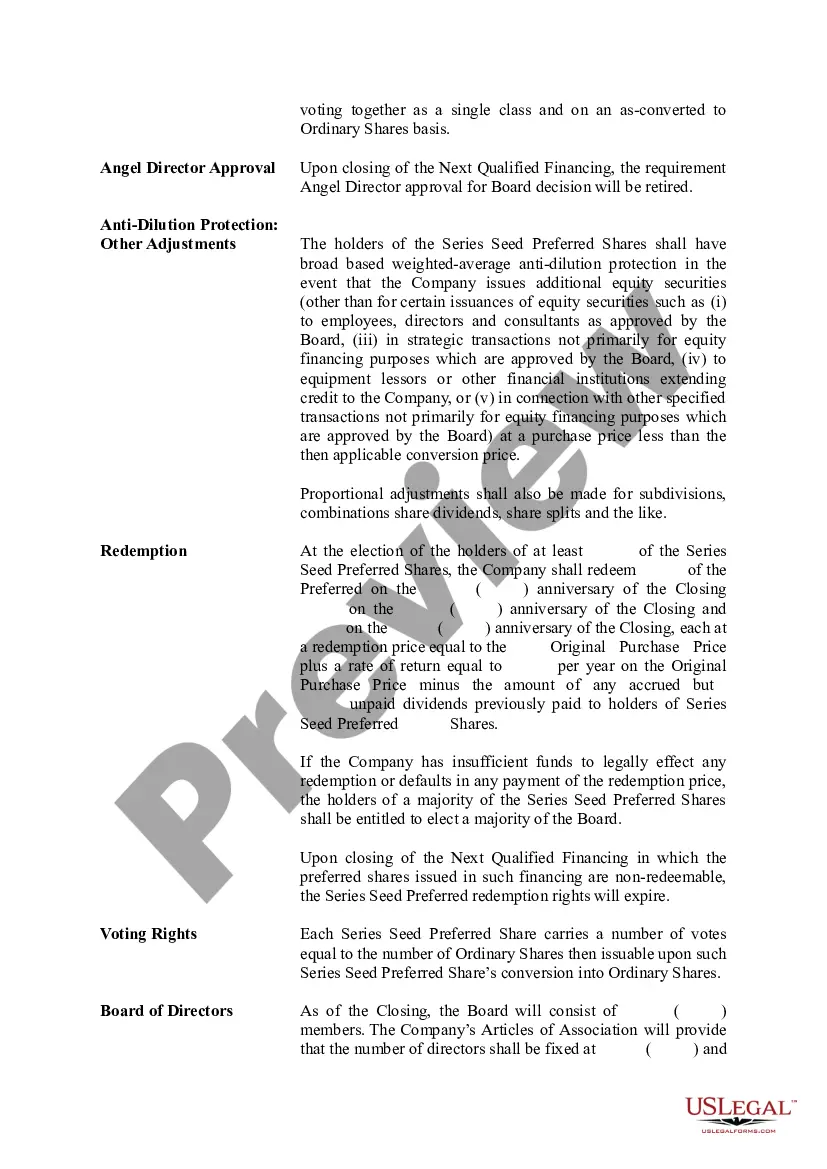

What to look for in a term sheet Valuation: pre-money valuation vs. post-money valuation.Type of stock: common vs. preferred.Option pool. Option pool - an amount of equity reserved for future hires.Liquidation Preference.Participation rights.Pro-rata rights.Tag-along & drag-along rights.Anti-dilution provision.

A liquidation preference is a clause in a contract that dictates the payout order in case of a corporate liquidation. Typically, the company's investors or preferred stockholders get their money back first, ahead of other kinds of stockholders or debtholders, in the event that the company must be liquidated.

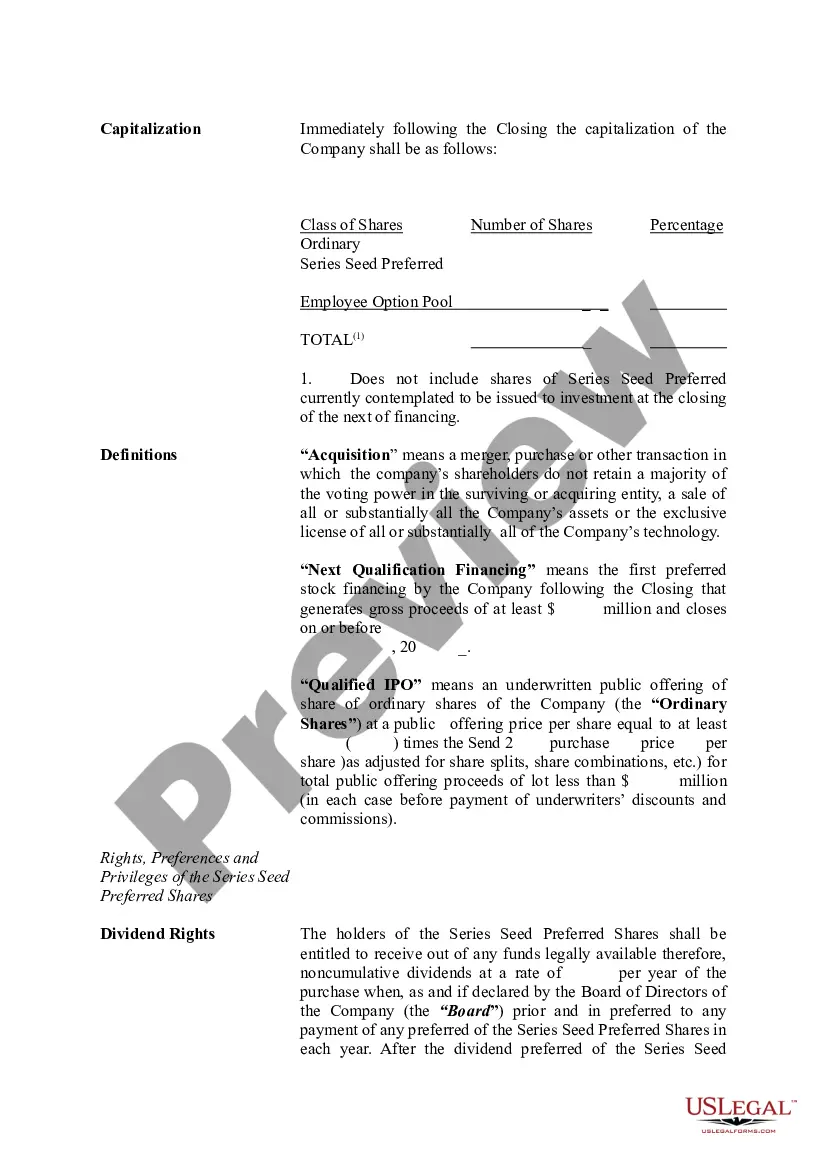

How to Read a Term Sheet Investors: Those who are investing money into the business. Amount Raised: Total amount raised to date. Price Per Share: Price of each share. Pre-Money Valuation: Value of the company before investment. Capitalization: Company's shares multiplied by share price.

A term sheet is an important document that is part of a tentative business deal. It is a summary of the terms and conditions of the tentative agreement. It is generally formatted as bullet points. It should be as detailed as possible so that the parties involved understand the information and are on the same page.

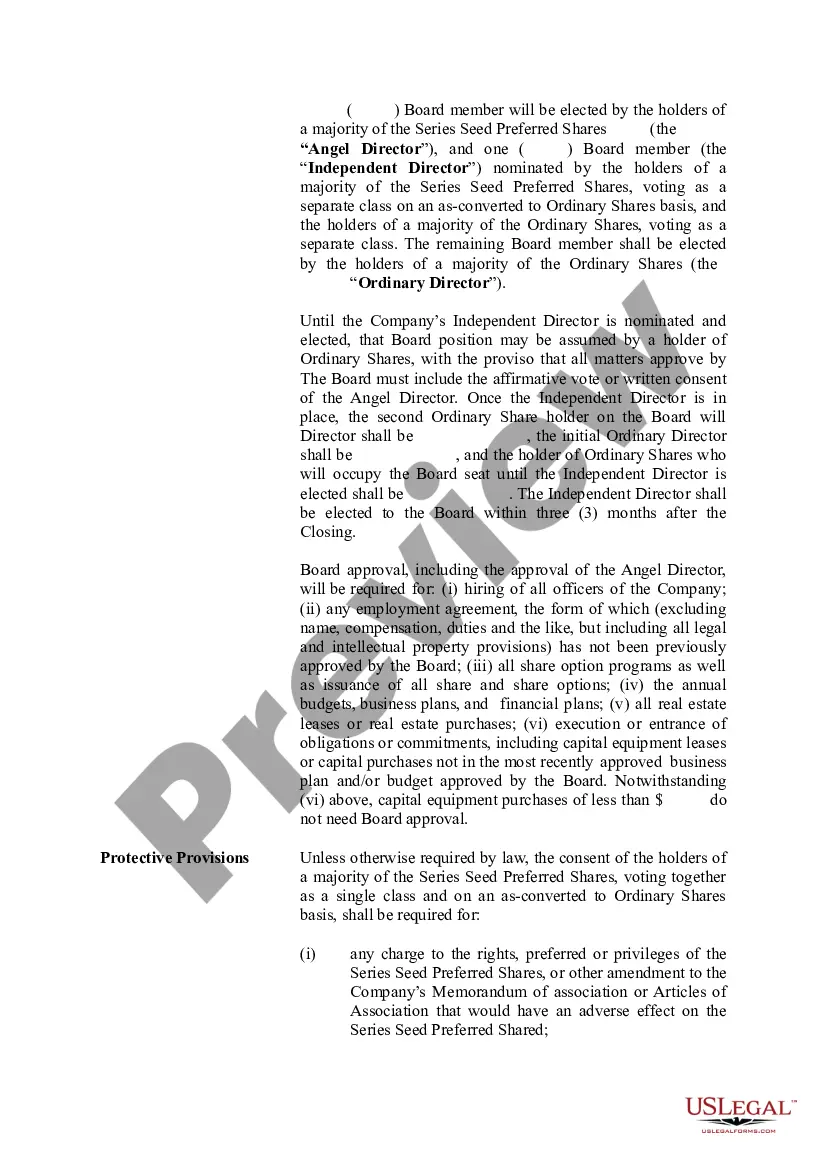

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity.Securities being issued.Board rights.Investor protections.Dealing with shares.Miscellaneous provisions.

A good term sheet aligns the interests of the investors and the founders, because that's better for everyone involved (and the company) in the long run. A bad term sheet pits investors and founders against each other.

The key clauses of a term sheet can be grouped into four categories; deal economics, investor rights and protection, governance management and control, and exits and liquidity.

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.