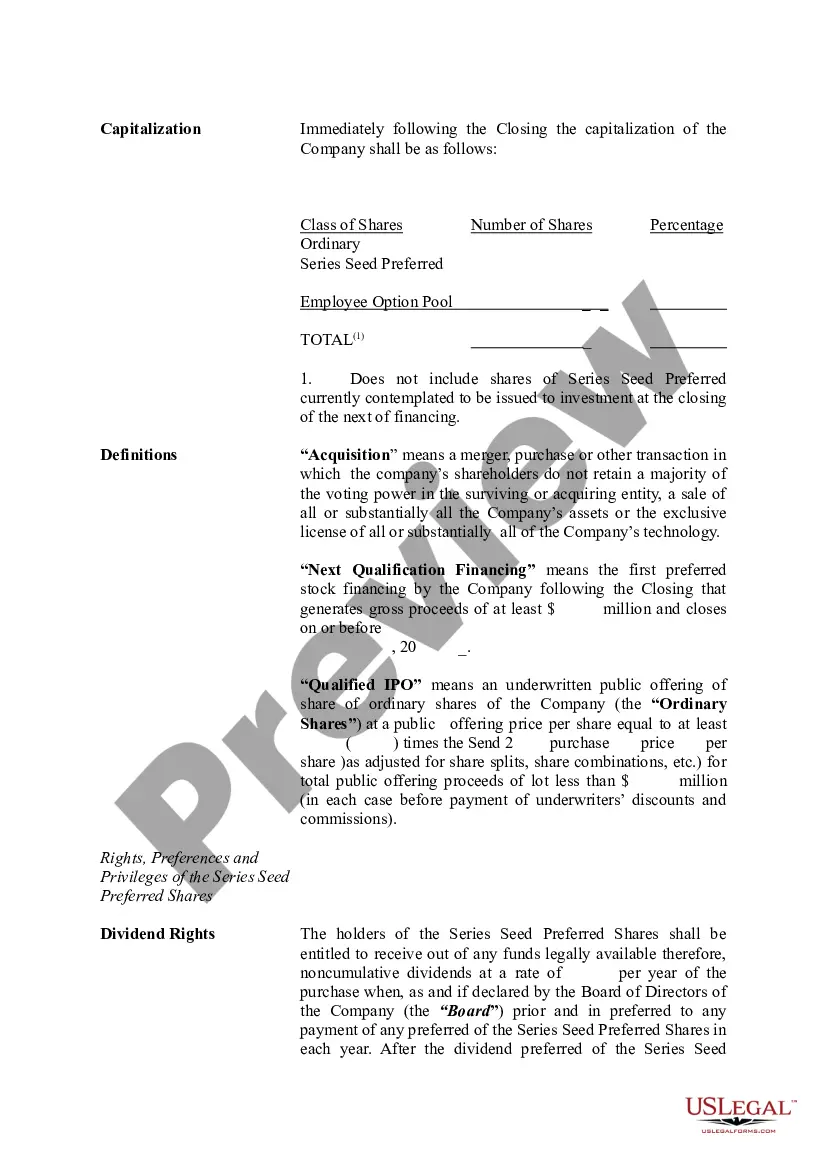

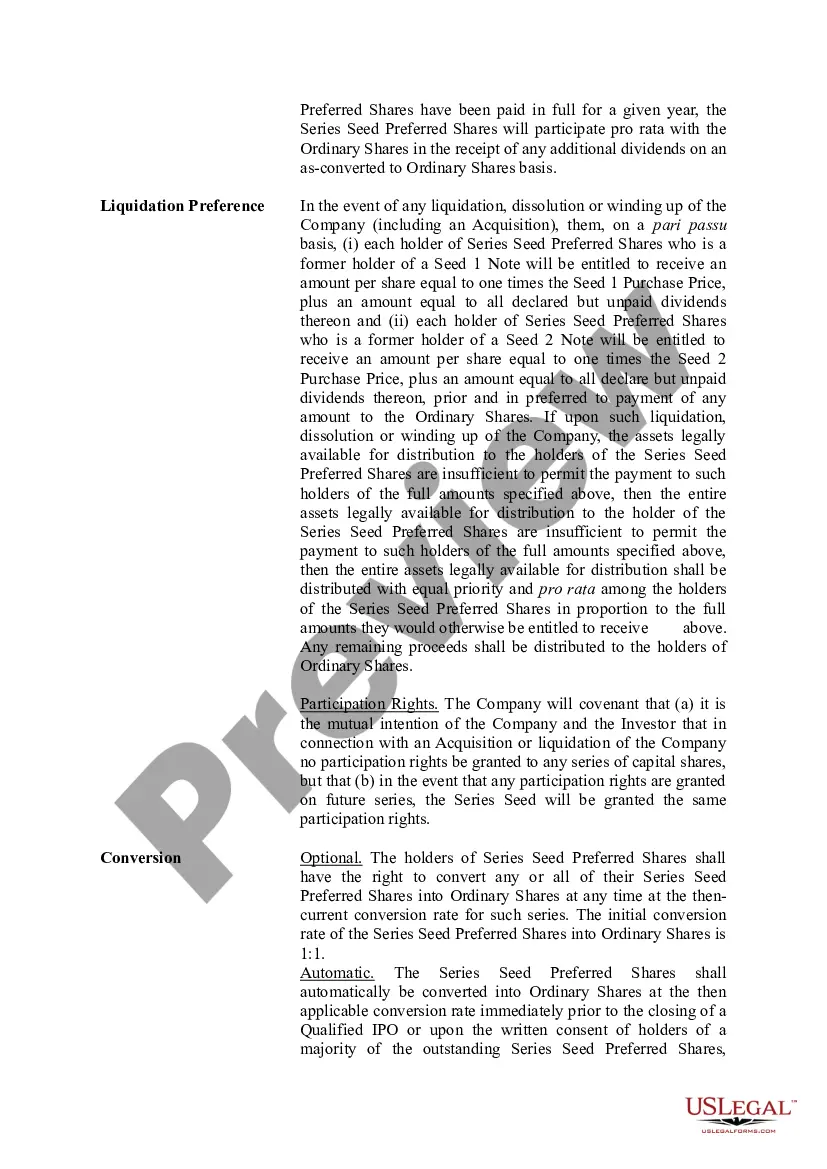

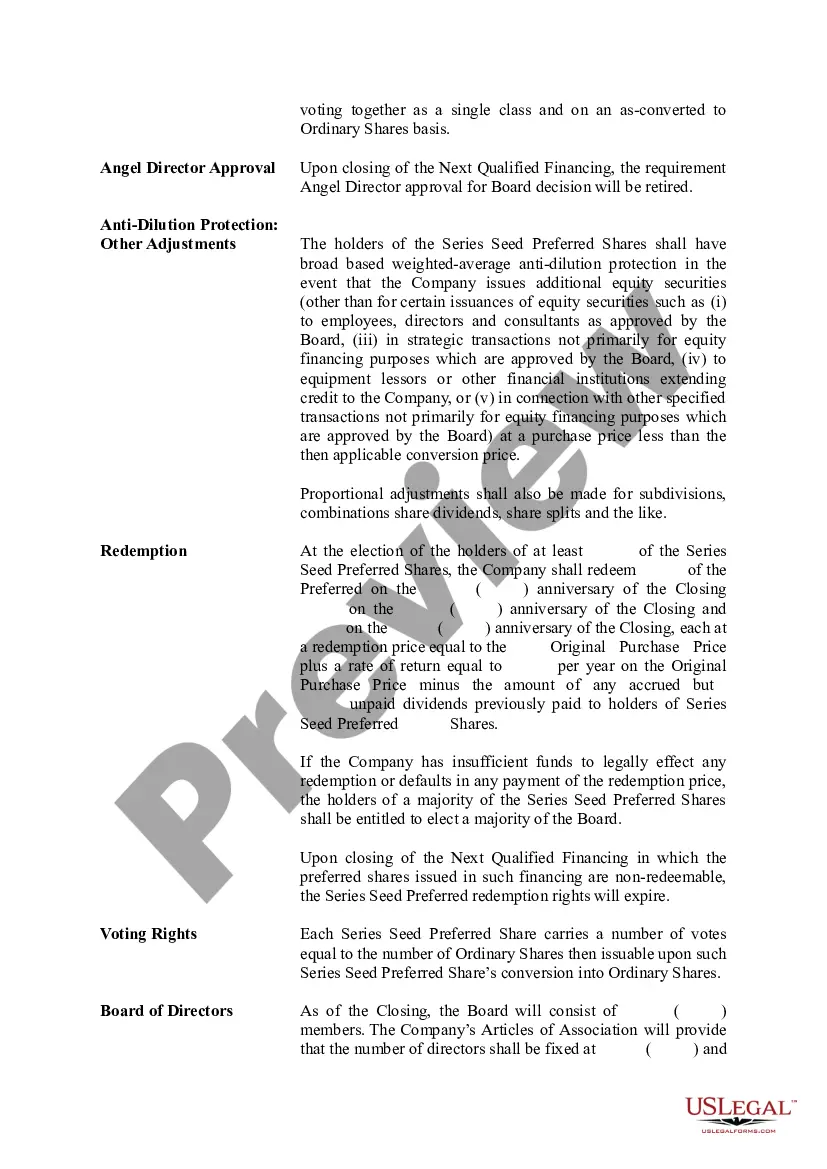

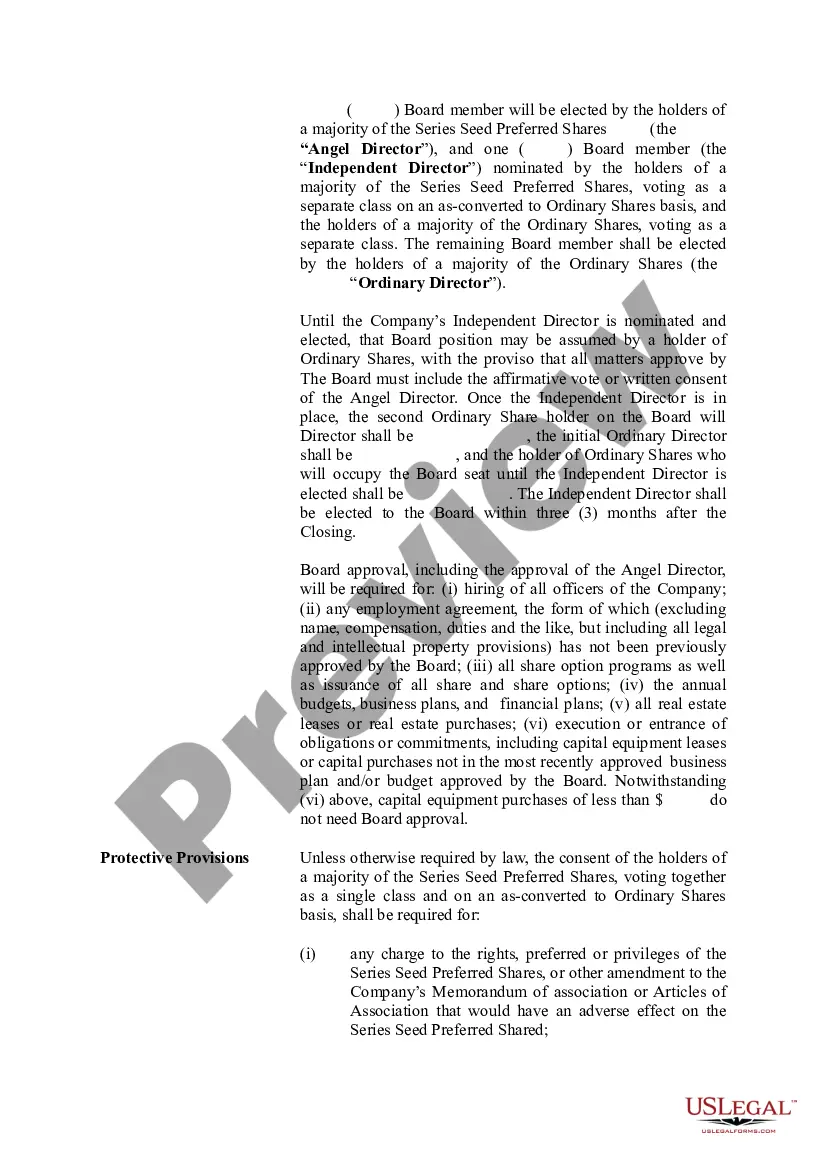

The Hennepin Minnesota Term Sheet — Series Seed Preferred Share for Company is a document that outlines the terms and conditions of a financing agreement between a company and investors. This term sheet specifically focuses on the Series Seed Preferred Share financing round and is commonly used in Hennepin County, Minnesota. The term sheet serves as a blueprint for negotiations and clarifies the rights, obligations, and expectations of both the company seeking funding and the investors providing the capital. It plays a crucial role in determining the rights and preferences of the preferred shareholders, ensuring transparency and facilitating a smooth investment process. The key elements covered in the Hennepin Minnesota Term Sheet — Series Seed Preferred Share for Company include: 1. Board Composition: This section specifies the number of seats on the company's board of directors that the preferred shareholders will be entitled to. It outlines whether the preferred shareholders will have preferred board representation or any additional voting rights. 2. Liquidation Preference: This clause determines the order in which the proceeds from a liquidation event (such as a sale or merger) will be distributed. The term sheet outlines whether the preferred shareholders have a liquidation preference over common shareholders and how much they will be entitled to in the event of liquidation. 3. Dividend Rights: This section addresses whether the preferred shareholders are entitled to receive dividends and if so, at what rate. It may specify whether dividends will be cumulative (accrued if unpaid) or noncumulative. 4. Conversion Rights: The term sheet discusses whether the preferred shares can be converted into common shares at a predetermined ratio. It may also outline any conversion events or milestones that trigger the conversion, such as a future financing round or an initial public offering (IPO). 5. Anti-Dilution Protection: This clause protects the preferred shareholders from dilution in case the company raises future capital at a lower valuation. It ensures that if the company issues additional shares at a lower price, the preferred shareholders' ownership percentage is adjusted accordingly. 6. Prorate Rights: Pro rata rights allow preferred shareholders to maintain their ownership percentage by participating in future financing rounds. It determines whether the preferred shareholders have the option to invest in future fundraising activities proportionate to their existing ownership. 7. Voting Rights: This section outlines the voting rights of the preferred shareholders and whether they possess any special voting rights on specific matters, such as approving major corporate transactions or amendments to the company's constitution. Different variations of the Hennepin Minnesota Term Sheet — Series Seed Preferred Share for Company may exist, tailored to specific industries or investment preferences. However, the core elements mentioned above generally remain the same, with some modifications and adjustments made based on the unique circumstances of each financing agreement.

Hennepin Minnesota Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Hennepin Minnesota Term Sheet - Series Seed Preferred Share For Company?

Preparing paperwork for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft Hennepin Term Sheet - Series Seed Preferred Share for Company without professional help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Hennepin Term Sheet - Series Seed Preferred Share for Company on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Hennepin Term Sheet - Series Seed Preferred Share for Company:

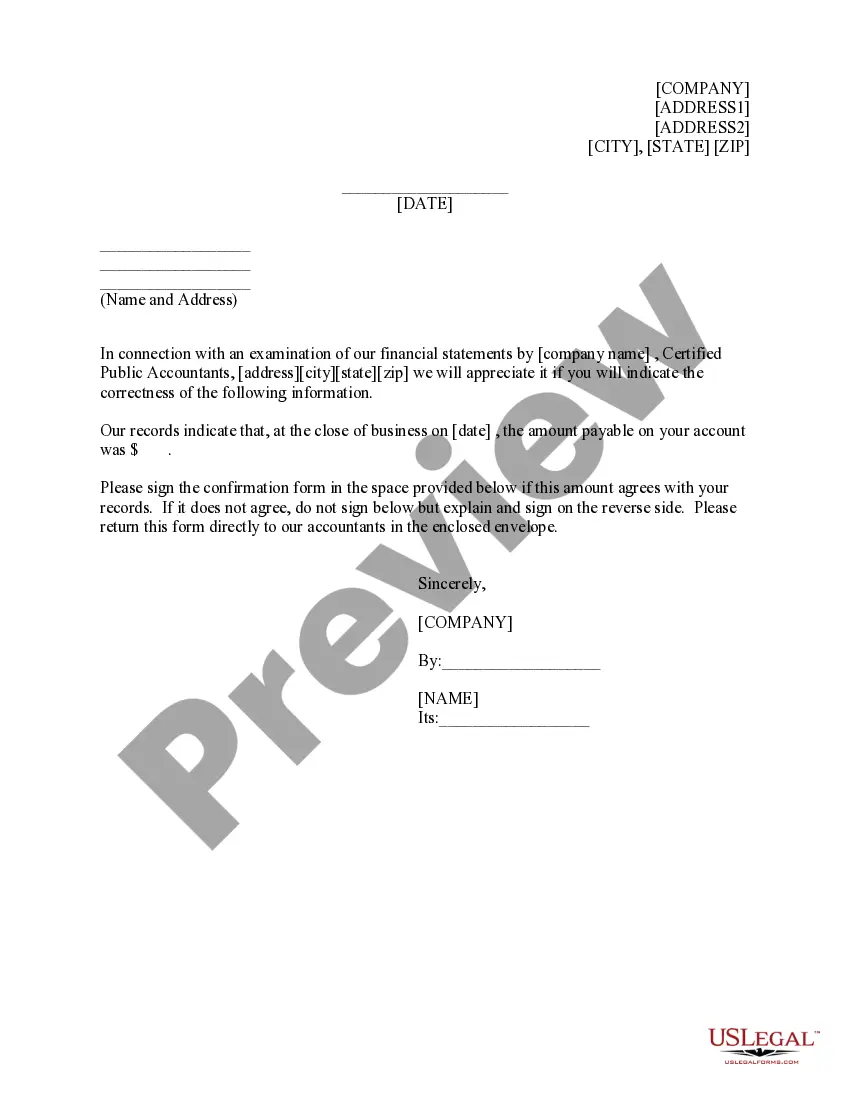

- Look through the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

Key Takeaways. The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

Common Series Seed terms include: Preferred Stock. Preferred stock is a class of stock with certain preferences and rights that are superior to the rights of the common stock that is issued to the founders. Series Seed will generally be issued as preferred stock.

Series B financing is the second round of funding for a company that has met certain milestones and is past the initial startup stage. Series B investors usually pay a higher share price for investing in the company than Series A investors. Series B investors typically prefer convertible preferred stock vs.

A Series AA Round is a round of startup financing using a class of preferred stock called the Series AA Preferred Shares. Series AA is also known as Seed because it comes before Series A. Series AA terms are usually not as onerous as Series A terms, and the valuation is typically lower.

Seed Preferred Shares means the seed preferred shares in the share capital of the Company, with a par value of US$0.005 each and the rights and privileges as set forth in the Memorandum and Articles.

Series A Note means the promissory note dated the Closing Date, executed and delivered by the Company to the Authority evidencing the Series A Loan; Sample 2.

A Series A term sheet is a basic agreement that outlines all the terms and conditions of the investment. Term sheets usually focus on two key areas; control of company shares and how financials will be divided if an exit occurs.

Series A startups are those that have the very beginnings of a business with a customer base, proof of concept, etc. Series B funding is typically for startups that are looking to increase production or sales.

Series A financing refers to an investment in a privately-held start-up company after it has shown progress in building its business model and demonstrates the potential to grow and generate revenue.

The original Series Seed equity financing document set was a collaborative effort among lawyers and investors, spearheaded by lawyer-turned-investor Ted Wang, to reduce the cost of fundraising for emerging companies by standardizing the core necessary legal documents, thereby reducing the amount of attorney time