The Kings New York Term Sheet — Series Seed Preferred Share is a financing agreement specifically designed for companies seeking growth capital. This term sheet outlines the terms and conditions under which investors are willing to provide funding to the company. It is essential for entrepreneurs to understand these terms before entering into any agreement. The Series Seed Preferred Share offered by Kings New York is specifically tailored for early-stage startups as they navigate the funding landscape. This type of preferred share gives investors certain rights and preferences over common shareholders, while also providing potential benefits for both parties involved. Key clauses detailed in the Kings New York Term Sheet — Series Seed Preferred Share for Company may include: 1. Valuation: This section specifies the pre-money valuation of the company, which determines the percentage ownership the investors will receive in exchange for their investment. 2. Investment Amount: The term sheet outlines the total investment amount committed by the investors, which is usually divided into multiple tranches based on predetermined milestones or timelines. 3. Liquidation Preferences: This clause defines the order and priority in which the proceeds from an acquisition or liquidation event are distributed among shareholders. It may include a multiple of the original investment or participation rights to ensure the investors receive their investment back first. 4. Conversion Rights: This section outlines the circumstances under which the preferred shares can be converted into common shares. Typically, conversion is triggered by an IPO or a subsequent funding round. 5. Voting Rights: The term sheet describes the extent of voting rights for preferred shareholders. Investors may have the ability to vote alongside common shareholders or have the right to specific reserved matters. 6. Dividends: This clause specifies whether preferred shareholders are entitled to receive dividends on their shares and outlines the structure and payment terms. It is important to note that there may be various types of Kings New York Term Sheet — Series Seed Preferred Share for Company, each with its own variations and additional clauses. These term sheets are often tailored based on the preferences of the investors and the specific needs of the company seeking funding. Understanding the Kings New York Term Sheet — Series Seed Preferred Share is crucial for entrepreneurs to make informed decisions about accepting funding offers. Seeking legal and financial advice before signing any agreement is highly recommended ensuring compatibility and alignment of interests between the company and its investors.

Kings New York Term Sheet - Series Seed Preferred Share for Company

Description

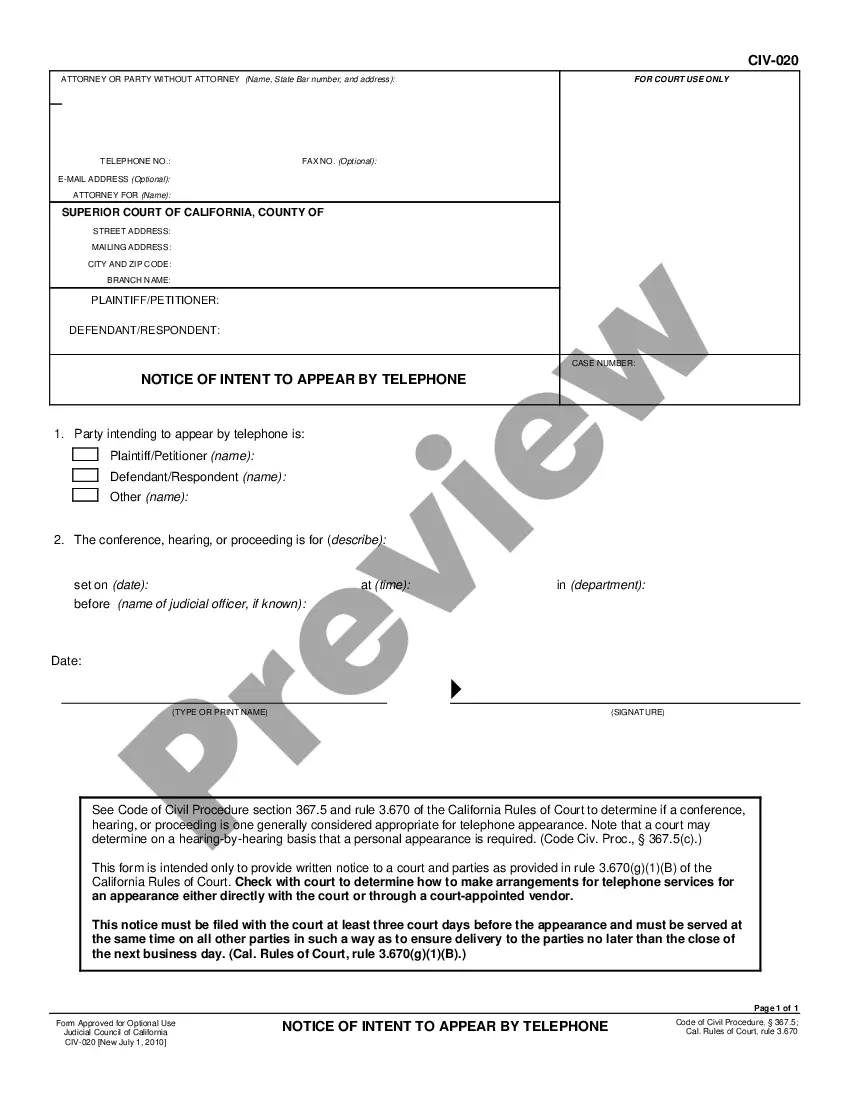

How to fill out Kings New York Term Sheet - Series Seed Preferred Share For Company?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Kings Term Sheet - Series Seed Preferred Share for Company, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Therefore, if you need the latest version of the Kings Term Sheet - Series Seed Preferred Share for Company, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Kings Term Sheet - Series Seed Preferred Share for Company:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Kings Term Sheet - Series Seed Preferred Share for Company and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!