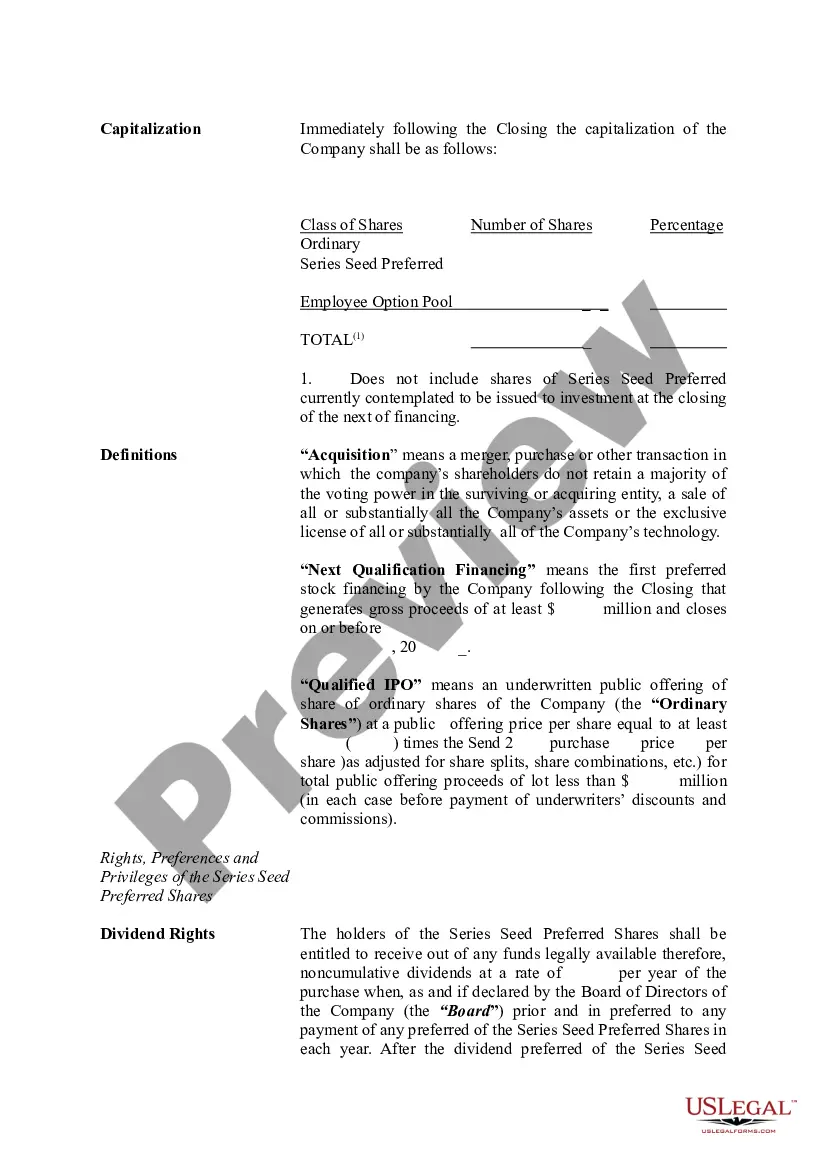

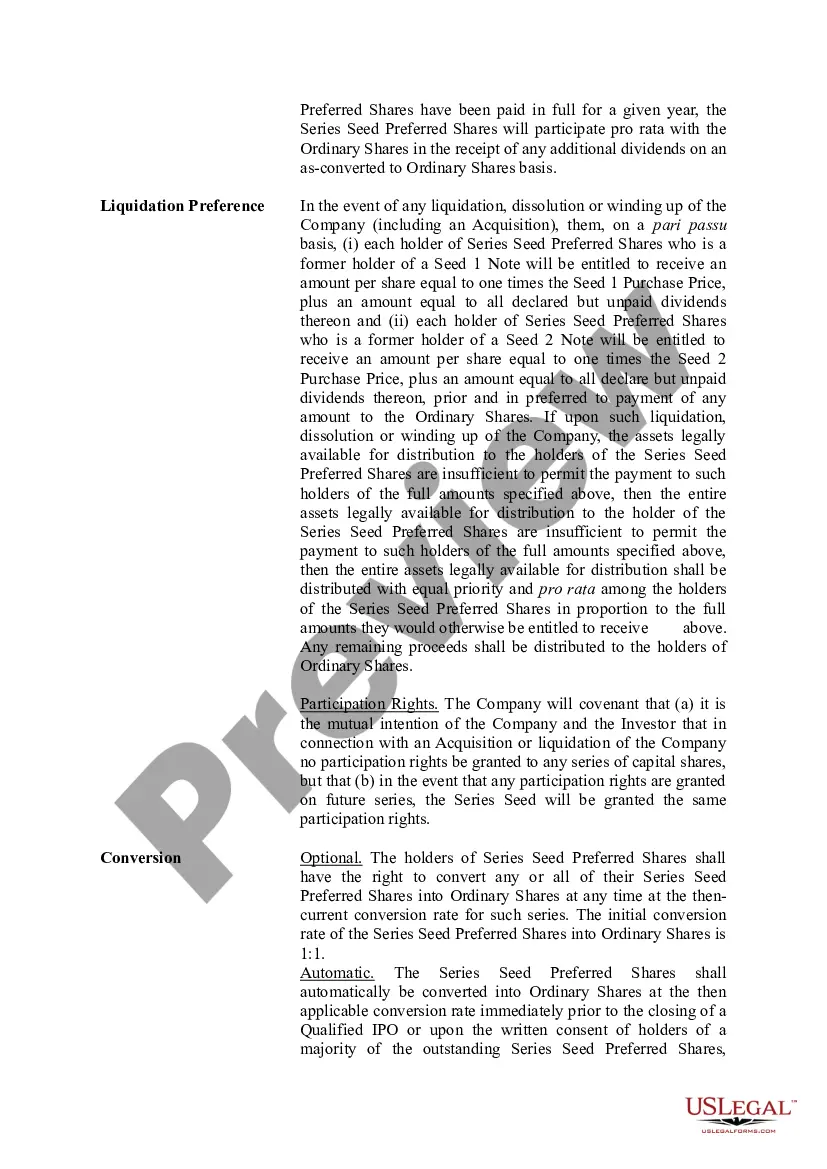

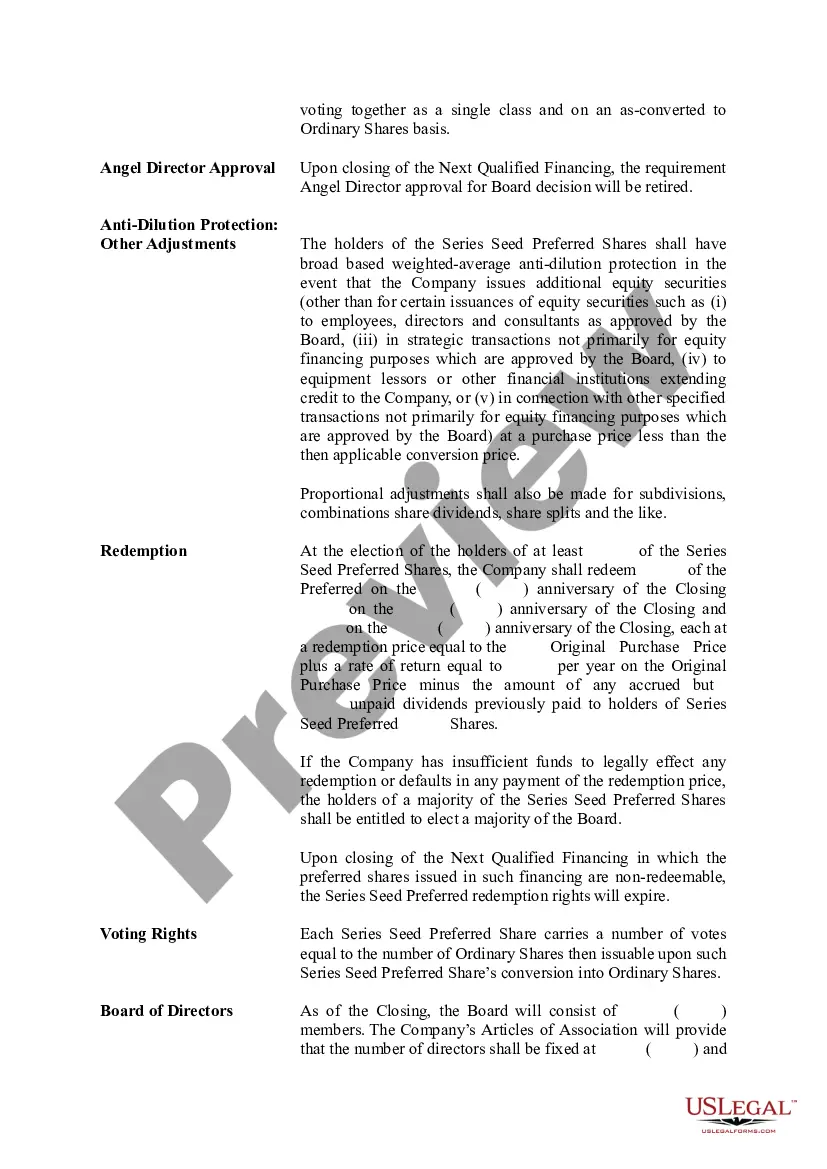

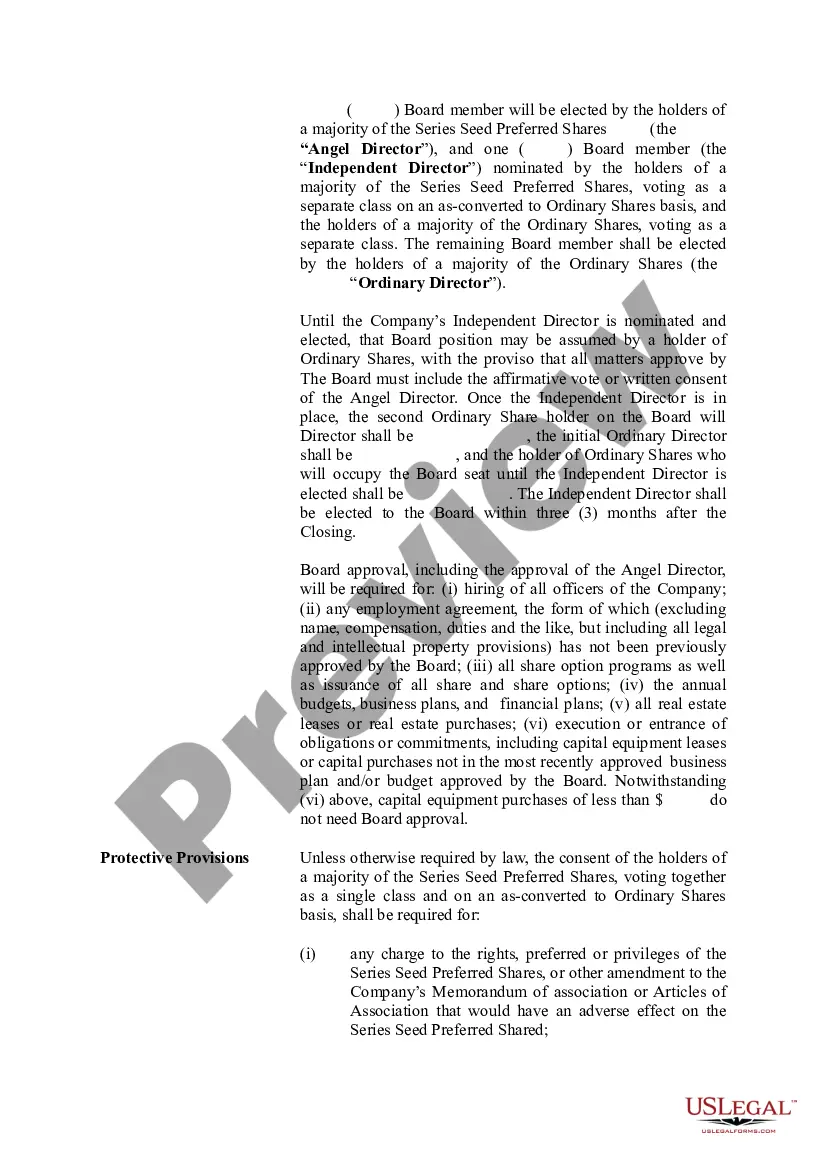

Queens New York Term Sheet — Series Seed Preferred Share for Company is a legally binding agreement that outlines the terms and conditions for venture capital investments in early-stage companies located in Queens, New York. This term sheet is specifically designed for companies seeking funding through a Series Seed Preferred Share structure. It serves as a basis for negotiation between the company and the investors, providing crucial details and guidelines for the investment process. The Series Seed Preferred Share term sheet for Queens, New York companies typically includes the following key elements: 1. Investment Amount and Valuation: This section defines the amount of capital that the investor will provide to the company and determines the valuation of the company based on the investment amount. 2. pre-Roman and Post-Money Valuation: The term sheet outlines the pre-Roman valuation (company's worth before the investment) and post-money valuation (company's worth after the investment) to determine the investor's ownership percentage. 3. Liquidation Preference: It specifies the order in which the shareholders will be paid during a liquidation event, such as the sale or acquisition of the company. This grants preference to preferred shareholders to common shareholders. 4. Conversion Rights: This section outlines any circumstances under which the preferred shares can be converted into common shares, allowing the investor to participate in potential future gains if the company experiences significant growth. 5. Anti-Dilution Protection: It details the provisions that protect the investor from dilution resulting from future financing rounds at a lower valuation, ensuring that the investor retains their ownership percentage. 6. Voting Rights: The term sheet indicates the voting rights of preferred shareholders, which may include approval rights for major corporate transactions or board seat provisions. 7. Dividend Preference: This section defines whether preferred shareholders are entitled to receive dividends and, if so, the priority and rate at which they will be paid, typically before common shareholders. 8. Redemption Rights: It discusses if preferred shareholders have the right to request the company to buy back their shares after a certain period or under specific conditions. While there may not be different "types" of Queens New York Term Sheet — Series Seed Preferred Share for Company, each term sheet is customizable based on the specific needs and preferences of the company and investor involved. These provisions act as a starting point for negotiations and can be adjusted to meet the unique requirements of both parties. In summary, the Queens New York Term Sheet — Series Seed Preferred Share for Company provides a comprehensive framework for venture capital investments in early-stage companies in Queens, New York. It covers essential elements such as investment amount, valuation, liquidation preference, conversion rights, anti-dilution protection, voting rights, dividend preference, and redemption rights, all aimed at safeguarding the interests of both the company and investor.

Queens New York Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Queens New York Term Sheet - Series Seed Preferred Share For Company?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Queens Term Sheet - Series Seed Preferred Share for Company, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Queens Term Sheet - Series Seed Preferred Share for Company from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Queens Term Sheet - Series Seed Preferred Share for Company:

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Seed Preferred Shares means the seed preferred shares in the share capital of the Company, with a par value of US$0.005 each and the rights and privileges as set forth in the Memorandum and Articles.

Seed funding is the first round of venture capital that new companies raise. Series A funds are considered the second round of venture capital that newly formed companies attempt to achieve.

Series A funding is considered seed capital since it's designed to help new companies grow. Series B financing is the next stage of funding after the company has had time to generate revenue from sales. Investors have a chance to see how the management team has performed and whether the investment is worth it or not.

A Series A term sheet is a basic agreement that outlines all the terms and conditions of the investment. Term sheets usually focus on two key areas; control of company shares and how financials will be divided if an exit occurs.

Seed Round: Refers to a series of related investments in which 15 or less investors "seed" a new company with anywhere from $50,000 to $2 million. This money is often used to support initial market research and early product development.

Common Series Seed terms include: Preferred Stock. Preferred stock is a class of stock with certain preferences and rights that are superior to the rights of the common stock that is issued to the founders. Series Seed will generally be issued as preferred stock.

Series A startups are those that have the very beginnings of a business with a customer base, proof of concept, etc. Series B funding is typically for startups that are looking to increase production or sales.

The original Series Seed equity financing document set was a collaborative effort among lawyers and investors, spearheaded by lawyer-turned-investor Ted Wang, to reduce the cost of fundraising for emerging companies by standardizing the core necessary legal documents, thereby reducing the amount of attorney time

Series B financing is the second round of funding for a company that has met certain milestones and is past the initial startup stage. Series B investors usually pay a higher share price for investing in the company than Series A investors. Series B investors typically prefer convertible preferred stock vs.

Series A Note means the promissory note dated the Closing Date, executed and delivered by the Company to the Authority evidencing the Series A Loan; Sample 2.